Fixed Rate Home Loans set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Bhg Loans offers a variety of loan products to meet your financial needs. Bhg Loans provides a convenient platform for applying and managing your loans.

A fixed-rate mortgage provides the security of a predictable monthly payment, allowing you to budget effectively and avoid the uncertainty of fluctuating interest rates. This type of loan is a popular choice for homeowners seeking financial stability and peace of mind, especially in times of economic volatility.

Whether you need a personal loan, a mortgage, or something else entirely, Loan Companies provides a comprehensive directory of lenders to explore.

By understanding the fundamentals of fixed-rate mortgages, you can make informed decisions that align with your long-term financial goals.

Myinstantoffer is a platform that allows you to quickly compare loan offers from different lenders. Myinstantoffer can help you find the best loan terms for your situation.

Last Word: Fixed Rate Home Loans

Navigating the world of fixed-rate home loans requires careful consideration of your individual circumstances and financial aspirations. By understanding the intricacies of interest rates, loan terms, and eligibility requirements, you can make an informed decision that aligns with your needs and maximizes your chances of securing a mortgage that provides stability and financial peace of mind.

Need to finance a home improvement project? Home Improvement Loans can help you get the funds you need to make your home dreams a reality.

Answers to Common Questions

What is the difference between a fixed-rate and an adjustable-rate mortgage?

Need a smaller loan? Small Loans are a great option for covering unexpected expenses or funding smaller projects.

A fixed-rate mortgage has a fixed interest rate that remains the same for the entire loan term, while an adjustable-rate mortgage (ARM) has an interest rate that can change periodically based on market conditions.

Looking for a loan provider near you? Loan Places Near Me can help you find local lenders in your community.

How long is a typical fixed-rate mortgage term?

Personal loans can be a great way to consolidate debt, finance a big purchase, or cover unexpected expenses. Personal Loans can provide you with the resources to explore different loan options.

Common fixed-rate mortgage terms range from 15 to 30 years. Shorter terms generally have lower interest rates but require higher monthly payments.

Need a loan but want to work with a local lender? Loan Companies Near Me can help you find reputable lenders in your area.

What factors affect my eligibility for a fixed-rate mortgage?

Your credit score, debt-to-income ratio, and income documentation are key factors that lenders consider when evaluating your eligibility.

Looking for the best personal loan companies? You’ve come to the right place! Best Personal Loan Companies can help you find the best loan options for your needs.

How do I choose the right fixed-rate mortgage for me?

Bright Lending is a popular choice for borrowers. Bright Lending offers a variety of loan options, so you can find the right fit for your financial situation.

Consider your financial goals, affordability, and risk tolerance. Compare loan offers from different lenders and explore options that align with your long-term financial plan.

Securing a mortgage is a big decision, and it’s crucial to find the best rates possible. Best Mortgage Rates provides you with the resources to compare rates and make informed choices.

Can I refinance my fixed-rate mortgage?

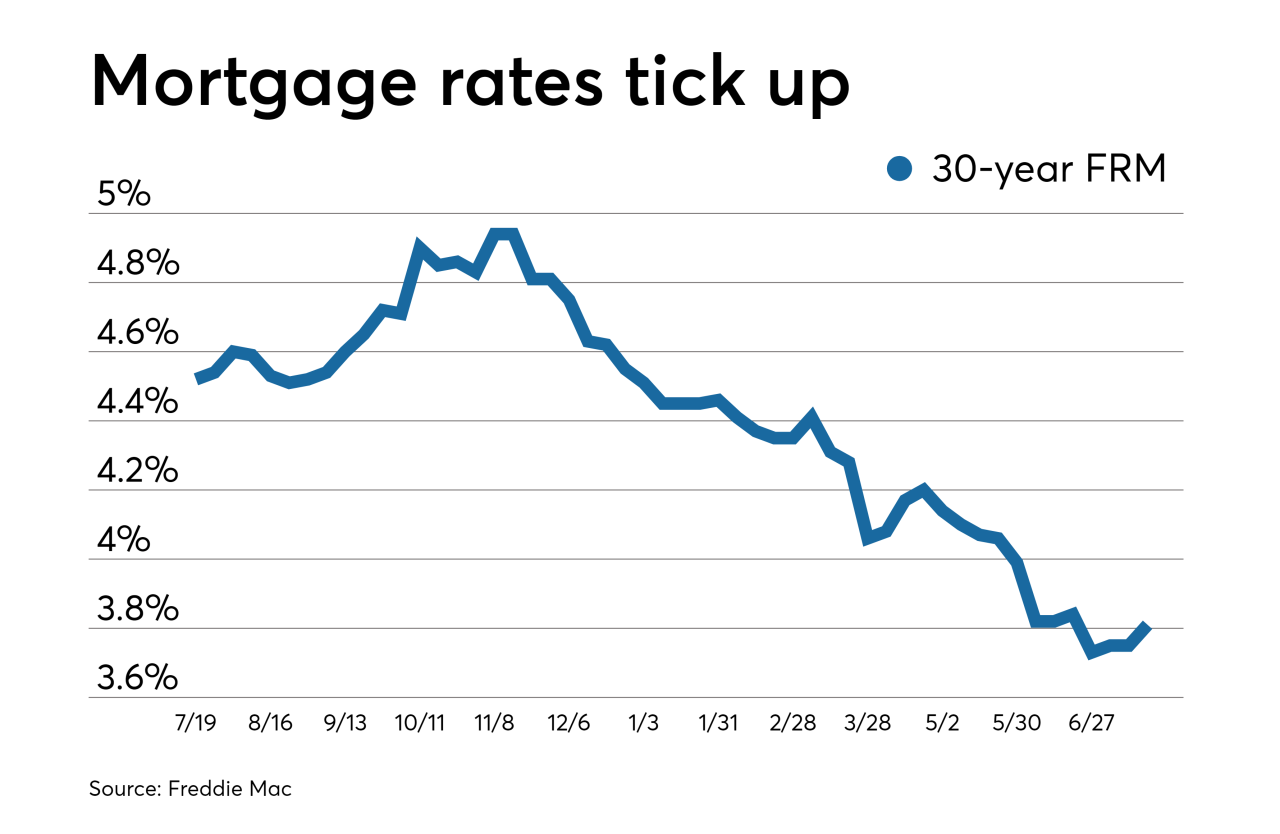

Yes, you can refinance your fixed-rate mortgage if interest rates drop or your financial situation changes. Refinancing allows you to potentially lower your monthly payments or shorten your loan term.

Consolidation loans can help you simplify your debt payments and potentially lower your interest rates. Consolidation Loans can provide you with the tools to manage your debt more effectively.

For veterans looking to purchase a home, Va Mortgage Rates offers valuable information on mortgage options specifically designed for those who have served in the military.

American Express offers personal loans with competitive rates and flexible terms. American Express Personal Loans can be a good option for those with a strong credit history.

If you’re looking to purchase a home in a rural area, Usda Loans might be a great option for you. These loans offer low interest rates and require no down payment for eligible borrowers.