Formula Annuity Loan 2024: In a world of evolving financial landscapes, understanding the nuances of different loan types is crucial. Formula annuity loans, with their unique structure and potential benefits, are gaining traction in 2024. This guide delves into the intricacies of these loans, exploring their core components, comparing them to traditional loans, and examining their applications across various industries.

Seeking financial security for a specific period? Annuity contracts often offer guarantees, like a 5-year guarantee , ensuring you receive regular payments for a minimum duration.

This guide serves as a comprehensive resource for individuals and businesses seeking to navigate the world of formula annuity loans. We will explore the key features, benefits, and potential drawbacks of this loan type, providing valuable insights for informed decision-making in 2024.

A contingent annuity is a type of annuity that is payable only if a certain event occurs, like the death of a spouse.

Contents List

Formula Annuity Loan: Understanding the Basics

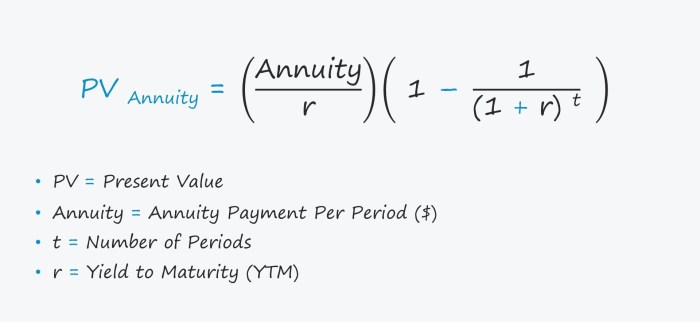

A formula annuity loan is a type of loan where the borrower makes regular, equal payments over a set period of time. These payments include both principal and interest, and the loan is structured in a way that ensures the borrower pays off the entire loan amount by the end of the term.

Charles Schwab offers an online calculator to help you explore the potential benefits of annuities. Use the annuity calculator to get personalized estimates and see how an annuity might fit into your financial plan.

This type of loan differs from traditional loans in its consistent payment structure and the way interest is calculated.

If you’re in the UK, there are specific regulations and options available for annuities. You can find information about the latest developments in annuities in the UK to make informed decisions about your retirement income.

Real-World Applications of Formula Annuity Loans

Formula annuity loans are commonly used in various scenarios, including:

- Mortgages:Many homeowners opt for formula annuity loans to finance their properties, making fixed monthly payments over a predetermined term (e.g., 15 or 30 years).

- Auto Loans:Car loans often utilize the formula annuity structure, allowing borrowers to pay off their vehicle over a set period, typically ranging from 3 to 7 years.

- Student Loans:Formula annuity loans are frequently employed for student loans, enabling borrowers to repay their educational expenses over a longer timeframe, usually 10 to 20 years.

Components of a Formula Annuity Loan: Formula Annuity Loan 2024

A formula annuity loan comprises several key components that determine its structure and repayment terms:

Key Components of a Formula Annuity Loan

| Component | Definition | Calculation |

|---|---|---|

| Principal | The initial amount borrowed | N/A (specified in the loan agreement) |

| Interest Rate | The percentage charged on the loan amount | N/A (specified in the loan agreement) |

| Loan Term | The duration of the loan, expressed in years or months | N/A (specified in the loan agreement) |

| Payment Amount | The fixed amount paid by the borrower each period | Calculated using the formula annuity equation |

Formula Annuity Loan vs. Traditional Loans

Formula annuity loans differ from traditional loans in several key aspects:

Key Differences Between Formula Annuity Loans and Traditional Loans, Formula Annuity Loan 2024

| Feature | Formula Annuity Loan | Traditional Loan |

|---|---|---|

| Payment Structure | Fixed, equal payments over the loan term | Variable payments, potentially changing over time |

| Interest Calculation | Interest is calculated on the remaining principal balance | Interest may be calculated on the entire loan amount or a portion of it |

| Loan Term | Fixed term, usually longer than traditional loans | Shorter term, often with the option for early repayment |

| Benefits | Predictable payments, lower initial payments | Potential for lower overall interest costs, flexibility in repayment |

| Drawbacks | Higher total interest costs due to longer term | Less predictable payments, risk of higher interest rates |

Applications and Uses of Formula Annuity Loans

Formula annuity loans find applications in various industries and sectors, including:

Real-World Examples of Formula Annuity Loan Applications

- Real Estate Development:Developers use formula annuity loans to finance large-scale projects, such as building apartments or commercial buildings.

- Infrastructure Projects:Formula annuity loans are often employed for infrastructure development, such as constructing roads, bridges, or public transportation systems.

- Renewable Energy Projects:Formula annuity loans are used to finance the construction and operation of renewable energy projects, such as solar farms or wind turbines.

Formula Annuity Loan in 2024: Trends and Outlook

The formula annuity loan market is evolving in 2024, influenced by various factors, including economic conditions, regulatory changes, and technological advancements.

Annuity contracts can be complex, but it’s important to understand the basics. A helpful resource for learning more about annuities is an annuity explained guide, which will provide a clear overview of the key concepts.

Key Trends and Predictions for Formula Annuity Loans in 2024

| Trend | Prediction | Impact |

|---|---|---|

| Rising Interest Rates | Higher interest rates are expected to increase the cost of borrowing | Borrowers may face higher monthly payments and total interest costs |

| Increased Demand for Sustainable Finance | Growing demand for sustainable financing options will drive the development of green formula annuity loans | More borrowers may opt for loans that support environmentally friendly projects |

| Digitalization of Lending | The adoption of digital lending platforms will streamline the loan application and approval process | Borrowers may experience faster and more convenient loan access |

Epilogue

Formula annuity loans offer a distinct approach to borrowing, presenting a unique blend of flexibility and predictability. By understanding the mechanics of these loans and their applications, individuals and businesses can make informed decisions about whether this financial tool aligns with their specific needs and goals in 2024.

Annuity contracts can be a valuable tool for retirement planning, but it’s important to understand the differences between an annuity and a perpetuity. While both provide a stream of income, an annuity has a defined end date, while a perpetuity continues indefinitely.

As the financial landscape continues to evolve, staying informed about innovative loan options like formula annuity loans is crucial for making sound financial decisions.

Understanding how the annuity rate is calculated is crucial for making informed decisions. This rate is influenced by factors like your age, investment amount, and the chosen payout period.

Common Queries

What are the main advantages of a formula annuity loan?

An annuity contract is backed by a specific annuity fund , which is managed by the insurance company to ensure consistent payments to annuitants.

Formula annuity loans offer advantages such as predictable payments, potential for lower interest rates over time, and flexibility in repayment terms. However, it’s crucial to understand the potential drawbacks and suitability for your specific financial situation.

Are formula annuity loans suitable for everyone?

When considering an annuity, you may be curious about the process of purchasing an annuity. Typically, you’ll invest a lump sum of money, and the insurer will then make regular payments to you for a predetermined period.

Formula annuity loans are not a one-size-fits-all solution. The suitability depends on factors like your financial goals, risk tolerance, and the specific terms of the loan. Consulting with a financial advisor is recommended to determine if this loan type aligns with your individual needs.

How do formula annuity loans differ from traditional loans?

The primary difference lies in the repayment structure. Formula annuity loans typically involve a fixed payment amount, but the allocation between principal and interest changes over time, leading to a decreasing interest component and an increasing principal component. Traditional loans often have a fixed interest rate and a consistent allocation between principal and interest.

For individuals reaching the age of 70 1/2, there are specific rules and considerations related to annuities. Learn more about annuities at 70 1/2 to ensure you are compliant with tax and retirement regulations.

If you’re interested in annuities that grow over time, you might be curious about calculating a growing annuity. These annuities typically involve a fixed interest rate that increases the payments over time.

For programmers working with annuities, it can be helpful to have a way to calculate them in code. You can learn how to calculate an annuity in Java to automate calculations and integrate them into your financial applications.

Considering an annuity with a substantial initial investment? You might be interested in the specifics of a $300,000 annuity and how it might provide a steady stream of income for retirement.

If you’re using a financial calculator like the BA II Plus, it’s essential to understand how to calculate an annuity due on this device. Annuity due payments are made at the beginning of each period, which can impact the overall calculations.

Many individuals are concerned about the safety and security of their retirement funds. When considering an annuity, you might wonder, “Is an annuity safe ?” Annuity contracts are backed by insurance companies, providing a level of security for your retirement income.