Formula For Calculating The Annuity Payment 2024 – Understanding the Formula for Calculating the Annuity Payment in 2024 is crucial for anyone considering financial planning, retirement strategies, or managing debt. Annuities are a powerful financial tool that can provide regular income streams for a specified period, but understanding how their payments are calculated is key to making informed decisions.

This guide delves into the intricacies of annuity calculations, exploring the core concepts, the formula itself, and its practical applications. We’ll examine the variables that influence annuity payments, analyze the impact of interest rates and inflation, and discuss the use of online calculators and tools for accurate calculations.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s like a structured savings plan that guarantees a steady income stream for a specific duration, often used for retirement planning or other long-term financial goals.

Planning your annuity withdrawals can be a crucial part of your retirement strategy. This article on Annuity Withdrawal Calculator 2024 provides insights into the various annuity withdrawal options available and explores the use of withdrawal calculators to help you plan for your retirement income.

This resource will be valuable for anyone seeking to maximize their annuity benefits.

The key components of an annuity include:

- Principal:The initial amount of money invested in the annuity.

- Interest Rate:The rate of return earned on the principal, which can be fixed or variable.

- Payment Period:The frequency of payments (e.g., monthly, quarterly, annually).

- Term:The total duration of the annuity contract, which can be for a fixed period or for the lifetime of the annuitant.

There are two main types of annuities:

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

Types of Annuities

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:Offer a guaranteed interest rate, providing predictable income payments.

- Variable Annuities:The interest rate fluctuates based on the performance of underlying investments, potentially offering higher returns but also carrying greater risk.

- Immediate Annuities:Payments begin immediately after the initial investment.

- Deferred Annuities:Payments start at a later date, allowing for growth potential before income begins.

The Annuity Payment Formula

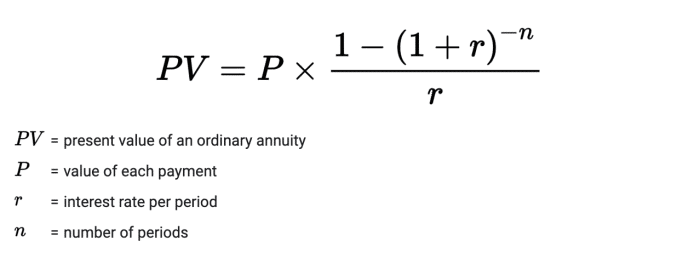

The formula for calculating the annuity payment is used to determine the amount of each regular payment that will be received over the life of the annuity. It takes into account the present value of the annuity, the interest rate, and the number of periods.

Understanding the tax implications of annuities is essential for any investor. This article on Annuity Under Income Tax Act 2024 provides insights into how annuities are treated under income tax laws and the tax implications of various annuity structures. This resource will be valuable for anyone seeking to minimize their tax liability while maximizing their annuity benefits.

Annuity Payment = PV- (r – (1 + r)^n) / ((1 + r)^n – 1)

If you’re living in South Africa and considering an annuity, it’s helpful to use an annuity calculator tailored to the local market. This article on Annuity Calculator South Africa 2024 provides information about annuity calculators specifically designed for South African investors.

This resource will be helpful for anyone seeking to explore annuity options in South Africa.

Where:

- PV= Present Value (the initial investment)

- r= Interest Rate per period

- n= Number of periods

Step-by-Step Calculation

- Identify the variables:Determine the present value, interest rate, and number of periods based on the specific annuity contract.

- Calculate the interest rate per period:If the interest rate is annual, divide it by the number of periods in a year (e.g., 12 for monthly payments).

- Apply the formula:Plug the values into the annuity payment formula and solve for the payment amount.

Practical Applications of the Formula: Formula For Calculating The Annuity Payment 2024

The annuity payment formula has numerous applications in financial planning and investment decisions. Here are some examples:

Retirement Planning

An individual planning for retirement can use the formula to determine the amount of monthly income they can expect from an annuity based on their savings and expected interest rates. This helps them understand how much they can withdraw each month without depleting their retirement funds.

Annuity Gator is a company that specializes in annuity products and services. If you’re considering working with them, it’s important to research their legitimacy and reputation. This article on Is Annuity Gator Legit 2024 provides insights into Annuity Gator’s business practices and customer reviews.

This information can help you make an informed decision about whether or not to work with them.

Loan Repayment, Formula For Calculating The Annuity Payment 2024

The formula can be applied to calculate the monthly payments for a loan, such as a mortgage or auto loan. By knowing the loan amount, interest rate, and loan term, you can determine the fixed monthly payment required to repay the loan.

Annuity payments are often described as a series of regular payments. This article on Annuity Is A Series Of 2024 delves into the concept of annuities as a series of payments and explains how these payments are calculated and distributed over time.

This resource will help you understand the mechanics of annuity payments and their implications for your financial planning.

Impact of Changing Variables

The annuity payment is sensitive to changes in the interest rate, time period, and present value. For instance, a higher interest rate will result in a larger annuity payment, while a longer time period will lead to a smaller payment.

Looking to understand the potential returns and implications of investing 600,000 dollars in an annuity? This article on Annuity 600 000 2024 provides insights into the factors to consider when making such a significant investment. This resource can help you determine if an annuity is the right investment strategy for you and how to maximize your returns.

Factors Influencing Annuity Payments

Several factors can influence the amount of annuity payments received. Understanding these factors is crucial for making informed decisions about annuity investments.

Thinking about investing in an annuity with a large sum? This article on Annuity 600k 2024 provides insights into the benefits and considerations of investing 600,000 dollars in an annuity. This resource can help you understand the potential returns and risks associated with such an investment.

Interest Rates

Interest rates play a significant role in determining annuity payments. Higher interest rates generally result in larger annuity payments, as the investment earns more returns. However, interest rates can fluctuate, affecting the future value of annuities.

Understanding how to calculate a federal annuity for FERS employees is crucial for retirement planning. This article on Calculating A Federal Annuity – Fers 2024 provides a step-by-step guide on calculating your FERS annuity based on your years of service and salary.

This resource will be helpful for current and future FERS employees.

Compounding Frequency

The frequency at which interest is compounded also affects annuity payments. More frequent compounding (e.g., monthly) leads to higher returns than less frequent compounding (e.g., annually), resulting in larger payments.

Inflation

Inflation erodes the purchasing power of money over time. Annuity payments may not keep pace with inflation, reducing the real value of the income received. To mitigate the impact of inflation, some annuities offer inflation adjustments to their payments.

Financial calculators are essential tools for anyone working with annuities. This article on Financial Calculator Annuity 2024 explores how to use a financial calculator to compute annuity payments, future values, and other important calculations. This resource will be helpful for individuals and professionals alike.

Annuity Calculators and Tools

Several online calculators and software tools are available to assist with annuity calculations. These tools simplify the process and provide accurate results based on user inputs.

Annuities can be structured in various ways, and it’s important to understand the difference between ordinary and due annuities. Learn more about the characteristics of ordinary annuities and how they differ from due annuities in this article on Annuity Is Ordinary 2024.

This information will help you make informed decisions about your annuity investments.

Online Annuity Calculators

Numerous websites offer free annuity calculators that allow users to input variables such as present value, interest rate, and time period to calculate the annuity payment. These calculators are convenient for quick estimates and comparisons.

Excel is a powerful tool for financial analysis, and it can be particularly useful for calculating annuities. This article on Calculating Annuity Excel 2024 provides a comprehensive guide on using Excel formulas to calculate annuity payments, future values, and other important metrics.

This resource will be invaluable for anyone working with annuities in Excel.

Software Tools

Financial planning software and spreadsheet programs often include built-in annuity calculation functions. These tools provide more comprehensive analysis and allow for more complex scenarios, such as variable annuities or annuities with inflation adjustments.

Advantages and Limitations

While annuity calculators and tools can be helpful, they have certain limitations. They rely on user inputs, so accuracy depends on the correctness of the information provided. Additionally, these tools may not account for all the complexities of annuity contracts, such as fees, surrender charges, or death benefits.

Considerations for Choosing an Annuity

Choosing the right annuity requires careful consideration of your financial goals, risk tolerance, and investment horizon. It’s crucial to understand the terms and conditions of the annuity contract and compare different options from reputable providers.

Terms and Conditions

Read the annuity contract thoroughly to understand the payment schedule, interest rate, fees, surrender charges, and other terms. Pay attention to the investment options, if applicable, and the guarantees provided.

Winning the Powerball lottery is a dream for many, but calculating the annuity payments can be a bit complex. This article on Calculating Powerball Annuity Payments 2024 breaks down the process of determining the annual payments you’ll receive over time.

It’s important to understand the implications of choosing the annuity option before making a decision.

Annuity Provider

Choose a reputable and financially sound annuity provider with a proven track record. Consider the provider’s financial stability, customer service, and product offerings.

Suitability

Evaluate the suitability of different annuity options based on your individual needs and goals. Consider factors such as your age, income, investment horizon, and risk tolerance. Consult with a financial advisor to get personalized recommendations.

Outcome Summary

By mastering the art of annuity calculations, you gain a deeper understanding of how these financial instruments work, empowering you to make informed choices about your financial future. Whether you’re planning for retirement, managing loans, or simply seeking a steady income stream, understanding the formula behind annuity payments is an essential step towards achieving your financial goals.

FAQ Summary

What is the difference between an ordinary annuity and an annuity due?

Choosing between an annuity and an IRA can be a significant decision for your retirement planning. Learn about the differences between these two retirement savings options and how to determine which one might be right for you in this article on Annuity Or Ira 2024.

This information can help you make informed decisions about your future financial security.

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period. This difference in timing can affect the overall value of the annuity.

Annuity concepts are important for anyone studying finance, especially those preparing for the Jaiib exams. Learn more about the role of annuities in the financial services industry and how they relate to the Jaiib curriculum in this article on Annuity Jaiib 2024.

Understanding annuities will be crucial for anyone pursuing a career in banking and finance.

How do interest rates affect annuity payments?

Higher interest rates generally lead to higher annuity payments, as the investment earns more over time. Conversely, lower interest rates result in smaller annuity payments.

What is the role of inflation in annuity payments?

Inflation can erode the purchasing power of annuity payments over time. To mitigate this, consider annuities with inflation adjustments or explore other investment options.

Are annuity calculators reliable?

Looking to calculate the future value of an annuity in Excel? Check out this guide on Fv Annuity Excel 2024 which provides a step-by-step breakdown and useful tips for using Excel’s financial functions to calculate annuity values. This is a helpful resource for anyone working with annuities in their financial planning or analysis.

Online annuity calculators can provide a good estimate of annuity payments, but it’s essential to use reputable sources and understand the limitations of these tools. Always consult with a financial advisor for personalized guidance.