Fv Calculator Annuity 2024: Planning Your Financial Future. Annuities are powerful financial tools that can help you secure a comfortable retirement or achieve other long-term financial goals. Understanding how to calculate the future value (FV) of an annuity is essential for making informed decisions about your savings and investments.

This guide will explore the fundamentals of FV calculators and their application to annuities. We’ll delve into key concepts like compounding frequency, present value, and the factors that influence annuity growth. Additionally, we’ll examine the latest trends in FV calculator technology and provide practical tips for using these tools to plan your financial future effectively.

Annuity plans can be a great way to secure your financial future, but it’s essential to understand the different aspects. If you’re curious about how annuities work in New Zealand, you can find information on Annuity Nz 2024.

This resource provides insights into the New Zealand annuity market and its implications.

Contents List

Understanding Future Value (FV) Calculators

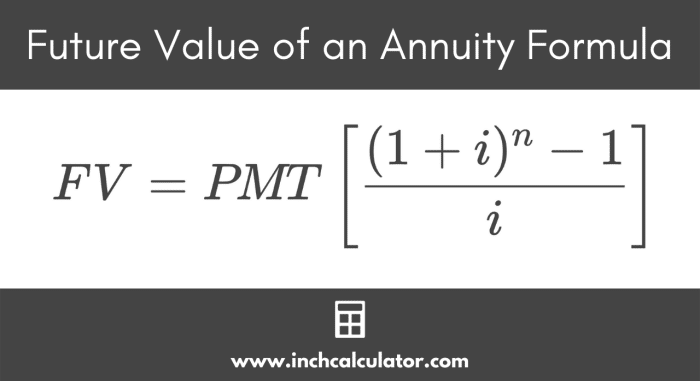

Future value (FV) calculators are invaluable tools for anyone looking to understand the potential growth of their investments over time. In the context of annuities, FV calculators help estimate the future value of a series of regular payments made over a specified period.

By inputting key variables, users can project the total amount accumulated at the end of the annuity term, providing insights into the long-term financial outcomes of their investment strategy.

One of the key benefits of annuities is the potential for guaranteed income. If you’re seeking information on whether annuity income is guaranteed, you can find it on Is Annuity Income Guaranteed 2024. This article explores the guarantees associated with annuities and helps you understand their financial security.

Key Input Variables

FV calculators require specific input variables to generate accurate estimations. These variables are:

- Principal:The initial amount invested or the first payment made in the annuity.

- Interest Rate:The annual rate of return expected on the investment. This rate can vary depending on the type of annuity and the current market conditions.

- Payment Amount:The regular amount paid into the annuity at each payment interval.

- Time Period:The total duration of the annuity, expressed in years or months.

Compounding Frequency

The frequency at which interest is compounded plays a significant role in FV calculations. Compounding refers to the process of earning interest on both the principal amount and previously accumulated interest. The more frequent the compounding, the higher the future value will be.

Understanding the concept of present value is essential for annuity calculations. The article on Annuity Is Present Value 2024 provides a clear explanation of how annuities relate to present value. This resource helps you grasp the financial principles underlying annuity calculations.

For instance, an annuity with monthly compounding will generally yield a higher FV than one with annual compounding, assuming all other variables are equal.

Annuity Basics

An annuity is a series of equal payments made over a fixed period. Annuities are commonly used for retirement planning, savings, and loan repayments. They offer a structured approach to managing finances, ensuring regular contributions towards a specific financial goal.

Annuity calculators can be helpful in estimating your potential income, but it’s important to consider your life expectancy. To find an annuity calculator that incorporates this factor, you can explore the Annuity Calculator Based On Life Expectancy 2024.

This tool provides a more personalized estimate based on your expected lifespan.

Key Characteristics, Fv Calculator Annuity 2024

The key characteristics of an annuity include:

- Regular Payments:Annuities involve a consistent stream of payments made at regular intervals, such as monthly, quarterly, or annually.

- Fixed Period:Annuities have a defined duration, specifying the number of payments to be made.

- Interest Rate:Annuities typically earn interest, which is compounded over time, increasing the overall value of the annuity.

Ordinary Annuities vs. Annuities Due

Annuities can be categorized into two main types:

- Ordinary Annuities:Payments are made at the end of each period. For example, in a monthly ordinary annuity, payments are made on the last day of each month.

- Annuities Due:Payments are made at the beginning of each period. In a monthly annuity due, payments are made on the first day of each month.

Present Value

Present value (PV) represents the current value of a future sum of money, considering the time value of money. In the context of annuities, PV is the amount that needs to be invested today to generate a specific future value at a given interest rate.

FV calculators can also be used to calculate the present value of an annuity, providing valuable information for financial planning.

Retirement planning involves understanding various tax implications. One question that often arises is whether annuities are subject to Required Minimum Distributions (RMDs). For clarity on this topic, you can consult the article on Is Annuity Subject To Rmd 2024.

This resource provides insights into the tax treatment of annuities and RMD requirements.

FV Calculator Applications for Annuities

FV calculators are widely used to estimate the future value of annuity investments, helping individuals make informed financial decisions. These calculators provide a clear picture of the potential growth of annuity payments over time, considering factors such as interest rates, payment amounts, and the duration of the annuity.

Retirement Savings

One of the most common applications of FV calculators is in retirement planning. By inputting estimated annual contributions, expected interest rates, and the number of years until retirement, individuals can project their retirement savings balance. This information helps them assess whether their current savings strategy is sufficient to meet their future financial needs.

Annuity contracts are legally binding agreements that outline the terms of your annuity payments. If you’re curious about the key aspects of an annuity contract, the article on Annuity Contract Is 2024 can provide valuable insights. This resource covers essential details about annuity contracts and their implications.

Loan Repayments

FV calculators can also be used to estimate the total amount owed at the end of a loan term. By inputting the loan amount, interest rate, and the number of payments, individuals can determine the total cost of borrowing and plan their repayment strategy accordingly.

If you have a pension pot and are considering an annuity, it’s essential to understand how to calculate the potential annuity payments. The article on Calculate Annuity From Pension Pot 2024 can help you determine the estimated annuity payments based on your pension savings.

Hypothetical Scenario

Let’s assume you invest $1,000 per month in an annuity with a 5% annual interest rate compounded monthly. Using an FV calculator, you can project the future value of this annuity after 20 years. The calculator will show that the future value of this annuity will be approximately $418,000.

This example demonstrates the power of compounding and how regular contributions can accumulate significant wealth over time.

Deferred annuities are a type of annuity where payments start at a later date. If you’re interested in learning how to calculate the value of a deferred annuity, the article on How To Calculate A Deferred Annuity 2024 can provide valuable guidance.

This resource covers the key concepts and calculations involved in deferred annuities.

Factors Influencing Annuity FV: Fv Calculator Annuity 2024

Several factors influence the future value of an annuity. Understanding these factors can help individuals optimize their investment strategies and maximize their returns.

Interest Rates

Interest rates have a direct impact on the future value of an annuity. Higher interest rates lead to faster growth of the annuity balance. For example, an annuity with a 6% interest rate will generally generate a higher FV than one with a 4% interest rate, assuming all other variables remain constant.

Annuity calculations often rely on mortality tables to estimate life expectancy. The Annuity 2000 Mortality Table 2024 is a widely used resource for these calculations. Understanding how this table works can give you a better grasp of how your annuity payments are determined.

Payment Amount

The amount of each payment significantly affects the future value of an annuity. Larger payments result in a higher FV, as more money is being invested over time. For instance, an annuity with a $1,500 monthly payment will accumulate a higher FV than one with a $1,000 monthly payment, assuming all other variables are the same.

One common question about annuities is whether they offer flexibility. To find out if an annuity can adapt to your changing needs, check out the article on Is Annuity Flexible 2024. This article explores the flexibility aspects of annuities and helps you understand how they can fit into your financial plan.

Annuity Period

The length of the annuity period also plays a crucial role in FV calculations. The longer the period, the more time interest has to compound, resulting in a higher future value. For example, an annuity lasting 30 years will generally accumulate a higher FV than one lasting 20 years, assuming all other variables are equal.

FV Calculators in 2024

FV calculator technology has advanced significantly in recent years, offering users more sophisticated features and functionalities. Online FV calculators have become increasingly user-friendly, providing intuitive interfaces and comprehensive results.

Annuity payments can vary depending on factors like the initial investment amount. If you’re curious about the potential payments from an annuity of $300,000, you can find information on Annuity 300 000 2024. This resource provides insights into annuity calculations based on a specific investment amount.

Trends in FV Calculator Technology

Current trends in FV calculator technology include:

- Mobile Accessibility:FV calculators are now readily available on mobile devices, allowing users to access them anytime, anywhere.

- Personalized Reports:Many FV calculators generate detailed reports that provide insights into the growth of the annuity over time, including charts and graphs.

- Integration with Financial Platforms:Some FV calculators are integrated with financial platforms, enabling users to track their investments and analyze their financial progress.

Popular FV Calculators

| Calculator Name | Key Features | Pros | Cons |

|---|---|---|---|

| Calculator A | [List key features] | [List pros] | [List cons] |

| Calculator B | [List key features] | [List pros] | [List cons] |

| Calculator C | [List key features] | [List pros] | [List cons] |

Using FV Calculators for Annuity Planning

Using an FV calculator to estimate the future value of an annuity is a straightforward process. By following these steps, individuals can gain valuable insights into their annuity growth potential and make informed financial decisions.

Step-by-Step Guide

- Input the Principal:Enter the initial investment amount or the first payment made into the annuity.

- Enter the Interest Rate:Specify the expected annual interest rate, considering the type of annuity and current market conditions.

- Input the Payment Amount:Enter the regular amount paid into the annuity at each payment interval.

- Specify the Time Period:Enter the total duration of the annuity, expressed in years or months.

- Select Compounding Frequency:Choose the frequency at which interest is compounded, such as monthly, quarterly, or annually.

- Calculate the Future Value:Click on the “Calculate” button to generate the estimated future value of the annuity.

Inflation and Taxes

When planning for annuity growth, it’s essential to consider the impact of inflation and taxes. Inflation erodes the purchasing power of money over time, reducing the real value of future annuity payments. Taxes are also a factor, as interest earned on annuities may be subject to taxation.

By factoring in these variables, individuals can create more realistic projections of their annuity growth.

Understanding the cash flows associated with annuities is crucial for accurate financial planning. Excel can be a powerful tool for these calculations. If you’re looking for guidance, the article on Calculating Annuity Cash Flows Excel 2024 provides a detailed explanation and helpful tips.

Adjusting FV Calculations

FV calculations can be adjusted based on changing market conditions or personal financial goals. For example, if interest rates increase, the future value of the annuity will be higher. Similarly, if an individual decides to increase their payment amount, the future value will also increase.

By regularly reviewing and adjusting FV calculations, individuals can ensure that their annuity planning aligns with their evolving financial needs and objectives.

Wrap-Up

By understanding the principles of FV calculators and applying them to your annuity planning, you can gain valuable insights into the potential growth of your savings. Armed with this knowledge, you can make confident decisions that align with your financial goals and aspirations.

When planning for retirement, annuities are a valuable tool. To get a clear picture of your potential income, you can use an annuity calculator. For those interested in BMO’s offerings, check out the Annuity Calculator Bmo 2024.

This tool helps you estimate your annuity payments based on your individual circumstances.

Remember, the future value of your annuity is not predetermined. It’s a dynamic figure that can be influenced by factors like interest rates, payment amounts, and the length of the annuity period. By actively managing these variables and staying informed about market trends, you can maximize the potential of your annuity and secure a brighter financial future.

FAQ Compilation

What is the difference between an ordinary annuity and an annuity due?

There are different types of annuities available, each with its own features and benefits. If you’re considering a specific type, you might be interested in the information on 6 Annuity 2024. This resource provides an overview of various annuity options and their key characteristics.

An ordinary annuity makes payments at the end of each period, while an annuity due makes payments at the beginning of each period. This difference can impact the future value of the annuity.

How do taxes and inflation affect annuity growth?

Taxes and inflation can erode the purchasing power of your annuity payments over time. It’s important to factor these considerations into your FV calculations to get a realistic picture of your future financial situation.

Are there any free FV calculators available online?

Yes, there are many free FV calculators available online. Some popular options include those offered by financial institutions, investment platforms, and personal finance websites.