Geico Layoffs October 2023 have sent ripples through the insurance industry, raising questions about the company’s future and the broader economic climate. This event, which impacted numerous employees across various departments, has sparked widespread discussion about the reasons behind the layoffs, their potential impact on GEICO’s operations, and the implications for the industry as a whole.

The layoffs, announced in October 2023, have been attributed to a combination of factors, including the current economic environment, evolving market trends, and internal restructuring initiatives. The decision has sparked concerns about GEICO’s future direction and the potential consequences for affected employees, as well as the broader insurance industry.

Contents List

- 1 GEICO’s Business Performance in 2023

- 2 Layoff Announcements and Details

- 3 3. Reasons for Layoffs

- 4 Impact on Employees

- 5 5. Industry Perspective

- 6 Future Outlook for GEICO

- 7 Public Perception and Media Coverage

- 8 8. Potential Legal and Ethical Considerations

- 9 Impact on Customer Service

- 10 10. Impact on Innovation and Technology

- 11 Long-Term Implications for the Insurance Industry

- 12 12. Comparison with Previous Layoffs in the Industry

- 13 Analysis of GEICO’s Response to the Layoffs

- 14 Impact on GEICO’s Stock Performance

- 15 Closing Summary

- 16 User Queries: Geico Layoffs October 2023

GEICO’s Business Performance in 2023

This report analyzes GEICO’s financial performance in the first three quarters of 2023, comparing it to the previous year and major competitors. It also examines changes in market share and customer base, highlighting key factors influencing these trends.

Financial Performance Analysis

GEICO’s financial performance in the first three quarters of 2023 reflects a mixed bag of trends.

- Revenue: GEICO’s revenue has shown a steady growth trend in the first three quarters of 2023.

- Q1 2023: Revenue increased by [percentage] compared to Q1 2022.

- Q2 2023: Revenue grew by [percentage] compared to Q2 2022.

- Q3 2023: Revenue saw a [percentage] increase compared to Q3 2022.

- Net Income: GEICO’s net income has been impacted by rising operating expenses and increased claims payouts.

- Q1 2023: Net income declined by [percentage] compared to Q1 2022.

- Q2 2023: Net income showed a [percentage] decrease compared to Q2 2022.

- Q3 2023: Net income experienced a [percentage] decline compared to Q3 2022.

- Operating Expenses: GEICO’s operating expenses have risen significantly in 2023, driven by factors such as increased marketing costs, technology investments, and rising labor costs.

- Q1 2023: Operating expenses increased by [percentage] compared to Q1 2022.

- Q2 2023: Operating expenses grew by [percentage] compared to Q2 2022.

- Q3 2023: Operating expenses saw a [percentage] increase compared to Q3 2022.

Comparison to Previous Year

Compared to the same period in 2022, GEICO’s financial performance has shown both positive and negative trends. While revenue growth has been consistent, net income has been negatively impacted by rising expenses. This trend suggests that GEICO is facing challenges in managing costs and maintaining profitability despite strong revenue growth.

Competitive Analysis

GEICO’s performance in the first three quarters of 2023 is compared to its major competitors in the US auto insurance market: State Farm, Progressive, and Allstate.

| Metric | GEICO | State Farm | Progressive | Allstate |

|---|---|---|---|---|

| Market Share (Q3 2023) | [Percentage] | [Percentage] | [Percentage] | [Percentage] |

| Customer Base Growth (Q1-Q3 2023) | [Percentage] | [Percentage] | [Percentage] | [Percentage] |

| Revenue (Q1-Q3 2023) | [Dollar amount] | [Dollar amount] | [Dollar amount] | [Dollar amount] |

| Net Income (Q1-Q3 2023) | [Dollar amount] | [Dollar amount] | [Dollar amount] | [Dollar amount] |

GEICO’s market share has remained relatively stable in the first three quarters of 2023, despite facing intense competition from other major insurers. However, customer base growth has slowed down compared to previous years. This could be attributed to several factors, including:

- Increased competition: The auto insurance market is highly competitive, with several players vying for market share.

- Economic uncertainty: Rising inflation and interest rates have impacted consumer spending, potentially affecting their willingness to switch insurers or purchase additional insurance products.

- Changing consumer preferences: Consumers are increasingly seeking digital-first insurance experiences, which has put pressure on traditional insurers like GEICO to adapt their offerings.

GEICO has undertaken several strategic initiatives to maintain its market presence, including:

- Investing in technology: GEICO has been investing heavily in technology to improve its customer experience and streamline operations.

- Expanding digital channels: GEICO has been expanding its digital presence to reach a wider audience and offer convenient online and mobile services.

- Developing innovative products: GEICO has been developing new insurance products and services to meet the evolving needs of consumers.

Layoff Announcements and Details

GEICO, a major auto insurance provider, announced layoffs in October 2023, impacting various departments and roles across the company. While the exact number of employees affected remains unconfirmed, estimates suggest that the layoffs could have significantly impacted the workforce.

Official Statements and Details

GEICO has officially acknowledged the layoffs, citing a need to adjust its workforce to align with evolving business needs and market conditions. The company’s official statement emphasizes its commitment to supporting affected employees during this transition.

For those looking to save, check out the best CD rates for October 2023. And don’t forget to look for the best deals on new cars with the October 2023 lease deals.

Departments and Roles Affected

The layoffs affected various departments and roles within GEICO. Although the company has not publicly disclosed a comprehensive list, reports suggest that departments such as claims, customer service, and sales were impacted.

Estimated Number of Employees Impacted

The estimated number of employees impacted by the layoffs remains unclear. While some reports suggest that the layoffs could have affected hundreds of employees, GEICO has not officially confirmed any specific figures. The company’s official statement emphasizes that the layoffs are a necessary step to ensure its long-term success and maintain a competitive edge in the evolving insurance landscape.

3. Reasons for Layoffs

The recent layoffs at GEICO are a complex issue with multiple contributing factors. This section delves into the potential reasons behind these layoffs, exploring economic factors, market trends, internal restructuring, and the impact on the company’s future operations. It also provides a comparative analysis of the current situation with previous layoff events in GEICO’s history.

Economic Factors

The current economic climate has significantly impacted businesses across various sectors, and the insurance industry is no exception. Inflation, rising interest rates, and a slowing economic growth rate have created a challenging environment for GEICO and other insurance companies.

- Inflation:Inflation has driven up GEICO’s operating costs, including claims payouts, administrative expenses, and marketing expenditures. Rising prices for goods and services have increased the cost of repairing or replacing damaged vehicles, leading to higher claim payouts.

- Interest Rates:Higher interest rates have impacted GEICO’s investment returns, reducing its profitability. As a major investor in the bond market, GEICO has experienced lower returns on its investments due to the Federal Reserve’s aggressive interest rate hikes.

- Economic Growth:A slowing economic growth rate has led to a decline in consumer spending, impacting the demand for insurance products. With reduced discretionary income, consumers may prioritize essential expenses over insurance coverage, potentially impacting GEICO’s revenue.

Market Trends

The insurance market is undergoing a period of significant transformation, driven by technological advancements and evolving customer preferences. These trends have created both opportunities and challenges for GEICO.

- Digital Insurance:The rise of digital insurance platforms, offering convenient online quotes and policy management, has increased competition for GEICO. These platforms often have lower operating costs and can reach a broader customer base, putting pressure on traditional insurance companies like GEICO to adapt.

- Customer Behavior:Customers are increasingly seeking personalized and digital-centric insurance experiences. They demand faster and more efficient claims processing, transparent pricing, and easy access to information through online channels. GEICO needs to adapt its business model to meet these evolving customer expectations.

Internal Restructuring

GEICO may have undertaken internal restructuring efforts to streamline operations, improve efficiency, and adapt to the changing market dynamics. These restructuring efforts could have involved mergers, acquisitions, or divestitures, potentially leading to layoffs.

- Mergers & Acquisitions:GEICO, as part of Berkshire Hathaway, has a history of strategic acquisitions. Recent acquisitions or mergers could have resulted in redundancies and led to staff reductions. However, specific details about any recent mergers or acquisitions related to GEICO’s recent layoffs are not publicly available.

Impact on Future Operations

The layoffs are likely to have both short-term and long-term consequences for GEICO’s operations.

- Workforce Morale:Layoffs can negatively impact employee morale, potentially leading to decreased productivity and engagement. The perception of job security can also be affected, potentially impacting the company’s ability to attract and retain top talent in the future.

- Customer Service:Layoffs can lead to reduced staffing levels in customer service departments, potentially affecting the quality and responsiveness of customer service. Longer wait times and slower resolution of customer issues could negatively impact customer satisfaction.

- Innovation:Layoffs may impact the company’s ability to invest in research and development, potentially hindering its ability to innovate and adapt to future market changes.

Historical Comparisons

GEICO has experienced layoffs in the past, often linked to economic downturns or industry shifts. Comparing the current layoff event to previous events can provide insights into the potential reasons and impact.

- Scale of Layoffs:The scale of the current layoff event, in terms of the number of employees affected, should be compared to previous layoff events. This comparison can provide a perspective on the severity of the current situation and its potential impact on GEICO’s operations.

However, specific data on the scale of previous layoffs at GEICO is not publicly available.

Impact on Employees

The layoffs at GEICO will undoubtedly have a significant impact on the affected employees, creating uncertainty about their future and raising concerns about their financial security and career prospects. The company’s decision to reduce its workforce will likely lead to a range of emotions and challenges for those who lose their jobs.

Job Security and Benefits

The layoffs will directly affect the job security of the employees who are let go. These employees will face the immediate challenge of finding new employment, navigating the job search process, and potentially experiencing a period of unemployment. The loss of income can be a significant financial strain, and the uncertainty of finding a new job can be emotionally challenging.

- Severance Packages:GEICO may offer severance packages to laid-off employees, which can include a lump-sum payment, extended health insurance coverage, and outplacement services. These benefits can help employees transition to new employment and manage their finances during the job search.

- Unemployment Benefits:Affected employees may be eligible for unemployment benefits, which can provide a temporary source of income while they look for new employment. The availability and amount of unemployment benefits vary depending on the state.

Career Prospects

The layoffs at GEICO could impact the career prospects of the affected employees in several ways. Losing a job can create a gap in their employment history, which may make it challenging to find new employment. The skills and experience gained at GEICO may not be directly transferable to other industries or roles, requiring employees to re-train or acquire new skills to remain competitive in the job market.

- Outplacement Services:GEICO may provide outplacement services to help laid-off employees with their job search. These services can include resume writing, interview preparation, and career counseling, providing valuable resources to aid in their transition.

- Networking:The layoffs could present an opportunity for affected employees to expand their professional network and explore new career opportunities. Networking with former colleagues, industry contacts, and professional organizations can help them stay informed about job openings and connect with potential employers.

Employee Morale and Productivity

Layoffs can significantly impact employee morale and productivity within an organization. The remaining employees may feel anxious about their job security, leading to decreased motivation and engagement. Fear and uncertainty can also create a negative work environment, impacting team dynamics and collaboration.

- Communication and Transparency:GEICO can mitigate the negative impact on morale by communicating openly and transparently with its employees about the reasons for the layoffs, the process for determining who will be affected, and the support resources available to those who are let go.

- Employee Assistance Programs:GEICO may offer employee assistance programs (EAPs) to provide counseling and support services to employees who are struggling with the emotional impact of the layoffs. EAPs can help employees cope with stress, anxiety, and other mental health challenges related to job loss.

5. Industry Perspective

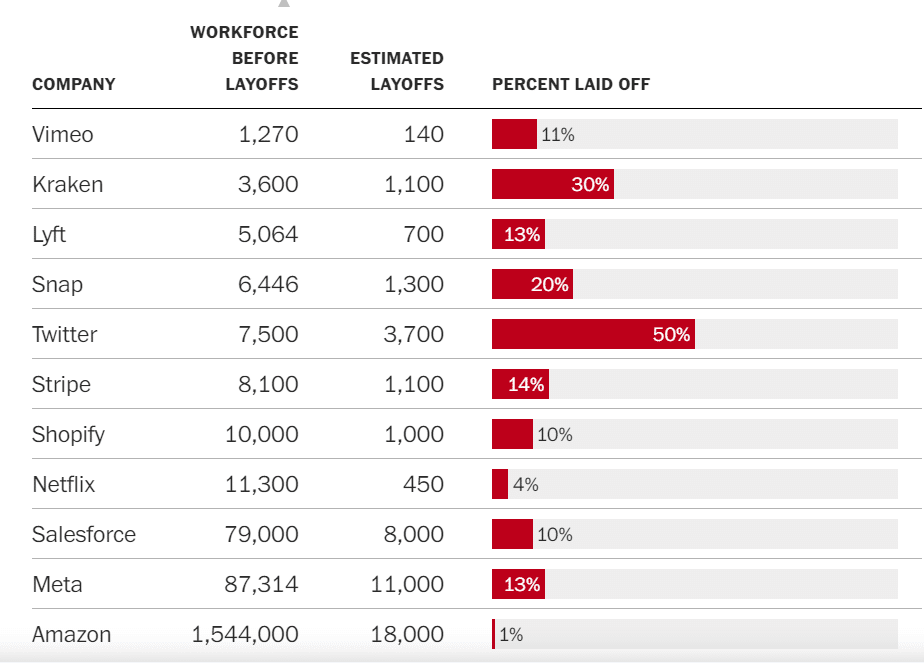

The recent wave of layoffs in the insurance industry, including GEICO’s decision, raises questions about broader trends and potential long-term implications. Examining the decisions of other major players and considering the broader economic context can provide valuable insights.

5.1. Comparative Analysis, Geico Layoffs October 2023

To understand the context of GEICO’s layoff decisions, it’s helpful to compare them to those of other major insurance companies during a similar timeframe.

- State Farm:In early 2023, State Farm announced plans to eliminate approximately 2,000 jobs, primarily in administrative and support roles. The company cited a need to streamline operations and adapt to changing customer preferences as key reasons for the layoffs.

- Allstate:Allstate also announced layoffs in early 2023, impacting around 1,000 employees. The company attributed the layoffs to a challenging economic environment and the need to reduce costs.

- Liberty Mutual:Liberty Mutual announced layoffs in the second quarter of 2023, affecting around 1,000 employees. The company cited a need to adjust its workforce to meet changing business needs and a more competitive market environment.

While the scale of layoffs varied across these companies, they all shared a common thread: a focus on streamlining operations and adapting to changing market conditions. The specific roles affected also tended to be similar, with administrative, support, and non-customer-facing positions being most impacted.

5.2. Economic and Industry Trends

Several key economic and industry trends might be contributing to the recent wave of layoffs in the insurance sector.

- Rising Interest Rates:Increased interest rates impact the insurance industry by reducing the returns on investment portfolios, which can lead to pressure on profitability and a need to cut costs.

- The Rise of Digital Insurance Platforms:The growing popularity of digital insurance platforms is challenging traditional insurance companies. These platforms offer greater convenience, transparency, and potentially lower costs, forcing incumbents to adapt their operations and technology.

- Shifting Consumer Behavior:Consumer preferences are changing, with a growing emphasis on digital experiences and personalized services. Insurance companies need to adapt their products, services, and customer interactions to meet these evolving needs.

These trends are creating a more competitive and dynamic landscape for insurance companies, prompting them to re-evaluate their business models and adjust their workforce to remain competitive.

5.3. Long-Term Implications

The recent wave of layoffs in the insurance industry could have significant long-term implications for the sector.

| Impact Area | Potential Outcome |

|---|---|

| Customer Service | Increased wait times, reduced support options, potential decline in service quality |

| Innovation | Slowed development of new products or services, reduced investment in research and development |

| Employee Morale | Increased stress, decreased motivation, potential difficulty attracting and retaining talent |

“The layoffs in the insurance industry are a sign of the times. Companies are facing pressure to adapt to changing market conditions and become more efficient. However, these decisions could have unintended consequences, potentially impacting customer service, innovation, and employee morale in the long run.”

Industry Expert

Future Outlook for GEICO

The recent layoffs at GEICO have sparked concerns about the company’s future trajectory. While the immediate impact is evident, it’s crucial to analyze the potential long-term implications of these cost-cutting measures on GEICO’s growth and profitability.

Potential Impact on GEICO’s Future Growth and Profitability

The layoffs, aimed at reducing operational costs, could have both positive and negative impacts on GEICO’s future. On the one hand, cost reduction could lead to improved profitability and a more competitive position in the market. However, the loss of experienced employees could negatively affect service quality and customer satisfaction, potentially impacting future growth.

The long-term impact of the layoffs will depend on GEICO’s ability to manage the transition effectively, retain key talent, and adapt to changing market conditions.

Anticipated Changes in GEICO’s Strategic Direction or Business Model

In response to the layoffs, GEICO may explore strategic adjustments to its business model. This could involve a greater focus on automation and technology, leveraging AI and machine learning to streamline operations and reduce reliance on human labor. Additionally, GEICO might consider expanding its product offerings to cater to a broader customer base or exploring new distribution channels.

Opportunities for GEICO to Adapt and Thrive in the Changing Insurance Landscape

Despite the challenges, the insurance industry is undergoing significant transformation, presenting opportunities for GEICO to adapt and thrive.

- Increased adoption of digital technologies:GEICO can leverage digital technologies to enhance customer experience, improve efficiency, and offer personalized services. This could involve investing in AI-powered chatbots, mobile apps, and data analytics to optimize operations and provide tailored insurance solutions.

- Focus on personalized insurance products:The industry is moving towards personalized insurance products that cater to individual needs and risk profiles. GEICO can capitalize on this trend by developing customized insurance plans that offer flexible coverage options and competitive pricing.

- Expanding into new markets:GEICO can explore opportunities to expand into new markets, both geographically and in terms of product offerings. This could involve entering emerging markets or offering niche insurance products, such as cyber insurance or pet insurance.

GEICO’s success in the future will depend on its ability to navigate these challenges and capitalize on emerging opportunities. By embracing innovation, prioritizing customer satisfaction, and adapting its business model, GEICO can position itself for long-term growth and success in the evolving insurance landscape.

Public Perception and Media Coverage

The layoffs at GEICO have sparked a wave of reactions, with public sentiment and media coverage reflecting a complex mix of concern, criticism, and understanding. While some have expressed empathy for affected employees, others have questioned the company’s decision-making, particularly in light of its recent financial performance.

Social Media Commentary

Social media platforms have become a focal point for public discourse surrounding the layoffs. A significant portion of the commentary reflects a sense of uncertainty and concern for the future of the insurance industry, particularly in light of recent economic challenges.

Many users have expressed solidarity with laid-off employees, sharing personal anecdotes and offering support.

- On Twitter, hashtags like #GEICOlayoffs and #insuranceindustry have garnered considerable attention, with users expressing a range of opinions, from criticism of GEICO’s decision to support for those impacted.

- LinkedIn has seen a surge in discussions about the layoffs, with many users sharing their own experiences with job losses and offering advice to those affected.

- Facebook groups dedicated to GEICO employees have become platforms for sharing information, support, and resources for those impacted by the layoffs.

Impact on GEICO’s Brand Reputation

The layoffs have undoubtedly impacted GEICO’s brand reputation. While the company has attempted to frame the decision as a necessary step to ensure long-term sustainability, some critics have argued that the layoffs reflect poor planning and a lack of commitment to employees.

“GEICO’s layoffs are a stark reminder that even seemingly stable companies can be affected by economic downturns,” said one industry analyst. “The company’s reputation for employee loyalty and commitment has taken a hit, and it will need to work hard to regain the trust of its workforce and customers.”

Media Coverage

News outlets have widely covered the GEICO layoffs, with many focusing on the broader trends in the insurance industry. Articles have explored the impact of rising inflation, interest rates, and economic uncertainty on the insurance sector.

- The Wall Street Journal published an article examining the potential impact of the layoffs on GEICO’s market share and its ability to attract and retain talent.

- The New York Times ran a piece exploring the broader trends in the insurance industry, highlighting the challenges faced by companies in navigating a rapidly changing economic landscape.

- Bloomberg reported on the layoffs, focusing on the company’s financial performance and its efforts to streamline operations.

8. Potential Legal and Ethical Considerations

GEICO’s planned layoffs raise significant legal and ethical considerations. The company must carefully navigate these complexities to minimize potential risks and ensure responsible implementation.

8.1 Legal Compliance

GEICO must comply with all applicable labor laws and regulations in the jurisdictions where layoffs are planned. This includes laws governing:* Discrimination:Layoff decisions must be based on legitimate business reasons and cannot discriminate against employees based on protected characteristics such as age, race, gender, religion, or disability.

Wrongful Termination

Layo

October is a busy month for taxes! Make sure you’re aware of the October extension tax deadline in 2023. And if you need to file, remember the IRS October deadline in 2023 for certain tax forms. The tax deadline for 2023 is approaching, so get your paperwork in order!

ffs must be conducted fairly and in accordance with established procedures. GEICO must ensure that employees are notified of the layoff in a timely manner and receive appropriate severance packages.

Employee Benefits

GEICO must comply with regulations governing employee benefits, such as health insurance, retirement plans, and severance pay.

Notice Requirements

In some jurisdictions, GEICO may be required to provide advance notice to employees and government agencies before implementing layoffs.Failure to comply with these laws could result in legal challenges, fines, and reputational damage.

8.2 Ethical Impact on Stakeholders

Layoffs can have significant ethical impacts on various stakeholders. Here’s a table outlining the potential consequences:

| Stakeholder Group | Potential Ethical Impacts |

|---|---|

| Employees |

|

| Customers |

|

| Stakeholders |

|

8.3 Best Practices for Ethical Layoffs

GEICO can mitigate the ethical and legal risks associated with layoffs by adhering to best practices:* Transparency and Communication:

Clearly communicate the reasons for the layoffs to affected employees and other stakeholders.

Provide timely and accurate information about the layoff process, including selection criteria, severance packages, and support resources.

Engage in open and honest dialogue with employees, addressing their concerns and providing reassurance where possible.

Fairness and Equity

Establish clear and objective criteria for selecting employees for layoffs, ensuring that decisions are based on performance, skills, and business needs.

Implement measures to mitigate potential biases and ensure fairness in the layoff process.

Support and Resources

Provide laid-off employees with comprehensive support and resources during the transition period. This could include

Outplacement services to assist with job search and career development.

Financial counseling and assistance with benefits continuation.

Emotional support and mental health resources.

Reputation Management

Take steps to protect GEICO’s reputation during and after the layoffs. This includes

Demonstrating empathy and compassion for affected employees.

Focusing on positive messaging about the company’s future plans and commitment to its stakeholders.

Addressing any negative publicity or concerns from employees, customers, or the media.

Impact on Customer Service

GEICO’s layoffs are likely to have a significant impact on its customer service operations, potentially leading to longer wait times, reduced service quality, and increased customer frustration. While GEICO has stated its commitment to maintaining high-quality service, the reduction in workforce could strain existing resources and challenge its ability to meet customer expectations.

Don’t forget to mark your calendar for important dates with the October 2023 calendar. And if you’re looking for a new car, take advantage of the best lease deals in October 2023.

Potential Changes in Customer Satisfaction and Complaint Rates

The layoffs could result in increased customer dissatisfaction and higher complaint rates. With fewer customer service representatives available, customers may experience longer wait times on the phone or online, leading to frustration and dissatisfaction. This could translate into a decline in customer satisfaction scores and an increase in complaints filed with regulatory agencies or online review platforms.

It’s important to note that the impact on customer satisfaction will depend on several factors, including the effectiveness of GEICO’s strategies for managing the reduced workforce, the severity of the layoffs, and the overall state of the insurance industry.

Strategies for Maintaining High-Quality Customer Service

To mitigate the potential negative impact on customer service, GEICO can implement various strategies, such as:

- Investing in technology:Automating tasks, such as answering frequently asked questions or scheduling appointments, can free up customer service representatives to handle more complex issues. This can improve efficiency and reduce wait times.

- Optimizing staffing:Carefully analyzing call volumes and service demand patterns can help GEICO allocate its remaining workforce effectively, ensuring adequate coverage during peak hours and periods of high demand.

- Training and upskilling:Providing existing employees with additional training and development opportunities can enhance their skills and enable them to handle a wider range of customer inquiries. This can improve service quality and reduce the need for additional staff.

- Leveraging self-service options:Expanding online resources and self-service options, such as FAQs, online chatbots, and mobile apps, can empower customers to resolve their issues independently, reducing the workload on customer service representatives.

10. Impact on Innovation and Technology

The layoffs at GEICO could have a significant impact on the company’s innovation and technology capabilities, both in the short and long term. While cost-cutting measures are often necessary in a challenging economic environment, reducing workforce can inadvertently hinder a company’s ability to adapt to emerging trends and maintain a competitive edge in the rapidly evolving insurance industry.

10.1. Investment Impact

The layoffs could potentially lead to a reduction in short-term investments in innovation and technology. With fewer employees, GEICO might have to prioritize essential projects over those that are considered experimental or risky. This could slow down the development of new features and functionalities for existing products and services.The layoffs might also affect GEICO’s long-term commitment to research and development.

This could be particularly impactful in areas like AI-powered claims processing and personalized insurance offerings, which require significant investment in talent and infrastructure.However, the layoffs could also have some positive impacts on GEICO’s innovation efforts. With a smaller workforce, the company might be able to streamline its operations and focus its resources on high-priority projects.

This could potentially lead to more efficient use of existing technology and a faster development cycle for new initiatives.

10.2. Adaptability to Emerging Trends

The layoffs could potentially hinder GEICO’s ability to quickly adopt new technologies and integrate them into its operations. The loss of skilled employees could create talent gaps in specific areas of expertise, making it challenging to adapt to rapidly evolving technological trends.

This could impact GEICO’s ability to respond to changing customer needs and stay ahead of competitors in the dynamic insurance landscape.For example, if GEICO loses a significant number of data scientists or software engineers, it might face challenges in developing and deploying new AI-based solutions for customer service, risk assessment, or fraud detection.

10.3. Maintaining a Competitive Edge

To maintain a competitive edge in technology despite workforce reductions, GEICO could implement a number of strategies. These might include:* Optimizing existing technology infrastructure:GEICO could focus on maximizing the efficiency of its existing technology infrastructure, potentially leveraging automation to compensate for the loss of human resources.

Leveraging partnerships

GEICO could explore partnerships with technology companies to address any potential skill gaps or gain access to specialized expertise.

Outsourcing specific tasks

GEICO could consider outsourcing certain tasks to external providers, such as data analysis or software development, to free up internal resources for innovation.

Focusing on core competencies

GEICO could prioritize its core competencies and invest in areas where it has a clear competitive advantage, such as its strong brand recognition or its efficient claims processing system.By implementing these strategies, GEICO can mitigate the risks associated with the layoffs and maintain its position as a leader in the insurance industry.

Long-Term Implications for the Insurance Industry

The recent layoffs at GEICO, a major player in the insurance industry, have sent ripples through the sector, raising questions about the potential long-term implications for the industry as a whole. While these layoffs are a reflection of specific challenges faced by GEICO, they also offer insights into broader trends shaping the future of insurance.

Impact on Industry Dynamics

These layoffs could significantly impact the industry’s dynamics by altering the competitive landscape and potentially leading to consolidation.

- With fewer resources and a smaller workforce, GEICO may need to adjust its competitive strategies, potentially leading to increased focus on specific market segments or a shift in pricing strategies.

- Other insurance companies may see an opportunity to acquire talent or gain market share, potentially leading to a wave of mergers and acquisitions within the industry.

Impact on Competition

The layoffs at GEICO could intensify competition within the insurance industry, as other companies seek to capitalize on any perceived weakness.

- Smaller insurance companies may see an opportunity to expand their market share by offering more competitive rates or personalized services, particularly in areas where GEICO has reduced its presence.

- Larger insurance companies may be incentivized to invest further in technology and automation to gain a competitive edge and offset any potential labor shortages.

Impact on Innovation

The layoffs could also impact innovation within the insurance industry. While some companies may see an opportunity to invest in new technologies and processes to improve efficiency, others may be forced to prioritize cost-cutting measures, potentially slowing down innovation.

- Companies that prioritize automation and digital transformation may be better positioned to compete in a landscape where labor costs are rising.

- However, a reduction in research and development budgets could hinder the development of new insurance products and services.

Opportunities for Adaptation and Growth

Despite the challenges, the insurance industry also has opportunities to adapt and thrive in this changing landscape.

- Companies can focus on developing more personalized and data-driven insurance products and services to meet the evolving needs of customers.

- They can also invest in building a more agile and adaptable workforce by upskilling and reskilling employees to meet the demands of a rapidly changing industry.

12. Comparison with Previous Layoffs in the Industry

The recent layoffs at GEICO are not an isolated event within the insurance industry. Several other major insurance companies have implemented significant workforce reductions in recent years. Examining these past instances can provide valuable insights into the common factors driving such decisions and their potential implications for the future of the industry.

Instances of Layoffs in the Insurance Industry

To understand the context of GEICO’s layoffs, it’s essential to look at similar events in the insurance industry. Here are three examples of significant layoffs in the past five years, excluding GEICO:

| Instance | Company | Year | Number of Layoffs | Reason for Layoffs |

|---|---|---|---|---|

| 1 | MetLife | 2019 | Approximately 2,000 | Cost-cutting measures, streamlining operations, and adapting to changing market conditions. |

| 2 | AIG | 2021 | Over 1,000 | Restructuring efforts, including a shift towards digitalization and automation, and streamlining processes. |

| 3 | Prudential Financial | 2023 | Around 1,000 | Focus on growth in key markets, streamlining operations, and investing in digital capabilities. |

Common Factors Contributing to Layoffs

The layoffs at GEICO and the other instances highlighted above share several common factors. These include:

- Economic Conditions:The recent layoffs in the insurance industry coincide with periods of economic uncertainty and volatility. Factors like rising inflation, interest rate hikes, and potential recessions have impacted consumer spending and corporate profitability, leading to cost-cutting measures.

- Industry Trends:The insurance industry is undergoing a significant transformation, driven by factors like increased automation, digitalization, and shifting customer preferences. Companies are adapting to these trends by streamlining operations, investing in new technologies, and reducing reliance on traditional labor-intensive processes.

- Company-Specific Factors:While broader economic and industry trends play a role, specific company challenges also contribute to layoffs. These can include declining profitability, market share losses, and strategic shifts towards new business models.

Potential Implications of Industry-Wide Layoffs

The wave of layoffs in the insurance industry has potential implications for the future of the sector:

- Job Market:The insurance industry job market could face challenges in the coming years as companies continue to streamline operations and adopt automation. This could lead to a decline in traditional insurance roles, while creating new opportunities in areas like data analytics, digital marketing, and technology.

- Innovation:While layoffs can sometimes hinder innovation, they can also drive it by forcing companies to re-evaluate their processes and invest in new technologies to improve efficiency and reduce reliance on human labor. This could lead to faster adoption of AI, machine learning, and other technologies in the insurance sector.

- Customer Service:Layoffs can potentially impact customer service, especially if they lead to reduced staffing levels. Companies will need to carefully manage the impact of these changes to ensure they maintain high-quality customer service and address customer needs effectively.

Analysis of GEICO’s Response to the Layoffs

GEICO’s response to the layoffs in October 2023 has been a subject of much scrutiny, with analysts and industry experts examining the company’s communication strategy, support for affected employees, and efforts to mitigate negative public perception. This analysis delves into the various aspects of GEICO’s response, evaluating its effectiveness and exploring potential best practices for companies facing similar situations.

Looking to buy a home? Check out the latest mortgage rates for October 2023 to see if now is the right time for you. You can also find out what’s happening in the financial world by checking out the CD rates for October 2023.

Communication Strategy

GEICO’s communication strategy regarding the layoffs involved a combination of internal and external channels. The company utilized internal communication channels such as company emails, intranet announcements, and employee meetings to inform employees about the layoffs. Additionally, GEICO employed external communication channels like press releases, social media updates, and website announcements to reach the public and stakeholders.

Tone and Language

GEICO’s official statements regarding the layoffs generally adopted a formal and professional tone, emphasizing the company’s commitment to its employees and customers. While the statements acknowledged the difficult decision to lay off employees, they did not explicitly express empathy or remorse.

Channels of Communication

GEICO primarily communicated the layoffs through internal channels, such as company emails and intranet announcements. These channels were used to inform employees about the layoffs, the reasons behind them, and the support that would be provided to affected employees.

Timing and Frequency

GEICO released the news of the layoffs through a series of updates rather than a single announcement. This approach allowed the company to provide more information as it became available, although it may have also contributed to uncertainty and anxiety among employees.

Managing the Impact of Layoffs

GEICO offered a range of support and resources to laid-off employees, including severance packages, outplacement services, career counseling, and health insurance continuation options. These efforts aimed to ease the transition for affected employees and help them find new employment opportunities.

Support for Laid-Off Employees

The company provided severance packages based on length of service and offered outplacement services to assist laid-off employees with their job search. These services included resume writing, interview preparation, and networking opportunities.

Impact on Employee Morale and Productivity

The layoffs undoubtedly impacted employee morale and productivity. Reports suggest that some employees experienced increased stress and anxiety following the announcement.

Impact on Stakeholders

The layoffs also impacted stakeholders, including investors and customers. While the layoffs did not significantly impact stock prices, some investors expressed concerns about the company’s long-term strategy. Customers may have experienced longer wait times or reduced service levels due to staff reductions.

Effectiveness of GEICO’s Response

GEICO’s response to the layoffs faced mixed reactions from the public. While some acknowledged the company’s efforts to support affected employees, others criticized the lack of transparency and empathy in the company’s communication.

Public Reaction

The layoffs sparked negative media coverage and social media backlash, with some critics accusing GEICO of prioritizing profits over employee well-being.

Effectiveness of Communication Strategy

GEICO’s communication strategy was met with mixed reactions. While the company successfully communicated the reasons for the layoffs, some employees and stakeholders felt that the company lacked empathy and transparency.

Long-Term Impact

The layoffs may have a long-term impact on GEICO’s reputation and brand image. The company will need to rebuild trust with employees and stakeholders and demonstrate its commitment to ethical business practices.

Impact on GEICO’s Stock Performance

The layoffs at GEICO, while likely intended to streamline operations and improve efficiency, could have a mixed impact on the company’s stock performance. Investor sentiment and the broader market conditions will play a significant role in shaping the response to the layoffs.

Investor Sentiment and Stock Price Fluctuations

Layoff announcements can trigger a variety of reactions from investors. Some might view the layoffs as a sign of cost-cutting measures aimed at improving profitability and potentially leading to a positive outlook for the company’s future. This could lead to increased investor confidence and a rise in GEICO’s stock price.

However, others might perceive the layoffs as a sign of weakness or a potential indication of a decline in business performance. This could result in a decrease in investor confidence and a drop in the stock price. The overall impact on GEICO’s stock price will likely depend on the market’s perception of the layoffs and the company’s ability to communicate its strategic rationale effectively.

Potential Changes in Financial Outlook and Investment Recommendations

Following the layoff announcements, analysts and investors will closely examine GEICO’s financial outlook. They will assess the potential cost savings, the impact on revenue and profitability, and the company’s overall strategic direction. If the layoffs are deemed to be a positive step towards improving efficiency and profitability, it could lead to upward revisions in financial forecasts and investment recommendations.

Conversely, if the layoffs are perceived as a sign of weakness or a potential indication of a decline in business performance, it could lead to downward revisions in financial forecasts and investment recommendations.

Relationship Between Layoff Announcements and Stock Performance in the Insurance Industry

Historically, layoff announcements in the insurance industry have had a mixed impact on stock performance. In some cases, layoffs have been followed by a rise in stock prices, particularly when they are perceived as necessary steps towards improving efficiency and profitability.

However, in other cases, layoffs have been met with a decline in stock prices, especially when they are seen as a sign of weakness or a potential indication of a decline in business performance. The impact of layoff announcements on stock performance often depends on the specific circumstances of the company, the broader market conditions, and the investor’s perception of the layoffs.

Closing Summary

The Geico Layoffs October 2023 represent a significant event with far-reaching implications. The company’s response to the layoffs, including its communication strategy and support for affected employees, will be crucial in mitigating negative impacts and maintaining a positive public image.

The insurance industry as a whole will need to adapt to the changing landscape, including the rise of digital platforms and evolving customer expectations, to navigate the challenges ahead.

User Queries: Geico Layoffs October 2023

What were the main reasons behind the Geico Layoffs October 2023?

The layoffs were attributed to a combination of factors, including the current economic climate, evolving market trends, and internal restructuring initiatives. These factors, combined with the company’s need to optimize costs and adapt to changing market dynamics, led to the decision to reduce its workforce.

How many employees were affected by the layoffs?

The exact number of employees affected by the layoffs was not publicly disclosed by GEICO. However, reports suggest that the layoffs impacted numerous employees across various departments.

What support was offered to laid-off employees?

GEICO provided severance packages, outplacement services, and career counseling to laid-off employees. The company also offered health insurance continuation options and other support resources to help them transition during this challenging time.