Geico Layoffs October 2023 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The insurance giant, known for its iconic gecko mascot and competitive rates, has found itself navigating a challenging economic landscape, prompting difficult decisions about its workforce.

The announcement of layoffs in October 2023 sent shockwaves through the industry and sparked widespread speculation about the reasons behind this significant move.

This analysis delves into the factors that contributed to the layoffs, exploring the economic climate, GEICO’s historical performance, and the company’s response to these unprecedented challenges. We’ll examine the impact on affected employees, the broader implications for the insurance industry, and the potential long-term effects on GEICO’s future.

Contents List

GEICO Layoffs: Geico Layoffs October 2023

The recent announcement of layoffs at GEICO, a prominent insurance provider, has sparked concern about the company’s future and the broader economic climate. Understanding the context surrounding these layoffs requires examining the current economic landscape, GEICO’s historical performance, and any prior restructuring efforts.

Economic Context

The current economic climate presents a complex backdrop for the insurance industry. Inflation has reached multi-decade highs, impacting consumer spending and demand for insurance. Rising interest rates are also influencing the industry’s investment strategies and profitability. The possibility of a recession further complicates the situation, potentially impacting claims frequency and severity.

Wondering if there are any tax deadlines in October? The When Are Taxes Due In October 2023 article has all the answers you need.

Inflation

Inflation has eroded purchasing power, leading consumers to prioritize essential expenses over discretionary spending, including insurance. This can translate into a decrease in demand for insurance products, potentially impacting revenue for insurance companies.

Interest Rates

Rising interest rates affect the insurance industry’s investment strategies and profitability. Insurance companies invest premiums received to generate returns, and higher interest rates can lead to higher returns on investments. However, higher interest rates also increase the cost of borrowing, which can affect the profitability of insurance companies.

Recession Concerns

A recession can significantly impact the insurance industry. During economic downturns, unemployment rises, leading to a potential decrease in demand for insurance. Moreover, recessions can result in increased claims frequency and severity, putting pressure on insurance companies’ financial performance.

October is a great time to snag a great deal on a new car. Check out the Best Car Lease Deals October 2023 article to see what kind of savings are available.

GEICO’s Performance

GEICO, a subsidiary of Berkshire Hathaway, has a long history as a major insurance provider. Its financial performance has been characterized by consistent revenue growth and profitability, fueled by its direct-to-consumer model and focus on customer service. However, recent trends suggest potential challenges.

Wondering when those tax payments are due? If October is your month, you’ll want to check out the When Are Taxes Due In October article. It’s packed with helpful information, including details on extensions and deadlines.

Revenue and Profitability

GEICO’s revenue has grown steadily in recent years, but the growth rate has slowed in recent quarters. This slowdown could be attributed to factors such as increased competition, rising claims costs, and the economic headwinds discussed earlier. Profitability has also been impacted by rising claims costs and expenses.

GEICO has maintained a significant market share in the insurance industry. However, the competitive landscape is evolving, with new entrants and existing players expanding their offerings. This increased competition could put pressure on GEICO’s market share.

Looking for information on the latest Jepi dividend? The Jepi Dividend October 2023 article will provide you with the latest updates on this popular investment.

Customer Satisfaction

Customer satisfaction with GEICO has historically been high, contributing to its brand loyalty. However, recent trends suggest potential areas for improvement. Customer feedback highlights concerns about rising premiums, long wait times for customer service, and difficulties with online platforms.

If you need a little more time to file your taxes, the Tax Extension Deadline 2023 article will provide you with all the information you need to make an informed decision.

Prior Restructuring

GEICO has undertaken restructuring efforts in the past, driven by factors such as operational efficiency, cost reduction, and market conditions.

Looking for some great lease deals this October? The October 2023 Lease Deals article can help you find the best offers available.

Prior Layoffs

In 2017, GEICO announced layoffs affecting a small number of employees. The stated reason for the layoffs was to streamline operations and improve efficiency. The impact on the workforce was limited, and GEICO continued to operate effectively.

Stay up-to-date on the latest mortgage rates with the Mortgage Rates October 2023 article. Understanding current rates can help you make informed decisions about your home financing.

Potential Reasons for Layoffs

The current economic climate, coupled with GEICO’s recent financial performance and market position, provides a backdrop for understanding the potential reasons for layoffs.

Economic Headwinds

The economic challenges discussed earlier, including inflation, rising interest rates, and recession concerns, are likely contributing to the decision to lay off employees. These factors can impact revenue growth, profitability, and operational efficiency.

October is a great time to find the perfect credit card for your needs. Whether you’re looking for travel rewards or cash back, the Best Credit Cards October 2023 article will help you compare the top contenders and make an informed decision.

Cost Reduction

Layoffs are often implemented as a cost-reduction measure, particularly in challenging economic environments. By reducing its workforce, GEICO may be seeking to lower expenses and improve profitability.

Don’t forget about the October Extension Tax Deadline 2023 ! This article can help you determine if you’re eligible for an extension and how to file for one.

Market Competition

The increasing competition in the insurance industry could be driving GEICO to streamline operations and improve efficiency to remain competitive. Layoffs may be a way to achieve these objectives.

Don’t miss the IRS Tax Deadline October 2023 article to ensure you’re aware of any upcoming tax obligations. Staying informed about deadlines is key to avoiding penalties and staying on top of your finances.

Operational Efficiency

Layoffs can also be a way to improve operational efficiency by eliminating redundancies and streamlining processes. GEICO may be seeking to improve its cost structure and become more agile in a competitive market.

If you’re curious about the recent news surrounding PNC Bank, the PNC Bank Layoffs October 2023 article provides an overview of the situation.

Layoff Announcement and Details

GEICO, a major auto insurance company, announced layoffs in October 2023. The decision to reduce its workforce was a result of various factors, including economic challenges and a strategic shift within the company.

Announcement Details

The official announcement regarding the layoffs was made on October 26, 2023. The layoffs were company-wide, affecting employees in various departments and locations across the United States. While specific departments were not publicly disclosed, reports suggest that marketing, sales, and information technology were among the affected areas.

October is a great time to find a high-yield CD. The Best CD Rates October 2023 article can help you find the best deals available.

The announcement was made through an internal memo sent to employees, followed by news coverage from various media outlets.

Number of Employees Affected

The exact number of employees impacted by the layoffs has not been publicly disclosed by GEICO. However, estimates suggest that the layoffs affected several hundred employees, representing a significant portion of the company’s workforce.

Want to stay organized and on top of your schedule? The October 2023 Calendar will provide you with a comprehensive overview of the month.

Reasons for Layoffs

GEICO attributed the layoffs to a combination of factors, primarily citing the challenging economic climate and a need to streamline operations. The company emphasized that the layoffs were part of a strategic shift aimed at improving efficiency and focusing on core business areas.

If you’re looking for information on the recent layoffs at Geico, the Geico Layoffs October 2023 article provides an overview of the situation.

Summary of the Layoff Announcement

GEICO announced layoffs in October 2023, affecting a significant portion of its workforce. The company attributed the decision to the challenging economic environment and a strategic shift to improve efficiency and focus on core business areas. While the exact number of employees affected remains undisclosed, the layoffs were company-wide, impacting various departments and locations.

Need to know when the tax deadline is? The Tax Deadline 2023 article has all the information you need to stay on track with your tax obligations.

Impact on Employees and the Insurance Industry

The recent layoffs at GEICO have sent shockwaves through the company and the broader insurance industry. While the company has cited economic challenges and changing market dynamics as the primary reasons for the job cuts, the impact on affected employees and the overall insurance landscape is significant.

Consequences for Affected Employees

The layoffs at GEICO will undoubtedly have a profound impact on the lives of affected employees. The loss of a job can be a deeply stressful and disruptive experience, leading to financial insecurity and uncertainty about the future.

- Financial Strain:Job loss can result in immediate financial hardship, forcing individuals to navigate unemployment benefits, manage expenses, and potentially seek new employment opportunities.

- Job Security Concerns:The layoffs at GEICO could contribute to a climate of anxiety and uncertainty among remaining employees, raising concerns about job security and the company’s long-term stability.

- Emotional Distress:Losing a job can lead to emotional distress, including feelings of stress, anxiety, depression, and a sense of loss. The transition to a new job or career path can be challenging and emotionally draining.

Impact on GEICO’s Operations and Market Position

The layoffs at GEICO are likely to impact the company’s operations in several ways:

- Reduced Workforce:The loss of experienced employees could lead to a reduction in workforce capacity, potentially affecting service levels and efficiency.

- Potential Impact on Customer Service:A decrease in staffing levels could affect the quality and responsiveness of customer service, potentially impacting customer satisfaction and loyalty.

- Market Share Implications:If the layoffs result in significant operational disruptions, GEICO’s market share and competitive position could be affected, particularly in a highly competitive insurance market.

Comparison to Other Insurance Companies and Sectors, Geico Layoffs October 2023

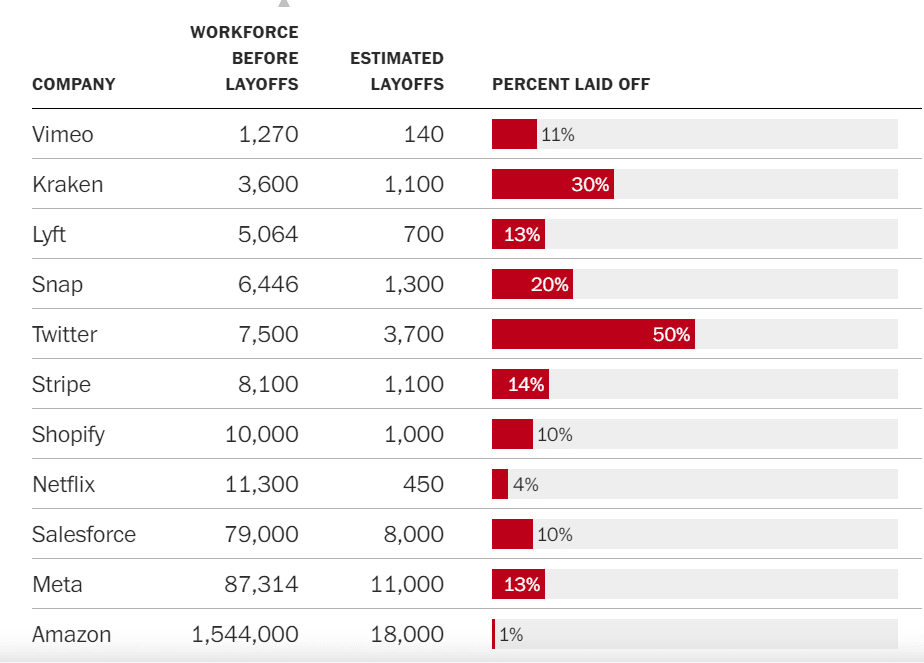

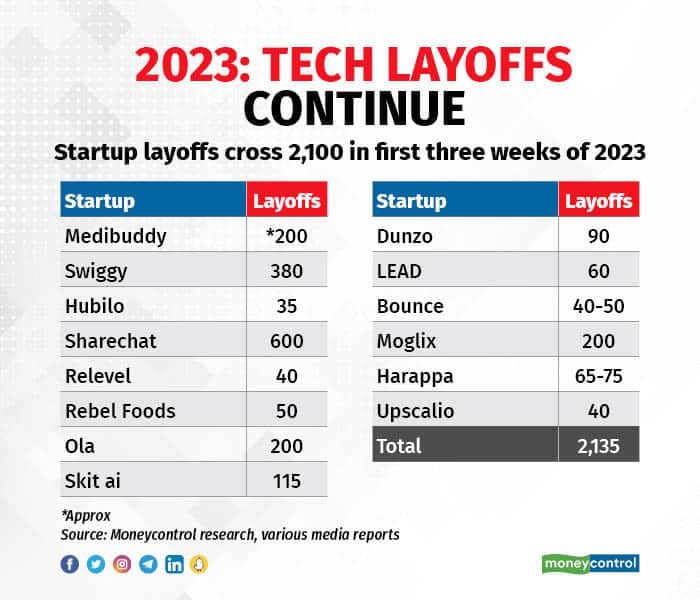

The layoffs at GEICO are not isolated. Many insurance companies and other sectors have implemented layoffs in recent months due to economic challenges, changing market dynamics, and technological advancements.

- Industry-Wide Trends:The insurance industry has faced increasing pressure from factors such as rising interest rates, inflation, and a changing regulatory environment. These challenges have led some insurance companies to make strategic decisions to cut costs and streamline operations, often through layoffs.

- Tech Industry Layoffs:The tech sector has also witnessed significant layoffs in recent years, as companies adjust to economic conditions and evolving technological landscapes. These layoffs have impacted various roles, from software engineers to marketing professionals.

- Economic Impact:The layoffs in the insurance industry and other sectors are a reflection of broader economic trends. Companies are seeking to reduce costs and adapt to changing market conditions, leading to job losses in various industries.

Last Recap

The Geico layoffs of October 2023 serve as a stark reminder of the dynamic nature of the business world and the impact of economic forces on even the most established companies. While the immediate impact is felt by the affected employees, the ripples extend beyond individuals, influencing the broader insurance landscape.

This event compels us to consider the evolving dynamics of the industry and the challenges that lie ahead for both companies and their employees.

Answers to Common Questions

What were the specific departments affected by the layoffs?

The official announcement did not disclose the specific departments affected by the layoffs. However, it’s likely that departments across the company were impacted, potentially including marketing, sales, IT, and customer service.

What is GEICO’s current market share in the insurance industry?

GEICO is a major player in the insurance industry, holding a significant market share. To get the most up-to-date information on their market share, it’s best to refer to recent industry reports or GEICO’s official financial statements.

What is the projected impact of the layoffs on GEICO’s future growth and profitability?

The impact of the layoffs on GEICO’s future growth and profitability is difficult to predict with certainty. The company’s response and strategic adjustments will play a significant role in determining their long-term success.

How did the public react to the layoffs?

Public reaction to the layoffs was mixed, with some expressing concern for the affected employees and others questioning the company’s decisions. Industry experts weighed in, analyzing the potential implications for the insurance sector.