Group Immediate Annuity Is Also Known As, a financial product offering a guaranteed stream of income, often goes by other names depending on the specific program or provider. Understanding these alternative names is crucial for navigating the complex world of annuities and making informed financial decisions.

For those in the UK, the annuity calculator Uk Money Saving Expert 2024 can help you compare different annuity options. Understanding the pv annuity of 1 table 2024 can be helpful when making these calculations.

This type of annuity is a popular choice for individuals seeking financial security in retirement, offering predictable income payments for life. While often referred to as a “Group Immediate Annuity,” it may also be called a “Group Annuity,” “Immediate Annuity,” or “Fixed Annuity,” among other variations.

Winning the lottery is a dream for many, but calculating lottery annuity payments 2024 can be a bit tricky. Understanding how to how to calculate annuities 2024 is crucial to make informed decisions about your winnings.

These different names often reflect specific characteristics of the program, such as the group affiliation or the payment structure. Exploring these alternative names can provide valuable insights into the diverse options available in the annuity market.

Contents List

- 1 What is a Group Immediate Annuity?

- 2 Other Names for Group Immediate Annuities

- 3 Advantages and Disadvantages of Group Immediate Annuities

- 4 Eligibility and Participation in Group Immediate Annuities

- 5 Funding and Payment Structures of Group Immediate Annuities

- 6 Tax Implications of Group Immediate Annuities

- 7 Real-World Examples and Case Studies

- 8 Regulations and Oversight of Group Immediate Annuities

- 9 Conclusion

- 10 User Queries: Group Immediate Annuity Is Also Known As

What is a Group Immediate Annuity?

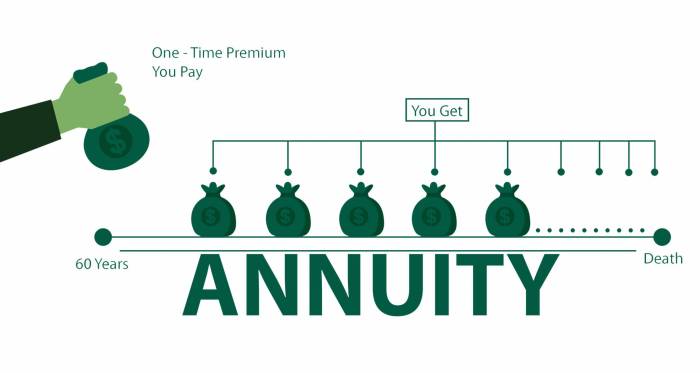

A Group Immediate Annuity (GIA) is a type of annuity contract that provides a guaranteed stream of income payments starting immediately upon purchase. This type of annuity is typically offered to groups of individuals, such as employees of a company or members of an association.

GIAs are designed to provide a secure and predictable source of retirement income or to supplement other income streams.

Key Characteristics of a GIA

GIAs are characterized by several key features that distinguish them from other types of annuities:

- Immediate Income:Payments begin immediately after the annuity is purchased, providing an instant source of income.

- Guaranteed Payments:The annuity contract guarantees a specific amount of income for a set period, providing financial security and predictability.

- Group Participation:GIAs are typically offered to groups of individuals, often through employers or organizations, allowing for collective purchasing power and potentially lower premiums.

- Flexibility in Payment Options:GIAs offer various payment options, such as fixed monthly payments, lump sum payments, or a combination of both.

Differences from Other Annuities, Group Immediate Annuity Is Also Known As

GIAs differ from other types of annuities in several ways:

- Immediate vs. Deferred:GIAs provide immediate income, while deferred annuities start payments at a future date.

- Group vs. Individual:GIAs are typically purchased by groups, while individual annuities are purchased by individuals.

- Guaranteed vs. Variable:GIAs offer guaranteed income payments, while variable annuities provide income that can fluctuate based on investment performance.

Other Names for Group Immediate Annuities

Group Immediate Annuities are also known by several other names, reflecting their various applications and historical context. These alternative names are commonly used in industry practices and literature, and understanding them can help in identifying and comparing different GIA options.

Alternative Names for GIAs

- Group Annuity:This is a general term used to refer to any type of annuity offered to a group of individuals.

- Immediate Group Annuity:This name emphasizes the immediate nature of the income payments.

- Group Pension Annuity:This term specifically refers to GIAs used in pension plans.

- Group Retirement Annuity:This name highlights the use of GIAs for retirement income.

- Collective Annuity:This term emphasizes the collective participation of a group in purchasing the annuity.

Historical Context and Origin

The use of alternative names for GIAs often reflects the historical evolution of annuity products and their applications. For example, the term “group pension annuity” emerged in the early 20th century as companies began offering pension plans to their employees.

As the use of GIAs expanded beyond pensions, other names emerged to encompass their broader applications.

If you’re tech-savvy, you might be interested in an annuity calculator visual basic 2024. Ultimately, the best way to determine the right annuity for you is to calculate your annuity 2024 and compare different options.

Examples of Usage

These alternative names are commonly used in industry practices and literature. For example, a financial advisor might refer to a “group retirement annuity” when discussing retirement planning options for employees of a company. A research paper on the use of annuities in pension plans might use the term “group pension annuity” to describe the specific type of annuity being studied.

Dreaming of a annuity 1 million 2024 ? While it’s a significant goal, understanding the different types of annuities is key. A fixed immediate annuity can provide a steady stream of income for life.

Advantages and Disadvantages of Group Immediate Annuities

GIAs offer several advantages that make them attractive to individuals and groups seeking a guaranteed income stream. However, they also have some potential drawbacks that should be considered before making a decision.

Advantages of GIAs

- Guaranteed Income:GIAs provide a predictable and secure stream of income that is not subject to market fluctuations.

- Immediate Income:Payments begin immediately after purchase, providing an instant source of income for retirement or other purposes.

- Potential for Lower Premiums:Group participation can lead to lower premiums due to economies of scale and collective bargaining power.

- Flexibility in Payment Options:GIAs offer various payment options, such as fixed monthly payments, lump sum payments, or a combination of both, to meet individual needs.

Disadvantages of GIAs

- Limited Growth Potential:GIAs typically offer fixed income payments, which may not keep pace with inflation over time.

- Lack of Investment Flexibility:The income payments are guaranteed, meaning there is no opportunity to invest the funds and potentially earn higher returns.

- Potential for Higher Fees:Some GIA programs may have higher fees than other types of annuities.

- Limited Access to Funds:Once the annuity is purchased, it may be difficult or impossible to access the principal amount, limiting liquidity.

Comparison with Other Annuities

Compared to other types of annuities, GIAs offer a balance of guaranteed income and immediate payments. While they may not offer the growth potential of variable annuities or the flexibility of deferred annuities, they provide a secure and predictable income stream that can be valuable for individuals seeking financial stability.

Eligibility and Participation in Group Immediate Annuities

Eligibility for participating in a GIA program typically depends on factors such as age, employment status, and membership in a qualifying group. The process of joining a GIA group or program can vary depending on the specific program and the sponsoring organization.

When you’re ready to start receiving your annuity payments, you’ll need to know how to calculate annuity withdrawal 2024. This will help you plan for your future expenses and ensure you’re getting the most out of your investment.

Eligibility Criteria

- Age:Most GIA programs have a minimum age requirement, typically around 50 or 55 years old.

- Employment Status:GIA programs are often offered to employees of companies or members of associations, so eligibility may depend on current employment status or membership.

- Group Affiliation:Individuals must be part of a qualifying group, such as employees of a company, members of a union, or members of a professional organization.

Process of Joining

The process of joining a GIA program typically involves the following steps:

- Contact the Sponsoring Organization:Individuals interested in participating in a GIA program should contact the sponsoring organization, such as their employer or association, to inquire about eligibility and program details.

- Review Program Materials:The sponsoring organization will provide information about the GIA program, including its features, benefits, and payment options.

- Complete Application and Documentation:Individuals must complete an application and provide necessary documentation, such as proof of age and employment status.

- Receive Approval and Purchase Annuity:Once the application is approved, individuals can purchase the GIA contract and begin receiving income payments.

Role of Employers or Organizations

Employers or organizations play a crucial role in facilitating GIA participation. They typically negotiate with insurance companies to secure group rates and administer the program for their employees or members. They may also provide educational resources and guidance to help participants understand the GIA program and make informed decisions.

Funding and Payment Structures of Group Immediate Annuities

GIAs can be funded through various options, and the payment structure can vary depending on the program. Understanding these funding and payment structures is essential for determining the overall cost and benefits of a GIA.

Variable annuities can be a good option for those seeking growth potential. Learning the variable annuity basics 2024 is a great starting point. Some annuities offer guaranteed variable annuity 2024 features, providing a safety net for your investment.

Funding Options

- Single Premium:Individuals can fund the GIA with a single lump sum payment, which provides immediate income for the duration of the annuity.

- Periodic Payments:Individuals can make periodic payments, such as monthly or annual installments, to fund the GIA. This option allows for more flexible contributions over time.

- Rollover from Other Retirement Accounts:Individuals can roll over funds from other retirement accounts, such as 401(k)s or IRAs, to purchase a GIA.

Payment Structures

- Fixed Monthly Payments:This is the most common payment structure, providing a fixed amount of income each month for the duration of the annuity.

- Lump Sum Payments:Individuals can choose to receive a lump sum payment at the beginning of the annuity period, providing a large amount of income upfront.

- Combination of Payments:Some programs offer a combination of fixed monthly payments and lump sum payments, providing flexibility in income distribution.

Impact on Benefits

The funding and payment structures of a GIA can significantly impact the amount of income received and the duration of the payments. For example, a single premium payment will provide a higher level of income than periodic payments, but the duration of the payments will be shorter.

Conversely, periodic payments will provide a lower level of income, but the payments will continue for a longer period.

Tax Implications of Group Immediate Annuities

The tax implications of participating in a GIA can vary depending on the specific program and the individual’s tax situation. Understanding these tax implications is essential for planning and managing your finances.

Tax Treatment of Contributions, Benefits, and Withdrawals

- Contributions:Contributions to a GIA are typically not tax-deductible. However, if the GIA is funded through a rollover from a qualified retirement account, the funds may be rolled over tax-free.

- Benefits:Income payments from a GIA are generally taxed as ordinary income. This means that the entire amount of each payment is subject to federal and state income taxes.

- Withdrawals:Withdrawals from a GIA before age 59 1/2 are typically subject to a 10% penalty, in addition to ordinary income tax. However, there may be exceptions to this rule, such as withdrawals for medical expenses or disability.

Comparison with Other Annuities

The tax treatment of a GIA is similar to other types of annuities. However, there may be some differences in the specific tax rules that apply to different types of annuities, such as variable annuities or deferred annuities. It is important to consult with a tax advisor to understand the specific tax implications of your GIA program.

Real-World Examples and Case Studies

GIAs have been used by individuals and groups for various purposes, such as retirement planning, income supplementation, and estate planning. Real-world examples and case studies can illustrate the practical application of GIAs and demonstrate their potential benefits and outcomes.

Real-World Examples

- Retirement Planning:A retired teacher might purchase a GIA to provide a guaranteed stream of income for their retirement years. The GIA payments could supplement their Social Security benefits and provide a predictable source of income.

- Income Supplementation:A retiree with a part-time job might purchase a GIA to supplement their income and ensure a stable financial base.

- Estate Planning:An individual with a large estate might purchase a GIA to provide income for their heirs after their death. The GIA payments could help to preserve the estate and provide financial support for the beneficiaries.

Case Study

Imagine a couple nearing retirement who have accumulated a significant amount of savings in their 401(k) accounts. They are concerned about market volatility and want a guaranteed stream of income to supplement their Social Security benefits. They decide to roll over a portion of their 401(k) funds into a GIA, providing them with a fixed monthly income that they can rely on for the rest of their lives.

Benefits and Outcomes

The couple’s decision to purchase a GIA provides them with the financial security they desire. They have a predictable and guaranteed income stream that is not subject to market fluctuations. The GIA payments allow them to cover their living expenses and enjoy their retirement years without financial worries.

Regulations and Oversight of Group Immediate Annuities

GIAs are subject to regulations and oversight by government agencies and industry organizations to ensure consumer protection and fair practices. These regulations cover various aspects of GIA programs, including pricing, disclosure, and sales practices.

Relevant Regulations and Oversight Bodies

- Department of Labor (DOL):The DOL oversees retirement plans, including pension plans that may offer GIAs. The DOL has regulations governing the disclosure of information about GIA programs and the fiduciary responsibilities of plan administrators.

- National Association of Insurance Commissioners (NAIC):The NAIC is a non-governmental organization that develops model laws and regulations for the insurance industry. The NAIC has model regulations for annuities, including provisions for the disclosure of information about GIA programs.

- State Insurance Departments:Each state has its own insurance department that regulates insurance companies and enforces state insurance laws. State insurance departments oversee the sale and marketing of GIAs within their respective states.

Legal and Regulatory Framework

The legal and regulatory framework surrounding GIAs is designed to protect consumers and ensure that they are provided with accurate information about the program. The regulations cover various aspects of GIA programs, such as:

- Disclosure of Information:Insurance companies must provide consumers with clear and comprehensive information about the features, benefits, and risks of GIA programs.

- Pricing and Fees:The regulations specify how insurance companies must calculate premiums and fees for GIA programs, ensuring transparency and fairness.

- Sales Practices:The regulations prohibit deceptive or misleading sales practices, ensuring that consumers are not pressured or misled into purchasing a GIA program.

Consumer Protection and Fair Practices

The regulations and oversight of GIAs play a crucial role in ensuring consumer protection and fair practices. By requiring insurance companies to provide accurate information and adhere to specific sales practices, the regulations help to ensure that consumers can make informed decisions about their financial futures.

Conclusion

Group Immediate Annuities, also known as Group Annuities, Immediate Annuities, or Fixed Annuities, offer a unique approach to retirement planning by providing guaranteed income streams. The flexibility in naming reflects the diverse features and benefits of these programs, allowing individuals to tailor their choices to their specific needs.

Whether you’re considering a single-premium payment or a periodic contribution structure, understanding the various names and their nuances can help you make the most informed decision for your financial future.

User Queries: Group Immediate Annuity Is Also Known As

What are the main benefits of a Group Immediate Annuity?

Group Immediate Annuities provide a guaranteed income stream for life, protecting against longevity risk and market volatility. They also offer tax advantages and can be a valuable tool for estate planning.

Are there any risks associated with Group Immediate Annuities?

If you’re in Canada, you can use an annuity calculator Canada 2024 to estimate your potential payouts. New York Life offers variable annuity New York Life 2024 options, which provide a mix of growth potential and guaranteed income.

While offering guaranteed income, Group Immediate Annuities typically have lower returns compared to other investments. They also may have surrender charges if you withdraw funds early.

How do I find a Group Immediate Annuity program that suits my needs?

Looking for a steady stream of income in 2024? Annuity 7 Percent 2024 might be a good option for you. This type of annuity offers a guaranteed return, but it’s important to understand the immediate annuity expense fees or charges associated with it.

Consult with a financial advisor who specializes in annuities. They can help you compare different programs and choose one that aligns with your financial goals and risk tolerance.