Growing Annuity Calculator Present Value 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This guide will explore the concept of growing annuities, delve into the intricacies of calculating their present value, and equip you with the knowledge to make informed financial decisions.

Annuity is often used to provide a steady stream of income during retirement. But what exactly does it provide? Learn more about Annuity Is Primarily Used To Provide 2024 to understand its purpose.

We will discuss how growing annuities work, the factors that influence their present value, and the practical applications of this financial tool in various contexts.

Planning for retirement and thinking about a 500k annuity? It’s a big decision! It’s important to understand the ins and outs of how annuities work before you commit. Read about Annuity 500k 2024 to get some insight.

Growing annuities, also known as increasing annuities, are a powerful financial instrument that allows for steady growth over time. Unlike traditional annuities, which offer fixed payments, growing annuities provide a series of payments that increase at a predetermined rate. This growth rate can be tied to factors like inflation or a specific investment strategy, ensuring that the value of your annuity keeps pace with the changing economic landscape.

This guide will explore the intricacies of growing annuities, their present value calculation, and how this information can be leveraged for strategic financial planning.

If you’re in Canada and considering an annuity, you might be wondering about the best way to calculate it. There are calculators specifically designed for this purpose. Check out Annuity Calculator Canada 2024 to see how it works.

Contents List

Understanding Growing Annuities

A growing annuity is a series of payments that increase over time. This increase is typically driven by a predetermined growth rate, making it a valuable tool for long-term financial planning. Unlike traditional annuities, which offer fixed payments, growing annuities provide a consistent stream of income that keeps pace with inflation or other economic factors.

Are you hoping for a lifetime annuity? Many people do! It’s a common desire for a secure stream of income. Learn more about Is Annuity Lifetime 2024 to understand the options.

Key Features of Growing Annuities, Growing Annuity Calculator Present Value 2024

- Regular Payments:Growing annuities involve a series of regular payments, typically made at the end of each period (e.g., monthly, quarterly, annually).

- Growth Rate:The key feature that distinguishes a growing annuity is its growth rate. This rate determines the percentage increase in each subsequent payment. The growth rate can be fixed or variable, depending on the terms of the annuity.

- Present Value:The present value of a growing annuity is the current worth of all future payments, discounted back to the present using a specified discount rate. This value is crucial for understanding the true worth of the annuity.

Factors Contributing to Annuity Growth

- Interest Rates:Interest rates play a significant role in annuity growth. Higher interest rates generally lead to higher growth rates, as the invested principal earns more income.

- Inflation:Inflation erodes the purchasing power of money over time. Growing annuities are designed to counter this erosion by increasing payments to keep pace with rising prices.

Real-World Scenarios

- Retirement Planning:Growing annuities can provide a steady stream of income during retirement, ensuring that your purchasing power remains stable.

- Investment Growth:Investors can use growing annuities to create a portfolio that generates increasing returns over time.

- Long-Term Savings:Growing annuities are a suitable tool for long-term savings goals, such as funding a child’s education or a down payment on a home.

Present Value Calculation

The present value (PV) of a growing annuity is the current value of all future payments, discounted back to the present. This calculation is essential for understanding the true worth of the annuity and making informed financial decisions.

Are you concerned about the religious implications of annuities? Many people are curious about the halal status of annuities. Read about Is Annuity Halal 2024 to find out more.

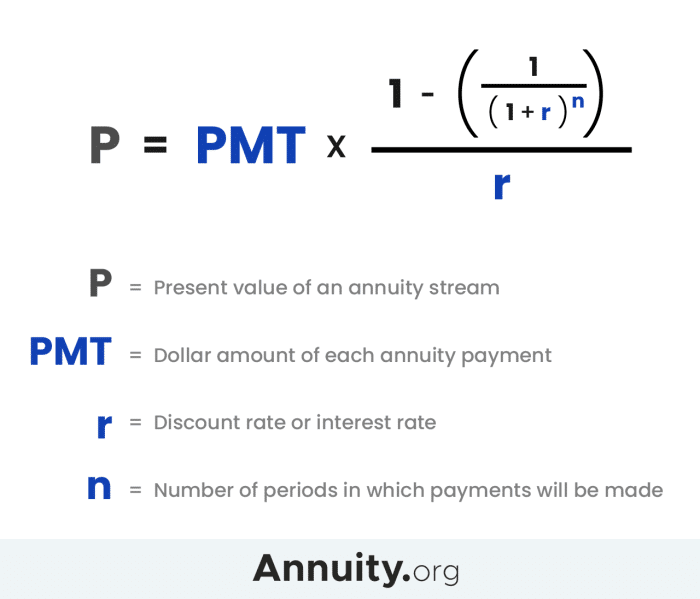

Formula

PV = P / (r

Do you have a pension pot and want to figure out how much of an annuity you can get? There are calculators that can help you estimate this. Check out Calculate Annuity From Pension Pot 2024 to find out more.

- g)

- [1

- (1 + g / 1 + r)^n]

Where:

- PVis the present value

- Pis the initial payment

- ris the discount rate

- gis the growth rate

- nis the number of periods

Significance of Discount Rate and Growth Rate

- Discount Rate:The discount rate reflects the time value of money. It represents the rate of return that could be earned on an alternative investment with similar risk. A higher discount rate leads to a lower present value.

- Growth Rate:The growth rate reflects the anticipated increase in future payments. A higher growth rate leads to a higher present value, as the future payments are worth more.

Step-by-Step Calculation Guide

- Identify the variables:Determine the initial payment (P), discount rate (r), growth rate (g), and number of periods (n).

- Plug the values into the formula:Substitute the known values into the present value formula.

- Calculate the present value:Perform the necessary calculations to arrive at the present value of the growing annuity.

Hypothetical Example

Suppose you have a growing annuity that pays $10,000 per year, with a growth rate of 3% and a discount rate of 5%. The annuity is expected to last for 10 years.

Annuity is sometimes called the “flip side” of something else. What is that something else? Understanding the concept of an annuity can be easier if you understand its counterpart. Read about An Annuity Is Sometimes Called The Flip Side Of 2024 to find out.

Using the formula, the present value would be calculated as follows:

PV = $10,000 / (0.05

If you’re receiving an annuity from LIC, you might be wondering about its taxability. It’s important to understand the tax implications of annuity income from LIC. Learn more about Is Annuity Received From Lic Taxable 2024 to get a clear picture.

- 0.03)

- [1

- (1 + 0.03 / 1 + 0.05)^10]

The present value of this growing annuity is approximately $85,135.

Annuity and pension are often used interchangeably, but are they actually the same thing? It’s important to understand the difference. Read about Is Annuity The Same As Pension 2024 to get a clear answer.

Factors Influencing Present Value

Several factors can significantly impact the present value of a growing annuity. Understanding these factors allows you to optimize the present value and maximize the value of your annuity.

Is annuity income taxable? This is a question many people have. It’s important to understand the tax implications of annuity income before making any decisions. Read about Is Annuity Income 2024 to find out.

Key Factors

- Initial Payment (P):A higher initial payment will result in a higher present value, as the future payments will be larger.

- Growth Rate (g):A higher growth rate leads to a higher present value, as the future payments will increase more rapidly.

- Discount Rate (r):A higher discount rate leads to a lower present value, as the future payments are discounted more heavily.

- Number of Periods (n):A longer period (more payments) will generally result in a higher present value, as there are more future payments to be discounted.

Impact of Changes

- Increasing the initial paymentwill directly increase the present value.

- Increasing the growth ratewill also increase the present value, making the annuity more valuable.

- Increasing the discount ratewill decrease the present value, as the future payments are discounted more heavily.

- Increasing the number of periodswill generally increase the present value, as there are more future payments to be discounted.

Tips for Optimizing Present Value

- Negotiate a higher initial payment:If possible, try to negotiate a higher initial payment to increase the present value of the annuity.

- Seek a favorable growth rate:Aim for a growth rate that outpaces inflation, ensuring that the purchasing power of your payments is maintained.

- Consider a lower discount rate:If you can find an annuity with a lower discount rate, it will increase the present value. However, be mindful of the risk associated with lower rates.

- Maximize the number of periods:A longer period will generally lead to a higher present value, so consider extending the duration of the annuity if possible.

Applications of Growing Annuity Present Value

The present value of a growing annuity has a wide range of applications in financial planning, investment analysis, and retirement planning. Understanding present value calculations can help you make informed financial decisions.

Wondering if those annuity payments you’re receiving are taxable? You’re not alone! Many people have questions about the tax implications of annuities. Check out this article on Is Annuity Payments Taxable 2024 to find out more.

Financial Planning

- Budgeting:Present value calculations can help you determine how much you need to save today to achieve your future financial goals. For example, you can use present value to calculate how much you need to invest now to have a certain amount of money for retirement.

Annuity is often seen as a way to provide income for an indefinite period. But is that really true? Understanding the duration of an annuity is crucial. Read about Annuity Is Indefinite Duration 2024 to learn more.

- Debt Management:Present value calculations can help you evaluate different loan options and choose the one that is most financially advantageous. You can calculate the present value of the loan payments to determine the true cost of borrowing.

Investment Analysis

- Comparing Investments:Present value calculations can help you compare different investment options and choose the one that offers the highest return. You can calculate the present value of future cash flows from different investments to determine which one is most attractive.

Annuity income is a key part of many retirement plans. But is it really considered income? That’s a question many people have. Find out more about Annuity Is Income 2024 to get a clear picture.

- Evaluating Projects:Present value calculations are used to evaluate the profitability of investment projects. You can calculate the present value of the future cash flows from a project to determine if it is worth undertaking.

Retirement Planning

- Estimating Retirement Income:Present value calculations can help you estimate how much income you will need in retirement to maintain your current lifestyle. You can calculate the present value of your expected retirement expenses to determine how much you need to save.

Annuity 9 2024 might sound like a strange search term, but it’s actually a common question. Many people are curious about how annuities work, and specifically, how they function in 2024. Learn more about Annuity 9 2024 to get a better understanding.

- Planning for Longevity:As people live longer, it is important to plan for a longer retirement. Present value calculations can help you determine how much you need to save to ensure that you have enough income for your entire retirement.

Tools and Resources

Several online calculators and financial software programs can be used to calculate the present value of a growing annuity. These tools can simplify the calculation process and help you make informed financial decisions.

When it comes to annuities, taxes are a big concern. It’s helpful to use a calculator to determine the tax implications of your annuity withdrawals. Check out Annuity Withdrawal Tax Calculator 2024 to see how it works.

Online Calculators

- Investopedia:Investopedia provides a free online calculator that can be used to calculate the present value of a growing annuity. The calculator is user-friendly and allows you to input the necessary variables to obtain the present value.

- Calculator.net:Calculator.net offers a similar online calculator that can be used to calculate the present value of a growing annuity. The calculator is easy to use and provides step-by-step instructions.

Financial Software

- Microsoft Excel:Microsoft Excel has built-in functions that can be used to calculate the present value of a growing annuity. The PV function allows you to input the necessary variables and obtain the present value.

- Quicken:Quicken is a popular financial software program that includes features for calculating the present value of a growing annuity. The software is user-friendly and provides a range of other financial planning tools.

Comparative Analysis

The online calculators and financial software programs discussed above offer a range of features and benefits. The best tool for you will depend on your specific needs and preferences. For example, online calculators are typically free and easy to use, while financial software programs offer a wider range of features but may require a subscription fee.

Resources for Further Learning

- Investopedia:Investopedia offers a comprehensive library of articles and resources on financial topics, including growing annuities and present value calculations.

- The Financial Planning Association:The Financial Planning Association provides resources and education for financial professionals and consumers. The organization’s website offers a wealth of information on financial planning topics, including growing annuities.

Final Review

Understanding the present value of a growing annuity is crucial for making sound financial decisions. Whether you’re planning for retirement, investing in a new venture, or simply managing your finances, the knowledge gained from this guide will empower you to navigate the complex world of financial instruments with confidence.

By grasping the key concepts and tools presented here, you can make informed choices that align with your financial goals and secure a brighter future.

FAQ Guide: Growing Annuity Calculator Present Value 2024

What are the key factors that influence the present value of a growing annuity?

The present value of a growing annuity is primarily influenced by the initial payment, growth rate, discount rate, and number of periods. Changes in any of these factors can significantly impact the present value.

How do I choose the right online calculator or software for calculating the present value of a growing annuity?

When selecting a tool, consider factors like ease of use, accuracy, and the specific features offered. Look for tools that allow for customization of input parameters and provide clear and understandable results.

Can I use a growing annuity calculator for other financial calculations?

While the primary focus of growing annuity calculators is on present value calculations, they can also be used for other financial planning purposes, such as determining future value or calculating the amount of periodic payments needed to reach a specific financial goal.