Has Capital One Improved Security Since the Breach? This question lingers in the minds of millions after the massive data breach of 2019, which exposed sensitive personal information of over 100 million individuals. The incident, which involved the theft of Social Security numbers, credit card details, and bank account information, shook the financial industry and raised serious concerns about the security of digital data.

In the wake of this devastating breach, Capital One has taken significant steps to enhance its security measures, but have these efforts been enough to restore customer trust and prevent future attacks?

Browse the implementation of When Will Capital One Start Payouts? in real-world situations to understand its applications.

This article will delve into the aftermath of the 2019 Capital One data breach, examining the company’s security measures implemented since then, and analyzing their impact on customer perception, regulatory response, and the broader financial industry. We will explore the lessons learned from this event and discuss the challenges and opportunities in maintaining data security in an increasingly complex digital landscape.

Contents List

- 1 The 2019 Capital One Data Breach

- 2 Capital One’s Security Measures Since the Breach

- 3 Impact on Customers and Public Perception

- 4 Regulatory Response and Legal Action

- 5 Industry Best Practices and Lessons Learned

- 6 Future Security Measures and Strategies: Has Capital One Improved Security Since The Breach?

- 7 Closing Summary

- 8 Q&A

The 2019 Capital One Data Breach

The 2019 Capital One data breach was a significant security incident that affected millions of customers. It highlighted the vulnerability of large financial institutions to cyberattacks and the potential consequences of data breaches. This incident prompted a reevaluation of security practices and led to a widespread discussion about data privacy and protection.

Discover how The Settlement’s Impact on Capital One Customers has transformed methods in this topic.

Scale and Impact

The breach affected over 100 million Capital One customers in the United States and Canada. It compromised sensitive personal information, including names, addresses, Social Security numbers, credit card numbers, and bank account details. The impact of the breach was far-reaching, affecting individuals’ financial security and privacy.

Compromised Information

- Names

- Addresses

- Social Security numbers

- Credit card numbers

- Bank account details

- Credit scores

- Credit card application information

- Transaction history

Attacker Methods

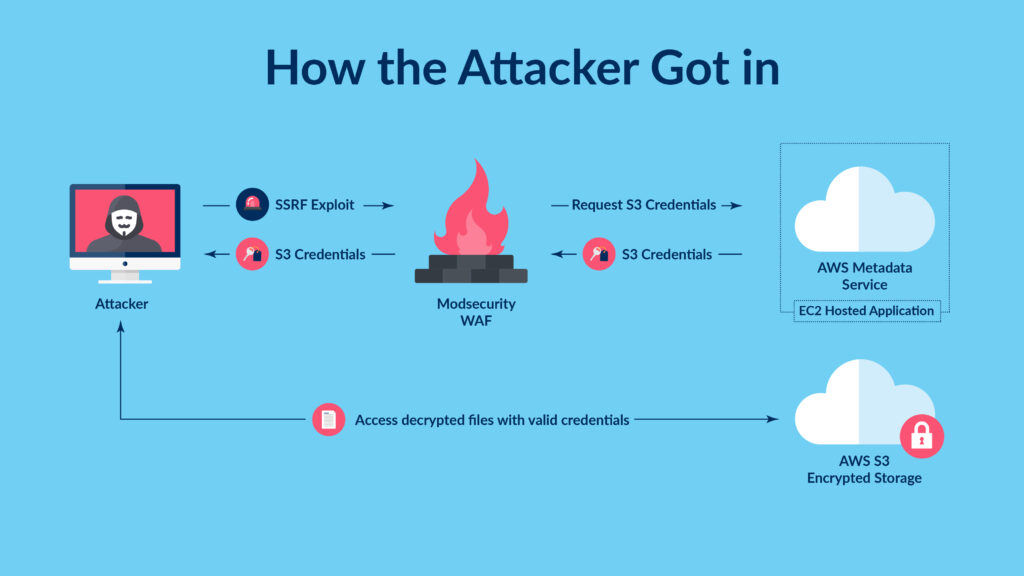

The attacker exploited a misconfigured web application firewall (WAF) to gain access to Capital One’s systems. The attacker was able to access a server that contained customer data and exfiltrate it. The breach highlighted the importance of properly configuring security systems and the need for continuous security monitoring.

Capital One’s Security Measures Since the Breach

In response to the 2019 data breach, Capital One implemented a series of security measures to enhance its data protection capabilities. These measures included investments in technology, improved security protocols, and increased employee training. The company aimed to strengthen its defenses against future cyberattacks and restore customer trust.

Examine how What to Do If Your Capital One Payout Is Delayed can boost performance in your area.

Enhanced Security Measures

- Increased security investments:Capital One significantly increased its investments in cybersecurity technology, including intrusion detection and prevention systems, threat intelligence platforms, and security analytics tools.

- Improved data encryption:The company enhanced its data encryption protocols to protect sensitive information at rest and in transit. This included adopting stronger encryption algorithms and implementing multi-factor authentication for access to sensitive data.

- Enhanced security protocols:Capital One implemented stricter security protocols for access control, data access management, and system monitoring. These measures aimed to prevent unauthorized access and detect suspicious activities in real-time.

- Improved employee training:The company expanded its cybersecurity training programs for employees, emphasizing the importance of data security and best practices for handling sensitive information.

- Vulnerability assessments and penetration testing:Capital One increased the frequency of vulnerability assessments and penetration testing to identify and address potential security weaknesses in its systems.

Security Posture Comparison

Before the breach, Capital One’s security posture relied heavily on traditional security measures, such as firewalls and intrusion detection systems. After the breach, the company adopted a more comprehensive approach to cybersecurity, incorporating advanced technologies, improved security protocols, and a greater focus on employee training and awareness.

Impact on Customers and Public Perception

The 2019 data breach had a significant impact on customer trust and confidence in Capital One. Many customers expressed concerns about the security of their personal information and the potential for identity theft. The breach also led to negative public perception of Capital One’s security practices.

Browse the implementation of When Will Capital One Finish Paying Settlements? in real-world situations to understand its applications.

Customer Trust and Confidence

The breach eroded customer trust in Capital One’s ability to protect their data. Many customers expressed concerns about the security of their personal information and the potential for identity theft. Some customers even considered switching to other financial institutions.

Rebuilding Customer Trust

Capital One took several steps to rebuild customer trust after the breach. These steps included offering free credit monitoring and identity theft protection services, providing clear and concise communication about the breach, and emphasizing the security measures it had implemented to prevent future incidents.

Discover how How to Get the Latest News on Capital One Settlement has transformed methods in this topic.

Public Perception

The 2019 data breach had a negative impact on the public perception of Capital One’s security practices. The company was criticized for its security vulnerabilities and the scale of the breach. The incident also highlighted the importance of data privacy and the need for financial institutions to prioritize cybersecurity.

Regulatory Response and Legal Action

The 2019 Capital One data breach triggered a regulatory response and legal action. Regulators investigated the incident, and the company faced legal challenges related to data privacy violations.

Regulatory Response

The breach prompted investigations by the Federal Trade Commission (FTC), the Office of the Comptroller of the Currency (OCC), and other regulatory agencies. These investigations focused on the security vulnerabilities that allowed the breach to occur and the company’s response to the incident.

Examine how Is There Still Time to Claim Capital One Settlement? can boost performance in your area.

Legal Action

The attacker, Paige Thompson, was arrested and charged with multiple federal crimes related to the breach. Capital One also faced lawsuits from customers who alleged that the company failed to protect their personal information. These lawsuits highlighted the legal implications of data breaches and the potential for financial institutions to be held liable for data privacy violations.

Data Privacy Regulations

The Capital One data breach highlighted the importance of data privacy regulations and the need for strong enforcement mechanisms. The incident led to increased scrutiny of data privacy laws and a renewed focus on protecting consumer data.

Industry Best Practices and Lessons Learned

The Capital One data breach provided valuable lessons for the financial services industry and highlighted the importance of adopting best practices for data security. The incident emphasized the need for a proactive approach to cybersecurity, continuous security monitoring, and robust incident response plans.

Examine how What to Expect from the Capital One Settlement in 2024 can boost performance in your area.

Industry Best Practices

- Regular vulnerability assessments and penetration testing:Financial institutions should conduct regular vulnerability assessments and penetration testing to identify and address security weaknesses in their systems.

- Strong access control and data access management:Implementing robust access control measures and data access management policies is crucial to prevent unauthorized access to sensitive information.

- Multi-factor authentication:Using multi-factor authentication for access to sensitive systems and data can significantly enhance security.

- Data encryption at rest and in transit:Encrypting data at rest and in transit helps protect sensitive information from unauthorized access.

- Continuous security monitoring and threat intelligence:Financial institutions should invest in continuous security monitoring and threat intelligence tools to detect and respond to emerging threats.

- Employee training and awareness:Providing comprehensive cybersecurity training to employees is essential to raise awareness and promote best practices for handling sensitive information.

- Robust incident response plans:Having a well-defined and tested incident response plan is crucial for responding effectively to data breaches and other security incidents.

Lessons Learned

The Capital One data breach highlighted the importance of:

- Proactive cybersecurity:Financial institutions should adopt a proactive approach to cybersecurity, rather than relying solely on reactive measures.

- Continuous security monitoring:Continuous security monitoring is essential to detect and respond to emerging threats in real-time.

- Strong incident response plans:Having a well-defined and tested incident response plan is crucial for minimizing the impact of data breaches.

- Employee training and awareness:Providing comprehensive cybersecurity training to employees is essential to raise awareness and promote best practices for handling sensitive information.

- Data privacy regulations:Strong data privacy regulations and enforcement mechanisms are essential to protect consumer data.

Effectiveness of Security Measures, Has Capital One Improved Security Since the Breach?

While Capital One has implemented significant security enhancements since the breach, the effectiveness of these measures in comparison to industry standards is difficult to assess without access to detailed information about the company’s security posture. However, the company’s investments in technology, improved security protocols, and increased employee training suggest a commitment to enhancing its data security capabilities.

Discover how Latest Updates on the Capital One Settlement Payout has transformed methods in this topic.

Future Security Measures and Strategies: Has Capital One Improved Security Since The Breach?

Capital One continues to invest in cybersecurity and adopt new technologies to enhance its data security posture. The company recognizes the evolving threat landscape and the importance of staying ahead of emerging cyber threats.

Check How to Stay Informed on Capital One Payout Updates to inspect complete evaluations and testimonials from users.

Future Security Measures

- Artificial intelligence (AI) and machine learning (ML):Capital One is exploring the use of AI and ML for threat detection, anomaly detection, and incident response.

- Cloud security:The company is investing in cloud security solutions to protect its data and applications in the cloud.

- Zero-trust security:Capital One is adopting a zero-trust security model, which assumes that no user or device can be trusted by default.

- Security automation:The company is automating security tasks, such as vulnerability scanning and incident response, to improve efficiency and effectiveness.

Emerging Technologies

Emerging technologies, such as AI, ML, and blockchain, have the potential to significantly enhance data security. These technologies can be used for threat detection, data encryption, and secure data sharing.

Challenges and Opportunities

Maintaining data security in the evolving threat landscape presents both challenges and opportunities. Challenges include the increasing sophistication of cyberattacks, the rise of new threats, and the need to adapt to rapidly changing technologies. Opportunities include leveraging emerging technologies to enhance security, collaborating with industry partners, and fostering a culture of cybersecurity.

Notice Why the Capital One Payout Has Been Delayed for recommendations and other broad suggestions.

Closing Summary

The Capital One data breach serves as a stark reminder of the vulnerabilities inherent in the digital world. While Capital One has made strides in bolstering its security posture, the threat landscape continues to evolve, demanding ongoing vigilance and innovation.

The future of data security hinges on a collaborative effort between financial institutions, regulators, and individuals to proactively address emerging threats and build a more resilient digital ecosystem.

You also can investigate more thoroughly about Is Capital One Settlement Payout Happening in 2024? to enhance your awareness in the field of Is Capital One Settlement Payout Happening in 2024?.

Q&A

What was the impact of the breach on Capital One’s stock price?

Following the breach, Capital One’s stock price experienced a dip, but it recovered relatively quickly. The company’s strong financial performance and proactive steps to address the breach helped mitigate the long-term impact on its stock value.

Did Capital One offer any compensation to affected customers?

Capital One offered free credit monitoring and identity theft protection services to all customers affected by the breach. The company also provided guidance and support to individuals who may have experienced financial harm as a result of the data compromise.

What are the key lessons learned from the Capital One data breach?

The Capital One breach highlighted the importance of robust security measures, including multi-factor authentication, strong password policies, and regular security audits. It also emphasized the need for organizations to have comprehensive incident response plans in place to effectively manage and mitigate the impact of security breaches.