Heloc Mortgage 2024: Navigating the world of home equity lines of credit (HELOCs) can feel like entering a maze, especially in today’s dynamic financial landscape. But understanding HELOCs is essential for homeowners seeking additional financing, as they can unlock valuable resources for various needs, from home renovations to debt consolidation.

A second charge mortgage, also known as a second mortgage, is a loan that is secured against your property. It’s often used for home improvements, debt consolidation, or other major expenses. If you’re considering a second charge mortgage, you can research “Second Charge Mortgage 2024” Second Charge Mortgage 2024 to understand the terms and conditions.

This guide will demystify HELOCs, exploring their intricacies, benefits, and potential drawbacks. We’ll delve into the current interest rate trends, eligibility requirements, and the application process. By the end, you’ll have a clear understanding of whether a HELOC is the right financial tool for your 2024 goals.

A home equity line of credit (HELOC) can be a valuable financial tool, allowing you to borrow against your home’s equity. To find the best HELOC options, you can search for “Best Home Equity Line Of Credit 2024” Best Home Equity Line Of Credit 2024.

This will help you compare different lenders and find the best rates and terms for your needs.

Contents List

HELOC Basics: Heloc Mortgage 2024

A Home Equity Line of Credit (HELOC) is a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. It functions as a revolving line of credit, similar to a credit card, where you can borrow money as needed up to a pre-approved limit.

Understanding current home mortgage rates is essential for making informed decisions about your home purchase. You can find up-to-date information by searching for “Home Mortgage Rates Today 2024” Home Mortgage Rates Today 2024. This will provide you with real-time data on current rates and help you compare options.

HELOCs offer flexibility and can be a valuable financial tool for homeowners, but it’s crucial to understand their nuances and potential drawbacks before considering one.

Online mortgage lenders offer a convenient and efficient way to apply for a mortgage. To find the best online lenders, you can search for “Best Online Mortgage Lenders 2024” Best Online Mortgage Lenders 2024. This will provide you with a list of top-rated online lenders and help you compare their offerings.

Key Features of HELOCs

HELOCs come with distinct features that set them apart from traditional mortgages. Here’s a breakdown of their core elements:

- Revolving Credit Line:Unlike a fixed-term loan, a HELOC allows you to borrow money repeatedly within a set credit limit, as long as the account is in good standing.

- Variable Interest Rates:HELOCs typically have variable interest rates, which means the rate can fluctuate over time based on market conditions. This can impact your monthly payments.

- Draw Period:A HELOC has a draw period, typically lasting 10-15 years, during which you can access funds. This is followed by a repayment period.

- Repayment Period:After the draw period ends, the HELOC enters a repayment period, usually 10-20 years. During this phase, you’ll make fixed monthly payments to repay the outstanding balance.

How HELOCs Differ from Traditional Mortgages

HELOCs differ from traditional mortgages in several key aspects:

- Borrowing Flexibility:HELOCs offer more flexibility than traditional mortgages, allowing you to borrow funds as needed, rather than receiving a lump sum upfront.

- Variable Interest Rates:Traditional mortgages typically have fixed interest rates, while HELOCs have variable rates that can change over time. This introduces uncertainty in monthly payments.

- Loan Terms:HELOCs have shorter draw periods and longer repayment periods compared to traditional mortgages.

- Loan Purpose:HELOCs are often used for home improvements, debt consolidation, or other expenses, while traditional mortgages are primarily for purchasing a home.

Benefits of Using a HELOC

HELOCs can offer several advantages for homeowners:

- Lower Interest Rates:HELOCs typically have lower interest rates than personal loans or credit cards, making them a more affordable option for borrowing.

- Tax Deductibility:Interest paid on HELOCs used for home improvements may be tax-deductible, depending on your specific situation.

- Flexibility:HELOCs provide flexibility, allowing you to borrow funds as needed and repay them at your own pace.

- Cash-Out Option:You can use a HELOC to access cash from your home equity, which can be useful for various purposes.

Potential Drawbacks of HELOCs

While HELOCs offer advantages, it’s crucial to be aware of their potential drawbacks:

- Variable Interest Rates:Interest rates on HELOCs can fluctuate, potentially increasing your monthly payments.

- Risk of Foreclosure:If you fail to make payments on your HELOC, you could face foreclosure on your home.

- Credit Score Impact:Taking out a HELOC can impact your credit score, particularly if you have a low credit score or borrow a large amount.

- Potential for Overspending:The revolving nature of HELOCs can make it easy to overspend, leading to debt accumulation.

HELOC Interest Rates in 2024

HELOC interest rates are influenced by a variety of factors, including the overall economic climate, the Federal Reserve’s monetary policy, and your individual creditworthiness. It’s important to stay informed about current trends and how these factors might affect your borrowing costs.

The Family Home Guarantee is a government scheme designed to help first-home buyers with a low deposit. To learn more about this program and its eligibility criteria, you can search for “Family Home Guarantee 2024” Family Home Guarantee 2024.

Current HELOC Interest Rate Trends

As of [current date], HELOC interest rates are generally [insert current HELOC interest rate trends]. This reflects the current [brief explanation of current economic conditions].

Second mortgages, also known as 2nd mortgages, are a type of loan secured against your property. They are often used for home improvements or debt consolidation. To understand current rates and terms, you can search for “2nd Mortgage Rates 2024” 2nd Mortgage Rates 2024.

Comparison with Other Loan Options

HELOC rates are typically lower than those offered by personal loans or credit cards. However, it’s essential to compare rates from different lenders to find the best deal. Consider the following:

- Personal Loans:These offer fixed interest rates and shorter terms, but they may have higher interest rates than HELOCs.

- Credit Cards:Credit cards offer revolving credit but typically have much higher interest rates than HELOCs.

Factors Influencing HELOC Interest Rates, Heloc Mortgage 2024

Several factors can influence HELOC interest rates:

- Prime Rate:The prime rate, set by banks, is a benchmark for many loan rates, including HELOCs. Changes in the prime rate can affect HELOC rates.

- Credit Score:Borrowers with higher credit scores generally qualify for lower interest rates. A strong credit score is crucial for securing favorable HELOC terms.

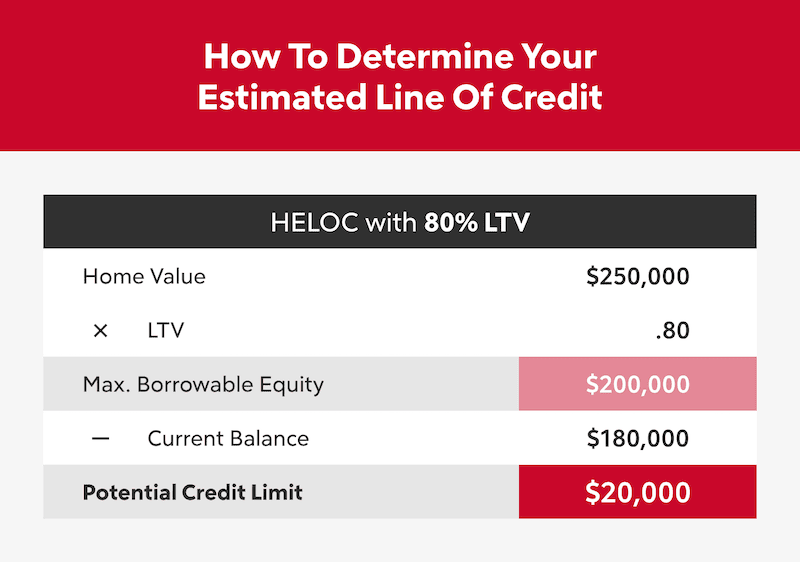

- Loan-to-Value Ratio (LTV):The LTV is the ratio of your loan amount to the value of your home. A lower LTV generally leads to lower interest rates.

- Market Conditions:Economic conditions, such as inflation and interest rate trends, can influence HELOC rates.

Potential Impact of Economic Conditions

Economic conditions can significantly impact HELOC interest rates. For instance, during periods of high inflation, interest rates tend to rise, which can affect the cost of borrowing with a HELOC. It’s essential to stay informed about economic trends and their potential impact on your loan costs.

Finding the right mortgage lender can be a daunting task, especially with so many options available. If you’re looking for lenders in your area, you can use a search engine to find “Mortgage Lenders Near Me 2024” Mortgage Lenders Near Me 2024.

This will provide you with a list of local lenders who can help you secure a mortgage.

HELOC Eligibility and Requirements

Not everyone qualifies for a HELOC. Lenders typically have specific eligibility criteria and requirements that borrowers must meet to be considered for approval.

Your credit score plays a crucial role in your mortgage application. To understand what credit score is needed to buy a house, you can search for “Credit Score To Buy A House 2024” Credit Score To Buy A House 2024.

This will provide you with insights into the credit score requirements for homeownership.

Typical Eligibility Criteria

Here are some common eligibility criteria for HELOCs:

- Homeownership:You must own your home and have sufficient equity built up in it.

- Credit Score:Lenders usually require a minimum credit score, typically in the [insert typical credit score range].

- Debt-to-Income Ratio (DTI):Your DTI is the percentage of your monthly income that goes towards debt payments. Lenders typically prefer a DTI below [insert typical DTI range].

- Income Verification:Lenders will verify your income to ensure you can afford the monthly payments.

- Employment History:A stable employment history is often a requirement for HELOC approval.

Necessary Documentation and Information

To apply for a HELOC, you’ll need to provide the following documentation:

- Proof of Income:Pay stubs, tax returns, or other documentation verifying your income.

- Credit Report:A copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion).

- Home Appraisal:An appraisal to determine the current market value of your home.

- Property Tax and Insurance Information:Documentation of your property taxes and homeowner’s insurance premiums.

- Bank Statements:Recent bank statements showing your financial activity.

Credit Score Requirements and Impact on Interest Rates

Your credit score plays a significant role in your HELOC eligibility and interest rate. Borrowers with higher credit scores typically qualify for lower interest rates and better loan terms. A credit score of [insert credit score range] is generally considered good for obtaining a favorable HELOC.

If you’re a business owner looking for financing, you might need a business mortgage. To explore your options, you can search for “Business Mortgage 2024” Business Mortgage 2024. This will provide you with information on business mortgage programs and help you find the best fit for your business.

Improving Credit Score for Better HELOC Terms

If your credit score is below the desired range, there are steps you can take to improve it:

- Pay Bills on Time:Make all your payments on time to avoid late fees and negative impacts on your credit score.

- Lower Credit Utilization:Keep your credit utilization ratio (the amount of credit you’re using compared to your total available credit) low. Aim for a utilization rate below [insert recommended utilization rate].

- Dispute Errors:Check your credit report for any errors and dispute them with the credit bureaus.

- Limit New Credit Applications:Each time you apply for new credit, it can slightly lower your credit score. Limit applications to only when necessary.

HELOC Application and Approval Process

The application and approval process for a HELOC involves several steps, from initial application to loan disbursement.

Fixed interest rates offer stability and predictability for your mortgage payments. To explore current fixed rates, you can search for “Fixed Interest Rates 2024” Fixed Interest Rates 2024. This will provide you with an overview of available options and help you make informed decisions about your mortgage.

Steps Involved in Applying for a HELOC

Here’s a general overview of the HELOC application process:

- Pre-Qualification:You can pre-qualify for a HELOC online or by contacting a lender. This provides an estimate of your eligibility and potential loan terms without affecting your credit score.

- Application:Once you’ve decided on a lender, you’ll need to submit a formal application. This will require you to provide personal and financial information, including your credit history and income verification.

- Credit and Income Verification:The lender will verify your credit history and income to assess your ability to repay the loan.

- Home Appraisal:A professional appraiser will evaluate the value of your home to determine your equity position.

- Loan Underwriting:The lender will review your application, credit history, income, and home appraisal to determine if you qualify for the HELOC.

- Loan Approval:If your application is approved, you’ll receive a loan offer with the terms and conditions.

- Loan Closing:You’ll need to sign the loan documents and provide any remaining required documentation.

- Loan Disbursement:Once the loan is closed, the funds will be made available to you.

Loan Approval and Underwriting

Loan approval involves a rigorous underwriting process where the lender evaluates your creditworthiness and financial stability. The lender will assess factors such as your credit score, debt-to-income ratio, income verification, and home equity.

Typical Timelines for HELOC Applications

The timeline for HELOC applications can vary depending on the lender and the complexity of your application. However, it typically takes [insert typical timeframe] for the entire process, from application to loan disbursement.

Rocket Mortgage is a popular online lender known for its streamlined mortgage process. To learn about their current interest rates, you can search for “Rocket Mortgage Interest Rates 2024” Rocket Mortgage Interest Rates 2024. This will provide you with insights into their offerings and help you compare them to other lenders.

Tips for Maximizing Chances of HELOC Approval

To increase your chances of HELOC approval, consider the following tips:

- Improve Your Credit Score:A higher credit score improves your chances of approval and can lead to better interest rates.

- Lower Your Debt-to-Income Ratio:Reduce your debt payments to improve your DTI and enhance your loan eligibility.

- Shop Around for Lenders:Compare offers from multiple lenders to find the most favorable terms.

- Prepare Thorough Documentation:Gather all the necessary documentation in advance to streamline the application process.

HELOC Draw Period and Repayment Options

Understanding the draw period and repayment options is crucial for managing your HELOC effectively. These factors can significantly impact your borrowing costs and overall financial planning.

Applying for a mortgage can be a complex process, but it doesn’t have to be overwhelming. To start your application journey, you can search for “Apply For Mortgage 2024” Apply For Mortgage 2024. This will guide you through the application process and help you find the right mortgage for your needs.

Draw Period and Its Duration

The draw period is the time frame during which you can access funds from your HELOC. This period typically lasts [insert typical draw period duration], allowing you to borrow money as needed up to your credit limit. After the draw period ends, you enter the repayment period.

Choosing the right bank for your home loan can be a significant decision. To find out which banks offer the best rates and terms, you can search for “Best Bank For Home Loan 2024” Best Bank For Home Loan 2024.

This will help you compare different banks and make an informed choice.

Repayment Options Available for HELOCs

HELOCs offer various repayment options to suit different financial needs. Here are some common choices:

- Minimum Payment:You’re typically required to make a minimum monthly payment during the draw period, often based on a percentage of the outstanding balance.

- Interest-Only Payments:During the draw period, you can choose to pay only the interest accrued on the borrowed amount, delaying principal repayment until the repayment period begins.

- Amortizing Payments:You can make fixed monthly payments that include both principal and interest, gradually reducing the outstanding balance.

- Flexible Repayment:Some lenders offer flexible repayment options, allowing you to make larger payments or adjust your payment schedule to suit your financial situation.

Impact of Repayment Terms on Interest Costs

The repayment terms you choose can significantly impact your overall interest costs. Interest-only payments can be attractive during the draw period, but they result in a larger principal balance to repay during the repayment period. Amortizing payments help reduce the principal balance faster, potentially saving you on interest costs over time.

Interest rates are a crucial factor when applying for a mortgage. They can fluctuate based on market conditions. To stay informed about current rates, you can search for “Interest Rates Mortgage Rates 2024” Interest Rates Mortgage Rates 2024. This will give you an overview of the prevailing rates and help you compare different lenders.

Managing HELOC Debt Responsibly

Managing HELOC debt responsibly is essential to avoid overspending and financial strain. Consider the following tips:

- Use It Wisely:Use your HELOC for planned expenses and avoid impulsive borrowing.

- Track Your Spending:Keep track of your HELOC usage and outstanding balance to avoid overspending and stay within your budget.

- Make Timely Payments:Make your monthly payments on time to avoid late fees and potential damage to your credit score.

- Consider Early Repayment:If you have extra funds, consider making additional payments to reduce your principal balance and save on interest costs.

Last Recap

In conclusion, HELOCs can be a powerful financial instrument for homeowners, but they’re not without their complexities. By carefully evaluating your individual circumstances, understanding the current market trends, and exploring available options, you can make an informed decision about whether a HELOC aligns with your financial objectives.

Staying updated on home interest rates is crucial for anyone planning to buy or refinance a home. Searching for “Home Interest Rates Today 2024” Home Interest Rates Today 2024 can give you insights into current rates and help you make informed decisions about your mortgage.

Remember, responsible borrowing and meticulous planning are key to harnessing the potential benefits of a HELOC while mitigating potential risks.

FAQ Corner

What are the typical interest rates for HELOCs in 2024?

HELOC interest rates in 2024 vary depending on factors like your credit score, loan amount, and the lender. It’s crucial to compare rates from multiple lenders to secure the best deal. Currently, HELOC rates are generally lower than those for personal loans and credit cards, but it’s essential to assess your specific needs and financial situation.

How long does it take to get approved for a HELOC?

The approval process for a HELOC can take anywhere from a few days to several weeks, depending on the lender and the complexity of your application. Providing all necessary documentation promptly can expedite the process.

What are the potential risks of using a HELOC?

HELOCs carry risks, such as variable interest rates that can fluctuate over time, potentially increasing your monthly payments. Additionally, if you default on your HELOC payments, you could risk losing your home. It’s crucial to have a solid repayment plan in place before taking out a HELOC.