Home Credit Interest Rate 2024: Navigating the financial landscape can be a daunting task, especially when it comes to securing loans. Home Credit, a prominent financial institution, offers a diverse range of loan products, each with its unique interest rate structure.

Navigating the home buying process can be daunting, especially for first-time buyers. Consider reaching out to a real estate agent or using resources designed for home buyers in 2024.

Understanding these rates is crucial for making informed financial decisions and securing the best possible terms for your borrowing needs.

This comprehensive guide delves into the intricacies of Home Credit’s interest rates in 2024, exploring the factors that influence them, comparing them to market benchmarks, and providing strategies for securing lower rates. We’ll examine the various loan types offered, their associated interest rate ranges, and the impact of credit score, loan amount, and tenure on your borrowing cost.

Contents List

Home Credit: A Comprehensive Guide to Interest Rates in 2024

Home Credit is a well-known financial institution offering a variety of loan products to individuals and families across the globe. Their services have become increasingly popular due to their flexible loan terms, accessible application processes, and widespread presence. This guide will provide a comprehensive overview of Home Credit’s interest rates in 2024, covering essential aspects like current trends, influencing factors, loan types, and strategies for securing lower interest rates.

Home Credit Overview

Home Credit has a rich history, founded in 1997 in the Czech Republic. The company has since expanded its operations to numerous countries, including Russia, China, India, and Vietnam, becoming a leading provider of consumer finance solutions. Home Credit’s core business revolves around offering various loan products, including personal loans, consumer durables loans, and microfinance loans.

Their services cater to a diverse customer base, primarily focusing on individuals with limited access to traditional banking services.

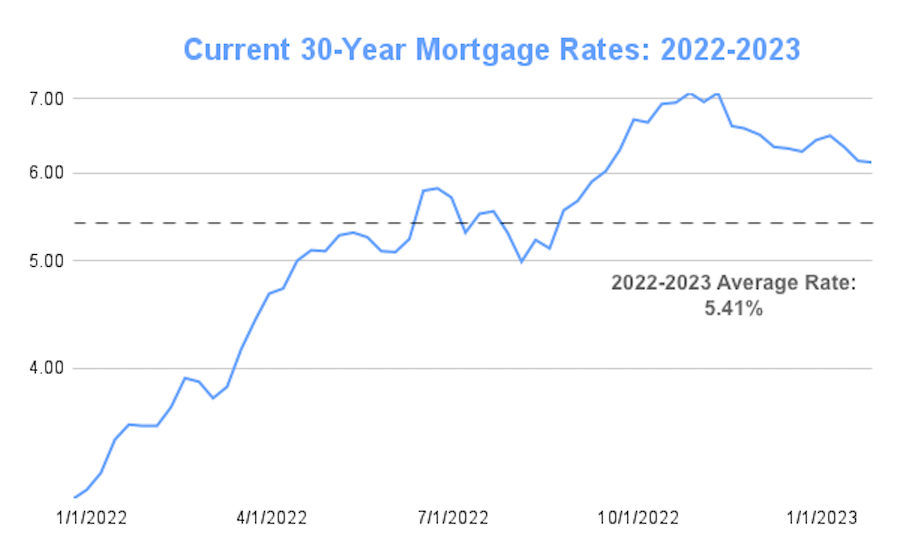

Keep an eye on home interest rates in 2024, as they can fluctuate significantly. It’s essential to shop around and compare rates from different lenders.

Home Credit Interest Rates in 2024

Home Credit’s interest rates in 2024 are influenced by a combination of factors, including the prevailing market conditions, the borrower’s creditworthiness, and the specific loan product being sought. While it’s impossible to provide exact interest rates without knowing the individual’s circumstances, we can analyze current trends and key factors influencing interest rate determination.

Loan Types and Interest Rates, Home Credit Interest Rate 2024

Home Credit offers a variety of loan products, each tailored to meet specific financial needs. The interest rates associated with these loan types can vary based on factors like loan amount, tenure, and borrower’s creditworthiness. Below is a table showcasing the different loan types and their corresponding interest rate ranges, loan amount, and loan tenure.

Working with a mortgage advisor can help you navigate the complexities of the mortgage process and find the right loan for your needs. Mortgage advisors can provide valuable guidance and support.

| Loan Type | Interest Rate Range | Loan Amount | Loan Tenure |

|---|---|---|---|

| Personal Loan | 12%

A bridge loan mortgage can be a useful tool if you’re buying a new home before selling your current one. It provides temporary financing until your existing home is sold.

|

$1,000

If you don’t meet traditional mortgage lending requirements, you may need to consider a non-QM mortgage. Non-QM mortgage lenders offer loans to borrowers with less-than-perfect credit or income.

|

12

If you have built equity in your home, you might consider taking equity out of your home through a home equity loan or line of credit. This can be a good option for home improvements or debt consolidation.

|

| Consumer Durables Loan | 15%

|

$500

Wells Fargo is a major mortgage lender in the US. To find out more about Wells Fargo mortgage rates in 2024, visit their website or contact a mortgage loan officer.

|

6

An interest-only home loan allows you to pay only the interest on your mortgage for a set period, making your monthly payments lower. However, you’ll have to make a larger lump sum payment at the end of the term.

|

| Microfinance Loan | 20%

Keller Williams Realty offers mortgage services through their affiliated lender, Keller Mortgage. If you’re working with a Keller Williams agent, they can connect you with Keller Mortgage to explore your mortgage options.

|

$100

|

3

|

It’s important to note that these are general ranges and actual interest rates may vary based on individual circumstances.

Finding the best VA home loan can be a challenge. Consider factors like interest rates, loan terms, and lender reputation when making your decision.

Factors Affecting Interest Rates

Home Credit’s interest rates are influenced by a multitude of factors, with the borrower’s credit score being a significant determinant. A higher credit score generally translates to lower interest rates, as lenders perceive borrowers with good credit history as less risky.

Other factors that play a role include the loan amount, tenure, and prevailing market conditions.

Secure the best possible interest rate for your home loan by researching and comparing offers from different lenders. Look for the best home loan interest rates available to you.

- Credit Score:A higher credit score demonstrates responsible financial behavior, leading to lower interest rates.

- Loan Amount and Tenure:Larger loan amounts and longer tenures often result in higher interest rates, as the lender assumes greater risk over a longer period.

- Market Conditions:Interest rates are influenced by macroeconomic factors such as inflation, central bank policies, and overall economic growth.

Strategies for Obtaining Lower Interest Rates

Securing lower interest rates can significantly impact the overall cost of borrowing. Here are some strategies to improve your chances of obtaining a favorable interest rate from Home Credit:

- Improve Your Credit Score:A higher credit score is the most effective way to secure lower interest rates.

- Negotiate Loan Terms:Don’t hesitate to negotiate loan terms with Home Credit, especially if you have a strong credit history and are willing to make a larger down payment.

- Compare Offers from Different Lenders:Shopping around and comparing offers from different lenders can help you secure the most competitive interest rates.

Transparency and Disclosure

Home Credit prioritizes transparency in its lending practices, ensuring clear disclosure of interest rates and loan terms. Before applying for a loan, it’s crucial to carefully review all loan terms and conditions, including interest rates, fees, and repayment schedules. Home Credit provides detailed information about its loan products on its website and through customer service channels.

For those seeking to buy a home with minimal upfront costs, a zero down mortgage could be a good option. While these mortgages don’t require a down payment, it’s important to consider the potential for higher interest rates.

Final Wrap-Up

By understanding the nuances of Home Credit’s interest rates and employing smart strategies, you can position yourself to secure favorable loan terms and navigate the borrowing process with confidence. Remember to carefully consider your financial situation, compare offers from multiple lenders, and prioritize transparency in your loan agreements.

With a well-informed approach, you can unlock the benefits of borrowing while minimizing the associated costs.

Facing difficulties with your mortgage? You’re not alone. There are resources available to help, such as mortgage help programs and counseling services.

Common Queries: Home Credit Interest Rate 2024

What is the minimum credit score required for a Home Credit loan?

If you have a Chase mortgage, you can find information about your Chase mortgage payment online or through their mobile app. You can also make payments online or by phone.

Home Credit has a minimum credit score requirement, but it varies depending on the loan type and your individual financial profile. It’s recommended to check their website or contact their customer service for specific requirements.

Can I prepay my Home Credit loan without penalty?

Home Credit’s loan agreements typically include prepayment terms. You can check your loan contract for details regarding prepayment options and any associated penalties.

How can I contact Home Credit for assistance?

You can reach Home Credit through their website, phone number, or by visiting a branch near you. Their customer service team is available to answer your questions and provide support.

If you’re a veteran looking to buy a home, you might be interested in a VA mortgage. These mortgages are designed specifically for veterans and active-duty military personnel and offer unique benefits, such as no down payment requirement.