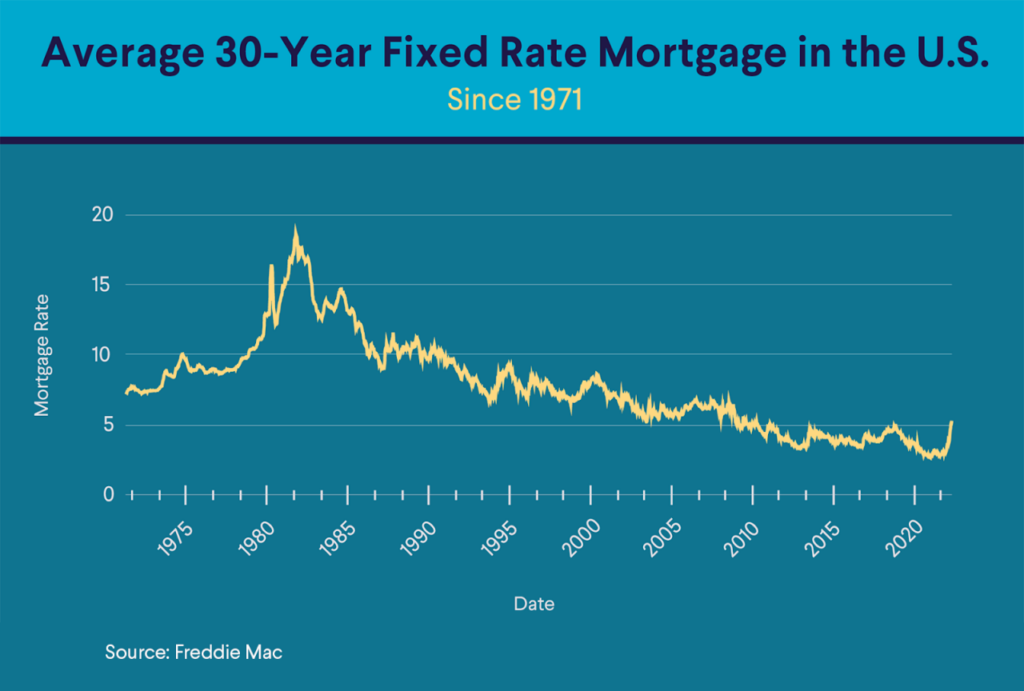

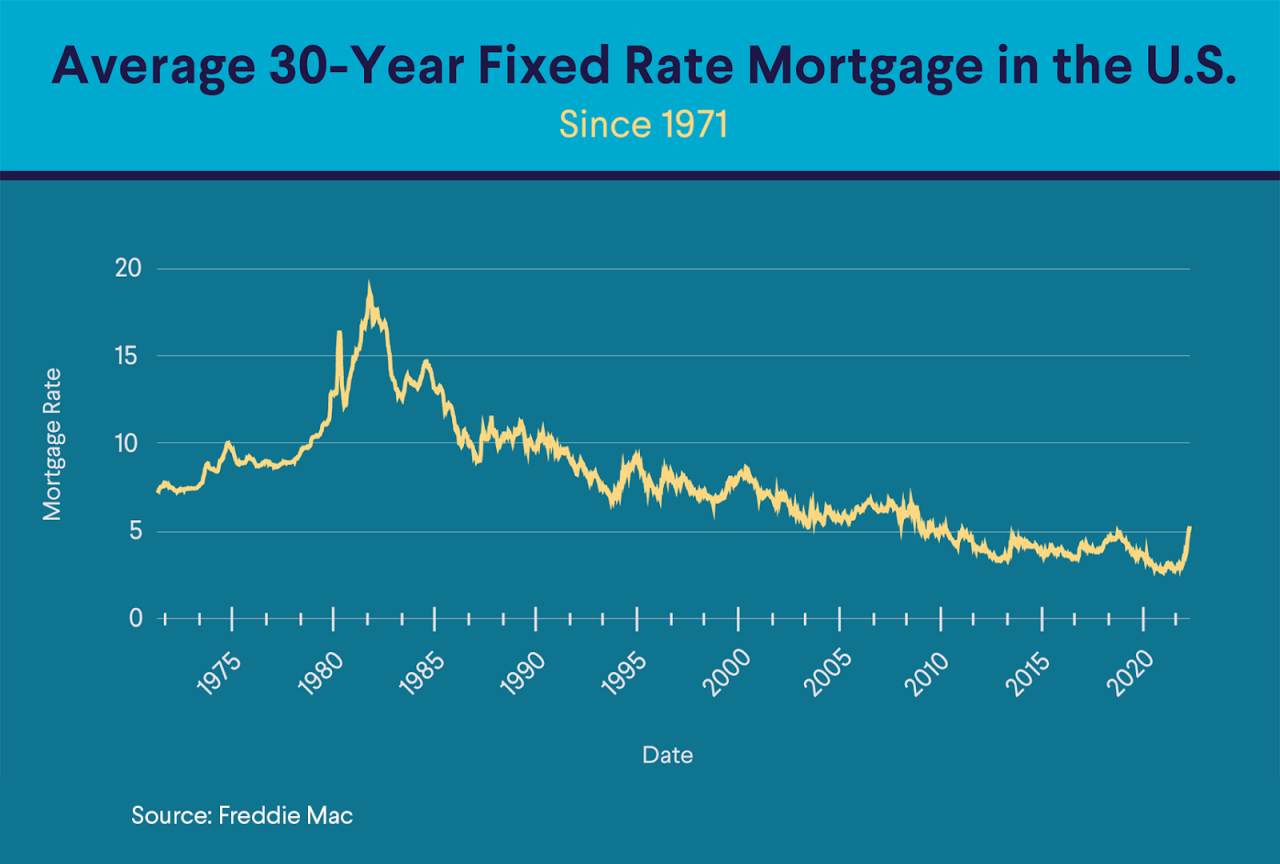

House Mortgage Rates 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The year 2024 presents a dynamic landscape for those seeking to purchase a home, with mortgage rates fluctuating in response to a complex interplay of economic factors.

Sofi offers a variety of financial products, including personal loans. Explore Sofi Loan 2024 options and see if they’re right for you.

This article delves into the current trends, key influencers, and strategic approaches to navigating this evolving market.

PenFed is a popular choice for home loans, and their rates are competitive. You can find more information about Penfed Mortgage Rates 2024 on our website.

Understanding the forces that shape mortgage rates is crucial for making informed decisions. We’ll explore the impact of inflation, Federal Reserve policy, and economic growth on rates, providing insights into potential future movements. We’ll also examine the role of government policies, investor sentiment, and market conditions in shaping the landscape of mortgage rates.

Are you considering refinancing your current mortgage? Find out about Refinance Mortgage Rates 2024 and see if it’s the right move for you.

Final Thoughts: House Mortgage Rates 2024

As we navigate the ever-changing landscape of House Mortgage Rates 2024, it’s essential to stay informed and adapt to the evolving market dynamics. By understanding the factors influencing rates, borrowers can position themselves to secure the best possible terms and manage their mortgage payments effectively.

Home mortgage interest rates are constantly fluctuating. Stay up-to-date with the latest Home Mortgage Interest Rates 2024 to make informed decisions.

Whether you’re a first-time buyer or a seasoned investor, this comprehensive analysis provides the knowledge and strategies to navigate this dynamic market with confidence.

Deciding on the right mortgage company can be a big decision. We’ve compiled a list of the Best Mortgage Companies 2024 to help you find the perfect fit for your needs.

FAQs

What are the current average mortgage rates?

If you’re looking to bridge the gap between selling your current home and buying a new one, a bridge loan might be a good option. Learn more about Bridge Loan Mortgage 2024 and how it can work for you.

Current average mortgage rates vary depending on the loan type (fixed-rate, adjustable-rate) and lender. It’s best to check with multiple lenders for the most up-to-date information.

Looking for the best deals on home loans in 2024? Check out Lowest Home Loan Rates 2024 for a comprehensive guide to current rates and lenders.

How often do mortgage rates change?

Mortgage rates can fluctuate daily, even hourly, in response to economic news and market conditions.

What is the difference between a fixed-rate and adjustable-rate mortgage?

A fixed-rate mortgage has a set interest rate for the entire loan term, providing predictable monthly payments. An adjustable-rate mortgage has an initial fixed rate that can adjust periodically based on market conditions, potentially leading to higher or lower payments.

What are some tips for securing the best mortgage rate?

Improve your credit score, shop around for lenders, consider a shorter loan term, and make a larger down payment.

A zero down mortgage can be a great option for first-time homebuyers. Learn more about Zero Down Mortgage 2024 and its requirements.

Planning to buy a second home? Get a better understanding of Second Home Mortgage Rates 2024 and explore your financing options.

If you’re eligible, a VA home loan can offer competitive rates and benefits. Check out Va Home Loan Interest Rates 2024 to learn more.

Wells Fargo is a major lender in the home loan market. Explore Wells Fargo Home Loan 2024 options and see what they offer.

Mortgage preapproval can give you an advantage in today’s competitive market. Learn more about Mortgage Preapproval 2024 and how it works.

Refinancing your home equity loan can help you save money on interest. Get the latest information on Refinance Home Equity Loan 2024 rates and terms.

FHA loans can be a good option for first-time homebuyers and those with less-than-perfect credit. Discover more about Fha Loans 2024 and their eligibility requirements.

If you’re looking to buy a home in a rural area, a USDA home loan might be a great option. Explore Usda Home Loan 2024 programs and see if you qualify.