Housing Interest Rates 2024 are a key factor shaping the real estate landscape. As the Federal Reserve continues to adjust monetary policy, homebuyers are facing fluctuating interest rates that impact affordability and purchasing power. Understanding the current rate environment, its influence on the market, and available strategies is crucial for navigating this dynamic landscape.

Interested in VA mortgage rates for 2024? VA Mortgage Rates 2024 provides up-to-date information on current rates and options for eligible veterans.

This guide explores the current housing interest rate landscape, analyzing the factors driving these rates and their impact on the housing market. It provides insights into the relationship between interest rates and housing affordability, highlighting the challenges and opportunities for homebuyers in this environment.

We’ll delve into strategies for navigating high-interest rates, including mortgage options, credit improvement tips, and alternative housing choices.

Looking for local mortgage lenders in 2024? Local Mortgage Lenders 2024 can help you find lenders in your area.

Contents List

- 1 Current Housing Interest Rate Landscape

- 2 Impact of Interest Rates on Housing Market

- 3 Strategies for Homebuyers in a High-Rate Environment

- 4 Outlook for Housing Interest Rates in 2024

- 5 Alternative Housing Options in a High-Rate Environment: Housing Interest Rates 2024

- 6 Final Thoughts

- 7 Frequently Asked Questions

Current Housing Interest Rate Landscape

The housing market is a dynamic landscape, influenced by a complex interplay of factors, including interest rates. In 2024, the average interest rates for various mortgage types have been fluctuating, impacting homebuyers’ decisions and the overall market activity. This article delves into the current housing interest rate landscape, its implications for the housing market, and strategies for navigating this dynamic environment.

Searching for cheap home loan options in 2024? Cheap Home Loans 2024 can help you find affordable financing solutions.

Average Interest Rates in 2024

As of [Tanggal], the average interest rates for various mortgage types in 2024 are as follows:

- 30-year fixed-rate mortgage:[Rata-rata persentase]

- 15-year fixed-rate mortgage:[Rata-rata persentase]

- Adjustable-rate mortgage (ARM):[Rata-rata persentase]

- Jumbo mortgage:[Rata-rata persentase]

These rates are subject to change based on various factors, including the Federal Reserve’s monetary policy, inflation, and economic growth.

Keep track of current housing rates with Housing Rates Today 2024 for informed decision-making.

Factors Influencing Interest Rates

The Federal Reserve’s monetary policy plays a crucial role in shaping interest rates. The Fed’s actions, such as raising or lowering the federal funds rate, directly influence the cost of borrowing money, including mortgage rates. Inflation, which measures the rate of increase in prices for goods and services, also impacts interest rates.

Stay up-to-date on FHA loan rates with FHA Loan Rates Today 2024 for informed financial planning.

When inflation is high, lenders tend to charge higher interest rates to compensate for the declining value of their money. Economic growth, measured by factors such as GDP and employment, can also influence interest rates. Strong economic growth often leads to higher interest rates as investors demand higher returns on their investments.

Choosing the right lender can be crucial. Best Mortgage Companies 2024 can help you compare and select a lender that meets your needs.

Comparison to Historical Trends

Comparing current interest rates to historical trends provides valuable insights into potential rate fluctuations. [Contoh kasus/data historical trends]. Based on these historical trends, [Prediksi kemungkinan fluktuasi].

Impact of Interest Rates on Housing Market

Interest rates have a significant impact on the housing market, influencing affordability, demand, and overall market activity. Understanding this relationship is crucial for both homebuyers and sellers.

Explore FHA lenders and their offerings for 2024 through FHA Lenders 2024 for potential loan options.

Interest Rates and Housing Affordability

Higher interest rates directly impact housing affordability by increasing the cost of borrowing money. When interest rates rise, monthly mortgage payments increase, making it more challenging for potential homebuyers to afford a home within their budget. This can lead to a decrease in demand for homes, particularly in price-sensitive segments of the market.

Impact on Homebuyers’ Purchasing Power

Rising interest rates directly affect homebuyers’ purchasing power. With higher interest rates, the amount of money a buyer can borrow decreases, reducing their ability to purchase a more expensive home. This can limit their choices and potentially lead to a decline in demand for higher-priced homes.

Consequences of High Interest Rates

High interest rates can have several consequences for the housing market. Increased borrowing costs can lead to a decline in demand, potentially resulting in a slowdown in home price appreciation or even price declines. High interest rates can also affect housing inventory, as some homeowners may be reluctant to sell their homes if they anticipate a decrease in their selling price or face difficulties finding a new home at a lower interest rate.

Interested in the current VA loan interest rates for 2024? VA Loan Interest Rate 2024 can provide you with the latest information.

Additionally, high interest rates can impact market activity, reducing the number of homes sold and transactions.

Thinking about transferring your existing home loan? Home Loan Transfer 2024 provides insights on the process and potential benefits.

Strategies for Homebuyers in a High-Rate Environment

Navigating a high-interest rate environment requires strategic planning and adjustments for homebuyers. Understanding different mortgage options, improving credit scores, and exploring potential financial assistance programs can enhance their chances of securing a favorable mortgage.

Explore Citizens Bank mortgage rates for 2024 with Citizens Bank Mortgage Rates 2024 to compare their offerings.

Mortgage Options

Different mortgage options cater to varying financial situations and risk tolerances. Here’s a table outlining key mortgage types and their advantages and disadvantages:

| Mortgage Type | Advantages | Disadvantages |

|---|---|---|

| Fixed-Rate Mortgage | Predictable monthly payments, stable interest rate over the loan term | Higher initial interest rates compared to ARMs |

| Adjustable-Rate Mortgage (ARM) | Lower initial interest rates compared to fixed-rate mortgages | Interest rate fluctuations can lead to unpredictable payments |

| Jumbo Mortgage | Higher loan amounts for purchasing more expensive homes | More stringent qualification requirements, higher interest rates |

Improving Credit Scores

A strong credit score is crucial for securing favorable mortgage terms. Homebuyers can improve their credit scores by:

- Paying bills on time

- Keeping credit utilization low

- Avoiding opening new credit accounts unnecessarily

- Dispute any errors on credit reports

Securing the Best Mortgage Terms

To secure the best possible mortgage terms, homebuyers should:

- Shop around for mortgage rates from multiple lenders

- Negotiate interest rates and closing costs

- Consider pre-approval to demonstrate financial readiness

- Explore potential down payment assistance programs

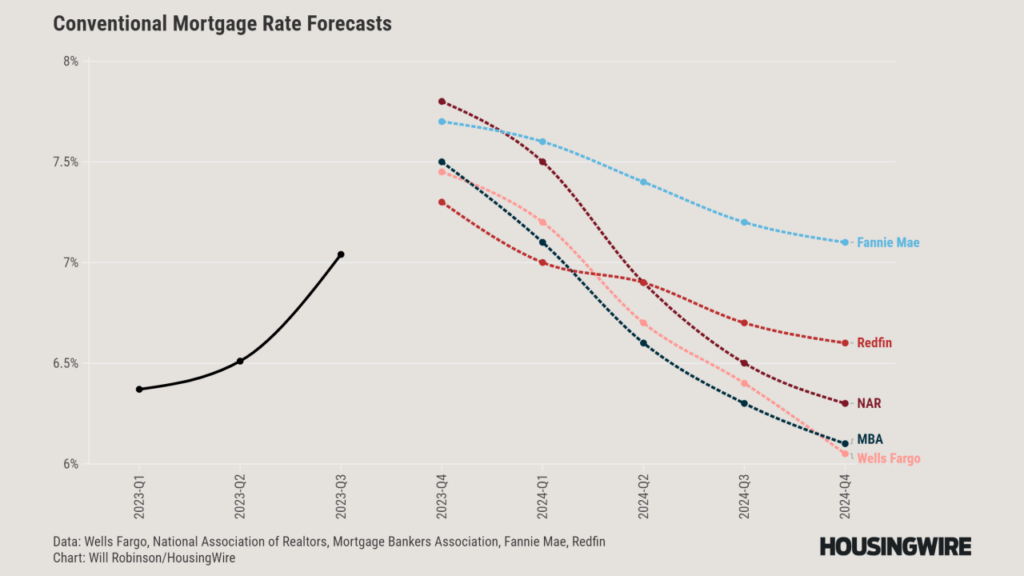

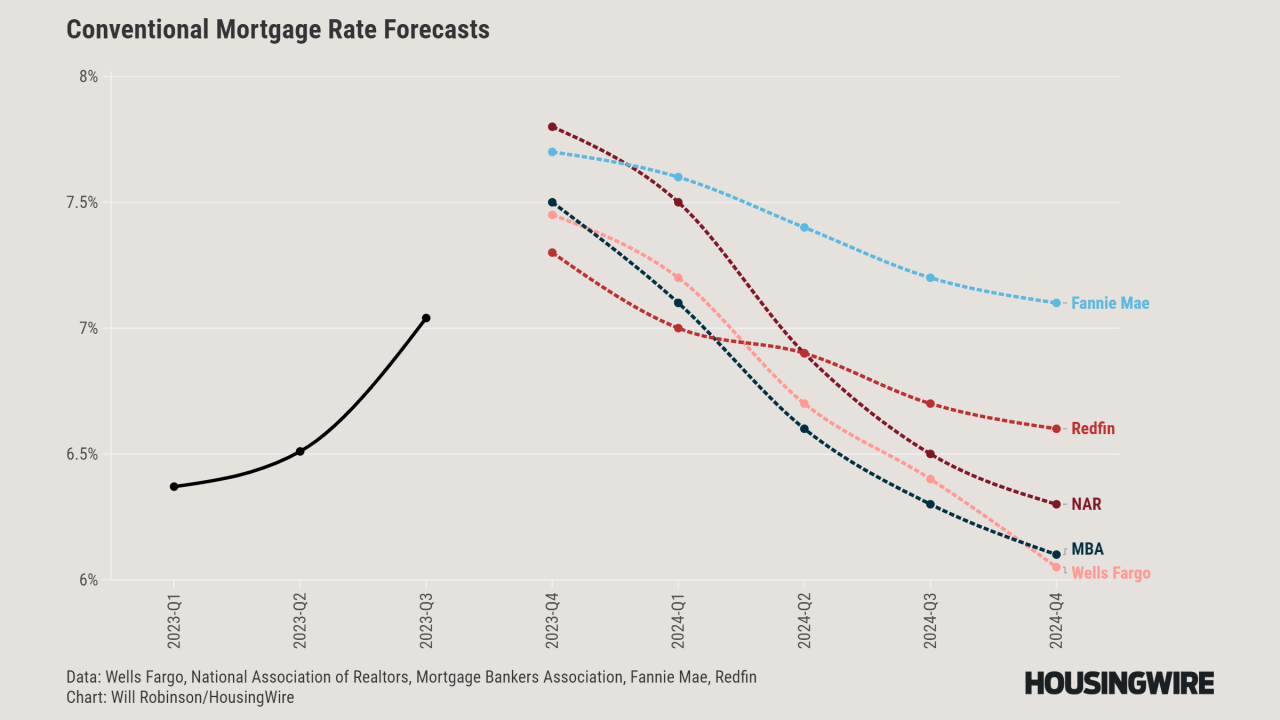

Outlook for Housing Interest Rates in 2024

Predicting future interest rate movements is inherently challenging, as they are influenced by a complex interplay of economic factors. However, based on current economic indicators and historical trends, [Prediksi pergerakan suku bunga].

Get pre-approved for a home loan in 2024 through Home Loan Pre Approval 2024 to streamline the home buying process.

Key Economic Indicators

Several key economic indicators will influence interest rate decisions, including:

- Inflation:[Jelaskan pengaruh inflasi terhadap suku bunga]

- Economic growth:[Jelaskan pengaruh pertumbuhan ekonomi terhadap suku bunga]

- Unemployment rate:[Jelaskan pengaruh tingkat pengangguran terhadap suku bunga]

- Consumer confidence:[Jelaskan pengaruh kepercayaan konsumen terhadap suku bunga]

Implications for Housing Market, Housing Interest Rates 2024

[Prediksi implikasi pergerakan suku bunga terhadap pasar perumahan].

Curious about Chase mortgage rates for 2024? Chase Mortgage Rates Today 2024 provides information on their current offerings.

Alternative Housing Options in a High-Rate Environment: Housing Interest Rates 2024

In a high-interest rate environment, exploring alternative housing options can provide flexibility and affordability. Here are some alternatives to consider:

Renting

Renting offers flexibility and can be a more affordable option, particularly in a high-interest rate environment. However, rent payments do not build equity, and rent increases can be unpredictable.

Looking for assistance with your mortgage in 2024? Mortgage Help 2024 can provide valuable resources and guidance to help you navigate the process.

Buying a Fixer-Upper

Purchasing a fixer-upper can offer an opportunity to buy a home at a lower price, but requires additional time, effort, and financial resources for renovations. This option can be attractive for those willing to invest time and effort to increase their property value.

Investing in a property? Investment Property Loans 2024 can offer competitive rates and terms to make your investment goals a reality.

Shared ownership involves purchasing a portion of a property with another individual or group. This can reduce the initial purchase price and monthly payments, but requires careful consideration of ownership agreements and potential conflicts.

Comparison of Options

| Housing Option | Pros | Cons |

|---|---|---|

| Renting | Flexibility, lower upfront costs | No equity building, unpredictable rent increases |

| Buying a Fixer-Upper | Lower purchase price, potential for equity growth | Requires renovation time, effort, and resources |

| Shared Ownership | Reduced purchase price, shared costs | Potential ownership conflicts, shared responsibility |

Final Thoughts

The housing market is constantly evolving, and understanding the intricacies of interest rates is essential for making informed decisions. Whether you’re a first-time homebuyer or a seasoned investor, staying informed about current trends and available strategies can help you navigate the market effectively.

By staying informed, you can make informed decisions that align with your financial goals and achieve your housing aspirations.

Learn more about securing a home mortgage in 2024 with Home Mortgage 2024 , which offers guidance on the process and requirements.

Frequently Asked Questions

What are the current average interest rates for mortgages?

Current average interest rates vary depending on the mortgage type and lender. It’s best to check with multiple lenders for the most up-to-date information.

How do interest rates affect my monthly mortgage payment?

Higher interest rates result in higher monthly mortgage payments. Conversely, lower interest rates lead to lower monthly payments.

What are some strategies for lowering my mortgage interest rate?

Strategies include improving your credit score, shopping around for the best rates, and considering a shorter loan term.