How do the 2024 tax brackets affect my retirement savings? This question is on the minds of many as they navigate the complex world of financial planning. Understanding the nuances of tax brackets is crucial for maximizing your retirement savings and ensuring a comfortable future.

The 2024 tax brackets are set to undergo changes, potentially impacting how much you pay in taxes and how much you can save for retirement.

This guide delves into the intricacies of the 2024 tax brackets, providing insights into how they influence your retirement savings contributions, withdrawals, and overall financial planning. We’ll explore the various types of retirement accounts, their tax implications, and strategies for optimizing your retirement savings within the new tax landscape.

Contents List

Understanding the 2024 Tax Brackets

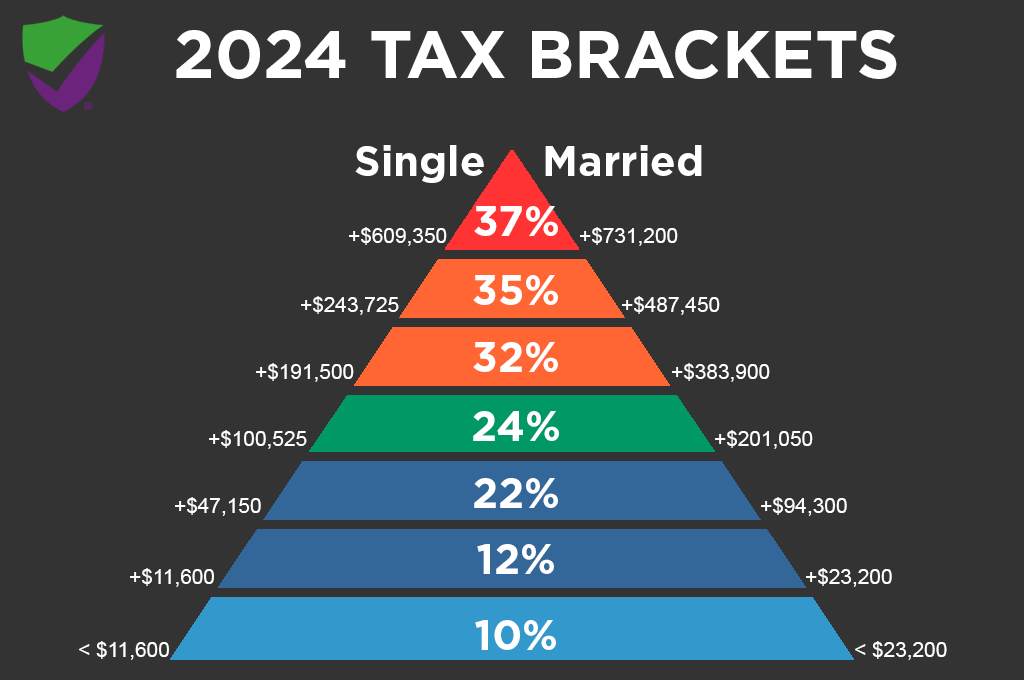

The 2024 tax brackets represent the different income ranges subject to varying tax rates. These brackets influence how much tax you pay on your income, potentially affecting your retirement savings.

Impact of Tax Brackets on Income Levels

The tax brackets are structured as follows:

- Each bracket represents a range of income, with a corresponding tax rate applied to that income.

- As your income increases, it moves into higher brackets, leading to a higher tax rate on the portion of income falling within that bracket.

- The tax brackets are designed to be progressive, meaning that higher earners pay a greater percentage of their income in taxes.

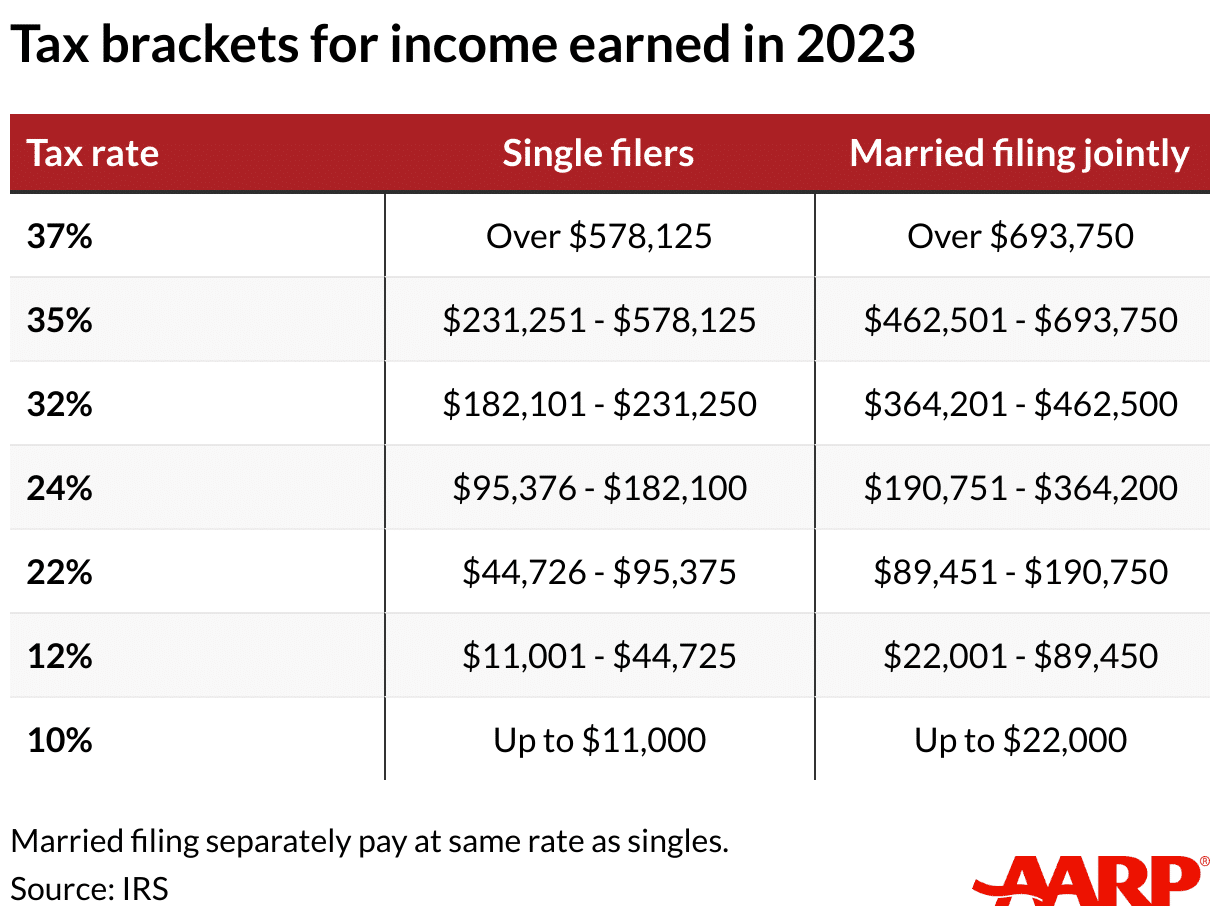

Comparison of 2024 and 2023 Tax Brackets

The following table shows the 2024 tax brackets for single filers, along with the corresponding rates from 2023:

| Income Range | 2024 Tax Rate | 2023 Tax Rate |

|---|---|---|

$0

|

10% | 10% |

$10,751

|

12% | 12% |

| $43,001

Heads of households have unique retirement planning considerations. Knowing the Roth IRA contribution limit for 2024 for head of household can help you make informed decisions about your savings strategy.

|

22% | 22% |

$109,251

|

24% | 24% |

$192,151

|

32% | 32% |

| $578,126

If you’re over 50, you can contribute more to your 401k. Find out the 401k contribution limits for 2024 for over 50 and take advantage of this opportunity to boost your retirement savings.

|

35% | 35% |

| $1,000,001+ | 37% | 37% |

Potential Impact on Different Income Levels

The 2024 tax brackets may have a significant impact on retirement savings, depending on your income level. For instance:

- Lower-income earnersmay experience a relatively small impact on their retirement savings, as their income falls within the lower tax brackets.

- Higher-income earnersmay see a more substantial impact, as their income is subject to higher tax rates. This could influence their ability to contribute to retirement accounts or invest in other assets.

Retirement Savings Contributions

Retirement savings contributions are a crucial aspect of financial planning, and understanding how they interact with the tax system is essential. Different types of retirement accounts offer varying tax benefits, influencing the amount you pay in taxes now and in retirement.

Tax Deductibility of Contributions

Traditional IRAs and 401(k)s allow pre-tax contributions, meaning you deduct the amount contributed from your taxable income, reducing your tax liability in the present. This results in immediate tax savings.

Thinking about contributing to a Roth IRA? Check out the Roth IRA contribution limit for 2024 to see how much you can contribute.

For example, if you contribute $6,500 to a traditional IRA and are in the 22% tax bracket, you save $1,430 in taxes ($6,500 x 0.22).

For those who drive for business purposes, the mileage rate for October 2024 is important to know for tax deductions. Make sure you’re using the correct rate for your expenses.

Comparing Roth IRAs and Traditional IRAs

Both Roth IRAs and traditional IRAs offer tax advantages, but in different ways.

- Traditional IRA:Contributions are tax-deductible, leading to lower taxes now, but withdrawals in retirement are taxed as ordinary income. This option may be advantageous for those expecting to be in a lower tax bracket in retirement than they are now.

- Roth IRA:Contributions are made with after-tax dollars, so you don’t get a tax deduction upfront. However, qualified withdrawals in retirement are tax-free. This option is beneficial for those anticipating being in a higher tax bracket in retirement or who want to avoid future tax liability on their retirement savings.

The choice between a Roth IRA and a traditional IRA depends on your individual circumstances, including your current tax bracket, anticipated future tax bracket, and risk tolerance.

If you’re in a partnership, you’ll need to file a W9 form. Make sure you have the latest version by checking out the W9 Form October 2024 for partnerships. This ensures you’re compliant with IRS regulations.

Tax Implications of Retirement Distributions: How Do The 2024 Tax Brackets Affect My Retirement Savings

When you withdraw money from your retirement accounts, such as a 401(k) or IRA, you’ll likely have to pay taxes on the distributions. The tax implications of retirement distributions depend on the type of account, the type of withdrawal, and your individual tax situation.

If you’re over 50, you have the advantage of catch-up contributions. Learn about the 401k limits for 2024 for over 50 to maximize your retirement savings.

Taxation of Retirement Distributions

Retirement accounts are typically tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw the money. When you take distributions, the withdrawn amount is taxed as ordinary income, which means it’s taxed at your regular income tax rate.

For example, if you withdraw $10,000 from your traditional IRA and your marginal tax rate is 22%, you’ll owe $2,200 in federal income tax on the withdrawal.

Tax Implications of Required Minimum Distributions (RMDs)

After age 72, you are required to take minimum distributions from your traditional IRA and 401(k) accounts. These distributions are also taxed as ordinary income. If you fail to take your RMD, you could face a hefty penalty.

For example, if your RMD for the year is $5,000 and you don’t take it, you’ll be penalized 50% of the amount you should have withdrawn, which would be $2,500 in this case.

Want to get a good estimate of your tax burden? Use a tax calculator to figure out how much you’ll pay in taxes in 2024. This helps you plan your finances and avoid any surprises come tax season.

Tax Rates Applied to Retirement Income

The tax rate applied to your retirement income depends on your total taxable income, including your retirement distributions, for the year. Here is a breakdown of the 2024 federal income tax brackets:

| Tax Bracket | Tax Rate | Taxable Income |

|---|---|---|

| 10% | 10% | $0 to $10,950 |

| 12% | 12% | $10,951 to $46,275 |

| 22% | 22% | $46,276 to $101,750 |

| 24% | 24% | $101,751 to $192,150 |

| 32% | 32% | $192,151 to $578,125 |

| 35% | 35% | $578,126 to $1,000,000 |

| 37% | 37% | Over $1,000,000 |

Note: These tax rates are subject to change. Consult with a tax professional for the most up-to-date information.

Running a small business? Keep track of tax deadlines. The tax extension deadline October 2024 for small businesses might give you some extra time to file, but don’t wait until the last minute!

Strategies for Optimizing Retirement Savings

Understanding the 2024 tax brackets is essential for maximizing your retirement savings. By strategizing your contributions and withdrawals, you can minimize your tax burden and maximize your retirement nest egg.

Minimizing Taxes on Retirement Savings Contributions, How do the 2024 tax brackets affect my retirement savings

There are several strategies you can employ to reduce the tax impact of your retirement savings contributions.

- Contribute to Roth IRAs:Roth IRAs allow you to contribute after-tax dollars, meaning you won’t pay taxes on your withdrawals in retirement. This can be beneficial if you expect to be in a higher tax bracket in retirement.

- Maximize Employer Matching Contributions:If your employer offers a 401(k) match, be sure to contribute enough to receive the full match.

Planning for retirement? It’s essential to know the 401k contribution limits for 2024 based on your income level. This information helps you maximize your contributions and get the most out of your retirement savings.

This is essentially free money that can significantly boost your retirement savings.

- Consider a Traditional IRA if you anticipate being in a lower tax bracket in retirement:Traditional IRAs allow you to deduct contributions from your taxable income, potentially lowering your current tax bill. However, you will need to pay taxes on your withdrawals in retirement.

Want to know how much you can contribute to a traditional 401k? Find out the 401k contribution limits for 2024 for traditional 401k and start planning for your retirement.

Maximizing Tax Benefits from Retirement Withdrawals

While you can’t avoid taxes entirely on your retirement withdrawals, there are ways to minimize your tax burden.

- Withdraw from Roth IRAs first:Roth IRA withdrawals are tax-free, so it’s generally advantageous to withdraw from these accounts before tapping into traditional IRAs.

- Consider Qualified Charitable Distributions (QCD):If you are over 70 1/2, you can make direct charitable donations from your traditional IRA without having to include the distribution in your taxable income.

Small businesses have specific 401k contribution limits. Check out the 401k contribution limits for 2024 for small businesses to make sure you’re taking advantage of all the benefits available to you.

- Take advantage of the “required minimum distribution” rules:The IRS requires you to begin taking withdrawals from your traditional IRA and 401(k) accounts after age 73. However, you can strategically withdraw the minimum amount each year to minimize your tax burden.

Adjusting Retirement Savings Strategies Based on 2024 Tax Brackets

The 2024 tax brackets will likely affect your retirement savings strategies. For example, if you are in a higher tax bracket, you may want to consider contributing to a Roth IRA instead of a traditional IRA.

Families have unique tax situations. Use a tax calculator for families in October 2024 to get a personalized estimate of your tax liability.

- Review your contribution strategy:The tax brackets can influence whether a Roth or traditional IRA is more advantageous for you.

- Consider increasing contributions:If you are in a lower tax bracket, you may want to consider increasing your retirement savings contributions to take advantage of the tax deductions.

- Rebalance your portfolio:The tax implications of different investments can vary. It’s important to review your portfolio and make adjustments to optimize your tax efficiency.

Tax Planning for Retirement

Retirement planning involves more than just saving money. It also includes strategically managing your finances to minimize your tax burden during your golden years. This is especially important considering that your income may be significantly different in retirement than it was during your working years.

Thinking about contributing to a traditional IRA? Find out how much you can contribute to a traditional IRA in 2024 to make the most of your retirement savings.

Impact of Tax Brackets on Retirement Income Planning

Understanding how tax brackets work is crucial for retirement income planning. As your income increases, you move into higher tax brackets, meaning you pay a higher percentage of your income in taxes. This can impact your retirement income, as you may need to withdraw more from your savings to maintain your desired lifestyle.

Thinking about opening a Roth IRA? Check out the Roth IRA income limit for 2024 to see if you qualify. Knowing these limits helps you decide if a Roth IRA is right for your financial situation.

For instance, if you are in a lower tax bracket during retirement, you can withdraw less from your savings to achieve the same after-tax income. This can help your savings last longer and provide you with financial security for the long term.

Need to understand the tax implications of your investments? Use a tax calculator for investments in October 2024 to get a clear picture of your potential tax liability. This can help you make informed decisions about your portfolio.

Strategies for Optimizing Retirement Savings

Here are some strategies for optimizing your retirement savings and minimizing your tax burden in retirement:

- Maximize tax-advantaged retirement accounts:Contributions to traditional 401(k)s and IRAs are tax-deductible, reducing your current tax liability. You’ll pay taxes on the distributions in retirement, but potentially in a lower tax bracket.

- Consider Roth accounts:Roth IRAs and Roth 401(k)s allow for tax-free withdrawals in retirement. This can be beneficial if you expect to be in a higher tax bracket in retirement than you are now.

- Utilize tax-loss harvesting:This strategy involves selling investments that have lost value to offset capital gains and reduce your tax liability. This can be especially helpful in retirement, when you may be more sensitive to tax implications.

- Take advantage of tax-efficient withdrawals:You can minimize your tax liability by strategically withdrawing from your retirement accounts. For example, you may want to prioritize withdrawals from accounts that are subject to lower tax rates.

- Plan for required minimum distributions (RMDs):If you have traditional IRAs or 401(k)s, you are required to start taking minimum distributions once you reach age 73. These distributions are taxable, so it’s important to plan for them in advance.

Resources for Obtaining Professional Tax Advice

It’s always a good idea to consult with a qualified tax professional for personalized advice. Here are some resources that can help you find a tax advisor:

- The American Institute of Certified Public Accountants (AICPA):This organization offers a directory of certified public accountants (CPAs) who can provide tax advice.

- The National Association of Enrolled Agents (NAEA):This organization represents enrolled agents, who are tax professionals licensed by the IRS.

- The National Society of Tax Professionals (NSTP):This organization provides a directory of tax professionals who are members of the society.

Closing Notes

Navigating the complexities of retirement savings and taxes can feel overwhelming. However, understanding the 2024 tax brackets and their implications can empower you to make informed decisions about your financial future. By strategically planning your contributions, withdrawals, and overall retirement savings strategy, you can minimize your tax burden and maximize your retirement nest egg.

Remember, seeking professional advice from a qualified tax advisor is always recommended to ensure you’re making the best choices for your unique circumstances.

Query Resolution

How do I know which tax bracket I’m in?

Your tax bracket is determined by your taxable income, which is your total income minus deductions and exemptions. The IRS provides tables that Artikel the tax brackets for each filing status.

What if I’m close to a tax bracket boundary?

If your income is near a tax bracket boundary, it’s important to consider how any additional income or deductions might push you into a higher or lower bracket. Consult with a tax advisor for personalized guidance.

Will the tax brackets change again in the future?

Tax laws are subject to change. It’s wise to stay informed about any potential updates or modifications to the tax brackets in the future.