How much can I contribute to a Roth IRA in 2024? This question is on the minds of many Americans looking to secure their financial future. A Roth IRA offers a powerful way to save for retirement with the potential for tax-free growth and withdrawals, making it an attractive option for individuals at all income levels.

But before you jump in, it’s important to understand the contribution limits and income restrictions that apply.

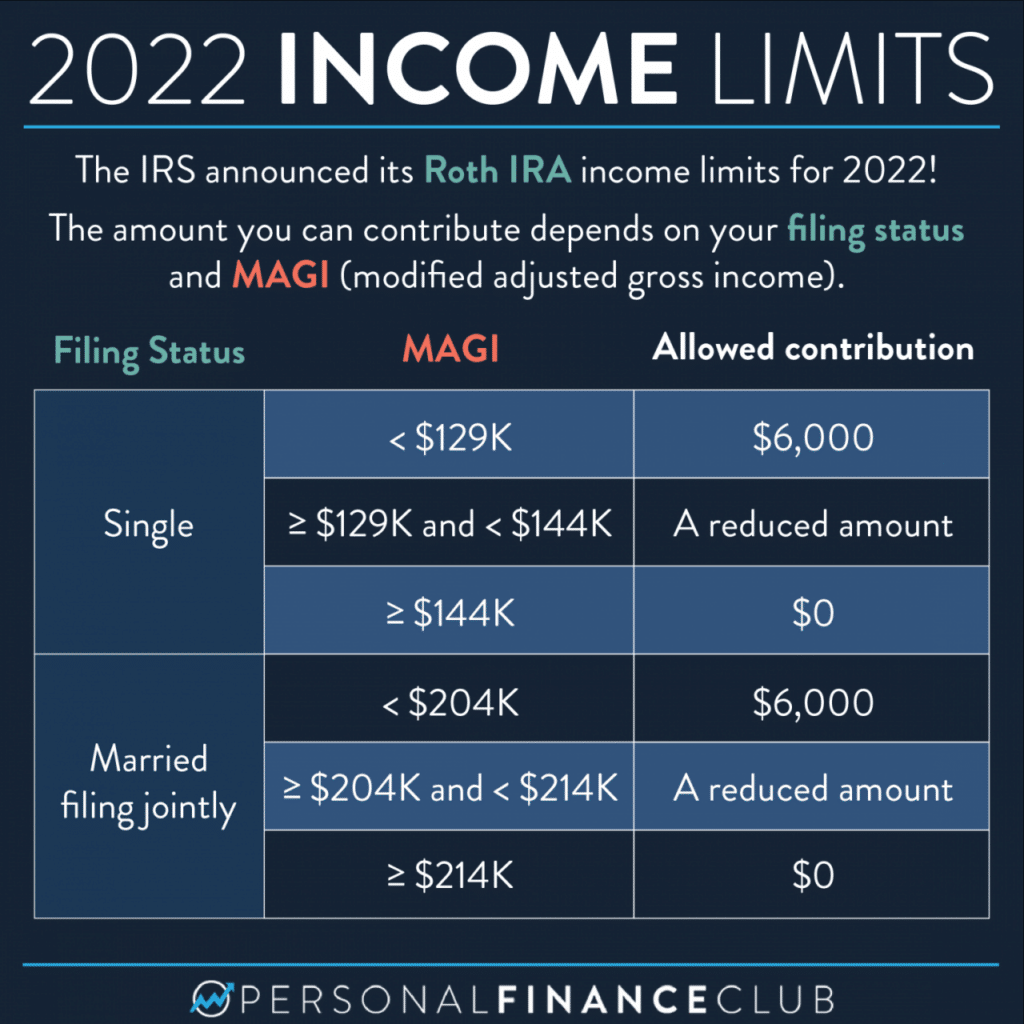

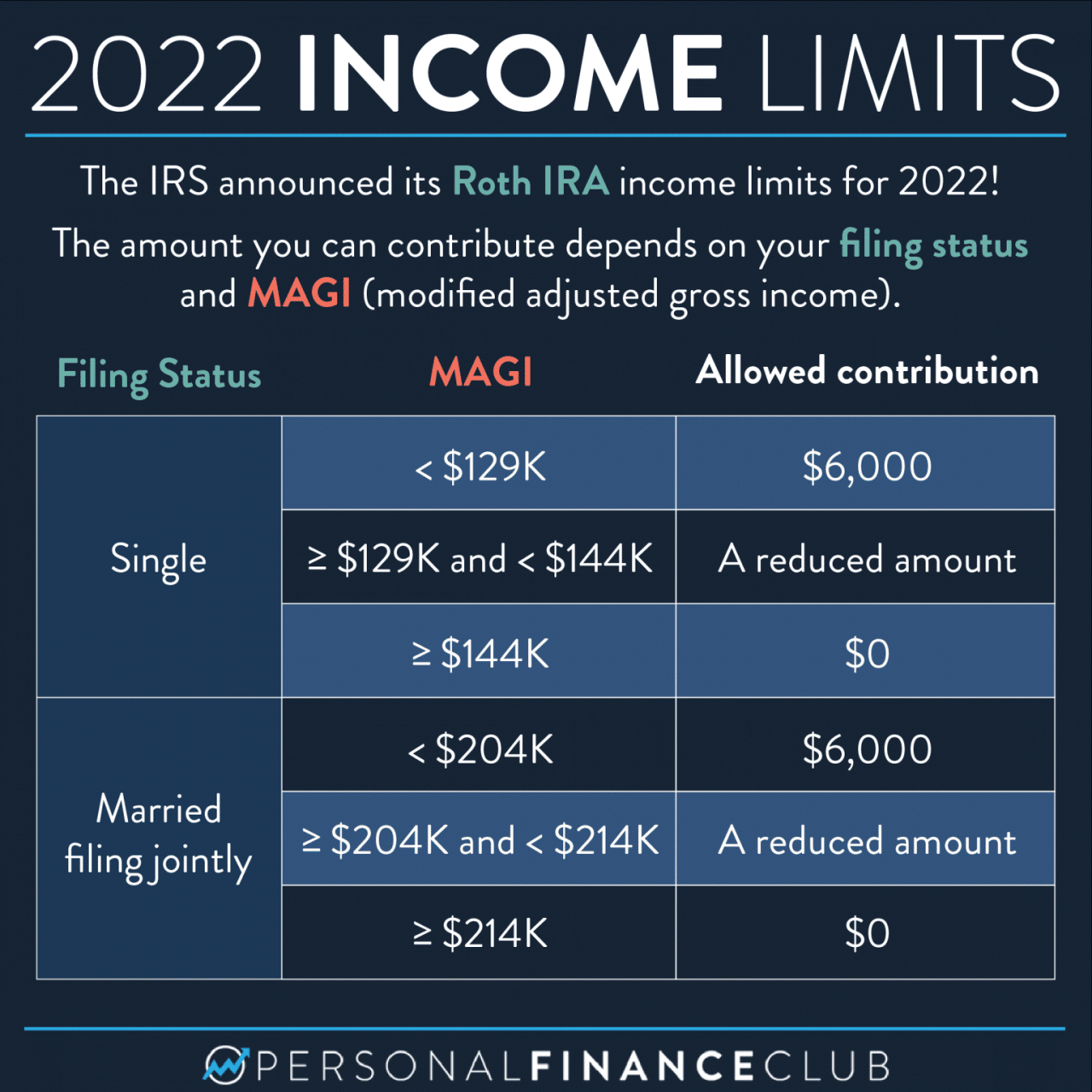

In 2024, the maximum contribution amount for a Roth IRA is $6,500 for individuals under 50 and $7,500 for those 50 and older. However, if your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute the full amount, or you may not be eligible at all.

For example, in 2024, single filers with a MAGI above $153,000 and married couples filing jointly with a MAGI above $228,000 are phased out of Roth IRA eligibility. This means that even if you meet the age requirement, you may not be able to contribute the full amount or any amount at all.

Understanding these limits is crucial for making informed decisions about your retirement savings strategy.

Contents List

Tips for Maximizing Roth IRA Contributions

Maximizing your Roth IRA contributions can significantly boost your retirement savings. By understanding the contribution limits and adopting smart strategies, you can take full advantage of this valuable retirement planning tool.

Speaking of financial planning, don’t forget about the W9 Form October 2024 deadline for filing. This form is crucial for anyone who receives payments from a company or organization, as it provides important tax information. Missing this deadline could lead to delays or complications with your tax filings.

Strategies for Maximizing Roth IRA Contributions

A well-designed strategy can help you make the most of your Roth IRA contributions. Here are some key considerations:

- Determine Your Contribution Limit:The annual contribution limit for Roth IRAs is subject to change, so it’s crucial to stay updated. For 2024, the limit is $7,000 for individuals under age 50 and $8,000 for those 50 and older.

- Factor in Your Income:If your income exceeds certain thresholds, you may be phased out of Roth IRA contributions. For 2024, the income limits are $153,000 for single filers and $228,000 for married couples filing jointly. If your income is close to these limits, consider making traditional IRA contributions instead, which may allow you to deduct contributions and pay taxes later in retirement.

Figuring out your retirement savings can be a bit confusing, especially with all the different options available. If you’re married, you might be wondering about the IRA contribution limits for married couples in 2024. Understanding these limits can help you maximize your contributions and build a strong financial future.

- Consider “Catch-Up” Contributions:If you’re 50 or older, you can make additional “catch-up” contributions to your Roth IRA, allowing you to save even more for retirement. For 2024, the catch-up contribution limit is $1,000.

Planning Regular Contributions, How much can I contribute to a Roth IRA in 2024

Consistency is key to maximizing your Roth IRA contributions. Consider these strategies:

- Set Up Automatic Transfers:Automate regular contributions from your checking or savings account to your Roth IRA. This ensures that you contribute consistently, even if you forget or are busy.

- Budget for Contributions:Include Roth IRA contributions in your monthly budget, treating them like any other essential expense. This helps ensure that you prioritize saving for retirement.

- Utilize Tax Refunds:If you receive a tax refund, consider using a portion of it to contribute to your Roth IRA. This can help you reach your contribution goals faster.

Contribution Scenarios and Impact

Here’s a table illustrating different contribution scenarios and their potential impact on retirement savings:

| Scenario | Annual Contribution | Years of Contribution | Estimated Retirement Savings (at 7% average annual return) |

|---|---|---|---|

| Scenario 1: Minimum Contribution | $1,000 | 30 | $76,123 |

| Scenario 2: Maximum Contribution | $7,000 | 30 | $532,855 |

| Scenario 3: Catch-Up Contributions | $8,000 (age 50+) | 10 | $128,194 |

Note:These are just estimates and actual returns may vary. It’s essential to consult with a financial advisor to determine the best course of action for your specific circumstances.

Last Point

Ultimately, deciding whether to contribute to a Roth IRA is a personal financial decision. Weighing the potential tax advantages, income limitations, and other factors specific to your situation is essential. By carefully considering your options and consulting with a financial advisor if needed, you can make an informed choice that aligns with your long-term financial goals.

Question & Answer Hub: How Much Can I Contribute To A Roth IRA In 2024

What is a Roth IRA?

A Roth IRA is a retirement savings account where contributions are made after taxes, allowing for tax-free withdrawals in retirement.

What are the tax implications of a Roth IRA?

Contributions to a Roth IRA are made with after-tax dollars, meaning you won’t receive a tax deduction in the year you contribute. However, qualified withdrawals in retirement are tax-free.

What is the difference between a Roth IRA and a traditional IRA?

A traditional IRA allows for pre-tax contributions, resulting in a tax deduction in the year of contribution. However, withdrawals in retirement are taxed. With a Roth IRA, contributions are made after taxes, but withdrawals in retirement are tax-free.

Can I contribute to both a Roth IRA and a traditional IRA?

Yes, you can contribute to both a Roth IRA and a traditional IRA, but there may be income limitations depending on your filing status.

For those looking to save for retirement through their workplace, the 2024 401k contribution limits for employees are important to know. These limits can vary based on your age and income, so it’s essential to stay informed about what you can contribute each year.

If you’re over 50, you might be eligible for “catch-up” contributions to your IRA. The IRA contribution limits for 2024 for those over 50 allow you to contribute a bit more to your retirement savings, helping you reach your financial goals faster.

As the October 2024 deadline approaches, it’s important to get organized and prepare your taxes. The tax preparation tips for the October 2024 deadline can help you avoid any surprises and ensure a smooth filing process.

You might be wondering if you can contribute to an IRA even if you already have a 401k. The good news is, you can! The ability to contribute to an IRA if you have a 401k can help you diversify your retirement savings and maximize your tax benefits.

With the start of a new year, it’s a good time to check out the new tax brackets for 2024. Understanding these brackets can help you estimate your tax liability and plan your finances accordingly.

If you’ve been volunteering your time and using your vehicle for charitable causes, you might be able to claim a deduction for your mileage. The October 2024 mileage rate for charitable donations is set by the IRS and can help you save on your taxes.

The tax landscape is constantly changing, so it’s important to stay updated on any new regulations or changes that might affect your tax filing. The tax changes impacting the October 2024 deadline could affect your tax liability, so it’s essential to stay informed.

Non-profit organizations also need to file W9 forms. The W9 Form October 2024 for non-profit organizations deadline is important for ensuring accurate tax reporting and receiving proper payments.

IRA contributions are a great way to save for retirement, and the IRA contribution limits for 2024 can help you maximize your savings. Make sure you understand the limits to get the most out of your contributions.

If you’re enrolled in a Roth 401k, you’ll want to know the 401k contribution limits for 2024 for Roth 401k. These limits can vary, so it’s essential to check them to ensure you’re contributing the maximum amount allowed.

Taking advantage of tax deductions can help you save money on your tax bill. The tax deductions for the October 2024 deadline can vary depending on your individual circumstances, so it’s important to review your options and claim any deductions you’re eligible for.

Wondering how much you can contribute to your IRA in 2024? The amount you can contribute to your IRA in 2024 depends on your age and income. Make sure you’re contributing the maximum amount allowed to maximize your retirement savings.

For self-employed individuals, the IRA contribution limits for solo 401k in 2024 are important to understand. These limits can be higher than traditional IRA limits, so it’s worth exploring this option if you’re self-employed.