How much can I contribute to my IRA in 2024? This is a question on the minds of many individuals looking to secure their financial future. Understanding IRA contribution limits is crucial for maximizing retirement savings and taking advantage of tax benefits.

Whether you’re just starting your retirement journey or have been saving for years, staying informed about IRA contribution limits is essential for making the most of your contributions.

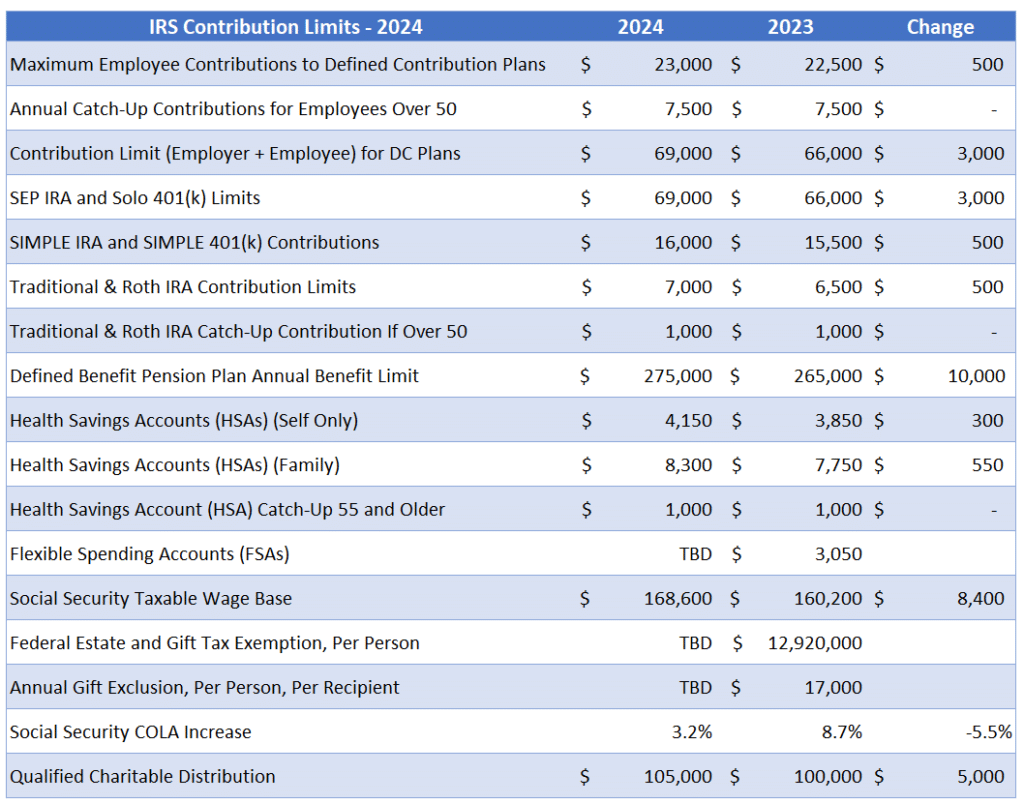

The annual contribution limit for traditional and Roth IRAs in 2024 may differ from previous years. Additionally, individuals aged 50 and older have the option to make “catch-up” contributions, allowing them to save even more for retirement. Furthermore, income limitations play a role in determining eligibility for traditional and Roth IRA contributions.

Understanding these factors is essential for making informed decisions about your retirement savings.

Contents List

IRA Contribution Limits for 2024

The maximum amount you can contribute to your IRA in 2024 depends on your age and whether you choose a traditional or Roth IRA. The contribution limits for both types of IRAs are the same, but the tax implications differ.

If you’re over 50, you may be eligible for an increased IRA contribution limit. The IRA contribution limits for people over 50 in 2024 allow you to contribute more to your retirement savings, helping you reach your financial goals.

Contribution Limits for 2024

The maximum contribution limit for both traditional and Roth IRAs in 2024 is $7,000. This represents an increase from the $6,500 limit in 2023.

Looking to save for retirement? The IRA contribution limits for 2024 have been updated, so make sure you’re aware of the maximum amount you can contribute to your account this year. Start planning for a comfortable retirement today!

Catch-up Contributions

Individuals aged 50 and older can make additional “catch-up” contributions to their IRAs. For 2024, the catch-up contribution limit is $1,000, bringing the total maximum contribution for individuals 50 and older to $8,000.

If you’re a foreign national living in the United States, you’ll need to file your taxes by the October 2024 deadline. Find out more about the October 2024 tax deadline for foreign nationals and ensure you’re compliant with the IRS regulations.

Eligibility for IRA Contributions

Not everyone can contribute to an IRA. Income limits restrict who can contribute to traditional and Roth IRAs.

The October 2024 tax deadline is fast approaching! Don’t wait until the last minute. Check out this helpful guide on how to file your taxes by the October 2024 deadline to ensure you’re prepared and avoid any penalties.

Traditional IRA Income Limits

Traditional IRA contributions are subject to income limitations, which determine the amount you can deduct on your tax return. In 2024, if your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to deduct any contributions.

Freelancers, just like sole proprietors, need to fill out a W9 Form to provide their tax information to clients or payers. This form helps ensure accurate payment and compliance with tax regulations.

These limits apply regardless of whether you’re single, married filing jointly, or head of household.

What’s the tax deadline for October 2024? Make sure you don’t miss the deadline for filing your taxes! The tax deadline for October 2024 is crucial for avoiding penalties and ensuring your tax obligations are met.

If your MAGI is:

- $73,000 or less (single filers), you can deduct the full contribution.

- $109,000 or less (married filing jointly or head of household), you can deduct the full contribution.

If your MAGI is higher than the limits, you may not be able to deduct the full contribution, or any contribution at all. For example, if you’re single and your MAGI is $80,000, you can’t deduct the full contribution.

Understanding the tax bracket thresholds for 2024 is crucial for accurate tax planning. Knowing your income range and the corresponding tax rate helps you make informed financial decisions and potentially minimize your tax liability.

Roth IRA Income Limits

Similar to traditional IRAs, Roth IRA contributions are subject to income limits. However, these limits apply to your ability to contribute to a Roth IRA, not to your ability to deduct contributions.

If you’re filing as a single filer, understanding the tax brackets for single filers in 2024 is essential for calculating your tax liability. Knowing your income range and the corresponding tax rate helps you make informed financial decisions.

If your MAGI is:

- $153,000 or less (single filers), you can contribute the full amount.

- $228,000 or less (married filing jointly or head of household), you can contribute the full amount.

If your MAGI exceeds these limits, you cannot contribute to a Roth IRA. For example, if you’re single and your MAGI is $160,000, you cannot contribute to a Roth IRA.

The mileage rate for work-related driving is updated periodically. If you’re wondering when the mileage rate will be updated for October 2024 , you can check the IRS website for the latest information. Staying up-to-date on these changes is essential for accurate tax deductions.

Partial Contributions

Even if you exceed the income limits for a traditional or Roth IRA, you may still be eligible for partial contributions. For example, if your MAGI is between $73,000 and $80,000, you may be able to deduct a portion of your traditional IRA contribution.

Curious about how much you’ll owe in taxes? Use a tax bracket calculator for 2024 to estimate your tax liability based on your income and filing status. This can help you plan your finances and make informed decisions.

However, this will depend on the specific amount of your MAGI.

If you’re driving your car for work, you might be eligible for a mileage deduction. The October 2024 mileage rate for driving to work is determined by the IRS and can be a significant tax savings for those who drive frequently for work purposes.

Tax Implications of IRA Contributions

Understanding the tax implications of IRA contributions is crucial for making informed financial decisions. The tax treatment of IRA contributions and withdrawals depends on the type of IRA you choose: traditional or Roth.

Retirement planning is important, and understanding IRA contribution limits is a key part of it. Check out the IRA contribution limits for 2024 and 2025 to ensure you’re maximizing your contributions and building a secure financial future.

Tax Implications of Traditional IRA Contributions

Traditional IRA contributions are tax-deductible, meaning they can reduce your taxable income in the year you make the contribution. This can lower your tax liability for the current year. For example, if you contribute $6,500 to a traditional IRA and are in the 22% tax bracket, you can reduce your taxable income by $6,500, potentially saving you $1,430 in taxes.

Planning for retirement? Don’t forget about your Roth IRA! The IRA contribution limits for Roth IRA in 2024 have been updated, so make sure you’re aware of the maximum amount you can contribute to your account this year.

Tax Advantages of Traditional IRA Contributions During Retirement

The tax advantages of traditional IRA contributions come into play during retirement. When you withdraw money from a traditional IRA in retirement, the withdrawals are taxed as ordinary income. This means that you will pay taxes on the money you withdraw, but you won’t have paid taxes on it when you contributed.

Are you a sole proprietor looking to file your taxes? You’ll need to fill out a W9 Form to provide your tax information to the payer. It’s a crucial step in the process, ensuring you receive proper payment and avoid any potential tax issues.

For example, if you contribute $6,500 to a traditional IRA in 2024 and withdraw $10,000 in 2044, you will only pay taxes on the $3,500 in earnings.

If you’re using your car for work, you might be eligible for mileage reimbursement. But what’s the actual rate? You can find out the mileage reimbursement rate for October 2024 on the IRS website. This rate is updated regularly, so make sure you’re using the correct one for your reimbursements.

Tax Implications of Roth IRA Contributions and Withdrawals in Retirement

Roth IRA contributions are made with after-tax dollars, meaning you don’t receive a tax deduction for contributions. However, Roth IRA withdrawals in retirement are tax-free. This means you won’t have to pay any taxes on the money you withdraw, including both contributions and earnings.

For example, if you contribute $6,500 to a Roth IRA in 2024 and withdraw $10,000 in 2044, you will not have to pay any taxes on the $10,000 withdrawal.

Strategies for Maximizing IRA Contributions

Maximizing your IRA contributions can significantly boost your retirement savings. By taking advantage of the full contribution limit, you can enjoy the benefits of tax-deferred growth and potentially reduce your tax liability. Here are some effective strategies to help you maximize your IRA contributions.

Automatic Contributions

Setting up automatic contributions is a simple yet powerful way to ensure you consistently contribute to your IRA. By automating the process, you eliminate the need to manually transfer funds each month, making it easier to stay on track. Many financial institutions offer automated contribution options, allowing you to set a specific amount to be transferred from your checking or savings account to your IRA on a regular schedule.

Using a Tax Refund, How much can I contribute to my IRA in 2024

If you receive a tax refund, consider using a portion of it to contribute to your IRA. A tax refund represents money you’ve already paid to the government, so using it to contribute to your IRA can help you save for retirement and potentially reduce your tax burden in the future.

Prioritizing IRA Contributions

When budgeting for your finances, prioritize your IRA contributions. By making them a non-negotiable expense, you’ll ensure that your retirement savings are a top priority. Consider creating a budget that includes your IRA contributions as a fixed expense, similar to rent or mortgage payments.

Tracking Progress

Regularly track your IRA contributions to stay on top of your progress. Monitor your contributions to ensure you’re on track to reach your savings goals. Many online brokerage platforms and financial institutions provide tools and resources to help you track your IRA contributions.

Seeking Professional Advice

If you’re unsure about the best strategies for maximizing your IRA contributions, consult with a financial advisor. A qualified financial advisor can help you develop a personalized retirement savings plan and provide guidance on maximizing your contributions.

Last Recap

Planning for retirement involves carefully considering your financial goals and utilizing available resources. IRAs provide a valuable tool for building wealth and securing a comfortable future. By understanding IRA contribution limits, eligibility requirements, and tax implications, you can make informed decisions about your retirement savings strategy.

Whether you choose a traditional or Roth IRA, maximizing your contributions can significantly impact your long-term financial well-being. Remember to review your financial situation regularly and adjust your retirement savings plan as needed to achieve your goals.

Query Resolution: How Much Can I Contribute To My IRA In 2024

What happens if I contribute more than the IRA limit?

If you contribute more than the annual IRA limit, you may be subject to penalties. The IRS considers excess contributions as taxable income, and you may have to pay a 6% penalty on the excess amount. It’s important to stay within the contribution limits to avoid any potential penalties.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and Roth IRA in the same year, but the total contribution amount cannot exceed the annual limit for both types of IRAs combined. For example, if the annual limit is $6,500, you can contribute $3,250 to a traditional IRA and $3,250 to a Roth IRA.

However, you should consider your income limitations and tax implications when deciding how much to contribute to each type of IRA.

What are the income limits for Roth IRA contributions?

The income limits for Roth IRA contributions in 2024 are based on your modified adjusted gross income (MAGI). If your MAGI exceeds a certain threshold, you may not be eligible to contribute to a Roth IRA or your contributions may be phased out.

It’s important to check the current income limits to ensure you qualify for Roth IRA contributions.