How Much Does A 80 000 Annuity Pay Per Month 2024 – How Much Does A $80,000 Annuity Pay Monthly in 2024? This question is at the forefront of many minds as individuals plan for their financial futures and seek reliable income streams during retirement. Annuities, financial instruments that provide regular payments over a specified period, offer a potential solution for those seeking a steady source of income in their later years.

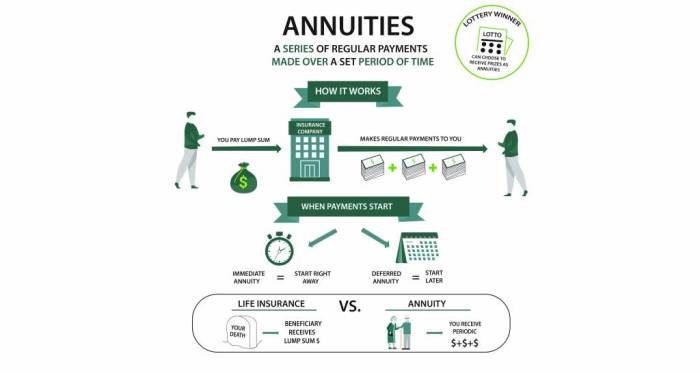

An annuity is not a single payment, but rather a series of regular payments over a set period of time. This can be a great option for those looking for a guaranteed income stream, but it’s important to understand the different types of annuities and how they work.

For more information on the nature of annuity payments, you can visit Annuity Is Single Payment 2024.

Understanding how much a $80,000 annuity can pay monthly in 2024 is crucial for making informed financial decisions and ensuring a comfortable retirement.

Annuity 401k 2024 refers to an annuity that is used as a retirement savings plan. This type of annuity allows you to contribute pre-tax dollars to your account and grow your savings tax-deferred. When you retire, you can withdraw your savings as a stream of income.

For more information on Annuity 401k 2024 and its associated terms, you can visit Annuity 401k 2024.

The amount an annuity pays monthly depends on several factors, including the initial investment, the type of annuity chosen, the interest rate, and the duration of the payout period. Fixed annuities offer guaranteed payments based on a fixed interest rate, while variable annuities provide payments that fluctuate with market performance.

The Annuity Loan Formula 2024 is a mathematical formula used to calculate the amount of an annuity payment. This formula takes into account the principal amount of the loan, the interest rate, and the length of the loan term.

Understanding this formula can be helpful when evaluating different annuity options. For more information on the Annuity Loan Formula 2024 and its application, you can visit Annuity Loan Formula 2024.

Indexed annuities offer a blend of both, providing a minimum guaranteed return tied to the performance of a specific index. Understanding these nuances is essential for selecting the annuity that best aligns with your financial goals and risk tolerance.

Whether or not annuity payments are taxable in 2024 depends on the specific type of annuity and the terms of the contract. Some annuities are tax-deferred, meaning that taxes are not paid until the money is withdrawn, while others are taxed annually.

For more information on the tax implications of annuity payments in 2024, you can visit Is Annuity Payments Taxable 2024.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period. It’s a popular option for retirement planning, as it can provide a reliable source of income during your golden years. Annuities work by converting a lump sum of money into a series of payments, typically monthly.

An annuity is also known as a “guaranteed income stream” or a “retirement income plan.” These terms refer to the regular stream of payments that an annuity provides. Annuity payments can be used to supplement retirement income or provide a steady income stream for a set period of time.

For more information on the different names and uses of annuities, you can visit Annuity Is Also Known As 2024.

This allows individuals to receive a consistent income stream even after they’ve stopped working.

Types of Annuities

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:These annuities guarantee a fixed rate of return, providing predictable monthly payments. The downside is that they may not keep up with inflation.

- Variable Annuities:These annuities invest your money in a variety of assets, such as stocks and bonds. Your monthly payments can fluctuate based on the performance of your investments. This offers potential for higher returns but also carries more risk.

- Indexed Annuities:These annuities link your returns to the performance of a specific index, such as the S&P 500. They offer some protection against market downturns while still providing the potential for growth.

Examples of Annuity Income

Let’s imagine you have a $80,000 annuity. The monthly payments you receive will depend on the type of annuity, interest rates, and the chosen payout period. For instance:

- A fixed annuity with a 3% annual interest rate might pay you around $333 per month.

- A variable annuity, with its returns fluctuating based on market performance, could offer higher payments in a bull market or lower payments during a bear market.

- An indexed annuity tied to the S&P 500 could provide payments that rise and fall based on the index’s performance.

Factors Affecting Annuity Payments: How Much Does A 80 000 Annuity Pay Per Month 2024

Several factors determine the monthly payment from an $80,000 annuity. Understanding these factors is crucial for making informed decisions about your retirement income.

1 An Annuity Is 2024 refers to a type of annuity that pays out a single payment of $1 in 2024. This type of annuity is typically used for short-term income needs or for specific financial goals. For more information on this type of annuity and its associated terms, you can visit 1 An Annuity Is 2024.

Interest Rates, How Much Does A 80 000 Annuity Pay Per Month 2024

Interest rates play a significant role in annuity payments. Higher interest rates generally result in larger monthly payments. Conversely, lower interest rates lead to smaller payments. This is because the interest earned on your principal contributes to the monthly income stream.

Annuity Type

The type of annuity you choose also influences your monthly payments. As discussed earlier, fixed annuities offer predictable payments, while variable and indexed annuities provide potential for higher returns but carry more risk. The specific features and guarantees of each annuity type will affect the payment amount.

If you’re looking for a way to generate a consistent income of 1 million dollars in 2024, an annuity might be the solution. Annuity 1 Million 2024 refers to an annuity that pays out a million dollars annually for a certain period.

This can be a great option for those who are looking to secure a substantial retirement income, but it’s important to understand the different types of annuities and their terms. For a deeper dive into this type of annuity, you can check out Annuity 1 Million 2024.

Payout Period

The chosen payout period, or how long you want to receive payments, significantly impacts the monthly amount. A longer payout period will generally result in smaller monthly payments, as the annuity needs to spread the principal over a longer time.

An annuity can be structured to last for a specific period of time, such as a certain number of years, or it can be designed to last indefinitely. This type of annuity is called a “perpetuity” and can be a great option for those looking for a long-term income stream.

For more information on indefinite-duration annuities, you can visit Annuity Is Indefinite Duration 2024.

Conversely, a shorter payout period will lead to larger monthly payments.

In 2024, annuities are generally taxable, but the specific tax implications can vary depending on the type of annuity and the terms of the contract. It’s important to understand the tax implications of annuities before making a decision. For more information on the taxability of annuities in 2024, you can visit Annuity Is Taxable 2024.

Comparing Monthly Payments

Consider the following examples to illustrate the impact of different factors on monthly payments:

- A fixed annuity with a 3% interest rate and a 20-year payout period might provide a monthly payment of around $400.

- The same annuity with a 10-year payout period could offer a monthly payment of about $800.

- A variable annuity with a 20-year payout period, depending on market performance, could offer higher or lower monthly payments compared to the fixed annuity.

Calculating Monthly Annuity Payments

Calculating the monthly payment from an $80,000 annuity can be done using various methods. You can use online annuity calculators or financial software, or consult with a financial advisor for personalized guidance.

Annuity 4 Percent 2024 refers to an annuity that promises a 4% return on your investment. This type of annuity can be a good option for those looking for a moderate income stream with a lower risk than higher-yielding annuities.

However, it’s important to compare different annuity options and their terms before making a decision. For more information on Annuity 4 Percent 2024 and its associated terms, you can visit Annuity 4 Percent 2024.

Using Online Calculators

Many online calculators allow you to estimate monthly payments based on factors like the annuity type, interest rate, and payout period. These calculators are generally user-friendly and provide quick estimates. However, they may not account for all the nuances of your specific situation.

6 Annuity 2024 refers to an annuity that pays out income for 6 years. This type of annuity can be a good option for those who are looking for a shorter-term income stream. However, it’s important to understand the different types of annuities and their terms before making a decision.

For more information on 6 Annuity 2024 and its associated terms, you can visit 6 Annuity 2024.

Financial Software

Financial software programs offer more comprehensive tools for calculating annuity payments. These programs can incorporate various factors, including taxes, fees, and investment growth projections. While they provide more detailed calculations, they may require a subscription or purchase.

An Annuity Issuer 2024 is a financial institution that sells annuities. These institutions can be insurance companies, banks, or other financial institutions. It’s important to compare different annuity issuers and their terms before making a decision. For more information on Annuity Issuer 2024 and its associated terms, you can visit Annuity Issuer 2024.

Consulting a Financial Advisor

Consulting with a financial advisor is the most recommended approach for determining the right annuity for your needs. They can provide personalized advice based on your financial goals, risk tolerance, and overall financial situation. A financial advisor can also help you understand the complexities of annuities and guide you through the selection process.

Whether or not annuity interest is taxable in 2024 depends on the specific type of annuity and the terms of the contract. Some annuities are tax-deferred, meaning that taxes are not paid until the money is withdrawn, while others are taxed annually.

For more information on the tax implications of annuity interest in 2024, you can visit Is Annuity Interest Taxable 2024.

Considerations for Annuity Investments

Investing in an annuity can be a wise choice for retirement planning, but it’s essential to understand the potential risks and rewards. Here are some key considerations:

Pros and Cons

- Pros:Annuities provide guaranteed income, protection against market volatility, and tax advantages. They can also offer longevity protection, ensuring income for your lifetime.

- Cons:Annuities can have high fees, limited liquidity, and may not keep up with inflation. They also lack flexibility compared to other investment options.

Risks and Rewards

- Risks:Annuities can involve surrender charges, which are penalties for withdrawing your money early. Some annuities may also have high fees or limited investment options.

- Rewards:Annuities offer guaranteed income streams, providing peace of mind during retirement. They can also protect your principal from market downturns, depending on the annuity type.

Annuity Comparison Table

| Annuity Type | Features | Benefits | Potential Monthly Payment |

|---|---|---|---|

| Fixed Annuity | Guaranteed interest rate, predictable payments | Security, stability | Lower than variable or indexed annuities |

| Variable Annuity | Investment options, potential for higher returns | Growth potential, flexibility | Fluctuating based on market performance |

| Indexed Annuity | Linked to market index, protection against downturns | Growth potential, downside protection | May vary based on index performance |

Additional Resources for Annuity Information

To learn more about annuities and retirement planning, you can consult reputable websites and organizations. Here are some resources:

Resource Table

| Organization | Website | Contact Information | Specialized Services |

|---|---|---|---|

| The American Association for Retired Persons (AARP) | https://www.aarp.org/ | 1-888-OUR-AARP (1-888-687-2277) | Retirement planning, financial resources, advocacy |

| The National Endowment for Financial Education (NEFE) | https://www.nefe.org/ | 1-800-392-NEFE (1-800-392-6333) | Financial education, retirement planning tools |

| The Securities and Exchange Commission (SEC) | https://www.sec.gov/ | 1-800-SEC-0330 (1-800-732-0330) | Investor protection, information on financial products |

Professional Financial Advice

Seeking professional financial advice from a qualified advisor is highly recommended when considering an annuity. They can help you understand your financial goals, risk tolerance, and overall financial situation. An advisor can also provide personalized recommendations for the right annuity type and payout options for your specific needs.

Annuity 8 Percent 2024 refers to an annuity that promises an 8% return on your investment. This type of annuity can be a great way to generate a higher income stream, but it’s important to understand the risks involved.

It’s crucial to do your research and compare different annuity options before making a decision. For more information on this type of annuity and its associated risks, you can check out Annuity 8 Percent 2024.

Ending Remarks

Ultimately, the monthly payment from an $80,000 annuity in 2024 will depend on a variety of factors, including the specific terms and conditions of the annuity contract. Consulting with a financial advisor can provide personalized guidance and help you make informed decisions about annuity investments.

Annuity 4 2024 is a type of investment that pays out a regular stream of income over a set period of time. This can be a great option for those looking for a guaranteed income stream, but it’s important to understand the different types of annuities and how they work.

For more information on this type of investment, you can visit Annuity 4 2024 to learn more.

By carefully considering your financial needs and exploring the different annuity options available, you can make a decision that sets you on a path towards a financially secure retirement.

Frequently Asked Questions

What are the potential risks of investing in an annuity?

While annuities offer a guaranteed income stream, they can also come with certain risks. For example, some annuities may have surrender charges if you withdraw funds before a certain period. Additionally, variable annuities are subject to market fluctuations, which can impact the value of your investment.

It’s important to understand these risks before making any investment decisions.

How do I choose the right type of annuity?

The best type of annuity for you will depend on your individual financial goals and risk tolerance. If you prioritize stability and guaranteed income, a fixed annuity may be suitable. If you’re willing to take on more risk for the potential of higher returns, a variable annuity might be a better choice.

It’s essential to carefully consider your options and seek professional advice to make an informed decision.