How much is the standard deduction in 2024? This question is on the minds of many taxpayers as they prepare to file their returns. The standard deduction, a fixed amount that taxpayers can subtract from their taxable income, can significantly reduce their tax liability.

Understanding how the standard deduction works and its impact on your tax bill is crucial, especially given the potential changes that may occur in the coming years. This guide delves into the intricacies of the standard deduction, providing valuable insights for both seasoned and new taxpayers.

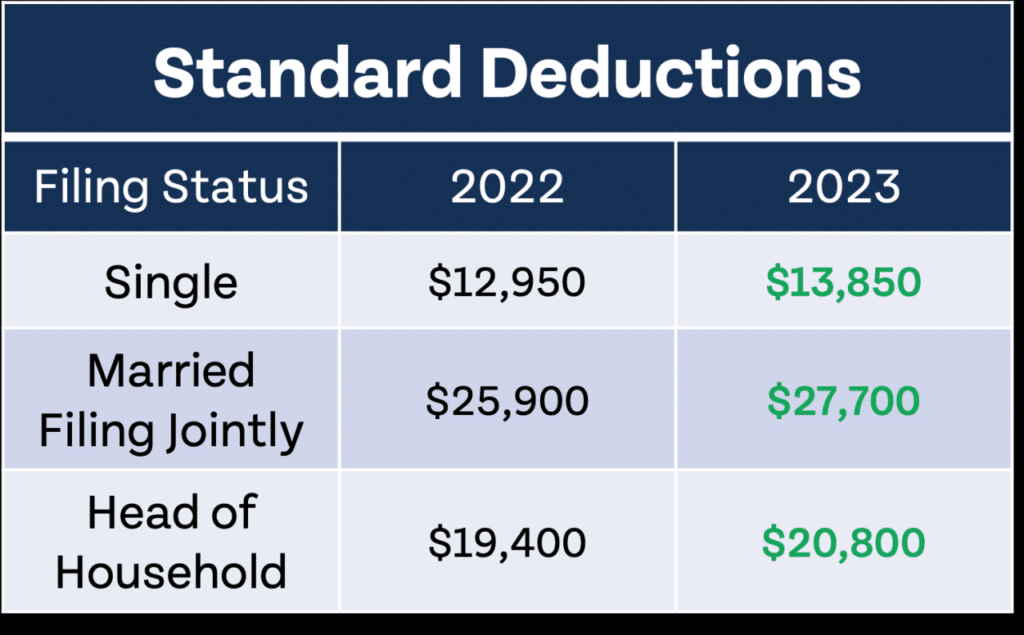

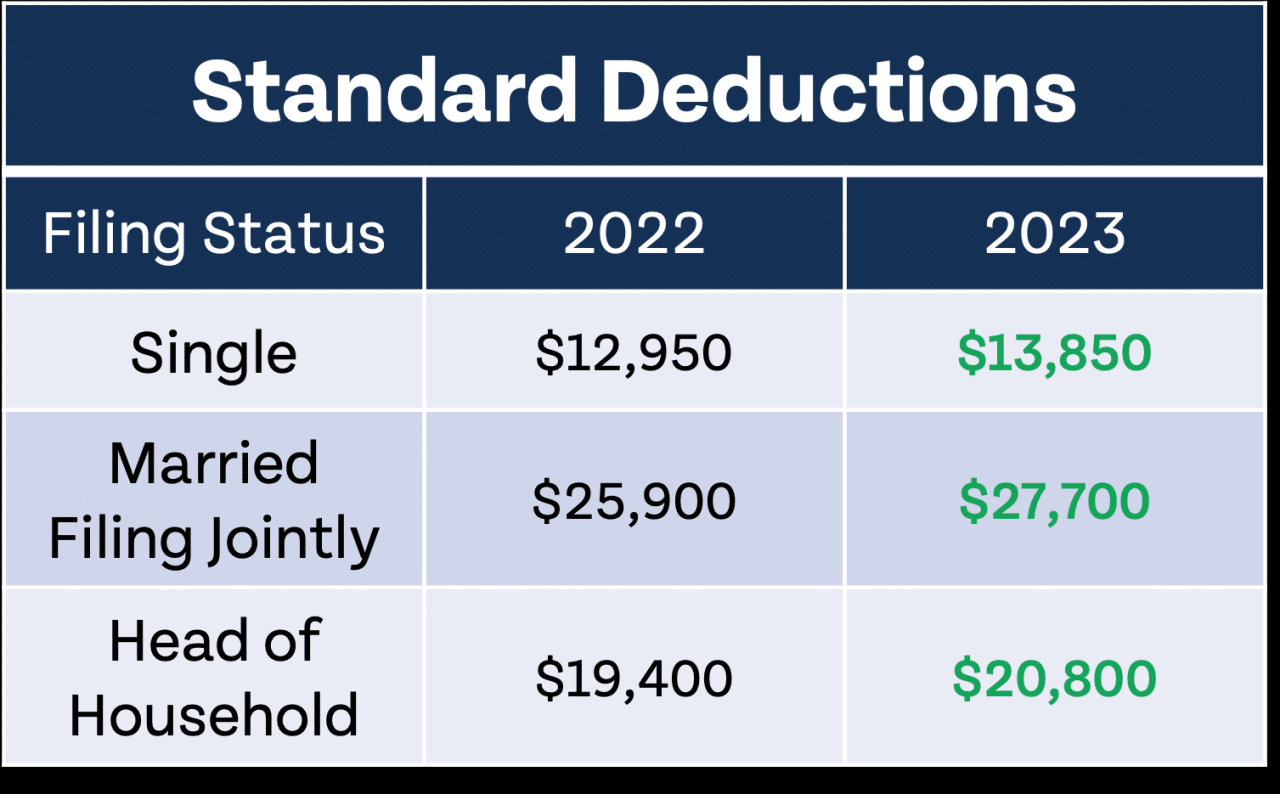

The standard deduction amount varies based on your filing status, whether you are single, married filing jointly, married filing separately, or head of household. In 2024, the standard deduction for single filers is $13,850, while married couples filing jointly can deduct $27,700.

Those who are married filing separately can claim a standard deduction of $13,850, and head of household filers can deduct $20,800. It’s important to note that these amounts may change in future years due to inflation and legislative updates.

Contents List

Standard Deduction Amounts for 2024: How Much Is The Standard Deduction In 2024

The standard deduction is a fixed amount that you can subtract from your adjusted gross income when calculating your federal income tax liability. It’s designed to simplify the tax filing process and reduce the tax burden for taxpayers who don’t itemize their deductions.

It’s important to know how much you can contribute to your retirement savings each year. The IRA contribution limits for SIMPLE IRAs in 2024 have increased, offering you more flexibility in saving for the future.

The amount of the standard deduction depends on your filing status.

Wondering how much you can contribute to your IRA this year? The IRA contribution limits for 2024 have been announced, so make sure to check them out.

Standard Deduction Amounts for Different Filing Statuses

The standard deduction amounts for 2024 are as follows:

| Filing Status | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married Filing Jointly | $27,700 |

| Married Filing Separately | $13,850 |

| Head of Household | $20,800 |

Potential Changes to Standard Deduction Amounts, How much is the standard deduction in 2024

The standard deduction amount can change from year to year, often due to inflation adjustments. While it’s difficult to predict future changes with certainty, the IRS typically adjusts the standard deduction for inflation each year. The amount of the adjustment depends on the Consumer Price Index (CPI) and is announced by the IRS before the start of each tax year.

Planning for your retirement involves understanding how much you can contribute to your IRA. The IRA contribution limits for 2024 and 2025 have been announced, giving you a clear picture of your savings potential.

For example, the standard deduction for 2023 was adjusted upwards from the previous year, reflecting the impact of inflation.

Tax brackets can impact your income in significant ways. Understanding how these brackets work is crucial for effective tax planning. Find out how will tax brackets affect your 2024 income with our helpful guide.

Impact of the Standard Deduction on Tax Liability

The standard deduction is a significant factor in determining your tax liability. It’s a fixed amount that you can deduct from your taxable income, reducing the amount of taxes you owe. The standard deduction amount varies based on your filing status and whether you’re claimed as a dependent on someone else’s return.

The October 2024 tax deadline is approaching! Make sure you have all the necessary information and resources to file your taxes on time. The IRS has provided helpful IRS resources for the October 2024 tax deadline to help you navigate the process smoothly.

Impact on Tax Liability at Different Income Levels

The standard deduction can significantly impact your tax liability, especially at lower income levels. Here’s an example:

| Filing Status | Income | Standard Deduction | Taxable Income | Tax Owed (Without Standard Deduction) | Tax Owed (With Standard Deduction) |

|---|---|---|---|---|---|

| Single | $30,000 | $13,850 | $16,150 | $3,230 | $0 |

| Married Filing Jointly | $60,000 | $27,700 | $32,300 | $6,460 | $0 |

| Head of Household | $40,000 | $20,800 | $19,200 | $3,840 | $0 |

In these examples, the individuals or couples would owe no taxes after claiming the standard deduction. This demonstrates how the standard deduction can significantly reduce your tax liability, particularly for those with lower incomes.

Conclusion

The standard deduction is a valuable tool for taxpayers, offering a straightforward way to reduce their tax liability. By understanding the factors that affect your eligibility and the different deduction options available, you can make informed decisions that optimize your tax savings.

As you navigate the complexities of the tax system, remember to stay informed about any potential changes to the standard deduction and seek professional guidance if needed. By taking advantage of the standard deduction and other tax benefits, you can ensure that you are paying the correct amount of taxes and maximizing your financial well-being.

Answers to Common Questions

What happens if I am claimed as a dependent on someone else’s tax return?

If you are claimed as a dependent on someone else’s tax return, you are generally not eligible to claim the standard deduction. However, there are exceptions, such as if you are over 19 years old and provide more than half of your own support.

It’s best to consult with a tax professional to determine your specific situation.

What are the different types of itemized deductions?

Some common itemized deductions include medical expenses, state and local taxes, mortgage interest, charitable contributions, and casualty losses. The specific deductions you can claim depend on your individual circumstances.

How do I know if I should claim the standard deduction or itemize?

The best approach is to calculate both the standard deduction and your itemized deductions and choose the option that results in the lower tax liability. There are online tools and tax software programs that can help you determine which option is best for you.

Students often have unique tax situations. Make sure you’re aware of the October 2024 tax deadline for students and any specific requirements that apply to you.

Failing to comply with tax regulations can have serious consequences. It’s important to understand the potential W9 Form October 2024 penalties for non-compliance to ensure you’re meeting all requirements.

Moving can be a big expense. The October 2024 mileage rate for moving expenses can help you deduct some of these costs, potentially saving you money on your taxes.

Businesses have their own tax deadlines to adhere to. The October 2024 tax deadline for businesses is a crucial date to keep in mind for accurate and timely filing.

Non-profit organizations also need to comply with tax regulations. Understanding the W9 Form October 2024 for non-profit organizations requirements is essential for smooth operations.

Tax credits can provide significant financial benefits. Take advantage of available tax credits for the October 2024 deadline to potentially reduce your tax liability.

Foreign nationals living in the US also have tax obligations. Be sure to check the October 2024 tax deadline for foreign nationals and any specific requirements that apply to your situation.

The mileage rate for business and moving expenses can change each year. You can find the most up-to-date information on the mileage rate for October 2024 by checking official IRS resources.

If you’re considering a Roth 401k, understanding the contribution limits is crucial. The 401k contribution limits for 2024 for Roth 401k have been established, so make sure to factor them into your retirement planning.

It’s helpful to compare IRA contribution limits year over year. The IRA contribution limits for 2024 vs 2023 provide insights into how much you can contribute to your retirement savings.