How To Calculate Annuity In Financial Calculator 2024: A Simple Guide delves into the world of annuities, providing a straightforward understanding of these financial instruments. Whether you’re planning for retirement, saving for a major purchase, or simply curious about how annuities work, this guide will equip you with the knowledge and tools to confidently navigate the process.

Calculating an annuity can be complex, but there are resources available to help you. You can find a step-by-step guide on how to calculate annuity to make the process easier.

Annuities are essentially a series of regular payments, often used for retirement income, but they can also be applied to various financial goals. Understanding how to calculate the present value of an annuity is crucial for making informed financial decisions.

Annuity certain is a specific type of annuity with guaranteed payments. You can find the formula used to calculate these payments by exploring formula annuity certain.

This guide will walk you through the essential steps, explaining the key variables and demonstrating how to use a financial calculator for accurate calculations.

If you’re considering an annuity, it’s crucial to know how to calculate the payments you’ll receive. You can find a guide on calculating annuity due payment to ensure you understand the financial implications.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a set period of time. These payments can be made at the beginning or end of each period, and the interest rate can be fixed or variable. Annuities are often used for retirement planning, saving for a specific goal, or providing income for a specific period of time.

Single life annuities are a common type, but their tax treatment can be complex. You can find out if a single life annuity is taxable to ensure you’re aware of the financial implications.

Types of Annuities

There are several different types of annuities, each with its own unique characteristics. Some common types include:

- Immediate Annuities:Payments begin immediately after the purchase of the annuity.

- Deferred Annuities:Payments begin at a later date, often after a certain period of time has elapsed.

- Fixed Annuities:Payments are guaranteed at a fixed rate of interest.

- Variable Annuities:Payments are linked to the performance of an underlying investment portfolio, so the amount of each payment can fluctuate.

Real-World Examples of Annuities, How To Calculate Annuity In Financial Calculator 2024

Annuities are used in a variety of real-world situations. Here are a few examples:

- Retirement Planning:Annuities can provide a steady stream of income during retirement.

- Saving for College:Annuities can be used to save for a child’s college education.

- Income Replacement:Annuities can provide income to replace lost wages after a disability or death.

Annuity Calculation Basics

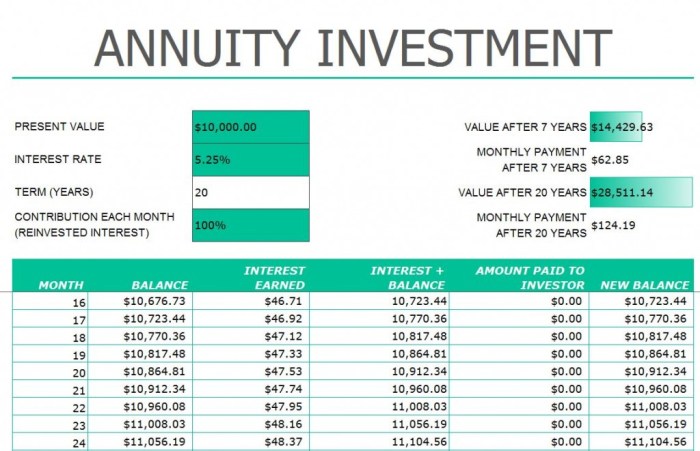

Calculating the present value of an annuity involves understanding the key variables and using the appropriate formula. Here’s a breakdown of the basics:

Key Variables

- Payment Amount (PMT):The amount of each payment in the annuity.

- Interest Rate (I/Y):The annual interest rate earned on the annuity.

- Time Period (N):The total number of payment periods in the annuity.

Present Value Formula

The present value (PV) of an annuity is the current value of all future payments, discounted at the given interest rate. The formula for calculating the present value of an ordinary annuity is:

PV = PMT

There are different types of annuities, and understanding their variations is essential. You can explore the world of 3 annuity options to see which might suit your needs.

Whether an annuity is a good or bad investment depends on your individual circumstances and goals. It’s essential to weigh the pros and cons to determine if annuity is good or bad for you.

- [1

- (1 + I/Y)^-N] / (I/Y)

Where:

- PV = Present Value

- PMT = Payment Amount

- I/Y = Interest Rate

- N = Number of Periods

Ordinary Annuities vs. Annuities Due

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period. The formula for calculating the present value of an annuity due is:

PV = PMT

- [1

- (1 + I/Y)^-N] / (I/Y)

- (1 + I/Y)

The only difference between the two formulas is the multiplication by (1 + I/Y) at the end, which accounts for the fact that payments are made at the beginning of each period in an annuity due.

Understanding the tax implications of annuity income is important. You can find information on whether annuity income is taxable to make sure you’re prepared.

Using a Financial Calculator

Financial calculators are designed to simplify annuity calculations. They have dedicated functions that allow you to quickly and accurately determine the present value of an annuity.

Annuity payments can be structured in various ways, including lump sum options. You can learn how to calculate annuity lump sum to understand the financial implications of this choice.

Essential Functions

Here are the key functions on a financial calculator that are relevant to annuity calculations:

- PV (Present Value):This function calculates the present value of a future stream of cash flows.

- FV (Future Value):This function calculates the future value of a present sum of money, compounded at a given interest rate.

- PMT (Payment Amount):This function represents the amount of each payment in an annuity.

- I/Y (Interest Rate per Year):This function represents the annual interest rate earned on the annuity.

- N (Number of Periods):This function represents the total number of payment periods in the annuity.

Step-by-Step Guide

To calculate the present value of an annuity using a financial calculator, follow these steps:

- Clear the calculator memory:This ensures that previous calculations don’t affect the current one.

- Input the known variables:Enter the values for PMT, I/Y, and N.

- Select the appropriate mode:Make sure the calculator is set to the correct mode for ordinary annuities or annuities due.

- Calculate the present value:Press the PV button to calculate the present value of the annuity.

Solving for Different Variables

Financial calculators can also be used to solve for different variables in an annuity calculation. For example, if you know the present value, interest rate, and time period, you can use the calculator to solve for the payment amount (PMT).

If you inherit an annuity, you’ll need to know how to handle it. You can learn about what happens when you inherit an annuity and your options for managing it.

Simply enter the known variables, and then press the PMT button to get the result.

Annuity payments are a common financial tool, especially for retirement planning. To understand how they work, you might want to learn how to calculate annuity cash flows. These payments can be structured in various ways, including monthly compounding.

For those interested in future value, you can check out how to calculate annuity future value compounded monthly.

Practical Examples and Scenarios

To illustrate the application of annuity calculations, let’s consider some practical examples with varying inputs:

Annuity Scenarios

| Scenario | Payment Amount (PMT) | Interest Rate (I/Y) | Time Period (N) | Present Value (PV) |

|---|---|---|---|---|

| Scenario 1 | $1,000 | 5% | 10 years | $7,721.73 |

| Scenario 2 | $2,000 | 6% | 15 years | $21,472.08 |

| Scenario 3 | $500 | 4% | 20 years | $7,360.09 |

Impact of Variable Changes

The present value of an annuity is influenced by the payment amount, interest rate, and time period. Let’s analyze how changes in these variables affect the present value:

- Higher Payment Amount:A higher payment amount results in a higher present value, as the future cash flows are larger.

- Higher Interest Rate:A higher interest rate results in a lower present value, as the future cash flows are discounted at a higher rate.

- Longer Time Period:A longer time period results in a higher present value, as there are more future cash flows to be discounted.

Common Mistakes and Tips: How To Calculate Annuity In Financial Calculator 2024

While financial calculators make annuity calculations easier, common mistakes can occur. Here are some tips to avoid errors and ensure accurate calculations:

Common Mistakes

- Incorrect Mode Selection:Ensure the calculator is set to the correct mode for ordinary annuities or annuities due.

- Incorrect Variable Input:Double-check that you have entered the correct values for PMT, I/Y, and N.

- Using the Wrong Formula:Use the appropriate formula for ordinary annuities or annuities due.

Tips for Accurate Calculations

- Read the Instructions:Familiarize yourself with the specific instructions and functions of your financial calculator.

- Double-Check Inputs:Always verify that you have entered the correct values for all variables.

- Use a Second Calculator:If possible, use a second calculator to verify your results.

Resources for Further Learning

For more detailed information on annuity calculations and financial calculators, you can consult the following resources:

- Financial Mathematics Textbooks:These books provide comprehensive coverage of annuity calculations and other financial concepts.

- Online Tutorials:Many websites offer free tutorials and guides on using financial calculators for annuity calculations.

- Financial Calculator Manuals:Refer to the manual for your specific financial calculator for detailed instructions and examples.

Closing Notes

By mastering the art of calculating annuities, you gain valuable insights into the financial implications of your choices. From understanding the impact of different interest rates and time periods to optimizing your savings strategies, this guide provides the foundation for making informed decisions about your financial future.

Annuity payments are often confused with pensions, so it’s important to understand the differences. You can find out if annuity is the same as pension to make informed decisions about your financial future.

FAQ Guide

What is the difference between an ordinary annuity and an annuity due?

An annuity is essentially a stream of payments, but it’s important to understand the precise definition. You can find a clear explanation of what an annuity is defined as to make sure you’re comfortable with the concept.

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period.

Can I use a spreadsheet instead of a financial calculator?

Yes, you can use spreadsheet software like Microsoft Excel or Google Sheets to calculate annuities. There are built-in functions that simplify the calculations.

Where can I find a financial calculator for free?

Many online resources offer free financial calculators. You can also download apps for your smartphone or tablet.

What are some other types of annuities besides immediate and deferred?

Other types include fixed annuities, variable annuities, and indexed annuities. Each type has its own features and risks.

Annuity products are often associated with insurance, but it’s important to understand their relationship. You can find out if annuity is insurance to make informed decisions about your financial planning.

Annuity is a series of payments, but it’s important to understand the nature of these payments. You can learn more about annuity as a series of payments to gain a better understanding of the concept.