How To Calculate Annuity On Calculator 2024: A Simple Guide – Ever wondered how to calculate the future value of your savings or the present value of a loan? Annuities, a series of regular payments, play a crucial role in financial planning, and understanding how to calculate them is essential.

An annuity is a financial product designed to provide regular payments. If you want a basic understanding of what an annuity is, you can find a concise definition here: Annuity Is Definition 2024. This can be a helpful starting point for your research.

This guide will walk you through the process of using a financial calculator to determine the future and present value of annuities, empowering you to make informed financial decisions.

Calculating an annuity can involve several factors, including the amount of your initial investment, the interest rate, and the length of the payout period. To learn more about the process of calculating an annuity, you can find a guide here: Calculating Annuity 2024.

This can be a useful tool for making informed decisions about your retirement planning.

Whether you’re planning for retirement, investing in a long-term savings plan, or understanding the financial implications of a loan, mastering annuity calculations can be a valuable skill. This guide will provide you with the necessary knowledge and step-by-step instructions to confidently calculate annuities using a calculator.

An annuity is a personal contract, and the life it’s written on matters. You might wonder, for example, “When an annuity is written, whose life is it based on?” The answer can be found in this article: When An Annuity Is Written Whose Life 2024.

This is important to understand when considering the terms of an annuity contract.

Contents List

Understanding Annuities

An annuity is a series of regular payments made over a set period of time. These payments can be used for various purposes, such as retirement income, investment growth, or paying off a loan. Annuities can be categorized into different types based on the timing and frequency of payments, as well as the purpose they serve.

Types of Annuities

- Fixed Annuities:These annuities offer guaranteed payments for a fixed period, providing a predictable income stream. They are typically used for retirement planning and are often considered less risky than variable annuities.

- Variable Annuities:These annuities offer payments that fluctuate based on the performance of the underlying investment portfolio. They are often used for investment growth and can potentially offer higher returns than fixed annuities, but they also come with higher risks.

- Immediate Annuities:These annuities start making payments immediately after the purchase, providing a source of income right away. They are commonly used for retirement planning and can be a good option for those who need immediate income.

- Deferred Annuities:These annuities begin making payments at a later date, allowing individuals to accumulate funds for a future need, such as retirement. They are often used for long-term savings goals and can provide tax-deferred growth.

Key Components of an Annuity

Understanding the key components of an annuity is crucial for making informed financial decisions. Here are the main elements:

- Principal:The initial amount of money invested or deposited into the annuity. It is the foundation upon which interest accumulates.

- Interest Rate:The rate at which the principal earns interest over time. This rate determines the growth of the annuity.

- Payment Period:The frequency at which payments are made, such as monthly, quarterly, or annually.

- Term:The duration of the annuity, which is the total number of payments made over the life of the annuity.

Ordinary Annuities vs. Annuities Due

The timing of payments can affect the value of an annuity. There are two main types:

- Ordinary Annuities:Payments are made at the end of each period, such as at the end of each month or year. This is the most common type of annuity.

- Annuities Due:Payments are made at the beginning of each period, such as at the beginning of each month or year. This type of annuity generally yields higher returns than ordinary annuities because the payments have an extra period to earn interest.

An annuity can be a valuable tool for generating a consistent income stream. If you’re curious about the potential of receiving $10,000 per month from an annuity, you can find more information here: Annuity 10000 Per Month 2024.

While this is just one example, it can give you a better idea of the possibilities.

Annuity Calculation Formulas

To determine the future value or present value of an annuity, specific formulas are used. These formulas consider the key components of the annuity, such as principal, interest rate, payment period, and term.

Annuity payments can be deposited into various types of accounts. To learn more about where annuity payments are typically deposited, you can find helpful information here: Annuity Is Which Account 2024. This can help you understand how your annuity payments will be managed.

Future Value of an Ordinary Annuity

FV = PMT- [((1 + i)^n – 1) / i]

An annuity calculator can help you estimate your potential income from an annuity. If you’re looking for a calculator specifically designed for the Hong Kong market, you can find one here: Annuity Calculator Hk 2024. This can be a useful tool for comparing different annuity options.

Where:

- FV = Future Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Present Value of an Ordinary Annuity

PV = PMT- [(1 – (1 + i)^-n) / i]

An annuity calculator can be a helpful tool for estimating your potential income from an annuity. If you’re looking for a calculator specifically designed for the UK market, you can find one here: Annuity Calculator Hmrc 2024. This can be a useful resource for planning your retirement income.

Where:

- PV = Present Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Adjusting Formulas for Annuities Due

To adjust the formulas for annuities due, simply multiply the result by (1 + i). This accounts for the fact that payments are made at the beginning of each period, giving them an extra period to earn interest.

Using a Calculator for Annuity Calculations

Financial calculators are designed to streamline annuity calculations. They offer built-in functions that simplify the process of determining future value and present value.

Calculating Future Value of an Annuity

- Input the Payment Amount (PMT):Enter the amount of each regular payment.

- Input the Interest Rate (i):Enter the interest rate per period, expressed as a decimal.

- Input the Number of Periods (n):Enter the total number of payments to be made.

- Select the Future Value Function (FV):Use the calculator’s function to calculate the future value of the annuity.

- Press Calculate:The calculator will display the future value of the annuity.

Calculating Present Value of an Annuity

- Input the Payment Amount (PMT):Enter the amount of each regular payment.

- Input the Interest Rate (i):Enter the interest rate per period, expressed as a decimal.

- Input the Number of Periods (n):Enter the total number of payments to be made.

- Select the Present Value Function (PV):Use the calculator’s function to calculate the present value of the annuity.

- Press Calculate:The calculator will display the present value of the annuity.

Inputting Variables

When inputting variables into the calculator, it’s crucial to ensure that the interest rate and payment period are consistent. For example, if the interest rate is annual, the payment period should also be annual. If the interest rate is monthly, the payment period should also be monthly.

An annuity can provide immediate income, starting right away. If you’re looking for an income stream that begins immediately, you can find more information about immediate annuities here: Annuity Is Immediate 2024. This can be a valuable option for those who need income right away.

Annuity Examples and Applications: How To Calculate Annuity On Calculator 2024

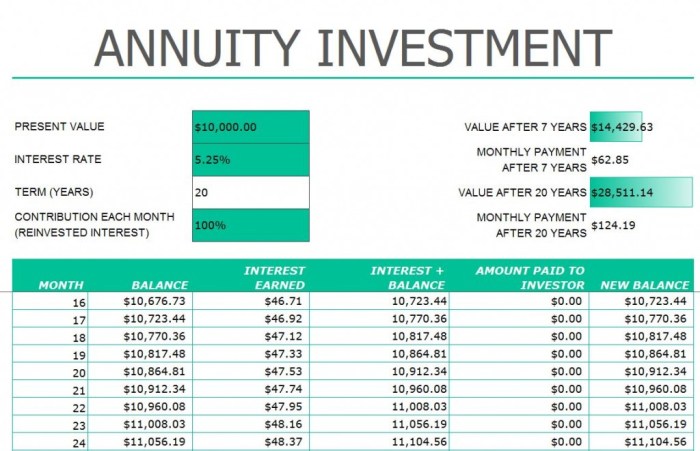

To illustrate how annuities work in practice, let’s consider a few scenarios. The following table presents different annuity scenarios with varying principal amounts, interest rates, payment periods, and terms.

Required Minimum Distributions (RMDs) apply to many retirement accounts, but the rules for annuities can be different. To find out if your annuity is subject to RMDs, you can check out this resource: Is Annuity Subject To Rmd 2024.

This can help you understand your tax obligations.

Annuity Scenarios

| Scenario | Principal | Interest Rate | Payment Period | Term | Future Value | Present Value |

|---|---|---|---|---|---|---|

| 1 | $10,000 | 5% | Annual | 10 years | $16,386 | $6,144 |

| 2 | $20,000 | 7% | Monthly | 20 years | $89,542 | $22,583 |

| 3 | $50,000 | 4% | Quarterly | 30 years | $216,892 | $36,043 |

Real-World Applications, How To Calculate Annuity On Calculator 2024

Annuities have numerous applications in personal finance and investment strategies:

- Retirement Planning:Annuities can provide a steady stream of income during retirement, helping individuals maintain their lifestyle.

- Investment Strategies:Annuities can be used as part of a diversified investment portfolio to generate long-term growth and income.

- Loan Payments:Annuities are often used to structure loan payments, ensuring consistent and predictable repayments.

Additional Considerations

When working with annuities, it’s important to consider factors that can influence their value and effectiveness.

Annuity contracts can be complex, and there are a few things to be aware of. To learn about some common annuity issues, you can check out this resource: Annuity Issues 2024. Being informed about potential pitfalls can help you make the best choices for your financial future.

Compounding Interest

Compounding interest plays a significant role in annuity calculations. As interest accrues on the principal and previous interest earned, the value of the annuity grows exponentially over time. The higher the compounding frequency, the faster the growth.

Inflation

Inflation can erode the purchasing power of an annuity over time. As the cost of goods and services increases, the value of the annuity’s payments may decline. It’s crucial to consider inflation when planning for long-term financial goals using annuities.

Calculating an annuity rate can be a bit technical, but it’s essential for understanding how much income you might receive. If you’re interested in learning more about this process, you can find a helpful guide here: Calculating An Annuity Rate 2024.

This can be a useful tool for comparing different annuity options.

Financial Advisor Consultation

Consulting with a qualified financial advisor is essential for personalized annuity planning. An advisor can help you assess your financial needs, risk tolerance, and investment goals to determine the most suitable annuity type and strategy.

If you’re thinking about an annuity, you might want to know how much income it could provide. An annuity estimator can help you get a rough idea. You can find an online tool to explore these estimates here: Annuity Estimator 2024.

This can be a useful starting point in your retirement planning process.

Wrap-Up

Calculating annuities on a calculator can be a powerful tool for understanding the financial implications of various investment and borrowing scenarios. By mastering these calculations, you gain a deeper understanding of how time value of money impacts your financial goals.

Annuity drawdown is a way to access your annuity funds over time. It’s essentially the process of withdrawing money from your annuity, often in a systematic way. You might be curious about the specifics of annuity drawdown and how it works in 2024.

If so, you can find more information here: Is Annuity Drawdown 2024. This can be a helpful approach for retirees who want to manage their income and expenses carefully.

Remember, while this guide provides a comprehensive overview, seeking personalized advice from a financial advisor can ensure you make informed decisions tailored to your specific needs and circumstances.

Quick FAQs

What is the difference between an ordinary annuity and an annuity due?

An annuity and a pension are often confused, but they are distinct. If you’re curious about their differences, you can find a helpful explanation here: Is Annuity The Same As Pension 2024. Understanding the nuances of each can help you make informed decisions about your retirement income.

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period.

How do I adjust the formulas for annuities due?

To adjust the formulas for annuities due, you simply multiply the future value or present value of an ordinary annuity by (1 + i), where ‘i’ is the interest rate.

Can I use a spreadsheet program like Microsoft Excel to calculate annuities?

Annuity and IRA are both retirement savings tools, but they function differently. To understand their differences, you can check out this helpful resource: Is Annuity The Same As Ira 2024. An annuity, in simple terms, is a contract that guarantees regular payments, often for life, in exchange for a lump sum payment.

This can be a valuable tool for retirement planning, especially when considering a consistent income stream.

Yes, spreadsheet programs like Excel have built-in functions for calculating annuities. You can use these functions to perform the same calculations as a financial calculator.

What are some real-world applications of annuities beyond retirement planning?

Annuities are also used in loan payments, insurance premiums, and investment strategies like structured settlements.