How to File a Chase Trip Delay Insurance Claim in October 2024 sets the stage for this informative guide, offering readers a clear path to navigate the process of filing a claim and maximizing their chances of success. This comprehensive guide explores the intricacies of Chase Trip Delay Insurance, providing step-by-step instructions and valuable insights to ensure a smooth and successful claim experience.

Finding the right annuity can feel like searching for a needle in a haystack. Annuity Number Lic 2024 might hold the key to unlocking your ideal annuity plan.

From understanding the coverage and eligibility requirements to navigating the claim filing process, this guide equips readers with the knowledge and tools needed to confidently file a claim and receive the compensation they deserve. It addresses common questions, Artikels essential documentation, and provides tips for maximizing your chances of a successful claim.

Many people wonder if they can continue working while receiving an annuity. The answer is yes, you can! Can You Receive Annuity And Still Work 2024 explores this topic, clarifying the rules and potential implications.

Contents List

Understanding Chase Trip Delay Insurance: How To File A Chase Trip Delay Insurance Claim In October 2024

Chase Trip Delay Insurance is a valuable benefit offered by Chase credit cards that can help cover unexpected expenses incurred due to travel delays. If your travel plans are disrupted by unforeseen circumstances, this insurance can provide financial assistance to alleviate the stress and cost associated with the delay.

Inflation can impact the value of your annuity over time. Annuity Calculator With Inflation 2024 allows you to factor in inflation when calculating your annuity’s potential growth.

Coverage Provided

Chase Trip Delay Insurance offers coverage for various expenses related to travel delays, including:

- Additional accommodation costs:If your flight is delayed for a certain period, the insurance can reimburse you for the cost of staying at a hotel or other lodging near the airport.

- Meal expenses:You may be eligible for reimbursement for meals purchased while waiting for your delayed flight.

- Transportation costs:If your flight is significantly delayed, the insurance may cover the cost of alternative transportation to your destination.

- Other miscellaneous expenses:Depending on the specific policy, you may be able to claim reimbursement for other travel-related expenses, such as phone calls, baggage fees, and even lost wages.

Types of Delays Covered

Chase Trip Delay Insurance typically covers delays caused by a range of events, including:

- Mechanical issues:Flight delays due to aircraft malfunctions or maintenance problems.

- Weather conditions:Delays caused by severe weather, such as storms, fog, or snow.

- Air traffic control delays:Delays resulting from air traffic congestion or other air traffic control issues.

- Security delays:Delays caused by security checks or screenings at the airport.

- Other unforeseen circumstances:Delays caused by unexpected events, such as strikes, natural disasters, or political unrest.

Eligibility Requirements

To be eligible for Chase Trip Delay Insurance, you must meet certain requirements, including:

- Using a Chase credit card to purchase your travel tickets:The insurance typically covers flights booked with a Chase credit card.

- Experiencing a covered delay:The delay must be caused by one of the events listed in the insurance policy.

- Meeting the minimum delay duration:The insurance usually requires a minimum delay period, such as 6 hours or more, for coverage to apply.

Filing a Claim

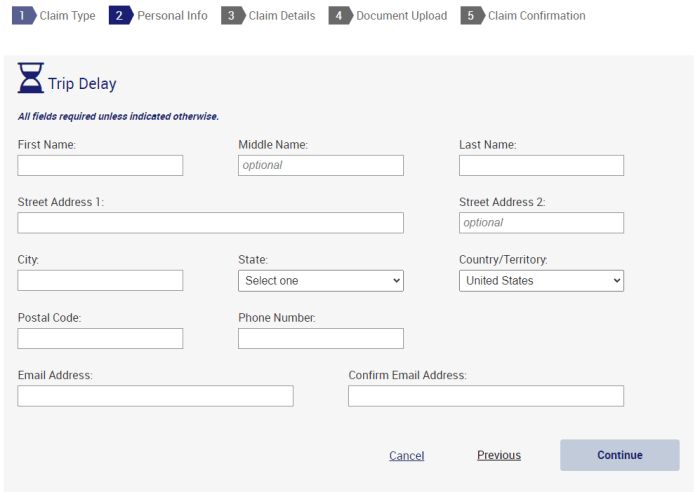

Filing a claim for Chase Trip Delay Insurance is a straightforward process. Here are the steps involved:

Step-by-Step Guide

- Contact Chase:Reach out to Chase customer service or the claims department to initiate the claim process.

- Gather necessary documentation:You will need to provide evidence of your delayed flight and related expenses. This documentation may include:

- Flight itinerary

- Boarding pass

- Hotel receipts

- Meal receipts

- Transportation receipts

- Any other relevant documentation

- Submit your claim:Once you have gathered all the required documents, you can submit your claim online, by phone, or by mail, depending on the available options.

- Review and approval:Chase will review your claim and supporting documentation. If approved, you will receive reimbursement for eligible expenses.

Contact Information

To file a claim for Chase Trip Delay Insurance, you can contact Chase customer service at [Insert Phone Number].

Not sure what an annuity is? Annuity What Is The Meaning 2024 offers a clear and concise definition of this financial product.

Claim Processing

The processing time for Chase Trip Delay Insurance claims can vary depending on several factors. Here’s a general overview of the process:

Timeline

Typically, it can take several weeks for Chase to process and approve a claim. However, this timeline may be affected by the complexity of the claim and the availability of supporting documentation.

Understanding annuities can be tricky, especially when it comes to calculating the due amount. Calculating Annuity Due On Ba Ii Plus 2024 can help you navigate this process, providing clear explanations and step-by-step guidance.

Factors Affecting Processing Time

- Completeness of documentation:Providing all necessary documentation promptly can help expedite the process.

- Complexity of the claim:Claims involving multiple delays or unusual circumstances may require additional review and investigation.

- Number of claims:During peak travel seasons or periods of increased claims activity, processing times may be longer.

Claim Updates

You can check the status of your claim by contacting Chase customer service or by logging into your online account. They will be able to provide updates on the progress of your claim.

Immediate care annuities can provide peace of mind knowing your loved ones will be taken care of. Immediate Care Annuity Just explains how these annuities work and their potential benefits.

Claim Denial

While Chase Trip Delay Insurance aims to provide coverage for eligible delays, there are instances where claims may be denied. Here’s a breakdown of common reasons and options for appealing a denied claim:

Reasons for Denial

- Failure to meet eligibility requirements:If your claim does not meet the specified criteria, such as the minimum delay duration or using a Chase credit card for booking, it may be denied.

- Lack of sufficient documentation:Insufficient or incomplete documentation may make it difficult to verify the claim and could lead to denial.

- Uncovered delay:If the delay is not caused by a covered event, such as a personal reason or a delay outside of Chase’s control, the claim may be denied.

Appealing a Denied Claim, How to File a Chase Trip Delay Insurance Claim in October 2024

If your claim is denied, you have the right to appeal the decision. To appeal, you will need to provide additional documentation or information to support your claim. You can submit the appeal online, by phone, or by mail, depending on the available options.

If you’re looking for information on Variable Annuity Unit Investment Trusts, you’ve come to the right place. Variable Annuity Unit Investment Trust 2024 provides a comprehensive overview of this financial product, covering its features, benefits, and potential risks.

Disputing a Denied Claim

If you believe your claim was denied unfairly, you can dispute the decision with Chase. This typically involves providing further evidence or documentation to support your claim and outlining the reasons why you believe the denial was unjustified.

Want to see how much your annuity is worth? Annuity Value Calculator 2024 allows you to estimate your annuity’s value based on different factors.

Tips for Successful Claim Filing

To maximize your chances of a successful claim, follow these tips:

Maximizing Success

- Keep detailed records:Maintain a log of your travel plans, flight details, and any expenses incurred due to the delay.

- Gather all necessary documentation:Ensure you have all the required receipts, boarding passes, and other relevant documents.

- File your claim promptly:Do not delay in filing your claim, as there may be time limits or deadlines for submission.

- Communicate clearly and effectively:Be clear and concise in your communication with Chase, providing all necessary information and addressing any questions they may have.

Common Mistakes to Avoid

- Not reading the policy carefully:Ensure you understand the terms and conditions of your Chase Trip Delay Insurance policy.

- Failing to meet the minimum delay duration:Check the minimum delay period required for coverage and ensure your delay meets this criteria.

- Not keeping track of expenses:Maintain accurate records of all expenses related to the delay to ensure proper reimbursement.

- Losing or misplacing documentation:Carefully store all relevant documents to avoid delays in processing your claim.

Effective Communication

When communicating with Chase about your claim, be polite, professional, and provide all necessary information. Clearly explain the circumstances of your delay and the expenses you incurred. If you have any questions, do not hesitate to ask for clarification.

When you need a financial solution for immediate needs, an annuity might be a good option. Immediate Needs Annuity Questionnaire can help you assess if this is the right choice for your situation.

Wrap-Up

Navigating the complexities of travel insurance claims can be daunting, but this guide provides a roadmap for success. By understanding the intricacies of Chase Trip Delay Insurance, following the Artikeld steps, and staying informed about the claim process, travelers can confidently navigate any unforeseen delays and ensure a smooth and successful claim experience.

Question & Answer Hub

What are the common reasons for trip delay insurance claims?

Common reasons include flight cancellations, mechanical issues, weather delays, and unexpected events like strikes or natural disasters.

How long does it take to process a Chase Trip Delay Insurance claim?

Processing times vary depending on the complexity of the claim and the documentation provided. However, Chase typically aims to process claims within a reasonable timeframe.

What happens if my claim is denied?

If your claim is denied, you can appeal the decision by providing additional information or documentation. The guide Artikels the process for appealing a denied claim.

LIC’s Immediate Annuity Plan can provide a guaranteed income stream for life. Lic Immediate Annuity Plan 2020 provides details on this plan and its features.

Excel can be a powerful tool for calculating annuities. Calculate Annuity On Excel 2024 provides step-by-step instructions on how to use Excel for annuity calculations.

Traveling abroad in 2024? Don’t forget about travel insurance! International travel insurance for COVID-19 in 2024 provides information on policies that cover COVID-19-related risks.

When you purchase an annuity, you’re essentially exchanging a lump sum for a guaranteed income stream. Annuity Is Purchased 2024 delves into the process of purchasing an annuity.

Backpacking around the world in 2024? Best international travel insurance for backpacking in 2024 helps you find the right coverage for your adventurous journey.

Annuity rates can fluctuate, but some plans offer attractive returns. Annuity 8.5 Percent 2024 discusses the potential benefits and risks of high-yield annuities.