How to prepare for potential layoffs in October 2024? As the economic landscape continues to shift, many professionals are grappling with concerns about job security. While layoffs are never easy, taking proactive steps can help you navigate this potential challenge with greater confidence and resilience.

The potential economic impact of a stimulus in October 2024 is a complex issue. How will the stimulus affect the economy in October 2024? is a question economists and policymakers are grappling with. Some believe it could boost spending and growth, while others worry about inflation and long-term debt.

It’s crucial to analyze the situation carefully and consider all potential outcomes.

This guide will explore strategies for assessing your personal risk, building a financial safety net, strengthening your skills, and preparing for a potential layoff.

By understanding the current economic climate, assessing your personal risk, and taking proactive steps to enhance your skills and marketability, you can increase your chances of remaining employed or finding a new opportunity quickly should a layoff occur. The key is to be prepared, both financially and professionally, for any eventuality.

If a stimulus check is issued in October 2024, the amount individuals receive will depend on several factors, including income levels and household size. October 2024 stimulus check amount for individuals is likely to be a subject of much debate and discussion.

Stay informed about the latest developments and potential changes to ensure you understand the potential benefits.

Contents List

- 1 Understanding the Current Economic Climate: How To Prepare For Potential Layoffs In October 2024?

- 2 Assessing Your Personal Risk

- 3 Building a Financial Safety Net

- 4 Strengthening Your Skills and Marketability

- 5 Networking and Job Search Strategies

- 6 Managing Your Mental and Emotional Well-being

- 7 Preparing for a Layoff

- 8 Epilogue

- 9 FAQ Overview

Understanding the Current Economic Climate: How To Prepare For Potential Layoffs In October 2024?

As we approach October 2024, it’s crucial to be aware of the economic landscape and potential indicators that might suggest layoffs. While predicting the future is impossible, understanding current trends and industry dynamics can help you assess your personal risk and prepare accordingly.

While a stimulus can be a helpful tool in certain economic situations, it’s important to consider the potential drawbacks. What are the potential drawbacks of a stimulus in October 2024? is a question that requires careful analysis. These might include increased inflation, dependence on government handouts, and long-term fiscal challenges.

Weighing the pros and cons is crucial for making informed decisions.

Factors Contributing to Potential Layoffs

Several factors can contribute to layoffs, including:

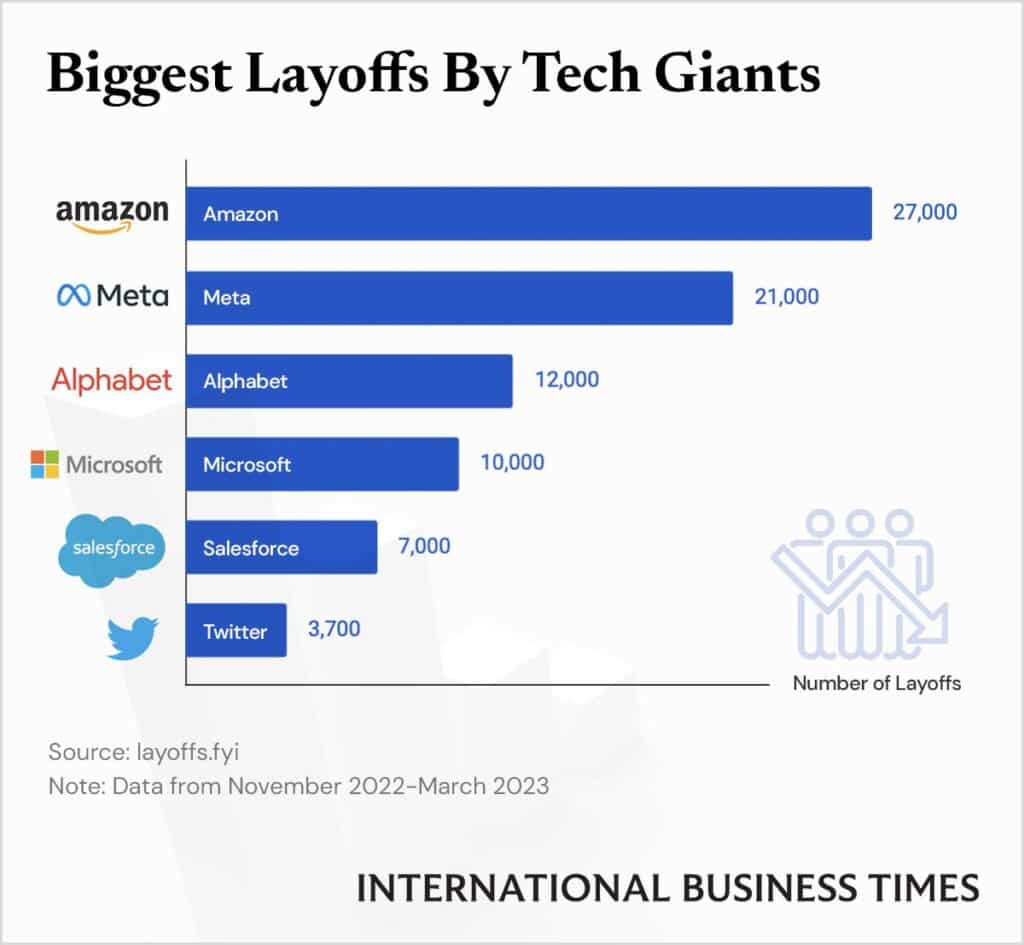

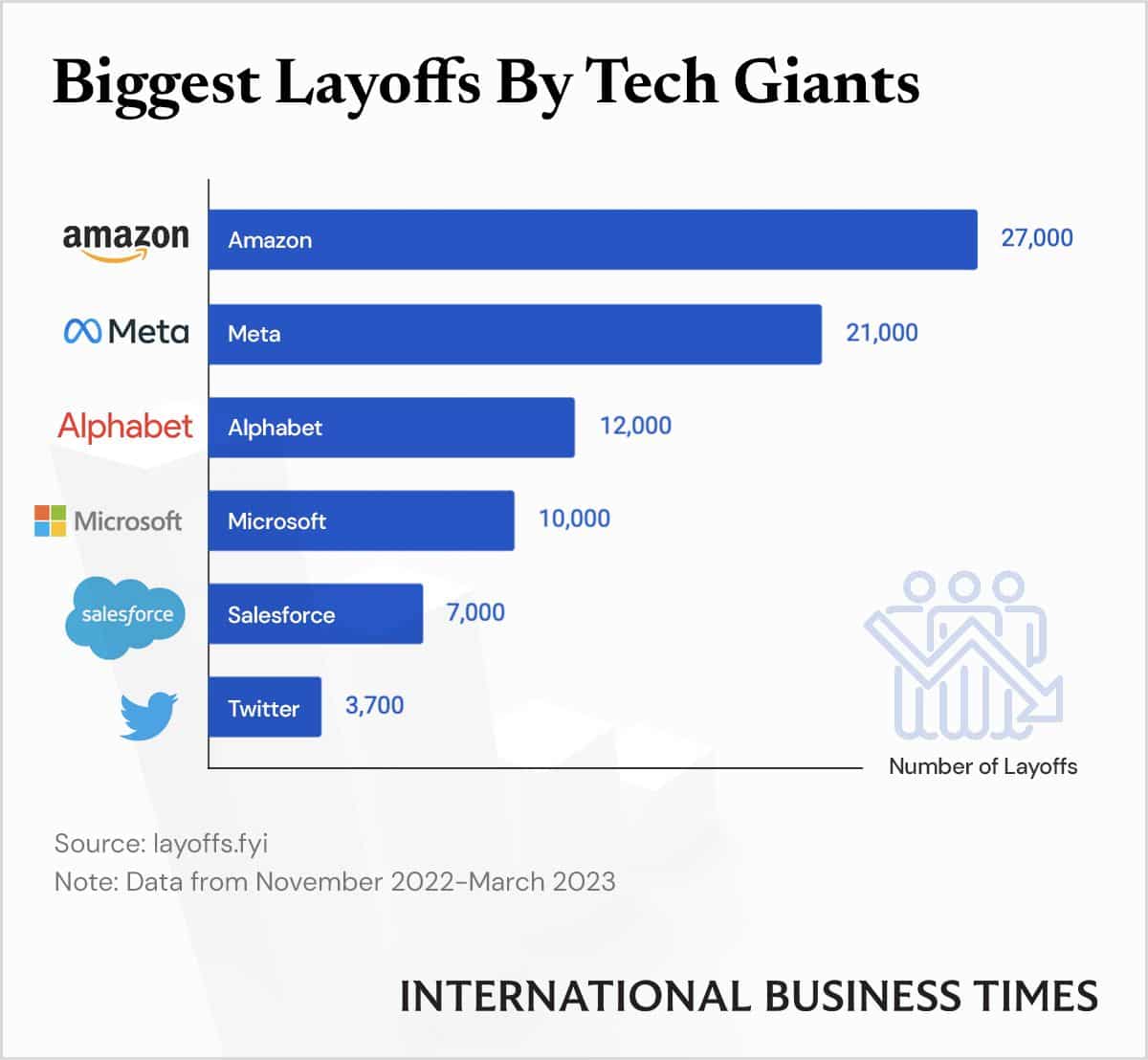

- Industry Trends:Certain industries are more susceptible to layoffs than others, such as technology, retail, and manufacturing. For example, the technology sector has experienced several rounds of layoffs in recent years due to factors like slowing growth, rising interest rates, and increased competition.

- Company Performance:A company’s financial performance is a key indicator of its stability. Declining revenue, profit margins, or stock prices can signal potential layoff risks. For example, a company experiencing significant revenue declines may need to reduce its workforce to cut costs and improve profitability.

The application process for a stimulus check will likely be similar to previous rounds, but specific details may vary. October 2024 stimulus check application process may involve filing a tax return or using a dedicated online portal. Stay informed about the latest information and deadlines to ensure you can apply if eligible.

- Global Economic Conditions:Global economic events, such as recessions, inflation, or geopolitical tensions, can also impact employment levels. For example, a global recession can lead to reduced consumer spending and business investment, resulting in layoffs across various industries.

Analyzing Company Financial Reports and News

To gauge potential layoff risks, you can analyze a company’s financial reports and news articles. Look for:

- Revenue and Profitability:Declining revenue or profit margins can indicate financial distress and potential layoffs.

- Stock Performance:A declining stock price can reflect investor concerns about a company’s future prospects and potential layoffs.

- Executive Statements:Pay close attention to statements made by company executives during earnings calls or press releases. They may hint at potential cost-cutting measures, including layoffs.

- Industry News:Stay informed about industry trends and competitor activities, as this can provide insights into potential layoffs in your sector.

Assessing Your Personal Risk

Once you have a better understanding of the economic climate and industry trends, it’s essential to assess your personal risk of being laid off. This involves considering your current job security and comparing your skills and experience with the company’s current needs and future plans.

Identifying Factors That Could Make You More Vulnerable to Layoffs

Here are some factors that could make you more vulnerable to layoffs:

- Job Security:Consider your length of service, performance reviews, and any recent changes in your role or responsibilities. For example, employees with shorter tenures or those who have recently received negative performance feedback may be at higher risk.

- Skill Set:Assess your skills and experience in relation to the company’s current needs and future plans. For example, if your skills are no longer in demand or the company is shifting its focus to new areas, you may be at higher risk.

Any stimulus measure in October 2024 is likely to have political implications. What are the political implications of a stimulus in October 2024? will be a topic of intense discussion and debate. The decision to implement a stimulus, the amount allocated, and the distribution method will all be subject to political scrutiny and potentially influence public opinion.

- Salary and Benefits:Higher-paid employees or those with generous benefits packages may be targeted for layoffs, especially during cost-cutting measures.

- Departmental Performance:If your department is struggling to meet its goals or facing budget cuts, you may be at higher risk of layoff.

Designing a Personal Risk Assessment Framework

To determine your vulnerability, consider creating a personal risk assessment framework. This could involve:

- Listing your skills and experience:Identify your strengths and areas where you can improve.

- Analyzing your company’s financial performance:Research your company’s financial reports and news articles to identify any potential risks.

- Evaluating your job security:Consider your length of service, performance reviews, and any recent changes in your role or responsibilities.

- Assessing your marketability:Evaluate your skills and experience in relation to the current job market.

Building a Financial Safety Net

A financial safety net is crucial in case of a layoff. It provides peace of mind and allows you to focus on your job search without financial stress.

Seniors are often on fixed incomes and may benefit from a stimulus check to help them cover essential expenses. October 2024 stimulus check for seniors could provide valuable support during a time of economic uncertainty. It’s crucial to ensure that seniors have access to the resources they need to maintain their well-being.

Creating a Detailed Budget

Start by creating a detailed budget to understand your current expenses and identify areas for potential savings. This involves tracking your income and expenses over a period of time and categorizing them into essential and non-essential items.

The likelihood of a stimulus check in October 2024 will depend on several key factors. What are the key factors that will determine the likelihood of a stimulus in October 2024? include the economic outlook, the political landscape, and the availability of government funds.

Analyzing these factors can provide insights into the potential for a stimulus and its potential impact.

Developing an Emergency Fund

Aim to build an emergency fund that can cover at least 3-6 months of living expenses. This fund should be easily accessible and should not be used for anything other than unexpected emergencies. You can build this fund by setting aside a portion of your income each month or by selling assets.

The stock market is highly sensitive to economic news, and a stimulus check could have a significant impact. How will the stimulus affect the stock market in October 2024? is a question investors are eager to answer. A stimulus could boost investor confidence and lead to higher stock prices, but it’s important to remember that market fluctuations are complex and unpredictable.

Reducing Debt and Improving Your Credit Score

Reducing debt and improving your credit score can significantly improve your financial stability and reduce your financial burden in case of a layoff. Consider strategies such as:

- Debt Consolidation:Combine multiple debts into a single loan with a lower interest rate.

- Debt Snowball Method:Pay off your smallest debts first, gaining momentum and motivation to tackle larger debts.

- Credit Monitoring:Regularly monitor your credit report and credit score to identify any errors and take steps to improve your creditworthiness.

Strengthening Your Skills and Marketability

In today’s competitive job market, continuous learning and skill development are essential. By strengthening your skills and marketability, you increase your chances of finding a new job quickly and securing a higher salary.

Identifying New Skills and Knowledge

Research industry trends and future job market demands to identify new skills and knowledge that are in high demand. For example, if you work in the technology sector, you might consider learning about artificial intelligence, machine learning, or data analytics.

It’s still uncertain whether there will be another stimulus check in October 2024. Will there be another stimulus check in October 2024? depends on a variety of factors, including the state of the economy, political considerations, and the availability of funding.

Keep an eye on news reports and official announcements for updates.

Acquiring New Skills

There are many ways to acquire new skills, including:

- Online Courses:Platforms like Coursera, Udemy, and edX offer a wide range of online courses on various topics.

- Certifications:Industry-recognized certifications can demonstrate your expertise and increase your marketability.

- Professional Development Programs:Many companies offer professional development programs to help employees acquire new skills and knowledge.

Updating Your Resume and LinkedIn Profile

Once you have acquired new skills, update your resume and LinkedIn profile to highlight your accomplishments and demonstrate your value to potential employers. Use s relevant to your industry and the skills you have acquired. Be sure to include quantifiable results and examples of your work.

It’s still too early to say for sure, but there’s a lot of speculation about whether students will receive a stimulus check in October 2024. October 2024 stimulus check for students is a hot topic, and many are looking for answers.

To get the most accurate information, keep an eye on official government announcements and reliable news sources.

Networking and Job Search Strategies

A proactive job search strategy is essential for finding a new job quickly and effectively. This involves identifying potential employers, networking with industry professionals, and exploring online job boards and professional networking platforms.

Low-income families are often among the most vulnerable during economic downturns, and they may benefit from a stimulus check. October 2024 stimulus check for low-income families could provide much-needed financial relief and help them meet basic needs. It’s essential to ensure that targeted assistance reaches those who need it most.

Developing a Proactive Job Search Strategy

Start by identifying potential employers in your industry or related fields. Research their company culture, values, and career opportunities. Then, develop a list of target companies and create a plan for reaching out to them.

Organizing Your Network

Reach out to your network of contacts, including former colleagues, classmates, and friends. Let them know you are looking for a new job and ask for any leads or referrals. Attend industry events and conferences to meet new people and expand your network.

There are always alternative economic policies that can be considered, and October 2024 will likely see a range of proposals. What are the alternative economic policies being considered for October 2024? might include tax cuts, infrastructure spending, or targeted aid to specific industries.

It’s essential to have a comprehensive understanding of these options to make informed decisions about the best course of action.

Exploring Online Job Boards and Professional Networking Platforms

Use online job boards like Indeed, LinkedIn, and Glassdoor to search for open positions. Create a strong profile on professional networking platforms like LinkedIn to showcase your skills and experience and connect with other professionals in your field.

The potential impact of a stimulus check on the economy in October 2024 is a subject of ongoing debate. October 2024 stimulus check impact on economy could range from boosting consumer spending and job growth to exacerbating inflation and increasing national debt.

It’s essential to carefully analyze the potential consequences and weigh the pros and cons.

Managing Your Mental and Emotional Well-being

Facing the possibility of a layoff can be stressful and anxiety-inducing. It’s essential to develop strategies for managing your mental and emotional well-being during this time.

A stimulus check in October 2024 could potentially have a number of benefits. What are the potential benefits of a stimulus in October 2024? could include boosting consumer spending, creating jobs, and providing financial relief to those in need. However, it’s important to carefully consider the potential downsides and ensure that the stimulus is implemented effectively.

Strategies for Managing Stress and Anxiety

Here are some strategies for managing stress and anxiety:

- Exercise Regularly:Physical activity can help reduce stress and improve your mood.

- Get Enough Sleep:Adequate sleep is crucial for maintaining mental and emotional well-being.

- Eat a Healthy Diet:A balanced diet can provide your body with the nutrients it needs to cope with stress.

- Practice Mindfulness:Mindfulness techniques, such as meditation or deep breathing exercises, can help calm your mind and reduce anxiety.

- Connect with Others:Spend time with loved ones and talk to friends or family members about your concerns.

Identifying Resources for Emotional Support, How to prepare for potential layoffs in October 2024?

If you are struggling to cope with stress or anxiety, consider seeking professional help. There are many resources available, including:

- Mental Health Professionals:Therapists and counselors can provide support and guidance for managing stress, anxiety, and depression.

- Support Groups:Support groups offer a safe and supportive environment for sharing experiences and connecting with others who understand what you are going through.

Maintaining a Healthy Work-Life Balance

During times of uncertainty, it’s essential to maintain a healthy work-life balance. Set boundaries between work and personal life and make time for activities that you enjoy. This will help you stay grounded and manage your stress levels.

Preparing for a Layoff

If a layoff occurs, it’s essential to be prepared. This includes understanding your company’s layoff policies and procedures, gathering essential documents, and preparing a plan for managing your finances and navigating the job search process.

To receive a stimulus check, individuals will likely need to meet certain eligibility requirements. October 2024 stimulus check eligibility requirements will be outlined by the government, and it’s important to stay informed about these guidelines. Factors like income level, age, and residency status may play a role in determining eligibility.

Gathering Essential Documents

Create a checklist of essential documents and information to gather in case of a layoff. This might include:

- Employment Contract:Review your employment contract to understand your rights and benefits.

- Performance Reviews:Gather any recent performance reviews or feedback.

- Salary and Benefits Information:Collect documentation on your salary, benefits, and any outstanding payments.

- Contact Information:Update your contact information and ensure your resume and LinkedIn profile are up-to-date.

Understanding Company Layoff Policies

Familiarize yourself with your company’s layoff policies and procedures. This will help you understand the process, your rights, and any severance packages offered.

Preparing for the Job Search Process

Develop a plan for managing your finances and navigating the job search process after a layoff. This might include:

- Updating Your Resume and LinkedIn Profile:Ensure your resume and LinkedIn profile are up-to-date and highlight your skills and experience.

- Networking:Reach out to your network of contacts and let them know you are looking for a new job.

- Job Search Strategies:Develop a proactive job search strategy and explore online job boards and professional networking platforms.

- Financial Planning:Review your budget and create a plan for managing your finances during the job search process.

Epilogue

Preparing for potential layoffs is not about dwelling on negativity but about taking control of your career and financial well-being. By following the steps Artikeld in this guide, you can equip yourself with the knowledge, skills, and resources to navigate any economic challenges with confidence and resilience.

Remember, your career is a journey, and even unexpected detours can lead to new and exciting opportunities. Stay informed, stay proactive, and stay optimistic.

FAQ Overview

What are some signs that a company might be considering layoffs?

Some warning signs include company-wide restructuring, budget cuts, hiring freezes, and a decline in stock price. However, it’s important to note that these signs don’t necessarily guarantee layoffs. It’s best to stay informed about your company’s financial performance and industry trends.

What if I’m laid off? What should I do next?

If you are laid off, the first step is to understand your severance package and benefits. Then, update your resume and LinkedIn profile, start networking, and actively search for new job opportunities. Remember to stay positive and focus on your strengths and career goals.