I Bond rate November 2024 for inflation protection: Are you looking for a safe haven for your savings during a period of rising inflation? I Bonds, offered by the U.S. Treasury, offer a unique opportunity to protect your purchasing power.

These bonds are linked to inflation, meaning their interest rate adjusts based on the Consumer Price Index (CPI), providing a hedge against rising prices. In this article, we’ll delve into the workings of I Bonds, explore their inflation protection mechanism, and analyze projected rates for November 2024.

I Bonds have become increasingly popular in recent years, especially as inflation has surged. Their unique features, including the potential for higher returns and the government guarantee, make them an attractive investment option for those seeking to preserve their wealth.

But before you jump into investing, it’s crucial to understand the nuances of I Bonds, including their limitations and potential risks. We’ll also discuss the factors that could influence I Bond rates in the coming months and provide insights into potential future trends.

Contents List

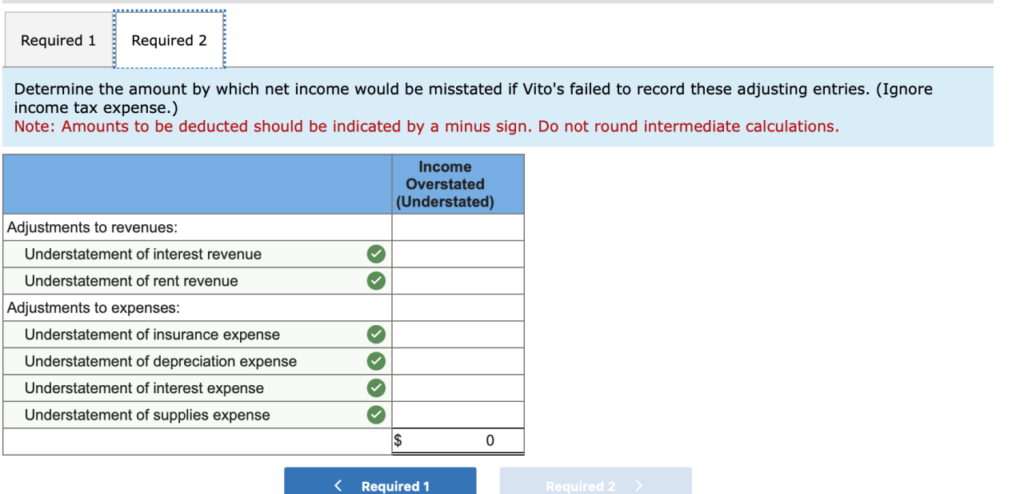

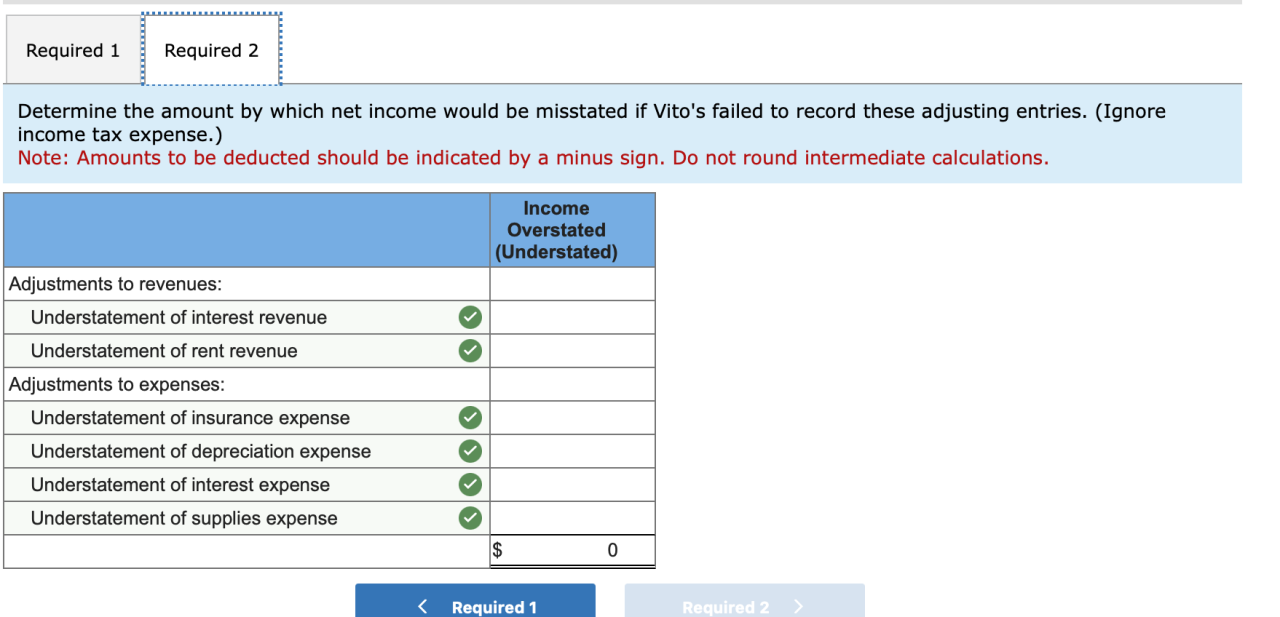

Inflation Protection: I Bond Rate November 2024 For Inflation Protection

I Bonds offer inflation protection, which means their value increases with inflation, helping you preserve your purchasing power over time. This is a crucial feature, especially in times of rising prices.

When it comes to retirement savings, you might be wondering about the maximum 401k contribution for 2024. This limit can help you set your savings goals.

Inflation Adjustment Mechanism

The inflation adjustment mechanism for I Bonds is designed to ensure that your investment keeps pace with the rising cost of living. The interest rate on I Bonds is composed of two parts: a fixed rate and a variable rate that changes every six months based on inflation.The fixed rate is set when you purchase the bond and remains the same for the life of the bond.

If you’re a head of household, you might be wondering about the Roth IRA contribution limit 2024 for head of household. This information can help you plan your retirement contributions.

The variable rate, on the other hand, is adjusted every six months based on the non-seasonally adjusted Consumer Price Index for All Urban Consumers (CPI-U). The variable rate is calculated as follows:

The variable rate is equal to 90% of the annualized rate of inflation, capped at 3.5%.

If you’re looking to maximize your retirement savings, you’ll want to check out the 401k contribution limits for 2024 compared to 2023. These limits can change annually, so it’s good to stay updated.

For example, if the annualized inflation rate is 4%, the variable rate would be 3.6% (90% of 4%). This variable rate is then applied to your bond’s principal for the next six months. The combined fixed and variable rates determine the overall interest rate you earn on your I Bond.

Many people are curious about the 401k contribution limit for 2024. Understanding this limit can help you maximize your retirement savings.

This means that as inflation rises, the variable rate increases, leading to a higher overall interest rate and a larger return on your investment.

If you’re involved in the Capital One class action lawsuit, you might be interested in the Capital One class action lawsuit October 2024 settlement amount.

Benefits of I Bonds During High Inflation, I Bond rate November 2024 for inflation protection

I Bonds are particularly beneficial during periods of high inflation because they offer a hedge against the eroding purchasing power of your money. As inflation rises, the variable rate on your I Bonds increases, helping to offset the decline in your purchasing power.For instance, if you invest $10,000 in an I Bond with a fixed rate of 0.5% and a variable rate of 3.6%, you would earn a total interest rate of 4.1% for the first six months.

If you’re a part of the Capital One class action lawsuit, you’ll likely want to know how to check the status of your settlement. How to check Capital One settlement payout status October 2024 can be found online.

This means you would earn $170.83 in interest during that period. If inflation continues to rise, the variable rate will likely increase further, leading to higher interest earnings and a greater return on your investment.

Estates and trusts have their own tax deadlines. Tax extension deadline October 2024 for estates and trusts can be found online, so make sure you’re aware of the deadline.

Investment Considerations

Investing in I Bonds presents a unique opportunity to protect your savings from inflation. However, like any investment, it’s crucial to consider the advantages and disadvantages before making a decision. This section delves into the factors you should consider when deciding if I Bonds are the right fit for your investment strategy.

Planning for retirement? It’s important to understand the Roth IRA contribution limits and tax implications in 2024 to make the most of your savings.

Minimum Investment Amount and Holding Periods

The minimum investment amount for I Bonds is $25, and you can purchase up to $10,000 per year. There is no maximum limit on the total amount of I Bonds you can hold. I Bonds have a one-year holding period.

Looking for the best deals on your online shopping? Best credit cards for online shopping in October 2024 can offer great rewards and perks, making your purchases even more rewarding.

If you redeem your I Bonds before five years, you will forfeit the last three months of interest earned. However, there are exceptions to this rule, such as if you are over 65 years old or if you are using the proceeds to purchase a home.

If you’re eligible for a standard deduction, it’s helpful to know the specifics for 2024. Standard deduction for people with disabilities in 2024 may differ depending on your circumstances.

Comparing I Bonds with Other Investment Options

I Bonds offer a unique combination of features that differentiate them from other investment options. Here’s a comparison of I Bonds with other popular investments, highlighting their strengths and weaknesses:

| Investment | Advantages | Disadvantages |

|---|---|---|

| I Bonds |

|

|

| Savings Accounts |

|

|

| Certificates of Deposit (CDs) |

|

|

| Stocks |

|

|

| Bonds |

|

|

Advantages and Disadvantages of Investing in I Bonds

I Bonds offer several advantages, making them an attractive investment option for those seeking inflation protection. However, they also have some disadvantages that should be considered.

Rumors of Cigna layoffs in October 2024 are circulating. Cigna layoffs October 2024 compared to previous years can provide some insight into the current situation.

Advantages

- Inflation Protection:I Bonds offer a guaranteed rate of return that adjusts with inflation, ensuring that your investment keeps pace with rising prices. This is a significant advantage in times of high inflation, as it helps to preserve the purchasing power of your savings.

- Tax-Deferred Interest:Interest earned on I Bonds is not taxed until you redeem the bonds. This can be beneficial for long-term investments, as it allows your interest to compound tax-free.

- Low Minimum Investment:I Bonds have a low minimum investment amount of $25, making them accessible to investors of all income levels.

Disadvantages

- Limited Liquidity:I Bonds have a one-year holding period, and you will forfeit the last three months of interest earned if you redeem them before five years. This can be a drawback if you need access to your funds quickly.

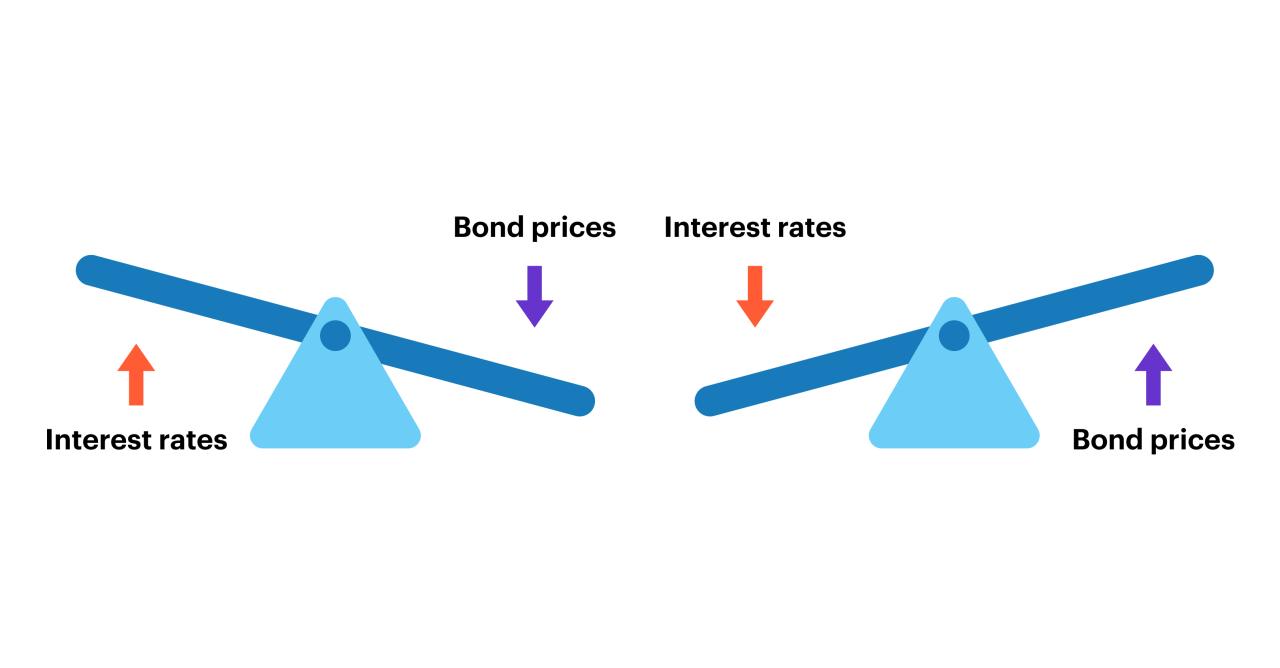

- Interest Rate Fluctuations:While I Bonds offer inflation protection, their interest rates are not guaranteed to beat inflation. The interest rate is fixed for six months and then adjusted every six months based on inflation. If inflation rises faster than the interest rate, your real return could be negative.

There have been rumors circulating about Cigna layoffs in October 2024. Cigna layoff rumors October 2024 are a hot topic, and it’s important to stay informed about potential changes in the workplace.

- Interest Rate Caps:The maximum interest rate that can be earned on I Bonds is capped at 10%. This means that if inflation exceeds 10%, your real return will be limited.

Epilogue

As we approach November 2024, the future of I Bond rates remains uncertain. While the current economic climate suggests potential for continued inflation, it’s essential to consider the broader economic landscape and the Federal Reserve’s monetary policy. I Bonds offer a valuable tool for investors seeking inflation protection, but they are not a one-size-fits-all solution.

It’s crucial to weigh their advantages and disadvantages carefully before making any investment decisions. By understanding the intricacies of I Bonds and considering your individual financial goals, you can determine if they are the right fit for your portfolio.

Answers to Common Questions

What is the minimum investment amount for I Bonds?

You can purchase I Bonds with a minimum investment of $25. You can also purchase an additional $10,000 per year through your tax refund.

How long do I need to hold an I Bond before I can redeem it without penalty?

You must hold an I Bond for at least 12 months. After that, you can redeem it anytime, but if you redeem it before five years, you’ll forfeit the last three months of interest earned.

Can I purchase I Bonds through a brokerage account?

No, I Bonds can only be purchased directly from the U.S. Treasury. You can purchase them through TreasuryDirect, the Treasury’s online system.

What are the tax implications of investing in I Bonds?

Interest earned on I Bonds is subject to federal income tax but is exempt from state and local taxes. You can choose to report the interest income each year or defer it until you redeem the bond.

If you have a 401k, you might wonder if you can also contribute to an IRA. Can I contribute to an IRA if I have a 401k is a common question.

The mileage rate for business travel is subject to change. Is the mileage rate changing in October 2024? is a question many people ask.

The Erste Bank Open 2024 is a popular tennis tournament. Erste Bank Open 2024 social media coverage and hashtags are essential for following the action.