Ibond rate changes November 2024 are a hot topic for investors, as these bonds offer a unique blend of potential returns and inflation protection. With the Federal Reserve adjusting interest rates and inflation fluctuating, understanding how these changes impact I-Bonds is crucial for investors seeking to optimize their portfolio.

This article delves into the specifics of the Ibond rate changes announced in November 2024, analyzing the new fixed and variable rates, their impact on existing bonds, and the factors influencing these adjustments. We’ll explore how these changes might affect your investment strategy and provide insights to help you navigate this dynamic landscape.

Contents List

I-Bond Rate Changes

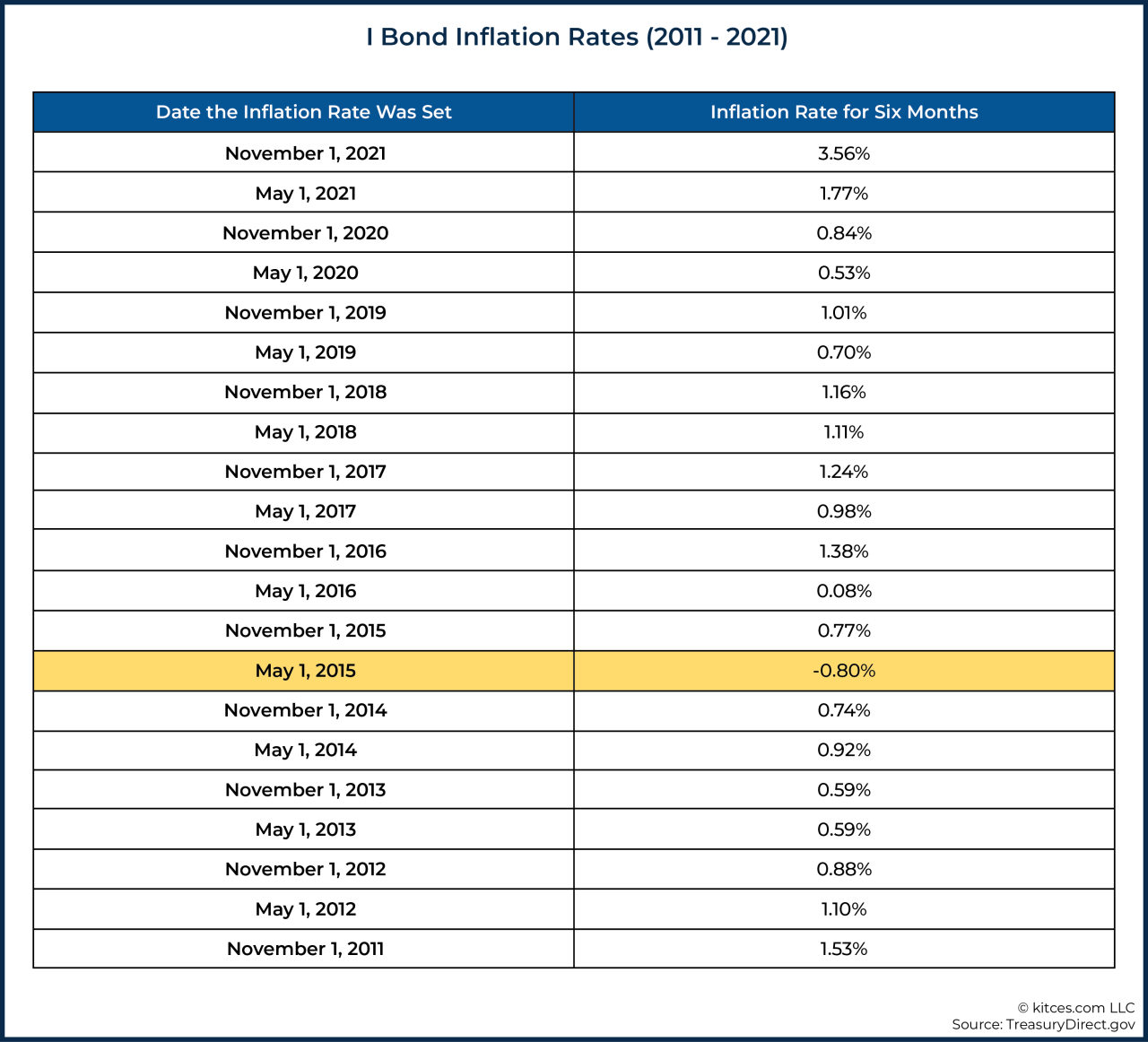

I-Bonds, or Series I Savings Bonds, are a type of savings bond offered by the U.S. Treasury that earns interest based on a combination of a fixed rate and a variable rate that adjusts with inflation. The interest rate on I-Bonds changes every six months, reflecting the current inflation rate.

Understanding your tax obligations is crucial for financial planning. If you’re a head of household, you’ll want to be aware of the tax brackets for head of household in 2024. This information will help you estimate your tax liability and make informed financial decisions.

This means that the return you receive on your I-Bond investment can fluctuate over time, depending on how inflation changes.

Looking to maximize your retirement contributions? You might be wondering about the amount you can contribute to your 401k after taxes in 2024. This information is essential for making informed decisions about your retirement savings plan.

I-Bond Interest Rate Components

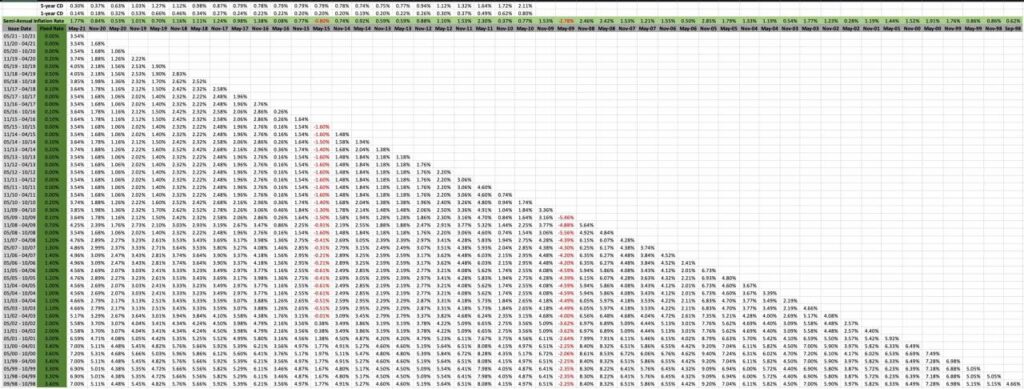

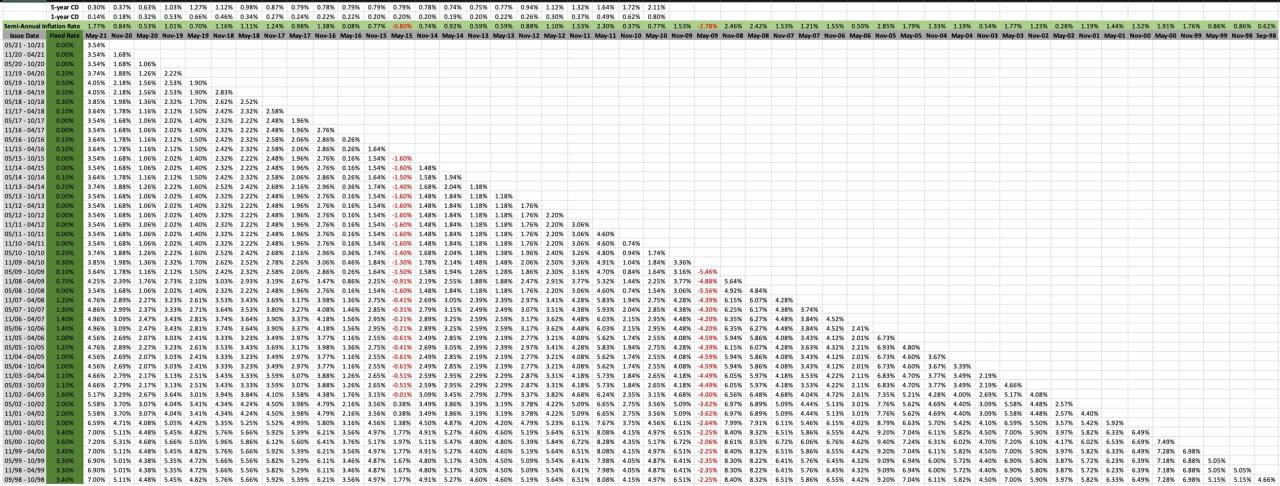

The interest rate on an I-Bond is comprised of two components: a fixed rate and a variable rate. The fixed rate is set at the time you purchase the bond and remains the same for the life of the bond.

If you’re a head of household, it’s essential to know the Roth IRA contribution limit for 2024 for head of household to make the most of your retirement savings.

The variable rate, however, changes every six months based on the rate of inflation. The variable rate is determined by the current inflation rate, which is measured by the Consumer Price Index for All Urban Consumers (CPI-U). The variable rate is calculated as follows:

Variable Rate = (Current CPI-U

Looking to boost your retirement savings? It’s helpful to understand the contribution limits for Roth IRAs in 2024. Knowing this limit will allow you to maximize your contributions and take advantage of tax-free growth in your retirement years.

- Previous CPI-U) / Previous CPI-U

- 2

The variable rate is then added to the fixed rate to determine the overall interest rate on the I-Bond. For example, if the fixed rate is 0.5% and the variable rate is 1.5%, the total interest rate on the I-Bond would be 2%.

Recent layoffs at Geico have sparked conversation about the ethical considerations involved. It’s important to consider the ethical considerations surrounding these Geico layoffs in October 2024. These discussions highlight the complex relationship between business decisions and employee well-being.

Inflation Adjustment

The variable rate component of an I-Bond is designed to protect investors from inflation. This means that the bond’s value will increase over time, even if the fixed rate is relatively low. However, the variable rate can also decline if inflation falls, potentially leading to a lower overall return on your investment.

Navigating the tax landscape can be tricky, especially for small business owners. Make sure you’re aware of the 2024 tax implications for small business owners to ensure you’re compliant and maximizing your financial benefits.

Impact of Rate Changes on Existing I-Bonds: Ibond Rate Changes November 2024

The announcement of new I-Bond interest rates naturally leads to questions about how these changes affect I-Bonds already held by investors. Understanding how rate changes impact existing bonds is crucial for making informed investment decisions.

It’s important to be mindful of contribution limits to avoid any unexpected penalties. If you’re unsure about the limits, check out the information on what happens if you exceed the Roth IRA contribution limit in 2024. This knowledge can help you stay on track with your retirement savings goals.

Impact on Existing Bonds

The new interest rate applies only to new I-Bonds purchased after the announcement date. Existing I-Bonds continue to accrue interest based on the fixed rate and the variable rate that was in effect when they were purchased. This means that the new rate does not retroactively apply to existing bonds.

Planning on making a charitable donation this October? You might want to check out the October 2024 mileage rate for charitable donations to make sure you’re getting the most out of your contribution. This rate is used to calculate the deductible value of your mileage when you volunteer for a charity, so it’s worth understanding how it works.

The interest rate on an I-Bond is fixed for the first six months and then changes every six months based on the inflation rate.

Different employers have different contribution limits for 401k plans. It’s important to know the 401k contribution limits for 2024 for different employers to maximize your retirement savings potential.

The impact of the rate change on the overall return of existing I-Bonds depends on several factors, including:

- The initial purchase date of the I-Bond.

- The fixed and variable rates at the time of purchase.

- The length of time the bond has been held.

- The future trajectory of inflation.

For example, if an I-Bond was purchased in 2023 with a fixed rate of 0% and a variable rate of 9.62%, it will continue to earn interest based on those rates for the next six months. If the new rate is announced to be higher, it will only apply to new I-Bonds purchased after the announcement.

Considering investing in I bonds? You’ll want to know the current I bond rate for November 2024 to understand the potential returns. This information will help you decide if I bonds are the right investment for you.

It is important to remember that I-Bonds are designed to protect against inflation. While the new rate may be higher, the overall return on existing bonds will still be influenced by the rates that were in effect when they were purchased.

If you’re a married couple thinking about contributing to a Roth IRA, you’ll want to know the Roth IRA contribution limits for married couples in 2024. This limit is important because it determines how much you can contribute each year without facing penalties.

Knowing this limit will help you plan your retirement savings strategy effectively.

Advantages and Disadvantages of I-Bonds

I-Bonds offer a unique investment opportunity with a combination of guaranteed returns and inflation protection. However, they also have certain limitations that investors should consider before making a decision. This section will delve into the advantages and disadvantages of investing in I-Bonds.

Advantages of I-Bonds, Ibond rate changes November 2024

I-Bonds offer several advantages that make them an attractive investment option for some investors.

- Inflation Protection:I-Bonds are designed to protect investors from inflation. Their interest rate is adjusted twice a year, based on the Consumer Price Index (CPI), ensuring that your investment keeps pace with rising prices. This is a significant advantage in times of high inflation, as it helps preserve the real value of your savings.

- Guaranteed Returns:Unlike stocks or bonds, I-Bonds offer a guaranteed rate of return. While the rate is not fixed, it is guaranteed for the duration of the bond. This provides a level of certainty and stability that is not available with other investments.

- Tax Advantages:Interest earned on I-Bonds is only taxed at the federal level. State and local taxes are not applied, making them a potentially more attractive investment for those in high-tax states.

- Safety and Security:I-Bonds are backed by the full faith and credit of the U.S.

government, making them one of the safest investments available. There is no risk of default or loss of principal.

Disadvantages of I-Bonds

While I-Bonds have many advantages, they also have some drawbacks that investors should be aware of.

- Limited Liquidity:I-Bonds have a one-year holding period, meaning you cannot redeem them for the first year. After that, you can redeem them, but you will incur a penalty if you do so before five years. This lack of liquidity can be a major disadvantage for investors who need access to their funds quickly.

- Potential for Lower Returns:I-Bonds are not designed to outperform the stock market or other high-risk investments. Their returns are generally lower than those of stocks or bonds, especially during periods of strong economic growth.

- Interest Rate Caps:The interest rate on I-Bonds is capped at a certain percentage, currently set at 10%.

This means that even if inflation is high, the rate will not exceed this cap.

- Limited Purchase Amount:There is a limit on the amount of I-Bonds you can purchase each year. In 2024, the limit is $10,000 per person, or $20,000 per household.

Summary

Understanding the intricacies of Ibond rate changes is essential for investors looking to capitalize on their potential for growth and inflation protection. By staying informed about the factors influencing these adjustments, you can make informed decisions about your I-Bond investments and potentially maximize your returns.

As we’ve seen, the November 2024 rate changes provide a snapshot of the evolving market dynamics and underscore the importance of staying up-to-date with these developments.

FAQ Overview

How do I-Bond rates differ from other bond rates?

Unlike traditional bonds, I-Bonds have a variable interest rate component that adjusts with inflation, offering protection against rising prices. This makes them an attractive option for investors concerned about inflation eroding their savings.

When will the next I-Bond rate change be announced?

The I-Bond rate changes are announced every six months, with the next announcement typically occurring in May and November. The specific date can be found on the TreasuryDirect website.

Are I-Bonds a good investment for everyone?

I-Bonds are a suitable investment for those seeking inflation protection and potential for long-term growth. However, they have limited liquidity and may not be appropriate for short-term investments or those with a high risk tolerance.

How long can I hold an I-Bond?

You can hold an I-Bond for a minimum of one year and a maximum of 30 years. However, if you redeem before five years, you’ll lose the last three months of interest earned.

What are the tax implications of investing in I-Bonds?

Interest earned on I-Bonds is subject to federal income tax, but it’s not subject to state or local taxes. You can choose to pay taxes on the interest earned each year or defer them until you redeem the bond.

Have you been affected by the Capital One data breach? You might be eligible for a settlement payout. Find out more about the Capital One settlement payout eligibility in October 2024 to see if you qualify.

Planning your retirement savings? It’s helpful to compare the Roth IRA contribution limits for 2024 vs 2023 to see how they’ve changed. This comparison will help you make informed decisions about your retirement savings strategy.

Looking to maximize your 401k contributions? You’ll want to know the maximum 401k contribution for 2024. This limit is important for planning your retirement savings and ensuring you’re taking advantage of all available benefits.

If you’re a married couple, understanding the Roth IRA contribution limits for 2024 for married couples is crucial for maximizing your retirement savings potential. This information will help you plan your contributions effectively and take advantage of tax-free growth in your retirement years.