Ibond rate outlook November 2024 provides insights into the potential trajectory of this popular savings vehicle. Understanding the current rate, economic factors influencing it, and possible scenarios for November 2024 can help investors make informed decisions about their financial strategies.

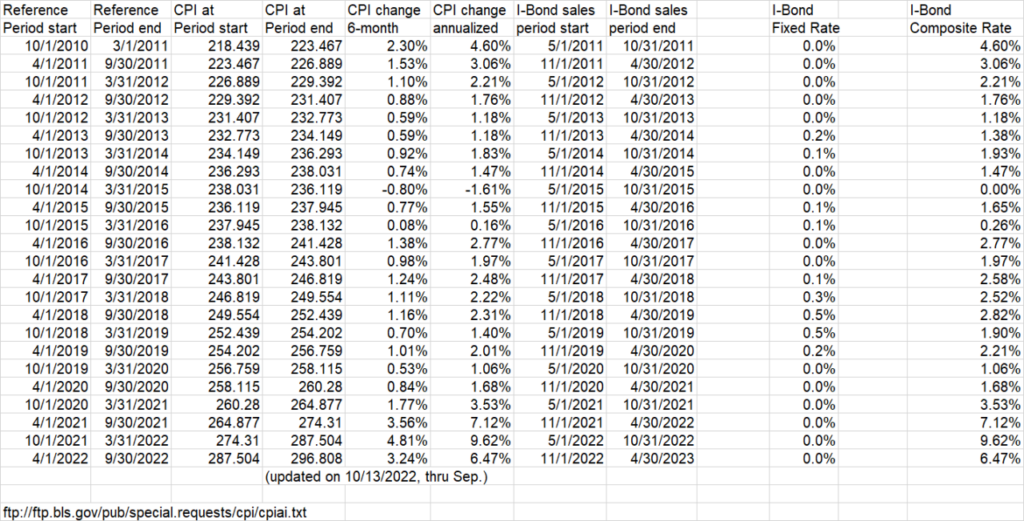

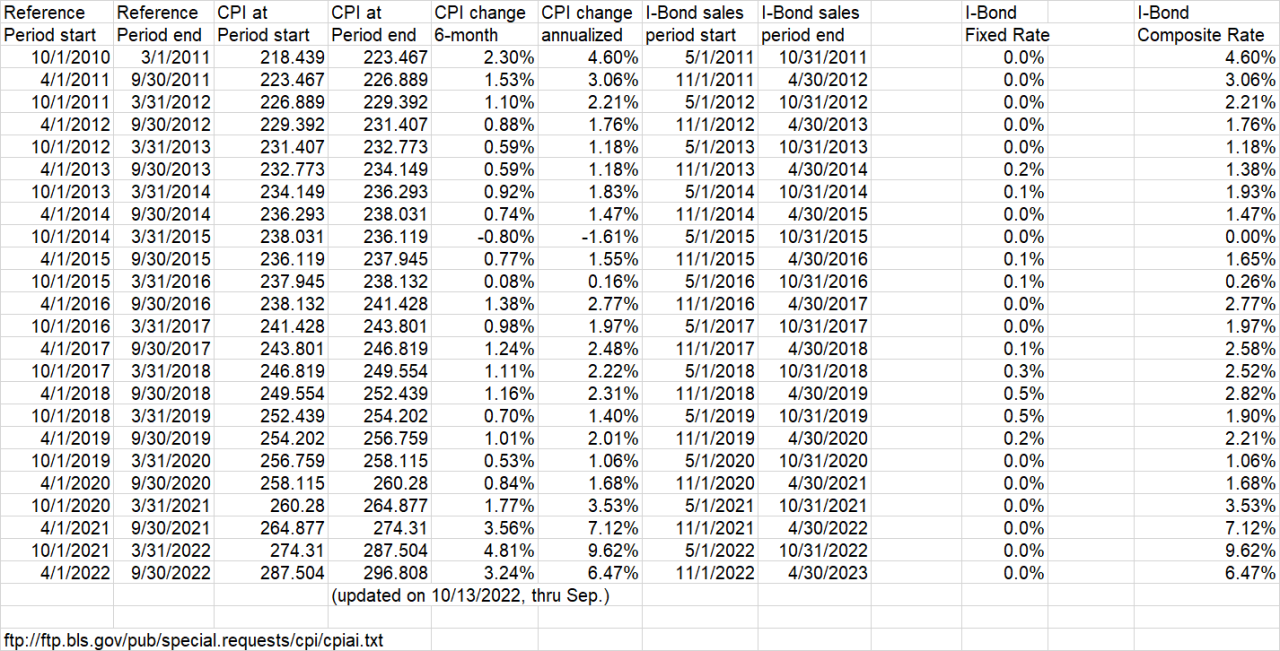

The Ibond rate is determined by a fixed rate component and an inflation adjustment. The fixed rate is set at the time of purchase and remains constant for the life of the bond, while the inflation adjustment is calculated every six months based on the Consumer Price Index (CPI).

This unique feature provides investors with protection against inflation, ensuring that their savings maintain their purchasing power over time.

Contents List

Ibond Rate Outlook for November 2024: Ibond Rate Outlook November 2024

The Ibond rate for November 2024 is set to be determined in October 2024, based on the inflation rate for the six months ending in September 2024. Predicting the exact rate is challenging, but we can analyze current economic trends and historical data to estimate potential scenarios.

Understanding the tax bracket thresholds for 2024 is essential for planning your finances. These thresholds determine how much tax you’ll pay on different levels of income. It’s helpful to review these thresholds regularly to see how they might affect your tax burden.

Ibond Rate Scenarios for November 2024

The Ibond rate for November 2024 is likely to be influenced by various economic factors, including inflation, interest rates, and overall economic growth. Based on current trends and historical data, here are three potential scenarios:

- Scenario 1: Moderate Inflation– If inflation remains moderate in the coming months, around 3-4%, the Ibond rate for November 2024 could be in the range of 4-5%. This scenario assumes that the Federal Reserve continues to raise interest rates gradually, keeping inflation under control.

Calculating your taxes as a small business owner can be tricky, especially with constantly changing rules. Thankfully, there are tools available to help. You can use a tax calculator for small businesses to estimate your tax liability for October 2024.

Just input your income and expenses, and the calculator will give you a good idea of what you can expect to owe.

- Scenario 2: Elevated Inflation– If inflation remains elevated, exceeding 4%, the Ibond rate for November 2024 could rise to 5-6%. This scenario suggests that the Fed might be less aggressive in raising interest rates, potentially leading to a higher Ibond rate to compensate for inflation.

Saving for retirement is a smart move, and a 401(k) is a popular way to do it. But the contribution limits change every year. To make sure you’re maximizing your contributions, it’s a good idea to check the 401(k) contribution limit for 2024 and compare it to the 2023 limit.

- Scenario 3: Deflationary Pressure– In a less likely scenario, if inflation starts to decline significantly, possibly due to a recession or a sharp drop in commodity prices, the Ibond rate for November 2024 could fall below 4%. This scenario would require a significant shift in economic conditions.

If you’re over 50, you have the opportunity to contribute a bit more to your 401(k) to catch up on your retirement savings. The 401(k) limits for 2024 for those over 50 are higher than the standard limit, so make sure to take advantage of this if you can.

Factors Influencing Ibond Rates

Several key factors can impact the Ibond rate for November 2024:

- Inflation: The primary driver of the Ibond rate is inflation. The rate is set based on the Consumer Price Index (CPI) for the previous six months. Higher inflation generally leads to higher Ibond rates.

- Federal Reserve Policy: The Federal Reserve’s monetary policy decisions, including interest rate hikes, can influence inflation and, consequently, Ibond rates. If the Fed aggressively raises rates, it could help curb inflation and potentially lead to lower Ibond rates in the future.

- Economic Growth: Strong economic growth can lead to higher inflation, potentially driving up Ibond rates. However, weak economic growth could result in lower inflation and lower Ibond rates.

- Global Economic Conditions: Global economic events, such as geopolitical tensions or commodity price fluctuations, can impact inflation and Ibond rates. For example, the recent energy crisis has contributed to higher inflation worldwide.

Comparison with Other Investment Options, Ibond rate outlook November 2024

The Ibond rate for November 2024 will need to be compared with other investment options to determine its attractiveness. Here’s a brief overview:

- High-Yield Savings Accounts: These accounts typically offer higher interest rates than traditional savings accounts but may not keep pace with inflation. Their rates are often variable and subject to change.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a specific period, providing predictable returns. However, their rates are generally lower than Ibond rates, especially in a high-inflation environment.

- Treasury Bills, Notes, and Bonds: These government securities offer varying maturities and interest rates. While their rates can be higher than Ibond rates, they do not offer inflation protection.

- Stocks and Mutual Funds: These investments offer the potential for higher returns but also carry higher risk. Their performance is highly dependent on market conditions.

Final Thoughts

The Ibond rate outlook for November 2024 offers a compelling glimpse into the future of this inflation-protected savings option. While the exact rate remains uncertain, understanding the key economic factors driving its trajectory allows investors to navigate their financial strategies with confidence.

Whether you are seeking to preserve your savings against inflation, diversify your portfolio, or simply explore a safe and secure investment option, Ibonds continue to be a compelling choice for investors of all levels.

Query Resolution

What is the minimum investment amount for an Ibond?

The minimum investment amount for an Ibond is $25.

How long can I hold an Ibond?

You can hold an Ibond for a minimum of one year and a maximum of 30 years. However, if you redeem an Ibond before five years, you will forfeit three months of interest.

Are Ibond interest payments subject to taxes?

Yes, Ibond interest payments are subject to federal income tax, but they are not subject to state or local taxes. You can choose to report the interest income annually or defer it until you redeem the bond.

Students often have unique tax situations, and it’s important to understand the rules that apply to them. If you’re a student, you can use a tax calculator for students to get a better grasp of your tax obligations for October 2024.

Students often have lower incomes, and the standard deduction can help reduce their tax liability. The standard deduction for students in 2024 is a specific amount you can subtract from your taxable income, potentially lowering your tax bill.

As you get older, it’s even more crucial to contribute as much as you can to your retirement savings. For those over 50, the maximum 401(k) contribution for 2024 is higher than the standard limit, allowing you to maximize your retirement nest egg.

SEP IRAs are a great option for self-employed individuals to save for retirement. The IRA contribution limits for SEP IRAs in 2024 can be a significant amount, so it’s worth looking into if you’re self-employed.

If you’re married and contributing to a Roth IRA, you’ll want to know the contribution limits for your household. The Roth IRA contribution limits for 2024 for married couples can vary depending on your income, so it’s important to check the guidelines.

Navigating taxes as a family can be complex. A tax calculator for families can help you understand your tax obligations for October 2024 and make sure you’re taking advantage of all the deductions and credits available to you.

The 401(k) contribution limit for 2024 is determined by your age. You can find the specific limits for your age group by checking the 401(k) contribution limits for 2024 by age chart. This will help you plan your retirement savings strategy.

If you’re expecting a settlement payment from Capital One, you’ll want to know when to expect it. The Capital One settlement payments are scheduled to be sent out in October 2024, so keep an eye out for your payment.

If you’re over 50, you can make “catch-up” contributions to your 401(k) to help you reach your retirement goals. The 2024 401(k) limits for catch-up contributions allow you to contribute an additional amount on top of the regular limit.

The standard deduction is a significant amount you can subtract from your taxable income. For married couples filing jointly, the 2024 standard deduction for married filing jointly can help lower your tax bill.

Retirees have specific tax deadlines to keep in mind. The October 2024 tax deadline for retirees is important to remember, as it may differ from the general tax deadline.