Ibond rate projection for November 2024 offers a glimpse into the future of this popular investment vehicle. Understanding how I Bond rates are determined, analyzing historical trends, and considering current economic conditions are crucial for making informed investment decisions. The rate projection for November 2024 is a valuable tool for investors looking to assess the potential returns of I Bonds in the coming months.

The projected rate for November 2024 will depend on several factors, including inflation, Treasury yields, and the overall economic climate. Historical data suggests that I Bond rates have generally followed inflation trends, with periods of both high and low returns.

As we approach the end of 2024, investors are eager to see how the projected rate will shape up and what it means for their investment strategies.

Contents List

Understanding I Bonds: Ibond Rate Projection For November 2024

I Bonds, or Series I Savings Bonds, are a type of savings bond offered by the U.S. Treasury that earns interest based on a combination of a fixed rate and an inflation rate. These bonds are designed to protect your savings from the eroding effects of inflation.

If you’re married but filing separately, you’ll want to know the standard deduction for 2024. You can find the latest information on the standard deduction for married filing separately in 2024 to help you prepare your taxes.

Interest Rate Calculation, Ibond rate projection for November 2024

The interest rate on I Bonds is calculated based on two components: a fixed rate and a variable rate tied to inflation. The fixed rate is set at the time you purchase the bond and remains the same for the life of the bond.

The highest tax bracket in 2024 can affect your tax liability. Find out what the highest tax bracket in 2024 is so you can plan your finances accordingly.

The variable rate, known as the inflation rate, is adjusted every six months based on the Consumer Price Index (CPI).

Cigna announced layoffs in October 2024, which may impact employees. You can read more about the Cigna layoffs October 2024 announcement to learn more about the situation.

The total interest rate for an I Bond is the sum of the fixed rate and the inflation rate, which is adjusted every six months.

If you’re a Capital One customer, you may be eligible for a settlement payout. Find out more about the Capital One settlement payout eligibility for October 2024 to see if you qualify.

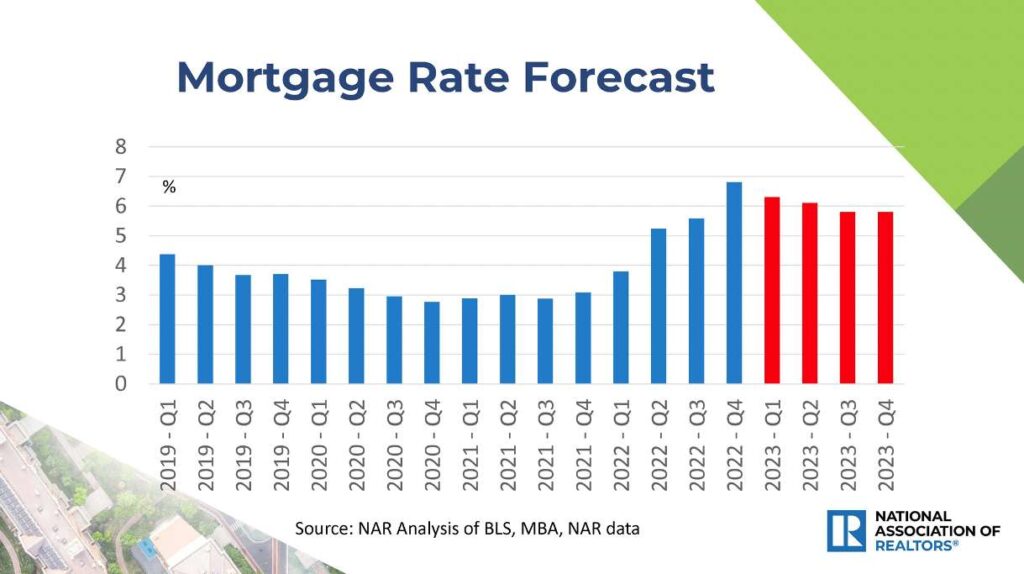

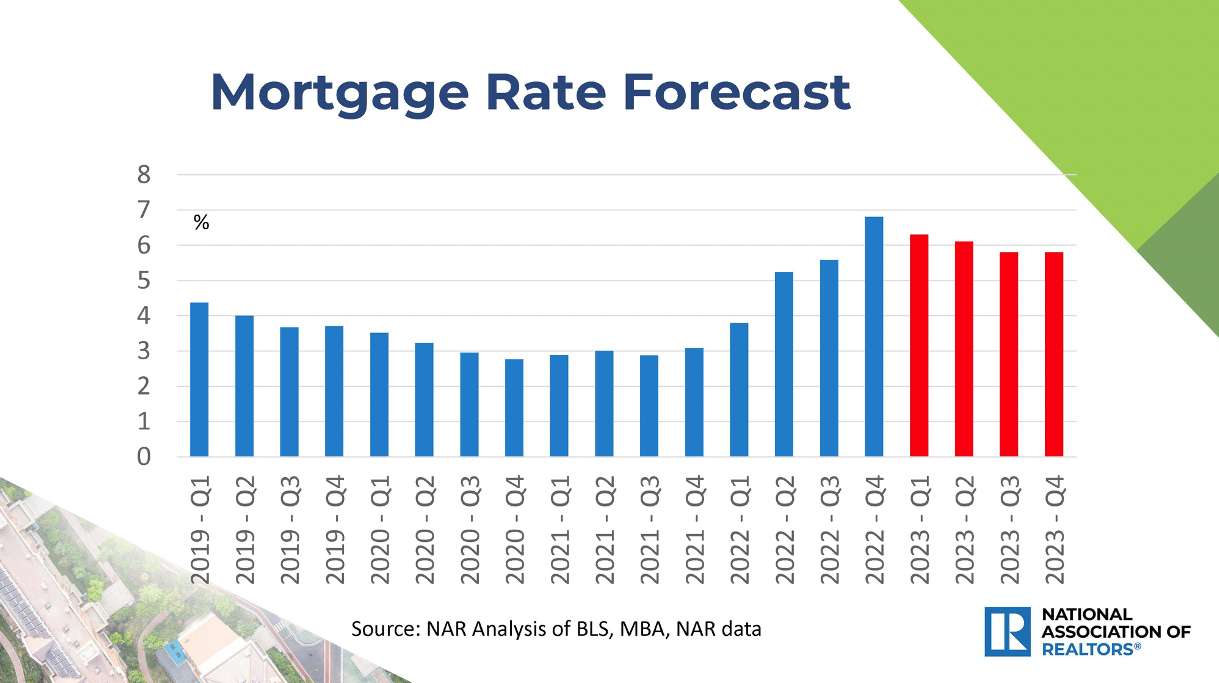

Current I Bond Rate and Historical Performance

The current I Bond interest rate is set at 4.30% for bonds purchased between May 1, 2023, and October 31, 2023. This rate consists of a fixed rate of 0.40% and an inflation rate of 3.90%. The interest rate on I Bonds can fluctuate over time, and historical performance can be used to assess the potential returns.

Depending on your income level, you may be able to contribute a certain amount to your 401k. Check out the 401k contribution limits for 2024 for different income levels to see how much you can contribute.

- For example, the interest rate on I Bonds purchased between November 1, 2022, and April 30, 2023, was 6.89%, which included a fixed rate of 0.00% and an inflation rate of 6.89%.

- I Bonds purchased between May 1, 2022, and October 31, 2022, had an interest rate of 9.62%, which included a fixed rate of 0.00% and an inflation rate of 9.62%.

These historical rates illustrate the potential for I Bonds to offer higher returns during periods of high inflation.

Ending Remarks

I Bond rate projections provide valuable insights for investors seeking to understand the potential returns of this unique investment. While the projected rate for November 2024 remains uncertain, considering historical trends, current economic conditions, and expert opinions can help investors make informed decisions.

Whether you are a seasoned investor or just starting out, understanding the factors that influence I Bond rates is crucial for maximizing your returns.

Questions Often Asked

What are the potential risks associated with investing in I Bonds?

I Bonds are generally considered a safe investment, but they do carry some risks. The main risk is that inflation could outpace the I Bond rate, resulting in a negative real return. Additionally, I Bonds have a 12-month holding period, and early redemption penalties apply if you withdraw funds before five years.

How often are I Bond rates adjusted?

I Bond rates are adjusted twice a year, on May 1 and November 1. The fixed rate remains the same for the life of the bond, while the variable rate is adjusted every six months based on inflation.

What are the tax implications of investing in I Bonds?

Interest earned on I Bonds is subject to federal income tax, but not state or local income tax. You can choose to pay taxes on the interest annually or defer them until you redeem the bond.

If you’re self-employed, you may have different 401k contribution limits. Check out the 401k contribution limits for 2024 for self-employed to see what you can contribute.

The IRS sets the 401k contribution limit for 2024. You can find out what the IRS 401k contribution limit for 2024 is to ensure you’re not overcontributing.

Students may be eligible for a standard deduction. You can learn more about the standard deduction for students in 2024 to see if you qualify.

The mileage rate is updated regularly. Find out when the mileage rate will be updated for October 2024 so you can adjust your deductions accordingly.

The Capital One class action lawsuit has been ongoing. Read more about the Capital One class action lawsuit details for October 2024 to learn about the latest developments.

With tax season approaching, you’ll want to find the best tax calculator. Compare different options with this guide to the best tax calculator for October 2024.

Families have specific tax needs. Find the right tax calculator for your family with this guide to tax calculators for families in October 2024.

401k contribution limits can vary depending on your age. Check out the 401k contribution limits for 2024 by age to see how much you can contribute.

If you’re eligible for a Capital One settlement payout, you’ll need to know the details. Find out about the Capital One settlement payout information for October 2024 to get the information you need.

It’s important to know the tax brackets for single filers in 2024. Check out the 2024 federal tax brackets for single filers to see how your income will be taxed.