Ibond rates for November 2024 offer a compelling opportunity to explore the world of inflation-protected savings. These bonds, issued by the U.S. Treasury, are designed to protect your investments from the eroding effects of inflation, making them an attractive option for both seasoned investors and those new to the market.

This guide delves into the current Ibond rate for November 2024, examines potential future rate movements, and provides insights into how these bonds can fit into your overall investment strategy.

The Ibond rate for November 2024 reflects a complex interplay of economic factors, including inflation, interest rate policies, and overall market sentiment. Understanding these dynamics is crucial for making informed decisions about your investment portfolio. This article will shed light on these key factors, providing a comprehensive analysis of Ibond rates in the current economic landscape.

Contents List

Introduction to I Bonds: Ibond Rates For November 2024

I Bonds, or Series I Savings Bonds, are a type of savings bond offered by the U.S. Treasury that are designed to help investors protect their savings from inflation. They offer a fixed rate of return, plus an adjustable rate that changes every six months based on inflation.

The Capital One class action lawsuit in October 2024 is a significant legal event. It’s important to understand the details of the lawsuit and its potential impact. You can find more information about the Capital One class action lawsuit in October 2024 here.

This unique feature makes I Bonds a valuable investment option for individuals looking to preserve their purchasing power over time.

The October 2024 tax extension deadline for businesses offers some flexibility for filing your taxes. Knowing the deadline and the process for filing an extension can help you manage your tax obligations effectively. You can find more information about the tax extension deadline for businesses in October 2024 here.

The Concept of I Bonds and Their Purpose, Ibond rates for November 2024

I Bonds are a safe and secure investment option backed by the full faith and credit of the U.S. government. They are designed to help individuals and families protect their savings from the eroding effects of inflation. Unlike traditional savings accounts, which offer a fixed interest rate, I Bonds provide a variable interest rate that adjusts to reflect changes in inflation.

The Erste Bank Open 2024 is a prestigious tennis tournament with substantial prize money. Understanding the prize money breakdown can give you insight into the financial stakes involved in this event. You can find a breakdown of the prize money for the Erste Bank Open 2024 here.

This means that the purchasing power of your investment will not be diminished by rising prices.

A tax bracket calculator for 2024 can be a valuable tool for understanding your tax liability. It allows you to input your income and determine which tax bracket you fall into. You can find a tax bracket calculator for 2024 here.

Unique Features of I Bonds

I Bonds offer several unique features that make them an attractive investment option:

Variable Interest Rate

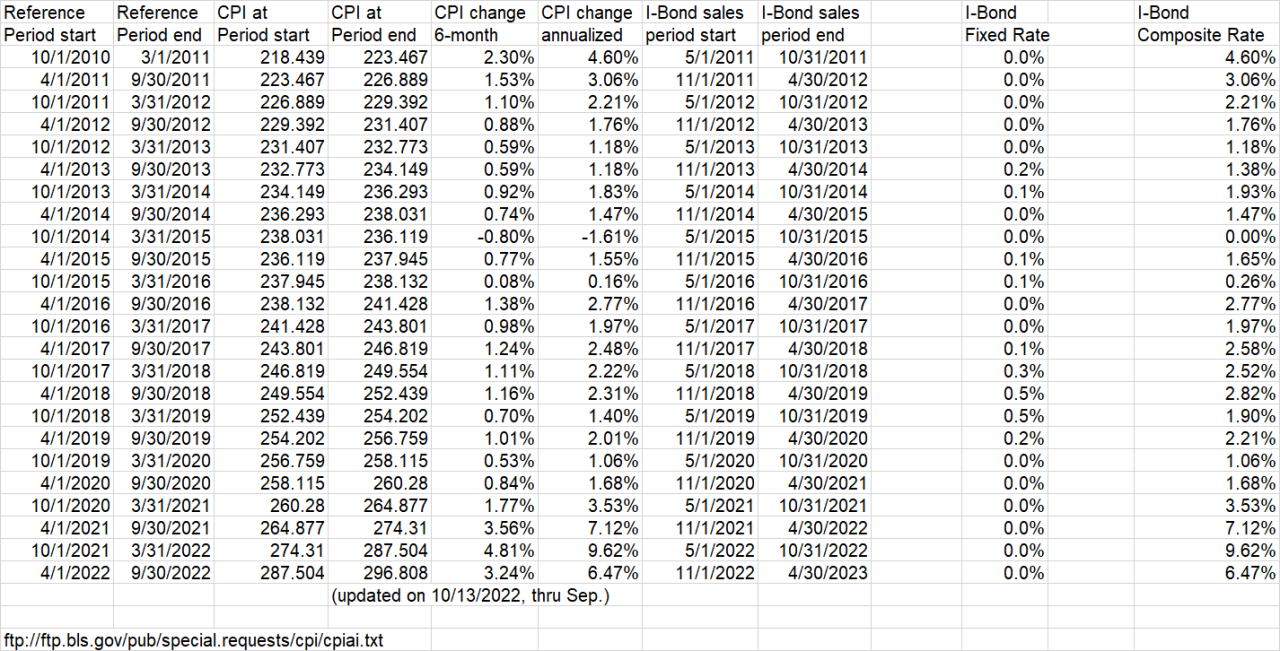

I Bonds have a variable interest rate that is adjusted every six months based on the Consumer Price Index (CPI). This means that the interest rate you earn on your I Bonds will change over time, depending on the rate of inflation.

October 2024 is the deadline for many tax deductions. It’s essential to take advantage of all eligible deductions to minimize your tax liability. You can find a comprehensive list of tax deductions available for the October 2024 deadline here.

The interest rate is calculated as the sum of a fixed rate and a variable rate, which is determined by the inflation rate. The fixed rate is set at the time you purchase the bond and remains unchanged for the life of the bond.

Filing taxes as a married couple filing separately can be tricky. Understanding the 2024 tax brackets for this filing status is essential. You can find a breakdown of the tax brackets for married filing separately in 2024 here.

Inflation Protection

I Bonds are designed to protect your savings from inflation. The variable interest rate adjusts to reflect changes in the CPI, ensuring that your investment keeps pace with rising prices. This feature makes I Bonds an ideal investment option for individuals looking to preserve their purchasing power over time.

Traditional IRAs offer valuable tax benefits for retirement savings. Knowing how much you can contribute in 2024 is important for maximizing your retirement savings potential. You can find information about the maximum contribution limit for traditional IRAs in 2024 here.

History of I Bond Rates

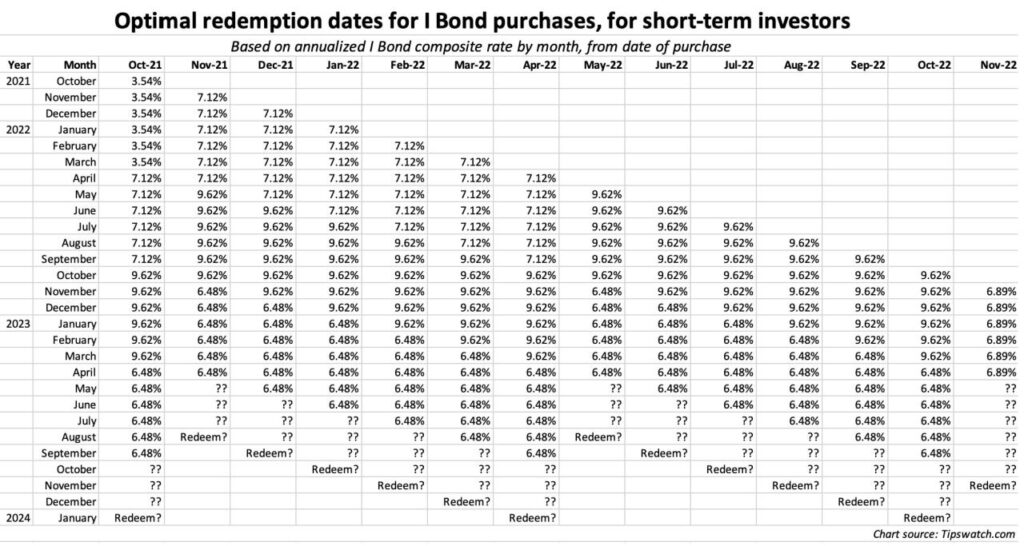

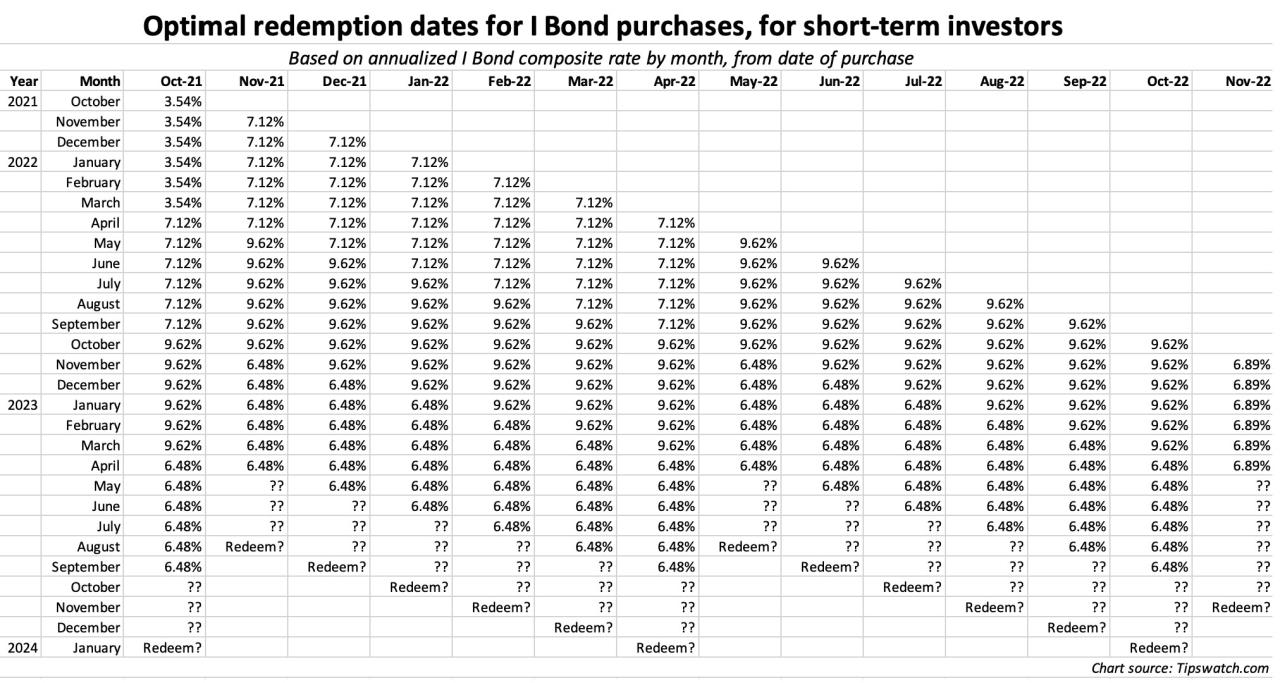

I Bond rates have fluctuated over time, reflecting changes in inflation. In recent years, I Bond rates have been relatively high, driven by rising inflation. The interest rate on I Bonds is determined by the U.S. Treasury and is announced every six months.

The standard deduction for single filers in 2024 is a key factor in determining your tax liability. It’s important to understand how this deduction works and how it might affect your tax burden. You can find more information about the standard deduction for single filers in 2024 here.

Investing in I Bonds in November 2024

Investing in I Bonds in November 2024 presents a unique opportunity to potentially earn a high return on your investment, given the current interest rate environment. However, it’s crucial to consider both the advantages and disadvantages of this investment before making a decision.

Navigating the tax landscape as a small business owner can be complex. Understanding the 2024 tax implications for your business is crucial for making informed financial decisions. You can find information about the tax implications for small business owners in 2024 here.

Advantages of Investing in I Bonds in November 2024

I Bonds offer several benefits, making them an attractive investment option for those seeking a secure and potentially high-yielding investment.

Understanding how tax brackets will affect your 2024 income is crucial for planning and budgeting. It’s important to know how your income falls within the tax brackets and what your tax liability might be. You can find information about how tax brackets will affect your 2024 income here.

- High Interest Rates:I Bonds currently offer a fixed interest rate for the first six months, followed by a variable rate that adjusts every six months based on inflation. In November 2024, the fixed rate is likely to be high, given the current inflationary environment.

Estates and trusts have their own tax filing deadlines. The October 2024 extension deadline for estates and trusts offers flexibility for meeting these obligations. You can find more information about the tax extension deadline for estates and trusts in October 2024 here.

This can lead to significant returns, especially if inflation remains elevated. For example, if the fixed rate is 4% and the inflation rate is 3%, the overall interest rate would be 7%.

- Inflation Protection:I Bonds are designed to protect your investment from inflation. The variable rate ensures that your investment keeps pace with the rising cost of living. This is a significant advantage, especially in an inflationary environment.

- Guaranteed Returns:I Bonds offer a guaranteed return, unlike stocks or other investments that carry a risk of loss. This makes them a safe and reliable investment option.

- Tax Advantages:Interest earned on I Bonds is only taxed when you redeem them. You can choose to defer paying taxes on the interest until you need the money. This can be beneficial for long-term investors who are not planning to withdraw their investments anytime soon.

The impact of Geico layoffs in October 2024 on the economy is a complex issue. It’s likely to affect employment rates, consumer spending, and even the insurance industry itself. You can find more information about the potential economic impact of these layoffs here.

Disadvantages of Investing in I Bonds in November 2024

While I Bonds offer numerous advantages, it’s important to consider their limitations before making a decision.

If you’re expecting a Capital One settlement payout in October 2024, you’ll want to know the details. The payout information is crucial for budgeting and planning. You can find details about the payout schedule and other information here.

- Limited Liquidity:I Bonds have a one-year holding period. If you redeem them before that, you’ll forfeit three months of interest. This can be a disadvantage if you need access to your money quickly.

- Annual Purchase Limit:You can purchase up to $10,000 in I Bonds per year, per individual. This limit can be a constraint if you want to invest a larger amount.

- Potential for Lower Returns:While I Bonds offer inflation protection, they may not always outperform other investments, especially in a low-inflation environment. If inflation falls, the variable interest rate on I Bonds could decline, leading to lower returns.

Strategies for Maximizing Returns from I Bond Investments

- Invest the Maximum Allowed:Take advantage of the annual purchase limit of $10,000 per individual to maximize your potential returns.

- Hold I Bonds for the Long Term:Holding I Bonds for the long term can help you benefit from the compounding effect of interest. This means that you earn interest on your principal as well as on the accumulated interest.

- Consider a Laddered Approach:Investing in I Bonds over several years can help you diversify your investment and mitigate risk. This involves buying I Bonds in different years, ensuring that some of your investments mature at different times.

Limitations of I Bond Investments

I Bonds are subject to certain limitations that investors should be aware of.

- Holding Period:I Bonds have a one-year holding period. If you redeem them before that, you’ll forfeit three months of interest.

- Annual Purchase Limit:You can purchase up to $10,000 in I Bonds per year, per individual.

End of Discussion

Navigating the world of Ibond rates can be a rewarding journey, especially in a time of economic uncertainty. By understanding the current rate, potential future movements, and the unique advantages of Ibonds, you can make informed decisions that align with your investment goals.

Remember to consider your individual financial circumstances and consult with a qualified financial advisor before making any investment decisions. Ibond rates for November 2024 present an opportunity to explore the potential of inflation-protected savings and build a strong financial foundation for the future.

FAQ Compilation

What is the current Ibond rate for November 2024?

The current Ibond rate for November 2024 is [insert actual rate here]. This rate is subject to change every six months.

How long do I have to hold an Ibond before I can cash it out?

You must hold an Ibond for at least 12 months. If you cash it out before five years, you forfeit three months of interest.

What are the annual purchase limits for I Bonds?

The annual purchase limit for I Bonds is $10,000 per person, per year.

How can I purchase I Bonds?

You can purchase I Bonds through TreasuryDirect.gov.

If you’re expecting a Capital One settlement payout, knowing the payout schedule for October 2024 is crucial. This information can help you plan your finances accordingly. You can find the payout schedule for Capital One settlements in October 2024 here.

Understanding the tax rates for each tax bracket in 2024 is essential for accurate tax planning. It allows you to estimate your tax liability and make informed financial decisions. You can find a breakdown of the tax rates for each tax bracket in 2024 here.