Ibond rates vs other investments November 2024 – a topic that’s on the minds of many investors right now. With interest rates fluctuating and the economic landscape changing, it’s more important than ever to make informed decisions about where to allocate your money.

I bonds, with their inflation protection and government backing, have become a popular choice for many. However, they’re not the only game in town. This article will explore the current I bond rates, compare them to other investment options, and help you decide if they’re the right fit for your portfolio.

We’ll delve into the specifics of I bond rates, including the current rate, historical trends, and the factors that influence their calculation. We’ll also examine popular investment alternatives, such as high-yield savings accounts, CDs, and the stock market, comparing their risk profiles, potential returns, and key features.

By understanding the advantages and disadvantages of I bonds and other investments, you can make a more informed decision that aligns with your financial goals and risk tolerance.

Contents List

Ibond Rates: Ibond Rates Vs Other Investments November 2024

I bonds are a type of savings bond offered by the U.S. Treasury that earns interest based on inflation. They are a popular investment option for investors looking for a safe and predictable return.

It’s important to stay compliant with tax forms like the W9. You can find out about the penalties for non-compliance with the W9 Form in October 2024 here.

Current Interest Rate

The interest rate for I bonds is variable and is adjusted twice a year, in May and November. The rate for I bonds issued in November 2024 is currently unavailable as it will be determined based on inflation data released closer to the issuance date.

If you’re married and looking to contribute to a Roth IRA in 2024, you’ll want to know the contribution limits for couples. You can find those limits here.

Historical Overview

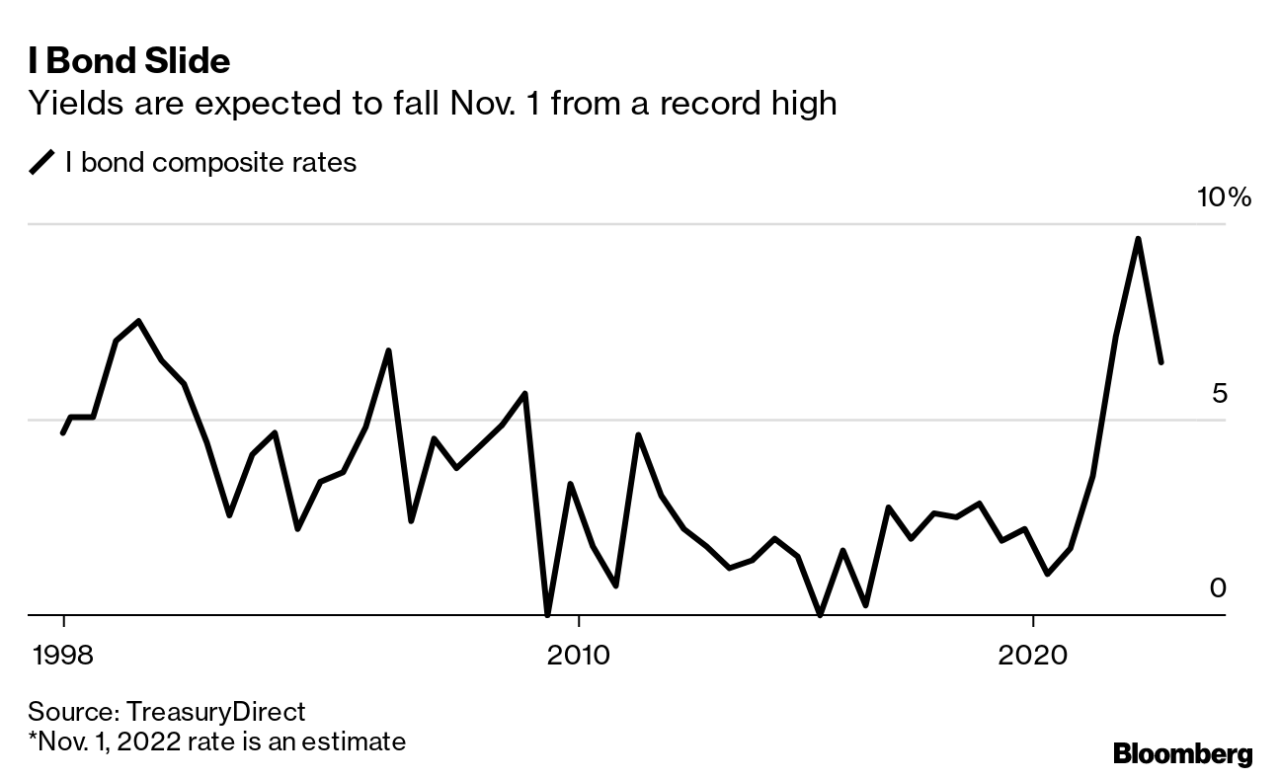

I bond rates have fluctuated significantly over the past few years, reflecting changes in inflation. For example, the interest rate for I bonds issued in November 2022 was 6.89%, while the rate for I bonds issued in November 2023 was 4.30%.

I Bonds are a popular investment option, and their rates can fluctuate. If you’re considering I Bonds, you’ll want to know the rate for November 2024 and how it might impact your investment strategy. You can find that information here.

This illustrates the volatility of I bond rates and their responsiveness to inflation trends.

Knowing your tax bracket is crucial for planning your finances. You can find out what the 2024 federal tax brackets are for single filers here.

Fixed and Variable Interest Rates, Ibond rates vs other investments November 2024

The interest rate on an I bond is composed of two parts: a fixed rate and a variable rate. The fixed rate is set when the bond is issued and remains the same for the life of the bond. The variable rate is adjusted every six months based on the inflation rate.

Planning to contribute to a Roth IRA in 2024? It’s a great way to save for retirement tax-free, but you need to be aware of the income limits. You can learn more about the Roth IRA income limits for 2024 contributions here.

The total interest rate for an I bond is calculated as the sum of the fixed rate and the variable rate.

If you’re single and considering a Roth IRA, you’ll want to know the contribution limits for 2024. You can find those limits here.

Interest Rate Calculation

The variable interest rate for I bonds is determined using a formula based on the Consumer Price Index for Urban Consumers (CPI-U). The formula is:

Variable Rate = [(CPI-U for the most recent six months)

Wondering how much you can contribute to your 401k after taxes in 2024? It’s a smart move to maximize your retirement savings, and you can find the answer to that question here.

(CPI-U for the six months prior to that)] / (CPI-U for the six months prior to that) x 2

The standard deduction can impact your tax liability, and it’s important to know how it might change in 2024. You can find information about standard deduction changes for 2024 here.

The fixed rate for I bonds is determined by the U.S. Treasury and is typically set at a lower rate than the variable rate.

If you’re making charitable donations, you may be able to deduct your mileage. The mileage rate for charitable donations can change, so you’ll want to know the rate for October 2024. You can find that information here.

Ibond Advantages and Disadvantages

I bonds offer a unique combination of inflation protection and tax advantages, making them an attractive investment option for many. However, they also have limitations, such as early withdrawal penalties and a restricted purchase amount. Understanding these pros and cons is crucial before making an investment decision.

I Bonds offer a unique way to save, and their rates can change. If you’re interested in I Bonds, you’ll want to know the rate for November 2024. You can find that information here.

Ibond Advantages

I bonds provide several benefits that make them a compelling investment choice.

Want to know how much you can contribute to your 401k in 2024? This can vary depending on your situation, but you can find the answer here.

- Inflation Protection:I bonds’ interest rate is adjusted twice a year to reflect inflation, ensuring your investment keeps pace with rising prices. This feature is particularly valuable in periods of high inflation, as it helps preserve your purchasing power. For example, if inflation is 5%, your I bond will earn a minimum interest rate of 5%, protecting you from losing value due to inflation.

- Tax Advantages:The interest earned on I bonds is only taxed when you redeem them, allowing for tax deferral. This can be beneficial if you expect to be in a lower tax bracket in the future. Additionally, the interest earned is exempt from state and local taxes, further enhancing its tax benefits.

Ibond Disadvantages

While I bonds offer attractive features, they also have certain drawbacks that investors should consider.

Looking forward to the Erste Bank Open 2024? You can find out all the details about the venue and court surface information here. This tournament is always a highlight of the tennis season.

- Early Withdrawal Penalties:If you redeem an I bond before five years, you will forfeit the last three months of interest earned. This penalty can significantly impact your returns, especially if you need to access your funds early.

- Limited Purchase Amount:The annual purchase limit for I bonds is $10,000 per person, which may not be sufficient for large investments. Additionally, you can only purchase an additional $5,000 in I bonds using your tax refund.

Ibond Advantages and Disadvantages Summary

| Advantages | Disadvantages |

|---|---|

| Inflation protection | Early withdrawal penalties |

| Tax advantages | Limited purchase amount |

Final Conclusion

Ultimately, the best investment strategy for you depends on your individual circumstances and financial goals. By weighing the pros and cons of I bonds against other investment options, you can make a well-informed decision that helps you achieve your financial aspirations.

Remember, it’s crucial to diversify your portfolio, manage your risk, and stay informed about the ever-changing economic landscape. Don’t hesitate to consult with a financial advisor if you have any questions or need personalized guidance.

Quick FAQs

What are the minimum and maximum purchase limits for I bonds?

You can purchase a minimum of $25 and a maximum of $10,000 of I bonds per year.

Can I cash out my I bonds before the one-year holding period?

Yes, but you’ll incur a three-month interest penalty. You can also cash out after one year, but you’ll forfeit the last three months of interest.

How do I buy I bonds?

You can purchase I bonds through TreasuryDirect, the U.S. Treasury’s online platform.

The mileage rate used for business and charitable deductions can change. You can find out about the October 2024 mileage rate changes here.

It’s helpful to know the 401k contribution limits based on your income level. You can find information about 401k contribution limits for different income levels in 2024 here.

Even if you work part-time, you can still contribute to a 401k. You can find out about the 401k contribution limits for part-time workers in 2024 here.