Immediate Annuities set the stage for this enthralling narrative, offering readers a glimpse into a financial tool that can provide guaranteed income for life. These annuities, unlike their deferred counterparts, begin paying out immediately upon purchase, making them a popular choice for retirees seeking financial security.

Calculating the potential benefits of an annuity can be helpful. You can find an online annuity calculator for 2024 here.

Immediate annuities offer a unique blend of guaranteed income, longevity protection, and tax advantages, making them a compelling retirement income strategy for those seeking financial peace of mind. They provide a steady stream of income that can be used to cover essential expenses, supplement other retirement income sources, or even pursue long-held dreams.

Contents List

- 1 Immediate Annuities

- 2 Final Review

- 3 Helpful Answers

Immediate Annuities

Immediate annuities are a type of financial product that provides a guaranteed stream of income for life. They are popular among retirees looking for a reliable source of income that can’t be outlived. In this article, we’ll explore the ins and outs of immediate annuities, covering their features, advantages, disadvantages, suitability, and how to choose the right one for your needs.

Calculating the potential benefits of an annuity can be helpful. You can find an annuity loan calculator for 2024 here.

What are Immediate Annuities?

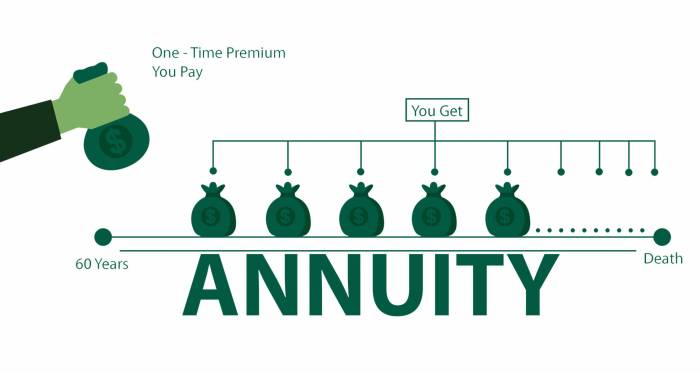

An immediate annuity is a financial contract where you make a lump-sum payment to an insurance company in exchange for regular payments that start immediately. These payments can be fixed or variable, depending on the type of annuity you choose.

Variable annuities and fixed annuities offer different features and benefits. If you’re interested in comparing variable and fixed annuities, you can find information on variable annuities vs. fixed annuities in 2024 here.

Types of Immediate Annuities

- Fixed Annuities:Provide a guaranteed, fixed amount of income for life. The payment amount is determined at the time of purchase and doesn’t change, regardless of market fluctuations.

- Variable Annuities:Offer the potential for higher income payments but also carry some investment risk. The payment amount is tied to the performance of a specific investment portfolio, which can fluctuate.

- Indexed Annuities:Offer a balance between fixed and variable annuities. The payment amount is linked to the performance of a specific index, such as the S&P 500, but with some guarantees against losses.

How Immediate Annuities Work

When you purchase an immediate annuity, you essentially transfer your savings to an insurance company in exchange for a guaranteed stream of income. The insurance company invests your money and uses a portion of the investment returns to fund your annuity payments.

The amount of your annuity payments depends on several factors, including the size of your lump-sum payment, your age, and the type of annuity you choose. You can receive payments monthly, quarterly, annually, or even as a lump sum.

Annuities can provide a stream of income for retirement. If you’re interested in learning more about a $600,000 annuity, you can find information on annuities of this size in 2024 here.

Advantages of Immediate Annuities

Immediate annuities offer several advantages for retirees, making them an attractive option for income planning.

Guaranteed Income

One of the primary benefits of immediate annuities is the guarantee of income for life. No matter how long you live, you’ll receive regular payments, providing peace of mind and financial security.

Understanding how different types of annuities work is important before making a decision. If you’re interested in learning more about 3-year annuities, you can find information on how they work in 2024 here.

Longevity Protection

Immediate annuities help protect against the risk of outliving your savings. Since payments continue for life, you don’t have to worry about running out of money in your later years.

Annuity bonds can be a complex investment product. If you’re looking to learn more about the formula for annuity bonds in 2024, you can find information here.

Tax Advantages

In some cases, a portion of your annuity payments may be tax-free. The tax treatment of annuity payments can vary depending on the type of annuity and your individual circumstances.

Disadvantages of Immediate Annuities

While immediate annuities offer several advantages, they also have some potential drawbacks to consider.

Limited Growth Potential

Immediate annuities typically offer limited growth potential compared to other investment options. Once you purchase an annuity, the principal is locked in, and your income payments are fixed or based on the chosen index.

Life Incl Variable Annuity (0214) is another type of annuity product available. If you’re interested in learning more about this product, you can find information on Life Incl Variable Annuity (0214) in 2024 here.

Surrender Charges

Some immediate annuities may have surrender charges if you withdraw your money before a certain period. These charges can reduce your overall returns, so it’s important to understand the terms of your contract.

Inflation Risk

Fixed annuities are susceptible to inflation risk. The purchasing power of your fixed income payments may decrease over time if inflation rises.

It’s important to understand the tax implications of annuities. If you’re wondering if an annuity from LIC is taxable in 2024, you can find the answer here.

When are Immediate Annuities Suitable?

Immediate annuities are not suitable for everyone. They can be a good option for retirees who:

Need a Guaranteed Income Stream

If you’re looking for a reliable source of income that you can’t outlive, an immediate annuity can provide that security.

The Director 5 Variable Annuity is another product offered by Transamerica. If you’re interested in learning more about this product, you can find information on the Director 5 Variable Annuity 2024 here.

Have a Lump Sum of Savings

Immediate annuities require a lump-sum payment to purchase, so you’ll need to have some savings available.

Are Risk-Averse

If you’re uncomfortable with market volatility, immediate annuities offer a guaranteed income stream, reducing investment risk.

Factors to Consider Before Purchasing

Before purchasing an immediate annuity, it’s essential to consider several factors, including:

Age and Health

Your age and health can significantly impact the amount of your annuity payments and the overall cost of the contract.

The Hartford Director 7 Variable Annuity is another popular product in the market. If you’re interested in learning more about this product, you can find information on the Hartford Director 7 Variable Annuity 2024 here.

Financial Goals

Consider your retirement income needs and how an immediate annuity fits into your overall financial plan.

Risk Tolerance

Immediate annuities offer different levels of risk, so it’s important to choose one that aligns with your risk tolerance.

There may be age limits for certain types of annuities. If you’re interested in learning more about the age limit for immediate annuities, you can find information here.

How to Choose the Right Annuity, Immediate Annuities

Choosing the right immediate annuity requires careful consideration and research.

Compare Different Providers

Shop around and compare different annuity providers and their offerings. Consider factors such as payment options, fees, and surrender charges.

Seek Professional Advice

It’s always a good idea to consult with a qualified financial advisor before making a decision. They can help you understand the complexities of annuities and determine if they are right for you.

Final Review

Immediate annuities can be a powerful tool in your retirement planning toolbox. By carefully considering your individual circumstances and goals, you can determine if an immediate annuity is the right fit for your financial future. Remember, seeking professional financial advice is essential to make an informed decision.

Helpful Answers

How much income can I expect from an immediate annuity?

It’s important to understand how annuities are treated for tax purposes. If you’re wondering whether annuity payments are considered income in 2024, you can find the answer here.

The income you receive depends on several factors, including the amount of your initial investment, your age, and the interest rates at the time of purchase. Annuity providers typically offer calculators to help you estimate your potential income.

Are immediate annuities safe?

Immediate annuities are generally considered safe because they are backed by the financial strength of the issuing insurance company. However, it’s important to research the financial stability of the provider before purchasing an annuity.

Annuities are a popular financial product, and there’s a lot of information available online. If you’re interested in learning more about annuities in general, you can find an overview of annuities in 2024 here.

Can I withdraw my principal from an immediate annuity?

Immediate annuities are typically designed to provide lifetime income, and withdrawals from the principal are often limited or subject to penalties. It’s important to understand the terms and conditions of the annuity contract before purchasing.

What are the tax implications of immediate annuities?

Annuity products are becoming increasingly popular, especially as people look for ways to secure their retirement income. If you’re interested in learning more about immediate annuities, you can find information on the meaning of an immediate annuity here.

The income payments from an immediate annuity are typically taxed as ordinary income. However, there may be tax advantages depending on the specific type of annuity you purchase.

Transamerica is a well-known provider of annuities, and their variable annuity product, the 0-Share 2024, may be of interest to investors. You can find more information on the Transamerica Variable Annuity 0-Share 2024 here.