Immediate Annuity 5 Year Certain provides a guaranteed income stream for at least five years, offering peace of mind during retirement. This type of annuity offers a secure way to supplement your income, ensuring you have a steady stream of payments regardless of market fluctuations.

Curious about what an annuity is? This definition can help you understand the basics of annuities and their role in financial planning.

Imagine having a reliable source of income that doesn’t depend on your investments performing well. An immediate annuity with a 5-year certain period can provide that security, allowing you to focus on enjoying your retirement years without financial worries.

Need to calculate an annuity due on your TI-84 calculator? This guide provides step-by-step instructions to help you master this calculation.

Contents List

Introduction to Immediate Annuities

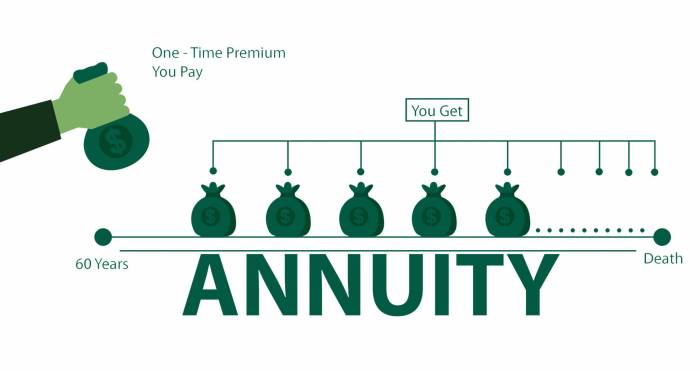

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments for life, starting immediately after the purchase. These annuities are particularly useful for individuals looking to convert a lump sum of money into a reliable income stream, especially during retirement.

An immediate lifetime annuity provides a guaranteed stream of income for the rest of your life. This link offers information on the benefits and drawbacks of this type of annuity.

What is a 5-Year Certain Immediate Annuity?

The term “5-year certain” refers to a specific feature of an immediate annuity. It guarantees that the income payments will continue for at least five years, regardless of the annuitant’s lifespan. After the five-year period, the payments may continue for life, depending on the chosen annuity option.

Want to learn how to calculate annuity future values? This resource explains the concept and provides examples to help you understand the process.

When Might a 5-Year Certain Immediate Annuity be Suitable?

- Retirement Income:Individuals seeking a stable and predictable income stream during retirement can benefit from the guaranteed payments for at least five years.

- Bridge Financing:A 5-year certain annuity can serve as a temporary income source while waiting for other investments to mature or for other financial arrangements to be finalized.

- Longevity Protection:Individuals concerned about outliving their savings can find peace of mind knowing that they will receive a guaranteed income for at least five years, even if they live longer than expected.

Benefits of a 5-Year Certain Immediate Annuity

Immediate annuities with a 5-year certain period offer several advantages that make them an attractive option for various financial planning needs.

Annuity income is not considered capital gains. This article provides a comprehensive explanation of the tax treatment of annuity income.

Guaranteed Income Stream

The most significant benefit is the guaranteed income stream for at least five years. This provides financial security and predictability, especially for individuals seeking a reliable source of income during retirement or for specific financial goals.

Potential for Growth

While the annuity payments are fixed, the underlying investment may continue to grow. This growth potential can enhance the overall value of the annuity over time, although it’s not guaranteed. The accumulated interest can potentially increase the future payments, depending on the annuity contract terms.

A variable annuity is a type of annuity that offers the potential for growth but also carries some risk. This article provides an overview of variable annuities and their features.

Longevity Risk Protection, Immediate Annuity 5 Year Certain

The 5-year certain period offers protection against longevity risk. Even if the annuitant lives longer than expected, the guaranteed payments for at least five years ensure a minimum level of income. This can be especially valuable for individuals concerned about outliving their savings.

An annuity is primarily used to provide a steady stream of income for a specific period of time. This article delves into the various ways annuities can be used to meet your financial needs.

Considerations for Choosing an Immediate Annuity

Before purchasing an immediate annuity, it’s crucial to carefully consider several factors to ensure it aligns with your individual financial goals and risk tolerance.

An annuity is essentially a sequence of payments made over a period of time. This link offers a deeper explanation of annuities and their various payment modes.

Interest Rates, Investment Options, and Fees

- Interest Rates:Interest rates play a significant role in determining the annuity payout. Higher interest rates generally lead to larger payments. It’s essential to compare interest rates offered by different insurance companies.

- Investment Options:Some immediate annuities offer investment options, allowing you to choose how your funds are invested. These options can potentially offer higher returns, but they also carry more risk.

- Fees:Immediate annuities typically involve fees, such as administration fees, surrender charges, and mortality charges. Understanding these fees and how they impact your overall returns is crucial.

Financial Goals and Risk Tolerance

Consider your individual financial goals and risk tolerance when choosing an immediate annuity. If you prioritize guaranteed income and stability, a 5-year certain annuity can be a good option. However, if you’re willing to take on more risk for the potential of higher returns, you might consider other investment options.

Comparison to Other Annuity Options

Immediate annuities with a 5-year certain period are just one type of annuity. Compare the benefits of a 5-year certain period to other annuity options, such as fixed annuities, variable annuities, and indexed annuities. Consider your individual needs and preferences when making a decision.

Want to calculate the number of periods for an annuity? This calculator can help you determine the number of periods required to reach your financial goals.

How Immediate Annuities Work

Understanding the mechanics of immediate annuities is essential for making informed decisions.

Annuity rates can fluctuate over time, so it’s helpful to have an understanding of historical trends. This link provides insights into annuity rates between 2021 and 2024.

Purchasing an Immediate Annuity

To purchase an immediate annuity, you’ll need to provide the insurance company with a lump sum of money. This lump sum is then used to purchase the annuity contract, which guarantees the income payments.

Looking for information on X Share Annuities? This link can provide you with the details you need to understand this type of annuity.

Payment Options

- Monthly Payments:The most common payment option is monthly payments, providing a regular and predictable income stream.

- Quarterly Payments:Quarterly payments offer a slightly less frequent income stream, suitable for individuals who prefer receiving payments less often.

- Annual Payments:Annual payments provide the least frequent income stream, suitable for individuals who prefer receiving a larger lump sum payment once a year.

Tax Implications

Annuity payments are typically taxed as ordinary income. The tax implications of receiving annuity payments can vary depending on the type of annuity and your individual tax situation. It’s essential to consult with a tax advisor to understand the tax implications of your specific annuity contract.

Looking for a variable annuity life insurance company in Amarillo, TX? This link might be a good starting point for your search. It provides information on the different types of variable annuities available and the factors to consider when choosing one.

Examples of Immediate Annuity Scenarios: Immediate Annuity 5 Year Certain

Let’s explore some hypothetical scenarios to illustrate how immediate annuities can be used in different situations.

Are you considering an immediate annuity? It’s important to know that the income from an immediate annuity is generally taxable. This article provides a detailed explanation of the tax implications of immediate annuities.

Retirement Income

Sarah, a 65-year-old retiree, has a lump sum of $200,000 saved for retirement. She decides to purchase a 5-year certain immediate annuity to provide a stable income stream. The annuity contract guarantees her a monthly payment of $1,500 for at least five years, providing her with a reliable source of income during her retirement years.

Calculating an annuity factor can be crucial for determining the present or future value of an annuity. This article provides a guide on how to calculate annuity factors.

Income for a Specific Period

John, a 45-year-old entrepreneur, is planning a five-year sabbatical. He has $100,000 saved and decides to purchase a 5-year certain immediate annuity to provide him with a guaranteed income stream during his sabbatical. The annuity contract guarantees him a monthly payment of $2,000 for five years, allowing him to pursue his personal interests without financial worries.

Inheriting an annuity can be a great financial windfall, but it’s important to understand the tax implications. This resource can help you determine if your inherited annuity is taxable and how to navigate the tax implications.

Visual Representation of Potential Benefits

Imagine a graph with time on the x-axis and income on the y-axis. The graph shows a straight line representing the guaranteed income payments from a 5-year certain immediate annuity. The line remains constant for the first five years, providing a predictable and stable income stream.

After five years, the line may continue upward, representing the potential for growth in payments if the underlying investment performs well.

Risks and Considerations

While immediate annuities offer advantages, it’s essential to be aware of potential risks and considerations before making a decision.

Lack of Flexibility

Once you purchase an immediate annuity, you generally cannot withdraw the funds or change the payment schedule. This lack of flexibility can be a drawback for individuals who may need access to their funds in the future.

Interest Rate Changes

Interest rates can fluctuate over time. If interest rates decrease after you purchase an immediate annuity, the value of your annuity may decline. However, the guaranteed payments will remain unchanged.

Comparison to Other Investment Options

Immediate annuities are not the only investment option available. Compare the potential risks of an immediate annuity with a 5-year certain period to other investment options, such as stocks, bonds, or real estate. Consider your risk tolerance and investment goals when making a decision.

Last Word

Immediate Annuities with a 5-year certain period can be a valuable tool for retirement planning. They offer guaranteed income, potential for growth, and protection against longevity risk. While there are potential downsides to consider, such as lack of flexibility and the risk of interest rate changes, an immediate annuity can provide peace of mind and financial security for many individuals.

Query Resolution

How do I know if an Immediate Annuity with a 5-year certain period is right for me?

Consider your individual financial goals, risk tolerance, and desired level of income security. Consult with a financial advisor to determine if an immediate annuity aligns with your specific needs.

What happens after the 5-year certain period?

After the guaranteed 5-year period, payments may continue for life, depending on the specific annuity contract. You should carefully review the terms and conditions of the annuity to understand how payments will be structured after the initial 5-year period.

Are there any fees associated with immediate annuities?

Yes, there may be fees associated with immediate annuities. These fees can include administrative fees, surrender charges, and mortality and expense charges. It’s important to understand the fees involved before purchasing an annuity.