Immediate Annuity Calculator is a powerful tool for retirement planning. It allows you to estimate the amount of income you can receive from an immediate annuity, based on your age, life expectancy, and the amount of money you have to invest.

Annuity and variable annuity are both types of investment that can provide a steady stream of income during retirement. If you’re considering this option, you might want to learn more about Annuity Vs Variable Annuity 2024. This information will help you understand the differences between the two and which option is best for your individual needs.

Immediate annuities are a type of insurance product that provides a guaranteed stream of income for life, making them an attractive option for retirees looking for financial security.

Annuities are a type of investment that can provide a steady stream of income during retirement. If you’re considering this option, you might want to learn more about Annuity 5 Year Payout 2024. This information will help you understand how annuity payouts work and how they can impact your retirement income.

Immediate annuities can be a valuable part of a comprehensive retirement plan, offering several benefits. They provide a guaranteed income stream, helping to eliminate the risk of outliving your savings. This makes them particularly appealing for those concerned about longevity risk.

Annuities can be a great way to supplement your retirement income, but there are different types to choose from. If you’re interested in learning more about the different types of annuities, you can find more information about Immediate Annuity And Deferred Annuity.

This article explains the key differences between immediate and deferred annuities and how these differences can impact your financial planning.

However, it’s crucial to understand the potential drawbacks, such as the possibility of lower returns compared to other investments. Using an Immediate Annuity Calculator can help you weigh the pros and cons and determine if an immediate annuity is right for your individual circumstances.

Annuity payments can be a great source of income during retirement, but you might be wondering about the tax implications. If you’re curious about the taxability of annuity interest, you can find more information about Is Annuity Interest Taxable 2024.

This article explains the tax rules surrounding annuity interest and how these rules can impact your retirement income.

Contents List

- 1 What is an Immediate Annuity?

- 2 How Immediate Annuities Work

- 3 Benefits of Immediate Annuities

- 4 Risks Associated with Immediate Annuities

- 5 Using an Immediate Annuity Calculator

- 6 Factors to Consider When Choosing an Immediate Annuity: Immediate Annuity Calculator

- 7 Alternatives to Immediate Annuities

- 8 Final Wrap-Up

- 9 Frequently Asked Questions

What is an Immediate Annuity?

An immediate annuity is a type of insurance product that provides a guaranteed stream of income for life, starting immediately after you purchase it. In simple terms, you give the insurance company a lump sum of money, and in return, they promise to pay you regular payments for as long as you live.

Variable annuities are a type of investment that can provide a steady stream of income during retirement. If you’re considering this option, you might want to learn more about Qualified Variable Annuity Taxation 2024. This information will help you understand the tax implications of investing in a variable annuity.

This can be a valuable tool for retirement planning, as it provides a reliable source of income that you can’t outlive.

Annuities are a type of investment that can provide a steady stream of income during retirement. If you’re considering this option, you might want to learn more about Calculating Annuity Annual Payment 2024. This information will help you understand how to calculate your annual annuity payment and how this payment can impact your retirement income.

Key Features and Characteristics

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, regardless of how long you live. This eliminates the risk of outliving your savings.

- Flexibility:You can choose from various payment options, such as monthly, quarterly, or annually. You can also choose how long you want the payments to last, such as for a specific period or for life.

- Tax Advantages:Depending on the type of annuity, some of the income you receive may be tax-deferred or tax-free.

Examples of How Immediate Annuities Can Be Used in Retirement Planning

- Supplementing Social Security:An immediate annuity can help bridge the gap between your Social Security benefits and your desired retirement income.

- Providing a Steady Income Stream:Immediate annuities can provide a reliable source of income to cover essential expenses, such as housing, food, and healthcare.

- Protecting Against Longevity Risk:Immediate annuities can help mitigate the risk of outliving your savings, especially if you live a long life.

How Immediate Annuities Work

Purchasing an immediate annuity involves a simple process. You first choose an insurance company and select the type of annuity that best suits your needs. You then provide the insurance company with a lump sum payment, and in return, they agree to pay you regular payments for life.

Types of Immediate Annuities

- Fixed Annuities:These annuities offer a fixed rate of return, guaranteeing a set amount of income for life. The payment amount is determined based on the interest rate prevailing at the time of purchase. Fixed annuities provide stability and predictability, but they may not keep up with inflation.

- Variable Annuities:These annuities offer the potential for higher returns, but they also come with higher risk. The payment amount is tied to the performance of a specific investment portfolio, such as stocks or bonds. Variable annuities may be suitable for those seeking potential growth but are willing to accept some risk.

Variable annuities are a popular investment option for retirees, but sales have been declining in recent years. If you’re considering a variable annuity, you might want to learn more about Variable Annuity Sales 2024. This information will help you understand the current market for variable annuities and whether they are a good fit for your financial goals.

- Indexed Annuities:These annuities combine features of fixed and variable annuities. They offer a minimum guaranteed return tied to a specific index, such as the S&P 500, while also providing the potential for growth based on the index’s performance. Indexed annuities can provide a balance between stability and potential growth.

Factors That Determine the Annuity Payment Amount

- Lump Sum Payment:The larger the lump sum payment, the higher the annuity payments.

- Interest Rates:Higher interest rates generally result in higher annuity payments.

- Your Age and Gender:Younger individuals and women typically receive lower annuity payments than older men, as they are expected to live longer.

- Annuity Payment Option:The choice of payment frequency (e.g., monthly, quarterly, annually) can affect the payment amount.

Benefits of Immediate Annuities

Immediate annuities offer several advantages for retirement income planning, including:

Guaranteed Income for Life

Immediate annuities provide a guaranteed stream of income for life, regardless of how long you live. This eliminates the risk of outliving your savings and provides peace of mind knowing that you will have a reliable source of income for the rest of your life.

Variable annuities are a type of investment that can provide a steady stream of income during retirement. If you’re considering this option, you might want to learn more about A Variable Annuity Guarantees Which Of The Following 2024.

This information will help you understand the guarantees that come with a variable annuity and how these guarantees can protect your investment.

Managing Longevity Risk

Immediate annuities help manage longevity risk, which is the risk of living longer than expected and running out of money in retirement. By providing a guaranteed income stream for life, annuities ensure that you have enough income to cover your expenses throughout your retirement years.

If you’re considering purchasing an annuity, you’ll need to decide how much you want to invest. If you’re curious about how much annuity you can get with a specific amount, you can find more information about How Much Annuity For 40 000 2024.

This article will help you understand the relationship between your investment amount and the amount of annuity you can receive.

Other Benefits

- Protection Against Market Volatility:Immediate annuities can help protect your retirement savings from market fluctuations. The guaranteed income stream is not affected by changes in the stock market or other investments.

- Simplicity:Immediate annuities are relatively simple to understand and manage. Once you purchase an annuity, you don’t have to worry about managing investments or making investment decisions.

- Tax Advantages:Depending on the type of annuity, some of the income you receive may be tax-deferred or tax-free.

Risks Associated with Immediate Annuities

While immediate annuities offer several benefits, they also come with some potential drawbacks. It’s important to understand these risks before making a decision.

Annuities are a popular retirement income product, but they can be used for other purposes as well. If you’re interested in learning more about the common uses of annuities, you can find more information about Annuity Is Primarily Used To Provide 2024.

This article explains the various ways annuities can be used to provide financial security.

Risk of Outliving Your Annuity Payments

While immediate annuities provide a guaranteed income stream for life, the payment amount is fixed. If you live longer than expected, the purchasing power of your annuity payments may decrease due to inflation. However, some annuities offer inflation protection, which can help mitigate this risk.

An annuity is a financial product that provides a stream of income payments for a certain period of time. If you’re curious about how annuities work, you can find more information about Annuity Kya Hai 2024. This article explains the basics of annuities and how they can be used to secure your financial future.

Impact of Interest Rate Changes

Interest rates can fluctuate over time, and this can affect the value of your annuity. If interest rates rise after you purchase an annuity, the value of your annuity may decrease. Conversely, if interest rates fall, the value of your annuity may increase.

If you’re using Excel to calculate the present value of an annuity, you can find more information about Pv Annuity Excel 2024. This article will explain how to use Excel to calculate the present value of an annuity and how this information can be used to make informed financial decisions.

Other Risks

- Loss of Principal:You generally cannot access the lump sum you paid for the annuity, even if you need the money for an emergency. This can be a drawback if you require access to your principal in the future.

- Insurance Company Risk:There is a small risk that the insurance company issuing your annuity could become insolvent. However, insurance companies are heavily regulated, and this risk is generally low.

Using an Immediate Annuity Calculator

An immediate annuity calculator is a useful tool that can help you estimate the amount of income you can expect to receive from an immediate annuity. This can be helpful in making informed decisions about whether an immediate annuity is right for you and how much you should invest.

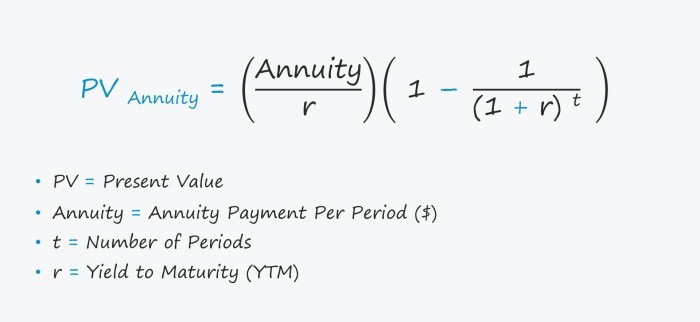

An annuity is a financial product that provides a stream of income payments for a certain period of time. If you’re interested in learning more about the calculations involved, you can find more information about Annuity Calculation Formula 2024.

This article explains the formulas used to calculate annuity payments and how these formulas can help you understand the value of an annuity.

Purpose of an Immediate Annuity Calculator

Immediate annuity calculators are designed to help you understand the potential income you can generate from an immediate annuity. They allow you to input various factors, such as your age, gender, lump sum payment, and desired payment frequency, and then calculate the estimated annuity payment amount.

Variable annuities are a type of investment that can provide a steady stream of income during retirement. If you’re considering this option, you might want to learn more about Variable Annuity Overview 2024. This overview will help you understand the basics of variable annuities, including how they work, their risks, and their potential benefits.

How to Use an Immediate Annuity Calculator

- Input Your Information:Enter your age, gender, and the lump sum payment you are considering.

- Select Payment Frequency:Choose how often you want to receive payments (e.g., monthly, quarterly, annually).

- Select Annuity Type:Choose the type of annuity you are interested in (e.g., fixed, variable, indexed).

- Calculate:Click the “Calculate” button to generate an estimated annuity payment amount.

Key Inputs and Outputs of an Immediate Annuity Calculator

- Inputs:Age, gender, lump sum payment, payment frequency, annuity type.

- Outputs:Estimated annuity payment amount, estimated total income over a specified period, estimated lifetime income.

Factors to Consider When Choosing an Immediate Annuity: Immediate Annuity Calculator

Choosing the right immediate annuity is crucial to ensure that you receive the income you need in retirement. Here are some key factors to consider:

Comparison of Immediate Annuity Types

| Type | Guaranteed Income | Potential for Growth | Risk Level |

|---|---|---|---|

| Fixed | High | Low | Low |

| Variable | Low | High | High |

| Indexed | Moderate | Moderate | Moderate |

Questions to Ask an Insurance Agent

- What are the fees associated with the annuity?

- What are the guarantees and limitations of the annuity?

- What is the insurance company’s financial stability?

- What are the withdrawal options and penalties?

- Are there any inflation protection options available?

Alternatives to Immediate Annuities

Immediate annuities are not the only retirement income option available. Other alternatives to consider include:

Other Retirement Income Options

- Traditional IRA or 401(k):These retirement accounts allow you to save for retirement on a tax-deferred basis. You can withdraw money from these accounts in retirement, but you will be taxed on the withdrawals.

- Roth IRA or 401(k):These retirement accounts allow you to save for retirement on an after-tax basis. You can withdraw money from these accounts in retirement tax-free.

- Annuities:Annuities can provide a guaranteed income stream for life, but they can be complex and come with various fees.

- Reverse Mortgages:A reverse mortgage allows homeowners aged 62 or older to borrow against the equity in their homes. However, reverse mortgages can be risky and should be carefully considered.

Comparison of Features and Benefits

Each retirement income option has its own features and benefits. It’s important to carefully compare the options and choose the one that best suits your individual needs and circumstances.

Pros and Cons of Each Alternative, Immediate Annuity Calculator

When considering alternatives to immediate annuities, it’s essential to weigh the pros and cons of each option. For example, traditional IRAs offer tax-deferred growth but may result in taxable withdrawals in retirement. Roth IRAs provide tax-free withdrawals but require you to contribute after-tax dollars.

Annuities can provide guaranteed income but can be complex and come with fees. Reverse mortgages can provide access to equity but can be risky.

Final Wrap-Up

Understanding the ins and outs of immediate annuities and utilizing a calculator to explore various scenarios can empower you to make informed decisions about your retirement income. While immediate annuities can offer significant benefits, they also involve considerations like interest rate fluctuations and the potential for outliving your annuity payments.

Carefully evaluating your needs, risk tolerance, and financial goals is essential before committing to an immediate annuity. Consulting with a financial advisor can provide valuable insights and guidance tailored to your specific situation.

A variable annuity can be a great way to supplement your retirement income, but it’s important to understand the implications of surrendering your policy. If you’re considering this option, it’s a good idea to learn more about Variable Annuity Out Of Surrender 2024 before you make a decision.

This information will help you understand the potential costs and benefits of surrendering your variable annuity.

Frequently Asked Questions

How do immediate annuities differ from deferred annuities?

Immediate annuities start paying out immediately after purchase, while deferred annuities have a delay before payments begin. This delay allows the investment to grow further before income starts.

What happens if I die before receiving all of my annuity payments?

Most immediate annuities have a death benefit provision. This means that if you die before receiving all of your payments, a beneficiary will receive a lump sum payment or a continuation of payments, depending on the terms of the annuity.

Are there any tax implications associated with immediate annuities?

Yes, annuity payments are generally taxed as ordinary income. However, there are specific tax rules that apply to annuities, so it’s important to consult with a tax advisor to understand the tax implications.