Immediate Annuity Calculator New York Life offers a powerful tool for retirement planning, allowing individuals to explore the potential benefits of immediate annuities. These financial products provide a guaranteed stream of income for life, offering peace of mind and financial security during retirement.

Immediate annuities offer a guaranteed stream of income starting right away. Learn more about their features and how they work in our article on Immediate Annuity Are.

The calculator simplifies the process of understanding how immediate annuities work, enabling users to input their personal information, such as age, desired income, and investment amount, to receive personalized estimates of potential monthly payments. By considering factors like longevity protection and inflation risk, the calculator helps individuals make informed decisions about incorporating immediate annuities into their retirement plans.

Understanding the concept of annuity due is crucial for making informed financial decisions. Explore the differences between annuity due and ordinary annuities in our article on Annuity Due Is 2024.

Contents List

Immediate Annuity Basics

An immediate annuity is a type of insurance product that provides a guaranteed stream of income for life. Once you purchase an immediate annuity, you receive regular payments, either monthly, quarterly, or annually, for the rest of your life. These payments are designed to provide financial security during retirement, ensuring a consistent income stream regardless of market fluctuations or longevity.

Kemper is a well-known provider of variable annuities. To learn more about their offerings, check out our article on Kemper Variable Annuity 2024 , which delves into the features and benefits of their variable annuity products.

Key Features of Immediate Annuities

- Guaranteed Income:Immediate annuities offer a guaranteed stream of income for life, regardless of how long you live. This provides financial security and peace of mind, especially for those concerned about outliving their savings.

- Longevity Protection:Immediate annuities can help mitigate the risk of outliving your savings. Even if you live longer than expected, your annuity payments will continue, ensuring a steady income source.

- Tax-Deferred Growth:The interest earned on the principal of an immediate annuity grows tax-deferred, meaning you won’t pay taxes on the earnings until you start receiving payments.

Benefits of Immediate Annuities for Retirement Planning

Immediate annuities can be a valuable tool for retirement planning, offering several advantages:

- Income Stability:Immediate annuities provide a stable and predictable income stream, which can be crucial for budgeting and planning expenses in retirement.

- Reduced Investment Risk:By converting a lump sum into an annuity, you eliminate the risk associated with market fluctuations and potential investment losses.

- Protection Against Outliving Savings:Immediate annuities provide a lifetime income stream, ensuring that you don’t outlive your retirement savings.

Types of Immediate Annuities Offered by New York Life

New York Life offers a variety of immediate annuity options to meet different needs and preferences. Some common types include:

- Single Premium Immediate Annuity (SPIA):This is the most common type of immediate annuity, where you make a single lump sum payment in exchange for regular income payments for life.

- Fixed Annuity:This type of annuity provides a fixed rate of return, ensuring a predictable income stream. However, the payments may not keep pace with inflation.

- Variable Annuity:This type of annuity offers the potential for higher returns but also carries greater investment risk. The income payments can fluctuate based on the performance of the underlying investment portfolio.

How Immediate Annuities Work

Purchasing an immediate annuity from New York Life is a straightforward process that involves a few key steps.

While annuities can be a valuable financial tool, they are not always the right choice for everyone. To gain a balanced perspective, read our article on Annuity Is Bad 2024 , which examines the potential drawbacks of annuities.

Process of Purchasing an Immediate Annuity

- Contact a New York Life Agent:Begin by contacting a New York Life agent to discuss your retirement income needs and explore different annuity options.

- Provide Information:You’ll need to provide information about your age, health, and financial goals to determine the best annuity option for you.

- Choose an Annuity Type:Select the type of immediate annuity that best aligns with your risk tolerance and income needs, such as a fixed or variable annuity.

- Determine Payment Amount:Decide on the amount of the lump sum payment you’ll make to purchase the annuity. This will determine the amount of your regular income payments.

- Select Payment Frequency:Choose the frequency of your annuity payments, such as monthly, quarterly, or annually.

- Finalize the Agreement:Once you’ve chosen the annuity type, payment amount, and frequency, you’ll finalize the agreement with the New York Life agent.

Calculating Immediate Annuity Payments

The amount of your annuity payments is calculated based on several factors, including:

- Your Age:Younger annuitants typically receive lower payments than older annuitants because they are expected to receive payments for a longer period.

- Principal Amount:The amount of your initial lump sum payment will directly impact the size of your annuity payments.

- Interest Rates:Current interest rates play a role in determining the annuity payment amount.

Payment Options Available with Immediate Annuities

New York Life offers various payment options to suit your needs, such as:

- Lifetime Income:Payments continue for the rest of your life, regardless of how long you live.

- Joint and Survivor:Payments continue for the lifetime of the annuitant and then to a designated survivor for a specific period or for the rest of their life.

- Period Certain:Payments are guaranteed for a specific period, even if the annuitant dies before the end of the period. Any remaining payments are typically paid to a designated beneficiary.

Using the New York Life Immediate Annuity Calculator

The New York Life immediate annuity calculator is a helpful tool that can help you estimate your potential annuity payments based on your individual circumstances.

Planning for retirement in New Zealand? Our article on Annuity Calculator Nz 2024 provides a helpful tool for estimating your future annuity payments.

Step-by-Step Guide to Using the Calculator

- Visit the New York Life Website:Go to the New York Life website and navigate to the immediate annuity calculator page.

- Enter Your Information:Provide your age, desired payment amount, and payment frequency.

- Select Annuity Type:Choose the type of immediate annuity you’re interested in, such as a fixed or variable annuity.

- View Estimated Payments:The calculator will display an estimated range of annuity payments based on the information you provided.

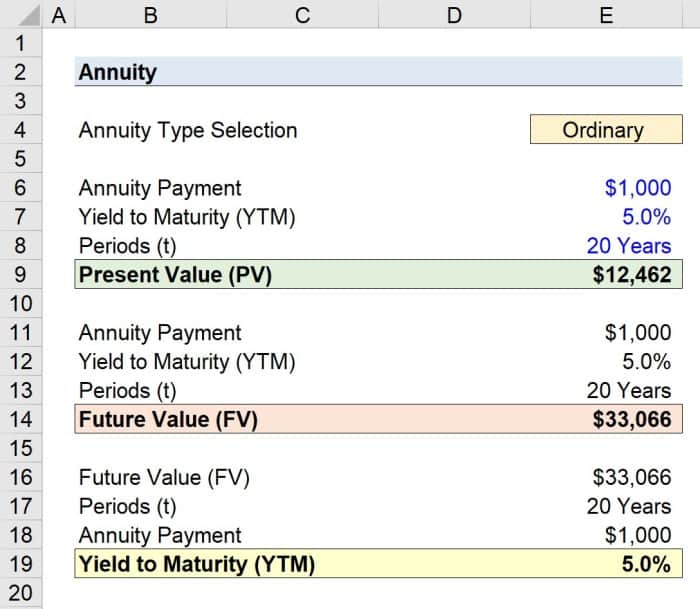

Inputs and Outputs of the Calculator

- Inputs:Age, desired payment amount, payment frequency, and annuity type.

- Outputs:Estimated annuity payments, including a range of potential outcomes based on different interest rate scenarios.

Considering Individual Financial Goals and Circumstances

It’s important to consider your individual financial goals and circumstances when using the New York Life immediate annuity calculator. The calculator can provide a helpful estimate, but it’s crucial to consult with a financial advisor to ensure that an immediate annuity is the right choice for you.

Variable annuity riders can offer additional protection and benefits. Explore the different types of riders and their implications in our article on Variable Annuity Riders 2024.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several potential benefits, but they also come with certain drawbacks. It’s important to weigh both sides before making a decision.

If you’re looking for information on how to calculate an annuity with different payments, you’ve come to the right place. Calculate Annuity With Different Payments 2024 provides a comprehensive guide to understanding the various factors involved in determining annuity payouts.

Potential Benefits of Immediate Annuities, Immediate Annuity Calculator New York Life

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, offering financial security and peace of mind.

- Longevity Protection:They can help mitigate the risk of outliving your savings, ensuring a consistent income stream even if you live longer than expected.

- Tax-Deferred Growth:The interest earned on the principal of an immediate annuity grows tax-deferred, allowing your money to grow tax-free until you start receiving payments.

Potential Drawbacks of Immediate Annuities

- Limited Liquidity:Once you purchase an immediate annuity, you typically can’t access the principal amount. This can be a drawback if you need to access your funds for unexpected expenses.

- Inflation Risk:Fixed annuities provide a fixed rate of return, which may not keep pace with inflation. This means your purchasing power could decline over time.

- Potential for Lower Returns:Immediate annuities may not offer the same potential for high returns as other investment options, such as stocks or bonds.

Comparison to Other Retirement Income Strategies

Immediate annuities are just one of many retirement income strategies. It’s essential to compare them to other options, such as:

- Retirement Savings Accounts (401(k), IRA):These accounts allow you to save for retirement on a tax-deferred basis, but you’ll need to manage your investments and withdraw funds in retirement.

- Annuities:Annuities can provide a guaranteed income stream, but they may come with fees and restrictions.

- Reverse Mortgages:These loans allow homeowners to tap into their home equity, but they can be expensive and come with risks.

Factors to Consider Before Purchasing an Immediate Annuity: Immediate Annuity Calculator New York Life

Before purchasing an immediate annuity, it’s crucial to carefully consider several factors to ensure it aligns with your individual needs and financial goals.

Confused about variable annuities? Our article on What Is A Variable Annuity And How Does It Work 2024 provides a detailed explanation of how these investment vehicles work and their potential benefits.

Key Considerations

- Age:Your age is a significant factor, as younger annuitants typically receive lower payments than older annuitants. Consider your life expectancy and how long you need income.

- Health:Your health can impact your life expectancy and the amount of income you’ll receive. Consider your overall health and any potential health risks.

- Financial Goals:Determine your retirement income needs and how an immediate annuity fits into your overall financial plan. Consider your expenses, desired lifestyle, and other sources of income.

Seeking Professional Financial Advice

It’s essential to consult with a qualified financial advisor before making a decision about purchasing an immediate annuity. They can help you evaluate your options, understand the risks and benefits, and ensure the annuity aligns with your financial goals.

Dreaming of a monthly income of $2,000? Our article on Annuity 2000 Per Month 2024 explores the possibility of achieving this goal through annuity investments.

Questions to Ask Before Purchasing an Immediate Annuity

- What are the different types of immediate annuities available?

- What are the fees and expenses associated with each annuity type?

- What are the payment options available, and how are payments calculated?

- What are the risks and benefits of purchasing an immediate annuity?

- How does an immediate annuity compare to other retirement income strategies?

Epilogue

Whether you’re seeking a steady stream of income or a way to protect your savings against market fluctuations, New York Life’s immediate annuity calculator provides valuable insights. By exploring the calculator’s features and understanding the potential benefits and drawbacks of immediate annuities, individuals can make informed financial decisions that align with their unique retirement goals.

Essential FAQs

What is the minimum investment amount for an immediate annuity with New York Life?

The minimum investment amount for an immediate annuity with New York Life varies depending on the specific annuity product you choose. It’s best to contact a New York Life representative or visit their website for the most up-to-date information.

Can I withdraw my principal from an immediate annuity?

Understanding the intricacies of Class B variable annuities can be challenging, but our article on Class B Variable Annuity 2024 breaks down the key aspects of this financial product in a clear and concise manner.

Immediate annuities typically have limited liquidity. Once you purchase an immediate annuity, you generally cannot withdraw your principal. You receive regular income payments for life, but you do not have access to the original investment amount.

What happens to my annuity payments if I die before receiving all of my principal back?

New York Life offers different death benefit options for immediate annuities. You can choose a death benefit that will pay a lump sum to your beneficiary or continue paying a reduced income stream to your beneficiary for a specific period.

The details of the death benefit will depend on the specific annuity product you choose.

The annuity method is a valuable tool for financial analysis. To learn more about its application and benefits, check out our article on Annuity Method 2024.

For a quick and easy way to learn about variable annuities, check out our article on Variable Annuity Quizlet 2024 , which provides a concise overview of this financial product.

The tax implications of variable annuities can be complex. Our article on Variable Annuity Tax 2024 provides valuable insights into the tax treatment of these investments.

Did you know that “annuity” can be shortened to a seven-letter word? Find out what it is in our article on Annuity 7 Letters 2024.

Calculating your retirement annuity is a crucial step in planning for your financial future. Our article on Calculating Retirement Annuity 2024 provides helpful tips and strategies for determining your retirement income.