Immediate Annuity Calculator Vanguard is a powerful tool that can help you plan for a secure retirement income stream. Annuity contracts provide guaranteed income payments for life, offering peace of mind and financial stability during your golden years. Vanguard, known for its low-cost investment products, also offers a range of immediate annuity options to meet different needs and risk tolerances.

Variable annuities with an “AIR” (Accumulation Interest Rate) feature can offer potential for growth. Variable Annuity Air 2024 explains this feature and its impact on your annuity’s performance.

This guide will explore the world of immediate annuities, specifically focusing on Vanguard’s offerings and the user-friendly calculator they provide. We’ll delve into the benefits, key features, and considerations involved in choosing the right immediate annuity for your retirement planning.

The variable annuity market has seen fluctuations in sales. Variable Annuity Sales 2021 2024 analyzes the trends in variable annuity sales from 2021 to 2024, offering insights into the market’s dynamics.

Contents List

Understanding Immediate Annuities

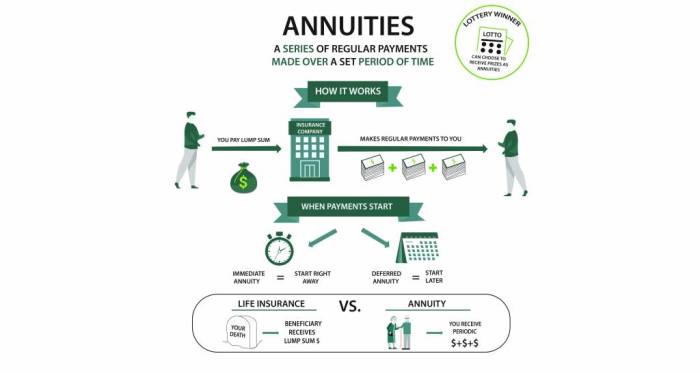

Immediate annuities are financial products that provide a guaranteed stream of income for life, starting immediately after you purchase the annuity. They are often used by retirees to supplement their income and ensure financial security in their later years. Immediate annuities are different from deferred annuities, which provide income payments at a future date, typically after a certain period of time.

If you’re looking for annuity solutions in Sarasota, Florida, “Annuity King Sarasota” might be a familiar name. Annuity King Sarasota 2024 explores this local provider and its offerings.

Benefits of Immediate Annuities

Immediate annuities offer several benefits, making them an attractive option for retirees seeking a steady income stream:

- Guaranteed Income Stream:Immediate annuities provide a guaranteed income stream for life, regardless of how long you live. This provides peace of mind and financial stability, knowing that you will receive regular payments regardless of market fluctuations or your own health.

- Potential Tax Advantages:Depending on the type of annuity and your specific circumstances, you may be able to receive tax-deferred or tax-free income payments. This can help reduce your overall tax burden and increase your after-tax income.

- Longevity Protection:Immediate annuities offer longevity protection, meaning you will receive payments for as long as you live, even if you live longer than expected. This is especially beneficial for individuals who are concerned about outliving their savings.

- Simplicity and Convenience:Immediate annuities are relatively simple to understand and manage. You make a one-time lump sum payment and receive regular income payments for life, without the need for ongoing investment management.

Vanguard’s Immediate Annuity Offerings

Vanguard offers a range of immediate annuity products designed to meet the diverse needs of retirees. Their annuities are known for their competitive rates, low fees, and transparent pricing.

Tax laws vary across the globe, and understanding the tax treatment of annuities in the UK is essential. Is Annuity Income Taxable In Uk 2024 provides guidance on how annuity income is taxed in the United Kingdom.

Vanguard Immediate Annuity Options

Vanguard offers several types of immediate annuities, each with its own unique features and benefits:

- Single Premium Immediate Annuity (SPIA):A SPIA is the most common type of immediate annuity. You make a single lump sum payment, and in return, you receive guaranteed income payments for life. SPIA payments can be structured in various ways, such as fixed payments, increasing payments, or payments that adjust for inflation.

Annuity contracts offer a guaranteed stream of income, but the certainty of payments depends on various factors. Is Annuity Certain 2024 examines the factors that contribute to the certainty of annuity payments.

- Joint and Survivor Annuity:This type of annuity provides income payments for two individuals, typically a married couple. The payments continue until the death of the last surviving spouse. This option ensures that the surviving spouse will continue to receive income after the death of the first spouse.

Knowing the contribution limits for variable annuities is essential for maximizing your savings. Variable Annuity Contribution Limits 2024 provides an overview of these limits and helps you plan your contributions effectively.

- Variable Annuity:While not strictly an immediate annuity, variable annuities offer the potential for growth, but they also carry investment risk. The income payments you receive are tied to the performance of the underlying investments, which can fluctuate over time. Vanguard offers a variety of variable annuity options, allowing you to choose the investment strategy that best aligns with your risk tolerance and financial goals.

The variable annuity industry is constantly evolving, and Variable Annuity Jobs 2024 explores the latest trends and opportunities in this field. If you’re considering a career in this area, this article provides valuable insights.

Factors to Consider When Choosing a Vanguard Annuity

When selecting a Vanguard annuity, it’s essential to consider factors such as your income needs, longevity, and investment goals. The right annuity for one person may not be suitable for another. For example, if you are concerned about inflation, you might choose an annuity that offers inflation protection.

Calculating the future value of an annuity can be helpful for planning. Fv Calculator Annuity 2024 provides insights into using an FV calculator to project the future value of your annuity payments.

If you have a shorter life expectancy, you might prefer a lower payout option to maximize your income during your lifetime.

Variable annuities and 401(k)s are both retirement savings options, but they have different features. Variable Annuity Vs 401k 2024 helps you compare these two options to determine which best aligns with your financial goals.

Using the Vanguard Immediate Annuity Calculator

Vanguard provides a user-friendly online calculator to help you estimate your potential annuity payments and explore different scenarios. The calculator allows you to input your age, gender, the amount you wish to invest, and your preferred payout option.

The Annuity 2000 Mortality Table is a crucial factor in calculating annuity payouts. Annuity 2000 Mortality Table 2024 provides insights into its significance and how it impacts your annuity payments.

Using the Calculator

- Visit Vanguard’s website:Go to Vanguard’s website and navigate to the “Retirement” or “Annuities” section. You should find the immediate annuity calculator there.

- Enter your information:Input your age, gender, the amount you wish to invest, and your desired payout option. You can also adjust other parameters, such as the frequency of payments and the duration of the annuity.

- Generate a quote:Once you have entered your information, click “Calculate” to generate a personalized annuity quote. The calculator will provide an estimated monthly payment amount and the total projected income you will receive over the life of the annuity.

- Explore different scenarios:You can use the calculator to explore different scenarios by changing your input parameters. For example, you can see how your estimated income changes if you invest a different amount, choose a different payout option, or adjust your age or gender.

Annuity insurance is a complex topic, and deciding whether it’s right for you in 2024 can be tricky. Is Annuity Insurance 2024 delves into the pros and cons, helping you make an informed decision.

Factors to Consider When Choosing an Immediate Annuity

Choosing an immediate annuity is a significant financial decision that should not be taken lightly. Several factors should be considered before making a decision:

Key Factors to Consider, Immediate Annuity Calculator Vanguard

- Income Needs:How much income do you need to maintain your desired lifestyle in retirement? This will help determine the appropriate annuity payment amount and payout option.

- Longevity:How long do you expect to live? This is crucial for determining the length of your annuity payments and whether you need longevity protection.

- Investment Goals:Do you have other investment goals, such as leaving an inheritance or funding specific expenses? Your investment goals should be considered when evaluating the suitability of an immediate annuity.

- Risk Tolerance:Are you comfortable with the potential for market fluctuations? Immediate annuities provide guaranteed income payments, but they do not offer the potential for growth. If you are risk-averse, an immediate annuity may be a suitable option.

Importance of Consulting a Financial Advisor

It is highly recommended to consult with a qualified financial advisor before making a decision about an immediate annuity. A financial advisor can help you assess your individual circumstances, understand the different annuity options available, and choose the product that best aligns with your financial goals and risk tolerance.

Understanding the tax implications of annuities is crucial. Is An Annuity Qualified Or Nonqualified 2024 provides clarity on whether your annuity is classified as qualified or nonqualified, helping you navigate tax-related issues.

Alternative Options to Immediate Annuities: Immediate Annuity Calculator Vanguard

While immediate annuities offer guaranteed income streams, they are not the only option for generating retirement income. Several alternative strategies can be considered, each with its own advantages and disadvantages:

Alternative Income-Generating Strategies

- Fixed Income Investments:Bonds, certificates of deposit (CDs), and other fixed income investments provide a steady stream of income with lower risk than stocks. However, their returns are typically lower than stocks and may not keep pace with inflation.

- Dividend-Paying Stocks:Stocks that pay dividends provide a source of income, but their value can fluctuate. Dividend payments are not guaranteed and can be reduced or eliminated if a company’s financial performance deteriorates.

- Real Estate:Real estate can provide rental income, but it also requires significant capital investment and ongoing management. The value of real estate can fluctuate, and there are risks associated with tenant issues and property maintenance.

Comparing Immediate Annuities and Alternatives

When comparing immediate annuities to alternative income-generating strategies, it’s essential to consider factors such as guaranteed income, potential for growth, risk tolerance, and tax implications. Immediate annuities offer guaranteed income and longevity protection, but they lack the potential for growth.

Wondering how inflation might impact your variable annuity in 2024? You’re not alone. Variable Annuity Inflation 2024 explores this topic, examining the potential for growth and risk within the current economic climate.

Alternative strategies, such as stocks and real estate, offer the potential for growth but also carry greater risk.

Last Word

Immediate annuities can be a valuable component of a well-rounded retirement plan. By using Vanguard’s calculator and carefully considering your individual circumstances, you can make informed decisions about your income stream and enjoy a secure and fulfilling retirement.

FAQ Explained

How does Vanguard’s Immediate Annuity Calculator work?

Vanguard’s calculator allows you to input your desired income amount, starting date, and other factors. It then provides personalized quotes based on your specific needs and current market conditions.

Dave Ramsey, a renowned financial advisor, has strong opinions on variable annuities. Variable Annuity Dave Ramsey 2024 summarizes his stance and offers an alternative perspective on this investment strategy.

What are the different types of immediate annuities offered by Vanguard?

Vanguard offers various immediate annuity options, including fixed annuities, variable annuities, and indexed annuities. Each type has different features and risk profiles, so it’s important to understand the differences before making a choice.

Can I adjust my annuity payments after I purchase an annuity?

The specific terms and conditions of your annuity contract will determine if you can adjust your payments. Some annuities allow for periodic adjustments, while others are fixed for the duration of the contract.

Variable annuities are often associated with growth potential, but it’s important to understand their role in fixed income portfolios. Is Annuity Fixed Income 2024 clarifies how variable annuities fit into the fixed income landscape.