Immediate Annuity Details sets the stage for this exploration, offering a comprehensive understanding of a financial tool that provides guaranteed income for life. These annuities, often considered a cornerstone of retirement planning, allow individuals to transform a lump sum of money into a steady stream of payments, providing peace of mind and financial security.

Understanding the tax implications of annuity withdrawals is crucial for retirement planning. This helpful tool can assist you: Annuity Withdrawal Tax Calculator 2024. Another aspect to consider is the distinction between Class B variable annuities, as explained in this article: Class B Variable Annuity 2024.

This guide delves into the intricacies of immediate annuities, explaining their workings, highlighting their benefits, and addressing potential risks. We’ll explore various types, from fixed to variable and indexed annuities, examining the factors that influence payout amounts and frequencies. Ultimately, this exploration aims to empower readers with the knowledge needed to make informed decisions about whether an immediate annuity aligns with their individual financial goals.

If you’re considering an annuity with a starting amount of $70,000, you’ll want to explore the details of annuities tailored to this specific amount. Remember, each annuity has its own unique features and benefits, so thorough research is essential for making the right choice for your retirement planning.

Contents List

- 1 Immediate Annuity Basics

- 2 How Immediate Annuities Work

- 3 Benefits of Immediate Annuities

- 4 Considerations Before Purchasing an Immediate Annuity

- 5 Immediate Annuity Providers and Products

- 6 Illustrative Examples of Immediate Annuities

- 7 Final Thoughts

- 8 Essential Questionnaire: Immediate Annuity Details

Immediate Annuity Basics

An immediate annuity is a type of insurance product that provides a guaranteed stream of income for life. It’s a popular choice for individuals seeking to secure their retirement income or supplement their existing income stream. This article will delve into the intricacies of immediate annuities, exploring their features, benefits, risks, and how they work.

Definition of an Immediate Annuity

An immediate annuity is a contract where you make a lump-sum payment to an insurance company in exchange for regular, guaranteed income payments that begin immediately. These payments can continue for the rest of your life, or for a specific period, depending on the type of annuity you choose.

When it comes to immediate annuities, the accumulation period is a key factor to consider. If you’re looking for a more in-depth understanding of variable annuities, you might find this resource helpful: Variable Annuity Quizlet 2024. It offers a comprehensive overview of this complex financial product.

Key Features of Immediate Annuities

Immediate annuities are distinguished from other annuity types by several key features:

- Immediate Income:Payments start immediately after the lump-sum payment is made.

- Guaranteed Income:The amount of each payment is fixed and guaranteed for the duration of the annuity.

- Longevity Protection:Immediate annuities provide a stream of income that can continue for the rest of your life, regardless of how long you live.

- Tax Benefits:The income from an immediate annuity is often taxed favorably, especially for those in retirement.

Situations Where Immediate Annuities Are Suitable, Immediate Annuity Details

Immediate annuities can be a suitable financial solution in various situations, including:

- Retirement Income:Immediate annuities provide a guaranteed income stream to supplement or replace other retirement income sources.

- Longevity Protection:For individuals concerned about outliving their savings, immediate annuities offer a guaranteed income stream for life.

- Estate Planning:Immediate annuities can be used to create a steady stream of income for beneficiaries after the annuitant’s death.

How Immediate Annuities Work

Understanding the mechanics of immediate annuities is crucial for making informed decisions about their suitability for your financial goals.

Purchasing an Immediate Annuity

The process of purchasing an immediate annuity involves these steps:

- Choose an Annuity Provider:Research and select a reputable insurance company offering immediate annuities.

- Determine Your Annuity Type:Decide between fixed, variable, or indexed annuities based on your risk tolerance and investment goals.

- Choose Your Payment Options:Select the frequency of payments (monthly, quarterly, annually) and the payment period (life, period certain, or a combination).

- Make the Lump-Sum Payment:Fund the annuity with a lump-sum payment, which will determine the amount of your guaranteed income stream.

- Receive Your Payments:Start receiving your guaranteed income payments according to the terms of your annuity contract.

Types of Immediate Annuities

Immediate annuities come in various forms, each with its own characteristics and payout structure:

- Fixed Annuities:Offer a fixed, guaranteed income stream for life, regardless of market fluctuations. They provide certainty but may not keep pace with inflation.

- Variable Annuities:Allow you to invest your lump-sum payment in a variety of sub-accounts, offering potential for growth but also exposing you to market risk. The income stream fluctuates based on the performance of your chosen investments.

- Indexed Annuities:Link your income stream to the performance of a specific market index, such as the S&P 500. They offer the potential for growth while providing some protection against losses.

Factors Influencing Payout Amount and Frequency

Several factors influence the amount and frequency of your immediate annuity payments:

- Lump-Sum Payment:The larger the lump-sum payment, the higher your guaranteed income stream.

- Age and Gender:Older individuals and women typically receive higher payments due to their shorter life expectancies.

- Interest Rates:Higher interest rates generally lead to higher annuity payments.

- Annuity Type:The type of annuity (fixed, variable, indexed) influences the payout structure and potential growth.

Benefits of Immediate Annuities

Immediate annuities offer several advantages that can make them an attractive retirement income solution.

Advantages of Immediate Annuities

- Guaranteed Income:Immediate annuities provide a steady stream of income for life, regardless of market fluctuations or your health.

- Longevity Protection:This feature ensures you won’t outlive your savings, providing peace of mind in retirement.

- Tax Benefits:The income from an immediate annuity is often taxed favorably, especially for those in retirement.

- Simplicity:Immediate annuities are relatively straightforward to understand and manage, eliminating the complexities of investment management.

Achieving Financial Goals with Immediate Annuities

Immediate annuities can help individuals achieve specific financial goals, such as:

- Retirement Income:Provide a reliable source of income to supplement or replace other retirement income sources.

- Estate Planning:Create a steady stream of income for beneficiaries after the annuitant’s death.

- Longevity Protection:Ensure a steady income stream throughout your retirement years, regardless of how long you live.

Comparison with Other Retirement Income Strategies

Immediate annuities offer advantages over other retirement income strategies, such as:

- Guaranteed Income:Unlike investments, immediate annuities provide a guaranteed income stream, eliminating the risk of market fluctuations.

- Longevity Protection:Unlike traditional savings accounts, immediate annuities provide a stream of income that can continue for the rest of your life.

- Simplicity:Compared to managing a portfolio of investments, immediate annuities are relatively straightforward to understand and manage.

Considerations Before Purchasing an Immediate Annuity

Before purchasing an immediate annuity, it’s essential to carefully consider the potential risks and ensure it aligns with your financial goals and circumstances.

Variable annuities can be complex, and one aspect to consider is the unit investment trust option. Understanding how this works is crucial when deciding if a variable annuity is right for you. You might also want to explore buyout offers available for variable annuities.

Potential Risks Associated with Immediate Annuities

- Interest Rate Risk:If interest rates rise after you purchase an annuity, your guaranteed income stream may be lower than if you had purchased the annuity at a later date.

- Inflation Risk:The purchasing power of your fixed income stream may decline over time if inflation outpaces the growth of your annuity payments.

- Loss of Principal:Once you purchase an immediate annuity, you generally cannot access your lump-sum payment. This can be a concern if you need to access your funds for unforeseen circumstances.

Importance of Considering Individual Circumstances

Before purchasing an immediate annuity, it’s crucial to consider your individual financial circumstances and goals, including:

- Age and Life Expectancy:Younger individuals may find immediate annuities less appealing, as they have a longer time horizon and may prefer to invest their money in growth-oriented assets.

- Risk Tolerance:Immediate annuities provide guaranteed income but may not keep pace with inflation. Individuals with a higher risk tolerance may prefer investments with the potential for higher returns.

- Financial Goals:Immediate annuities are suitable for specific financial goals, such as retirement income or longevity protection. Ensure the annuity aligns with your overall financial plan.

Questions to Ask Annuity Providers

Before purchasing an immediate annuity, ask potential annuity providers these questions:

- What are the fees associated with the annuity?

- What is the guaranteed income stream, and how is it calculated?

- What are the payment options available?

- What are the surrender charges and other penalties for early withdrawal?

- What is the financial strength and stability of the insurance company?

Immediate Annuity Providers and Products

Several reputable insurance companies offer a range of immediate annuity products. Understanding the features, benefits, and fees of different providers and products is crucial for making an informed decision.

Variable annuities allow you to invest in a range of funds. It’s important to carefully consider the different fund options available to you and their potential for growth. You might also be interested in learning about annuities with a guaranteed 4% return, as detailed here: Annuity 4 Percent 2024.

Prominent Immediate Annuity Providers

| Provider | Website |

|---|---|

| AIG | aig.com |

| New York Life | newyorklife.com |

| Prudential | prudential.com |

| TIAA | tiaa.org |

| Transamerica | transamerica.com |

Comparison of Immediate Annuity Products

| Provider | Product Name | Features | Benefits | Fees |

|---|---|---|---|---|

| AIG | AIG Life Income Annuity | Fixed income stream, lifetime payments | Guaranteed income, longevity protection | Annual fee, surrender charges |

| New York Life | New York Life Immediate Annuity | Fixed income stream, period certain options | Guaranteed income, tax benefits | Annual fee, surrender charges |

| Prudential | Prudential Immediate Annuity | Variable income stream, investment options | Potential for growth, tax-deferred growth | Annual fee, investment management fees |

| TIAA | TIAA Immediate Annuity | Indexed income stream, market index linked | Potential for growth, inflation protection | Annual fee, surrender charges |

| Transamerica | Transamerica Immediate Annuity | Fixed income stream, flexible payment options | Guaranteed income, longevity protection | Annual fee, surrender charges |

Types of Immediate Annuities and Their Suitability

| Type | Payout Structure | Suitability |

|---|---|---|

| Fixed Annuity | Guaranteed, fixed income stream | Individuals seeking guaranteed income, risk-averse investors |

| Variable Annuity | Income stream fluctuates based on investment performance | Individuals with higher risk tolerance, seeking potential for growth |

| Indexed Annuity | Income stream linked to a market index | Individuals seeking potential for growth with some inflation protection |

Illustrative Examples of Immediate Annuities

Let’s consider a hypothetical scenario to illustrate how immediate annuities work in practice.

Scenario: Retirement Income

Imagine John, a 65-year-old retiree, has a lump sum of $500,000 saved for retirement. He wants to secure a guaranteed income stream to supplement his existing savings. John decides to purchase a fixed immediate annuity with a monthly payment option.

The insurance company offers him a guaranteed annual income of $30,000, or $2,500 per month, based on his age, gender, and the current interest rates.

Variable annuities are often offered by life insurance companies. These companies can provide valuable information about the different types of variable annuities available, including those with “O” shares, as explained in this article: O Share Variable Annuity 2024.

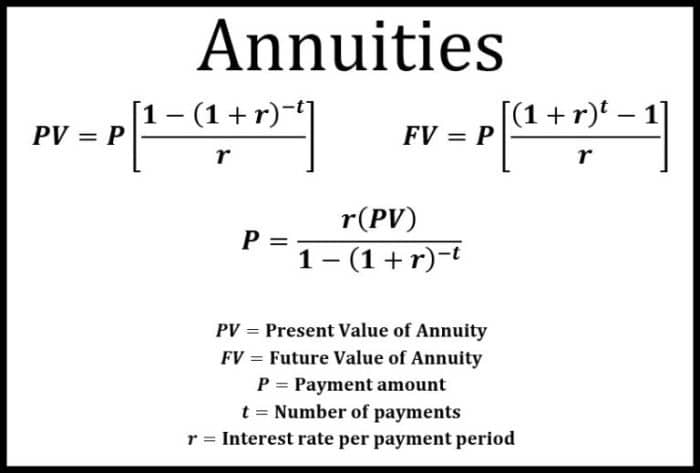

Calculation and Distribution of Payout

John’s annuity payout is calculated based on the lump-sum payment, his age, gender, and the annuity provider’s interest rate assumptions. The monthly payment of $2,500 will be distributed to him for the rest of his life, providing a guaranteed income stream that he can rely on.

Planning for retirement in 2024? You might want to consider a variable annuity to help secure your future. These annuities offer the potential for growth, but it’s important to understand the differences between them and traditional IRAs, as explained in this article: Variable Annuity Vs Ira 2024.

Impact on Retirement Income Stream

John’s immediate annuity provides a reliable source of income, ensuring he has a steady stream of cash flow to cover his expenses in retirement. The guaranteed income stream provides peace of mind, eliminating the uncertainty of market fluctuations and allowing him to focus on enjoying his retirement years.

Final Thoughts

Immediate annuities can be a valuable tool for individuals seeking guaranteed income, particularly during retirement. By carefully considering the various types, benefits, and risks, you can determine if an immediate annuity fits within your overall financial strategy. Remember, seeking professional financial advice is crucial to ensure that your investment decisions are aligned with your unique circumstances and goals.

Essential Questionnaire: Immediate Annuity Details

What are the tax implications of immediate annuities?

The payments received from an immediate annuity are typically taxed as ordinary income. However, the specific tax treatment may vary depending on the type of annuity and the individual’s tax situation. It’s essential to consult with a tax advisor to understand the tax implications of your specific annuity.

Can I withdraw my principal investment from an immediate annuity?

Reaching the age of 70 1/2? This milestone brings important decisions regarding retirement income. Learn more about annuities and their implications at this age. It’s also a good time to address any questions you may have about annuities, which you can find answers to here: Annuity Questions 2024.

Immediate annuities are generally considered non-withdrawable contracts. Once you purchase an immediate annuity, you typically cannot access the principal investment. However, some annuities may offer limited withdrawal options, but these may come with penalties or restrictions.

How do immediate annuities differ from deferred annuities?

Immediate annuities provide payments immediately after purchase, while deferred annuities offer payments at a later date, often during retirement. Deferred annuities allow for growth potential during the accumulation period, but they don’t provide guaranteed income until the payout phase begins.