Immediate Annuity Earnings offer a unique way to generate income, particularly for retirees or individuals seeking a steady stream of payments. Unlike other annuities that require a period of accumulation before payouts begin, immediate annuities provide regular income payments starting immediately upon purchase.

A Guaranteed Variable Annuity 2024 offers some level of protection against market fluctuations, but it’s essential to weigh the pros and cons carefully. With thorough research and understanding, you can make informed decisions about your retirement savings.

These annuities are essentially contracts with insurance companies where you exchange a lump sum of money for a guaranteed stream of income for life or a specific period.

The appeal of immediate annuities lies in their ability to provide financial security and peace of mind. They can be a valuable tool for individuals looking to supplement their retirement income, fund long-term care expenses, or simply enjoy the benefits of a guaranteed income stream.

Contents List

Understanding Immediate Annuities

Immediate annuities are a type of insurance product that provides a guaranteed stream of income for life, starting immediately after the purchase. Unlike other annuities, such as deferred annuities, immediate annuities don’t require a period of accumulation before payments begin.

These products are particularly appealing to retirees seeking a secure and predictable income stream to supplement their savings.

Key Features and Benefits of Immediate Annuities

Immediate annuities offer a range of features and benefits that make them attractive to individuals looking for guaranteed income. These features include:

- Guaranteed Income for Life:Immediate annuities provide a steady stream of payments for the remainder of the annuitant’s life, regardless of how long they live. This eliminates the risk of outliving one’s savings.

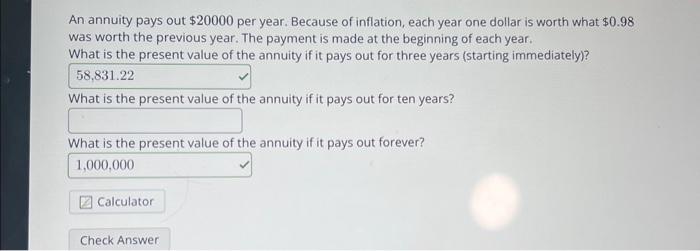

- Protection Against Inflation:Some immediate annuities offer inflation protection, which adjusts payments upward over time to keep pace with rising costs. This ensures that the purchasing power of the income stream remains relatively constant.

- Tax-Deferred Growth:The earnings on an immediate annuity are generally tax-deferred until they are withdrawn, which can help to reduce the overall tax burden.

- Simplicity and Predictability:Immediate annuities are relatively simple to understand and manage. The payment amounts are fixed, and the payout schedule is predictable, making it easier to plan for future expenses.

Types of Immediate Annuities

Immediate annuities come in various forms, each with its own unique characteristics and features. Some common types include:

- Single Premium Immediate Annuity (SPIA):This type of annuity is purchased with a lump-sum payment, and the payments begin immediately after the purchase.

- Fixed Immediate Annuity:A fixed immediate annuity provides a fixed payment amount for life, regardless of market fluctuations. The payment amount is determined at the time of purchase and remains unchanged.

- Variable Immediate Annuity:With a variable immediate annuity, the payment amount is linked to the performance of a specific investment portfolio. The payments can fluctuate based on the portfolio’s performance, but they are not guaranteed.

- Indexed Immediate Annuity:An indexed immediate annuity offers a combination of guaranteed payments and potential growth based on the performance of a specific index, such as the S&P 500.

How Immediate Annuities Generate Earnings

Immediate annuities generate income by converting a lump-sum payment into a stream of regular payments. The process involves a combination of interest rate calculations and mortality rate assumptions.

If you’re considering an immediate annuity, you can find helpful information in the Immediate Annuity Brochure. You can also easily Calculate Annuity Online 2024 to get a better understanding of your potential returns.

Interest Rates and Mortality Rates

The amount of income an immediate annuity provides is influenced by the prevailing interest rates and the annuitant’s life expectancy. Insurance companies use a combination of these factors to calculate the annuity payments. Higher interest rates generally lead to larger payments, as the insurer can earn more on the invested funds.

Conversely, lower interest rates result in smaller payments.

Variable annuities offer flexibility, but it’s important to consider Variable Annuity Withdrawals 2024 and potential penalties. When choosing an annuity, you’ll need to consider the Annuity Issuer 2024 and their reputation.

Mortality rates, which reflect the likelihood of an individual dying at a particular age, also play a crucial role. The insurer assumes that the annuitant will live for a certain period, and the payments are structured accordingly. If the annuitant lives longer than expected, the insurer will pay out more than initially anticipated.

Many people are interested in 5 Percent Annuity 2024 , but it’s important to remember that returns are not guaranteed. You should also be aware of Variable Annuity Early Withdrawal Penalty 2024 before making any decisions.

However, if the annuitant dies earlier, the insurer will have paid out less.

Annuitization, Immediate Annuity Earnings

The process of converting a lump-sum payment into a stream of payments is known as “annuitization.” When you purchase an immediate annuity, you essentially exchange your principal for a guaranteed income stream. The insurer uses the principal to invest in a portfolio of assets, and the earnings from these investments are used to fund the annuity payments.

Understanding Calculating Annuity Cash Flows 2024 is crucial for planning your retirement. Before diving into the details, it’s helpful to review Annuity What Is It Definition 2024 to get a clear understanding of the concept.

The annuitant is essentially selling their longevity risk to the insurer in exchange for a guaranteed income stream.

Factors Influencing Immediate Annuity Earnings

The amount of income an immediate annuity provides is influenced by a variety of factors, including:

Investment Strategies

The insurer’s investment strategy plays a significant role in determining the annuity payments. Insurance companies use a variety of investment strategies to generate returns on the funds they receive from annuity purchases. The type of investments they choose and the performance of those investments will impact the amount of income they can distribute to annuitants.

Age and Health

An individual’s age and health are also key factors in determining annuity payouts. Younger individuals with longer life expectancies will generally receive lower payments than older individuals with shorter life expectancies. Similarly, individuals in good health will typically receive higher payments than those with health conditions that may shorten their life expectancy.

Jackson is a well-known provider of variable annuities, and you can learn more about Jackson Variable Annuity 2024 and Variable Annuity Jackson 2024. To understand the basics, you can read about Immediate Annuity Defined.

Other Personal Factors

Other personal factors, such as gender, marital status, and the presence of dependents, can also affect annuity payouts. For example, women generally live longer than men, so they may receive lower payments than men of the same age. Individuals with dependents may also receive lower payments, as the insurer assumes that they will need to provide income for a longer period.

Immediate Annuities vs. Other Investment Options

Immediate annuities are just one of many investment options available to individuals. They offer a unique combination of guaranteed income, longevity protection, and tax benefits. However, it is important to consider the advantages and disadvantages of immediate annuities compared to other investment options.

Comparison with Other Investment Options

| Investment Option | Risk | Return | Liquidity |

|---|---|---|---|

| Immediate Annuity | Low | Moderate | Low |

| Bonds | Moderate | Moderate | Moderate |

| Stocks | High | High | High |

| Real Estate | High | High | Low |

Immediate annuities offer a lower risk profile than stocks or real estate, as they provide guaranteed income. However, they also have lower potential returns than these investments. Bonds offer a moderate level of risk and return, and they are generally more liquid than immediate annuities.

Stocks are the riskiest investment option but also have the potential for the highest returns. Real estate can offer both high risk and high return, but it is also relatively illiquid.

Considerations for Choosing an Immediate Annuity

Individuals considering an immediate annuity should carefully evaluate their financial situation, investment goals, and risk tolerance. There are a number of factors to consider when selecting an annuity provider and product.

Factors to Consider

- Annuity Provider:It is important to choose a reputable and financially sound annuity provider. Research the provider’s financial stability, track record, and customer service ratings.

- Annuity Product:There are a variety of immediate annuity products available, each with its own features and benefits. Carefully compare the different options to find one that meets your specific needs and financial goals.

- Payment Options:Consider the payment frequency and payment options available. Some annuities offer monthly payments, while others offer quarterly or annual payments. You can also choose to receive a lump-sum payment or a combination of lump-sum and periodic payments.

- Inflation Protection:If you are concerned about inflation, look for an annuity that offers inflation protection. This will help to ensure that your income stream keeps pace with rising costs.

- Fees and Expenses:Be aware of any fees and expenses associated with the annuity. Some annuities charge annual fees, surrender charges, or other expenses. Make sure you understand the cost structure before making a purchase.

Important Questions to Ask

Before purchasing an immediate annuity, it is important to ask yourself the following questions:

- What are my financial goals?

- What is my risk tolerance?

- How long do I expect to live?

- What is my income needs?

- What are the potential tax implications?

- What are the fees and expenses associated with the annuity?

Closing Notes: Immediate Annuity Earnings

Understanding immediate annuities and their earning potential can be crucial in making informed financial decisions. By carefully considering your individual needs, financial goals, and risk tolerance, you can determine if an immediate annuity is a suitable investment strategy. Remember, seeking professional financial advice from a qualified advisor can help you navigate the complexities of annuity products and make the best choice for your unique circumstances.

Essential Questionnaire

What is the minimum amount I need to invest in an immediate annuity?

The minimum investment amount varies depending on the annuity provider and the specific product. It’s essential to research and compare different options to find the best fit for your financial situation.

How long will I receive income payments from an immediate annuity?

You can choose an immediate annuity that provides income for life or for a fixed period. The duration of payments depends on the type of annuity you select.

Are there any fees associated with immediate annuities?

Yes, there are typically fees associated with immediate annuities, such as administrative fees, surrender charges, and mortality and expense charges. It’s crucial to understand all the fees involved before purchasing an annuity.

Annuity issues can be complex, especially in 2024, so it’s crucial to understand the Annuity Issues 2024. Understanding the terms like Annuity Is Term 2024 and how An Annuity Is A Series Of 2024 can help you make informed decisions.

What happens if I die before I receive all the income payments from my immediate annuity?

In most cases, the remaining income payments are either paid to a designated beneficiary or returned to the insurance company. The specific terms vary depending on the annuity contract.