Immediate Annuity Example illustrates how this financial product can provide a steady stream of income during retirement. Imagine a 65-year-old individual with $500,000 in retirement savings who desires a monthly income of $3,000. By purchasing an immediate annuity, they can transform their savings into a guaranteed income stream, ensuring financial security throughout their golden years.

Annuity plans are a popular topic in financial education. Take a look at Annuity Is A Mcq 2024 to test your knowledge and learn more about these plans.

This example explores the mechanics of immediate annuities, outlining the calculation process, factors influencing payment amounts, and the advantages and disadvantages of this retirement income strategy. We will also compare immediate annuities with other popular retirement options, such as traditional IRAs or 401(k)s, to provide a comprehensive understanding of their place in retirement planning.

Explore the world of variable annuities with Variable Annuity Usa 2024. This resource provides valuable information about these investment vehicles and their potential benefits.

Contents List

- 1 Immediate Annuity Basics

- 2 Immediate Annuity Example: Scenario

- 3 Calculating Immediate Annuity Payments: Immediate Annuity Example

- 4 Advantages and Disadvantages of Immediate Annuities

- 5 Immediate Annuity vs. Other Retirement Options

- 6 Considerations for Choosing an Immediate Annuity

- 7 Closure

- 8 Answers to Common Questions

Immediate Annuity Basics

An immediate annuity is a financial product that provides a guaranteed stream of income for life, starting immediately after you purchase it. It’s a popular choice for retirees looking for a reliable source of income to cover their expenses. In this article, we’ll delve into the specifics of immediate annuities, covering their features, types, benefits, drawbacks, and how they compare to other retirement income options.

If you’re comfortable with calculations, you can learn how to calculate your own annuity payments. Check out How To Calculate Annuity On Casio Calculator 2024 for step-by-step instructions.

Definition of an Immediate Annuity

An immediate annuity is a type of annuity contract that begins making payments to the annuitant immediately after the purchase. In essence, you exchange a lump sum of money for a guaranteed stream of income that continues for the rest of your life.

Variable annuities offer the potential for growth alongside income. Discover the possibilities of Variable Annuity Life Insurance Company Amarillo Tx 2024 and see if this option is right for you.

Key Features of an Immediate Annuity

Immediate annuities are characterized by several key features that make them attractive to certain individuals:

- Guaranteed Income:Once you purchase an immediate annuity, you’re guaranteed a fixed stream of income for the rest of your life, regardless of how long you live.

- Longevity Protection:This feature ensures that you’ll receive income for as long as you live, even if you outlive your savings. This is especially beneficial for those concerned about running out of money in retirement.

- Flexibility:You can choose the payment frequency (monthly, quarterly, annually, etc.) and the term (fixed period or lifetime) that best suits your needs.

- Tax-Deferred Growth:The earnings on your annuity contract grow tax-deferred, meaning you won’t pay taxes on the growth until you start receiving payments.

Types of Immediate Annuities, Immediate Annuity Example

There are several types of immediate annuities available, each with its own unique characteristics:

- Single Premium Immediate Annuity (SPIA):This is the most common type of immediate annuity, where you make a single lump-sum payment to purchase the annuity.

- Fixed Immediate Annuity:This type provides a fixed payment amount for the life of the annuity, regardless of market fluctuations.

- Variable Immediate Annuity:This type offers payments that fluctuate based on the performance of an underlying investment portfolio. This can lead to higher returns but also carries more risk.

- Indexed Immediate Annuity:This type provides payments that are linked to the performance of a specific index, such as the S&P 500. It offers potential for growth while also providing some downside protection.

Immediate Annuity Example: Scenario

Let’s consider a hypothetical scenario to illustrate how an immediate annuity works. Suppose John, a 65-year-old retiree, has $500,000 in retirement savings. He wants to use a portion of his savings to secure a steady income stream and plans to purchase an immediate annuity with $250,000.

One of the key features of annuities is their guaranteed payouts. Understand the specifics of Is Annuity Certain 2024 to make informed decisions about your retirement income.

He desires a monthly income of $2,000 and prefers to receive payments for the rest of his life. He chooses a fixed immediate annuity with a guaranteed monthly payment of $2,000 for life.

A single premium annuity can provide a substantial starting point for your retirement income. Learn more about G Purchased A $50 000 Single Premium 2024 to understand how this option might benefit you.

Calculating Immediate Annuity Payments: Immediate Annuity Example

The payment amount you receive from an immediate annuity depends on several factors, including:

- Your age:The older you are, the higher your annuity payment will be, as you’re expected to live for a shorter period.

- The amount of your purchase payment:The more you invest in the annuity, the higher your monthly payments will be.

- Interest rates:Higher interest rates generally lead to higher annuity payments.

- Mortality tables:These tables are used by insurance companies to estimate life expectancy, which influences annuity payment amounts.

Calculating Payments for John’s Scenario

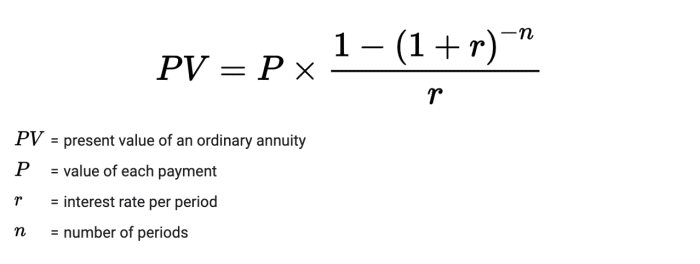

In John’s case, the insurance company would use its mortality tables and current interest rates to determine the monthly payment amount. Since this is a hypothetical example, we won’t be able to provide precise calculations, but the process would involve using actuarial calculations to determine the present value of the future income stream based on his age and chosen payment term.

Want to see how an annuity might work for you? Try using an Annuity Calculator Usa 2024. These online tools can help you estimate your potential payouts based on your individual circumstances and investment preferences.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer both advantages and disadvantages, and it’s important to weigh these carefully before making a decision.

It’s important to understand how annuity payments are treated for tax purposes. Check out Is Annuity Counted As Income 2024 to gain clarity on this aspect.

Advantages

Here are some of the key benefits of immediate annuities:

- Guaranteed Income:Provides a predictable and reliable income stream for life.

- Longevity Protection:Ensures that you’ll receive income even if you live longer than expected.

- Tax-Deferred Growth:Earnings grow tax-deferred until you start receiving payments.

- Simplicity:Relatively straightforward to understand and purchase.

Disadvantages

Immediate annuities also have some potential drawbacks:

- Limited Flexibility:Once you purchase an annuity, you generally cannot withdraw your principal or change the payment amount.

- Potential for Lower Returns:The returns on immediate annuities may be lower than other investment options, especially if interest rates are low.

- Inflation Risk:Fixed annuity payments may not keep pace with inflation, eroding your purchasing power over time.

- Lack of Control:You have limited control over how your money is invested.

Immediate Annuity vs. Other Retirement Options

Immediate annuities are just one of many retirement income options available. It’s essential to compare them to other strategies to determine which best suits your individual needs and goals.

Annuity plans can be integrated with other financial strategies. Explore the possibilities of Annuity Health Insurance 2024 to find a solution that addresses both your financial and health needs.

Traditional IRAs and 401(k)s

Traditional IRAs and 401(k)s are tax-advantaged retirement savings accounts that allow you to accumulate funds for retirement. However, these accounts don’t provide guaranteed income, and you’re responsible for managing your investments and withdrawals.

Don’t forget to factor in inflation when planning for your future. An Annuity Calculator With Inflation 2024 can help you account for the rising cost of living and ensure your retirement income remains adequate.

| Feature | Immediate Annuity | Traditional IRA/401(k) |

|---|---|---|

| Income Security | Guaranteed income for life | No guaranteed income |

| Growth Potential | Limited growth potential, depending on the type of annuity | Potential for higher growth, but subject to market risk |

| Flexibility | Limited flexibility, typically no withdrawals allowed | Greater flexibility in withdrawals and investment choices |

| Tax Benefits | Tax-deferred growth, but taxed as ordinary income at withdrawal | Tax-deferred growth, but taxed at withdrawal |

Considerations for Choosing an Immediate Annuity

Before purchasing an immediate annuity, it’s crucial to consider several factors:

- Your financial goals:What are your income needs in retirement? How much risk are you willing to take?

- Your age and health:Your life expectancy will influence the payment amount you receive.

- Interest rates:Current interest rates will affect the annuity payment amount.

- Annuity provider:Choose a reputable and financially sound provider with a strong track record.

- Contract terms:Carefully review the contract terms, including payment frequency, term, and any fees or penalties.

Consulting a Financial Advisor

It’s highly recommended to consult with a qualified financial advisor before purchasing an immediate annuity. They can help you assess your financial situation, understand your options, and choose the best annuity product for your needs.

Understanding the Annuity Rate Is 2024 is crucial for making informed decisions about your retirement planning. It helps you assess the potential returns and determine if an annuity aligns with your financial goals.

Closure

Immediate annuities can be a valuable tool for retirees seeking a guaranteed income stream. By converting a lump sum of savings into a series of regular payments, individuals can enjoy financial security and peace of mind during their retirement years.

However, it’s crucial to carefully consider the potential downsides, such as limited flexibility and the possibility of lower returns compared to other investment options. Ultimately, the decision of whether or not to purchase an immediate annuity should be made after consulting with a financial advisor and considering individual circumstances and financial goals.

Looking for a way to secure your financial future? Consider exploring the options available with 6 Annuity 2024. These plans offer a steady stream of income throughout your retirement years, giving you peace of mind knowing your financial needs are met.

Answers to Common Questions

How do immediate annuities work?

Immediate annuities work by converting a lump sum of money into a series of regular payments that begin immediately. The payments are guaranteed for a specific period or for the lifetime of the annuitant. The amount of each payment is determined by factors such as the initial investment amount, interest rates, and the annuitant’s age and life expectancy.

What are the risks associated with immediate annuities?

One of the main risks associated with immediate annuities is the potential for lower returns compared to other investment options. The guaranteed income stream comes at the cost of potential growth. Additionally, inflation can erode the purchasing power of annuity payments over time.

Another risk is the potential for the annuity provider to become insolvent, which could jeopardize the guaranteed payments.

How can I find a reputable annuity provider?

When choosing an annuity provider, it’s essential to research their financial stability, track record, and customer reviews. You can also consult with a financial advisor who can provide guidance and recommendations based on your individual circumstances.

Age can play a role in your eligibility for certain annuity plans. Check out Variable Annuity Age Requirements 2024 to learn more about these requirements.

Want to delve deeper into the mechanics of annuities? Explore Annuity Calculation Formula 2024 to gain a better understanding of how annuity payments are determined.

Annuity plans come in different forms. Understand the differences between Immediate Annuity And Deferred Annuity to choose the option that best suits your needs and timeline.