Immediate Annuity First Payment is a pivotal moment in your financial journey. It marks the beginning of a steady stream of income, offering a sense of security and peace of mind. This initial payment is not just a financial transaction; it represents the culmination of planning and preparation, setting the stage for a comfortable future.

Annuity is a financial tool that provides a stream of regular payments, making it a popular option for retirement planning. Annuity Is A Series Of Equal Payments 2024 explains the basic concept of an annuity, outlining how these payments work.

Understanding the intricacies of this first payment is crucial, as it directly impacts your overall financial strategy and long-term goals.

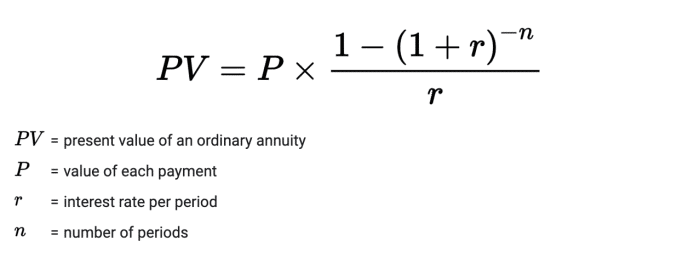

The annuity discount factor plays a crucial role in calculating annuity payments. Calculate Annuity Discount Factor 2024 explains this factor and its impact on your overall annuity payments.

Immediate annuities are financial instruments that provide a guaranteed stream of income for a specified period or for life. Unlike deferred annuities, which begin paying out at a later date, immediate annuities start generating income immediately after purchase. This makes them a popular choice for individuals seeking a steady source of income during retirement or for other financial needs.

Returns on annuities can vary depending on the type of annuity and the market conditions. 7 Annuity Return 2024 explores the potential returns you can expect from an annuity in 2024.

The first payment is the initial disbursement received by the annuitant, setting the foundation for the subsequent payments that will follow throughout the annuity term.

The annuity factor is used to calculate the present value of future annuity payments. Calculating An Annuity Factor 2024 explains the process of calculating this factor and its role in determining annuity payments.

Contents List

What is an Immediate Annuity?

An immediate annuity is a financial product that provides a stream of regular payments to the annuitant, starting immediately after the purchase. It’s a way to convert a lump sum of money into a guaranteed income stream for life.

Variable annuities offer different payout options to suit your specific needs. Variable Annuity Payout Options 2024 provides an overview of these options, allowing you to choose the payout structure that aligns with your financial goals.

Key Features of Immediate Annuities

- Guaranteed Payments:Immediate annuities offer a guaranteed stream of payments for a specified period, such as a certain number of years or for the rest of the annuitant’s life.

- Lump Sum Investment:An immediate annuity requires a single upfront payment, which is used to purchase the annuity contract.

- Flexible Payment Options:Annuity payments can be structured in various ways, including monthly, quarterly, or annually, and can be adjusted for inflation.

Immediate vs. Deferred Annuities

- Immediate Annuities:Payments begin immediately after the purchase of the annuity.

- Deferred Annuities:Payments start at a future date, allowing the invested funds to grow over time.

Real-World Examples of Immediate Annuities, Immediate Annuity First Payment

- Retirement Income:Immediate annuities can provide a reliable source of income for retirees, supplementing their savings or pensions.

- Estate Planning:Annuities can be used to create a legacy by providing a steady stream of income to beneficiaries after the annuitant’s death.

- Long-Term Care Planning:Immediate annuities can help cover the costs of long-term care, providing financial security in case of unexpected health issues.

The First Payment: Timing and Importance

The first payment in an immediate annuity is a crucial milestone, marking the start of the guaranteed income stream.

Accurately calculating your retirement annuity payments is essential for financial planning. Calculating Retirement Annuity Payments 2024 provides a comprehensive guide on how to calculate these payments based on your individual needs and goals.

Significance of the First Payment

- Confirmation of Income:The first payment signifies the annuitant’s commitment to the annuity contract and provides a tangible confirmation of the income stream.

- Financial Security:The first payment provides immediate financial security, offering a reliable source of income for essential expenses or financial planning.

- Peace of Mind:Knowing that regular payments are guaranteed can provide peace of mind, reducing financial anxieties and allowing for better financial planning.

Payment Schedule: Immediate Annuities vs. Other Investments

- Immediate Annuities:Payments are typically made on a regular schedule, such as monthly, quarterly, or annually, starting immediately after the purchase.

- Other Investments:Investments like stocks, bonds, or real estate may generate income, but the timing and amount of payments are not guaranteed.

Factors Influencing the Timing of the First Payment

- Annuity Contract Terms:The contract specifies the payment schedule and the date of the first payment.

- Purchase Date:The date the annuity is purchased determines the starting date of the first payment.

- Payment Frequency:The chosen payment frequency (monthly, quarterly, annually) will influence the timing of the first payment.

Key Considerations for Immediate Annuity First Payment

Understanding the terms of the annuity contract, particularly regarding the first payment, is crucial.

Annuity can be a valuable financial tool for retirement planning and other financial goals. Annuity Is Good 2024 explores the potential benefits of annuities and their suitability for various financial situations.

Importance of Understanding the Contract

- Payment Amount:The contract specifies the amount of the first payment, which will be based on the initial investment, interest rates, and other factors.

- Payment Frequency:The contract Artikels the frequency of payments, whether they are monthly, quarterly, or annually.

- Payment Schedule:The contract details the exact dates when payments will be made.

Factors Influencing the First Payment Amount

| Factor | Impact on First Payment |

|---|---|

| Initial Investment Amount | A higher initial investment generally results in a larger first payment. |

| Interest Rates | Higher interest rates can lead to a larger first payment. |

| Annuity Type (Fixed vs. Variable) | Fixed annuities typically offer a guaranteed payment amount, while variable annuities may have fluctuating payments based on market performance. |

| Payment Frequency | The frequency of payments (monthly, quarterly, annually) affects the size of each individual payment. |

Examples of Impact on First Payment

- Higher Initial Investment:A $100,000 investment will generally yield a larger first payment than a $50,000 investment, assuming other factors remain constant.

- Rising Interest Rates:If interest rates rise, the first payment amount may increase, reflecting the higher returns on the investment.

- Variable Annuity:The first payment amount in a variable annuity can fluctuate based on the performance of the underlying investment portfolio.

The Role of Interest Rates in the First Payment

Interest rates play a significant role in determining the first payment amount.

Whether annuity payments are considered income depends on the specific type of annuity and your tax situation. Is Annuity Considered Income 2024 clarifies the tax implications of annuity payments, helping you understand how they are treated for tax purposes.

Impact of Interest Rates

- Higher Interest Rates:Higher interest rates generally lead to larger first payments, as the investment earns more income.

- Lower Interest Rates:Lower interest rates can result in smaller first payments, as the investment earns less income.

Rising vs. Falling Interest Rates

- Rising Interest Rates:If interest rates rise after an annuity is purchased, the first payment amount may not be affected, as the annuity contract typically locks in the initial interest rate. However, future payments may be higher due to the higher interest rate environment.

While annuities offer a guaranteed stream of income, it’s important to understand their certainty. Is Annuity Certain 2024 examines the factors that contribute to the certainty of annuity payments.

- Falling Interest Rates:If interest rates fall after an annuity is purchased, the first payment amount may not be affected, as the annuity contract locks in the initial interest rate. However, future payments may be lower due to the lower interest rate environment.

Immediate annuities provide a guaranteed stream of income starting immediately after you purchase the contract. Immediate Annuity Contract dives into the details of this type of annuity, outlining its advantages and drawbacks.

Relationship Between Interest Rates and First Payment

| Interest Rate | First Payment Amount (Example) |

|---|---|

| 2% | $5,000 |

| 3% | $5,500 |

| 4% | $6,000 |

-Note

Immediate annuities provide a rapid stream of income, making them an attractive option for immediate financial needs. Immediate Annuity Payout explains the mechanics of these payouts and their potential benefits.

These are hypothetical examples and actual payment amounts will vary based on individual annuity contracts and market conditions.*

Variable annuities can provide death benefits, offering financial protection to your beneficiaries. Variable Annuity With Death Benefit 2024 discusses the details of these death benefits and their potential impact on your financial planning.

Tax Implications of the First Payment

Receiving the first payment from an immediate annuity can have tax implications.

To better understand how variable annuities work, it’s helpful to examine a real-life example. Variable Annuity Example 2024 provides a practical scenario that illustrates the features and potential outcomes of variable annuities.

Tax Treatment of Annuity Payments

- Taxable Portion:A portion of each annuity payment is typically considered taxable income, representing the return on the investment.

- Non-Taxable Portion:A portion of each payment may be considered non-taxable, representing the return of the principal investment.

Tax Calculation and Application

- Annuity Contract:The annuity contract will specify the tax treatment of payments, including the portion that is considered taxable income.

- Tax Forms:Annuity payments are reported on specific tax forms, such as Form 1099-R, which provides information about the taxable and non-taxable portions of the payments.

Tax Treatment for Different Types of Annuities

- Fixed Annuities:The tax treatment of payments from fixed annuities is typically straightforward, with a fixed percentage of each payment considered taxable income.

- Variable Annuities:The tax treatment of payments from variable annuities can be more complex, as the taxable portion may vary depending on the performance of the underlying investment portfolio.

Strategies for Maximizing the First Payment

Several strategies can help maximize the amount of the first payment from an immediate annuity.

Immediate annuities are a specific type of annuity characterized by immediate payments. Immediate Annuity Definition provides a clear and concise definition of this annuity type, outlining its key features.

Strategies to Maximize First Payment

- Increase Initial Investment:A larger initial investment will generally result in a larger first payment, assuming other factors remain constant.

- Negotiate Interest Rates:Shop around for annuities with competitive interest rates, as higher interest rates can lead to larger first payments.

- Choose a Fixed Annuity:Fixed annuities typically offer a guaranteed payment amount, which can provide greater certainty about the size of the first payment.

- Consider Payment Frequency:Choosing a less frequent payment schedule (e.g., quarterly instead of monthly) can result in a larger first payment, but fewer payments overall.

Benefits and Drawbacks of Strategies

- Higher Initial Investment:Benefits: larger first payment; Drawbacks: may require a larger initial investment.

- Negotiating Interest Rates:Benefits: potential for higher first payment; Drawbacks: may require extensive research and comparison shopping.

- Fixed Annuity:Benefits: guaranteed payment amount; Drawbacks: may offer lower potential returns compared to variable annuities.

- Less Frequent Payments:Benefits: larger first payment; Drawbacks: fewer payments overall.

Examples of Achieving Financial Goals

- Retirement Income:A larger first payment from an immediate annuity can provide a significant boost to retirement income, allowing for greater financial flexibility.

- Estate Planning:Maximizing the first payment can help ensure that beneficiaries receive a substantial amount of income after the annuitant’s death.

- Long-Term Care Planning:A larger first payment can provide greater financial security in case of unexpected health issues, helping to cover the costs of long-term care.

Last Point

Navigating the intricacies of immediate annuity first payments requires careful consideration of various factors, including interest rates, contract terms, and tax implications. By understanding the key elements and exploring available strategies, individuals can maximize their initial payment and optimize their financial well-being.

Whether you are seeking a reliable income stream during retirement or a financial safety net, a well-informed approach to immediate annuities can provide the financial security you need to achieve your goals.

Query Resolution

What factors influence the amount of the first payment?

The first payment amount is determined by factors such as the initial investment amount, interest rates, annuity type (fixed vs. variable), and payment frequency.

When considering an annuity, understanding the differences between variable annuities and traditional IRAs is crucial. Variable Annuity Vs Ira 2024 provides a clear comparison of these two investment vehicles, helping you make an informed decision.

What are the tax implications of the first payment?

The tax implications of the first payment depend on the type of annuity and the individual’s tax situation. A portion of the first payment may be considered taxable income, while the rest may be considered a return of principal.

What are some strategies for maximizing the first payment?

Strategies for maximizing the first payment include choosing a higher initial investment amount, selecting a fixed annuity with a higher interest rate, and opting for a more frequent payment schedule.