Immediate Annuity Income Calculator helps you estimate your potential retirement income by converting a lump sum into a stream of guaranteed payments. This powerful tool can be a valuable asset in your retirement planning, allowing you to understand the potential income you could receive from an immediate annuity.

Leaders 2 is a variable annuity product that offers potential for growth and income. If you’re considering this product in 2024, you can find detailed information at Leaders 2 Variable Annuity 2024. This resource will provide insights into the features and benefits of Leaders 2 variable annuity.

An immediate annuity is a financial product that provides a guaranteed stream of income payments for life. It’s a popular choice for retirees looking for a secure and predictable source of income. By using an immediate annuity income calculator, you can explore different annuity options and understand how your chosen annuity would affect your monthly income.

Thinking about a large annuity payment? You might be curious about the details of a Annuity 600k 2024. This type of annuity can provide a substantial stream of income, but it’s important to understand the nuances of these arrangements before committing.

Contents List

Understanding Immediate Annuities

Immediate annuities are a type of insurance product that provides a guaranteed stream of income for life, starting immediately upon purchase. These annuities are often purchased with a lump sum of money, such as a retirement savings account or inheritance, and they offer a way to convert a lump sum into a steady income stream.

Excel is a powerful tool for financial calculations, including annuity factors. If you’re looking to calculate annuity factors using Excel in 2024, you can find helpful instructions at Calculating Annuity Factor In Excel 2024.

The income payments are typically made monthly, but they can also be made quarterly, annually, or even as a lump sum.

Variable annuities offer the potential for growth, but they also come with some risk. If you’re considering this type of annuity, it’s essential to understand the intricacies. You can find a comprehensive overview of variable annuities in 2024 at Variable Annuity Overview 2024.

Benefits of Immediate Annuities, Immediate Annuity Income Calculator

Immediate annuities offer several benefits for retirees, including:

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, regardless of market fluctuations. This means that you can be confident that you will receive regular payments, even if your investments decline in value.

- Protection from Market Volatility:Unlike investments in stocks or bonds, immediate annuities are not subject to market volatility. This means that your income payments will not be affected by market downturns.

- Longevity Protection:Immediate annuities provide a lifetime of income, ensuring that you will receive payments for as long as you live. This is particularly important for retirees who are concerned about outliving their savings.

Comparing Immediate Annuities with Other Retirement Income Options

Immediate annuities are often compared to other retirement income options, such as traditional pensions and 401(k)s. Here’s a brief comparison:

| Feature | Immediate Annuity | Traditional Pension | 401(k) |

|---|---|---|---|

| Guaranteed Income | Yes | Yes | No |

| Longevity Protection | Yes | Yes | No |

| Market Volatility | No | No | Yes |

| Flexibility | Limited | Limited | High |

As you can see, immediate annuities offer a unique combination of guaranteed income, longevity protection, and protection from market volatility. However, they also come with limited flexibility compared to other retirement income options.

Visual Basic can be used to create custom annuity calculators. If you’re interested in developing your own annuity calculator using Visual Basic in 2024, you can find helpful resources at Annuity Calculator Visual Basic 2024.

Immediate Annuity Income Calculator: Purpose and Functionality

An immediate annuity income calculator is a tool that helps individuals estimate the monthly income they can expect to receive from an immediate annuity. This calculator is a valuable tool for retirement planning, as it allows individuals to understand how much income they can generate from their savings and to compare different annuity options.

HSBC offers a range of financial products, including variable annuities. If you’re interested in learning more about variable annuities offered by HSBC in 2024, you can explore Variable Annuity Hsbc 2024. This resource will provide insights into the features and benefits of HSBC’s variable annuity offerings.

Key Inputs for the Calculator

To use an immediate annuity income calculator, you will need to provide the following information:

- Age:Your age at the time of purchase.

- Principal Amount:The amount of money you will use to purchase the annuity.

- Interest Rate:The interest rate offered by the annuity provider.

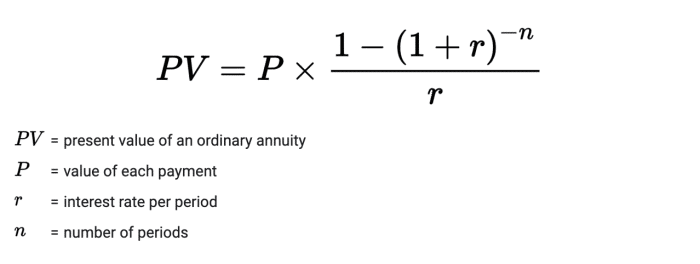

How the Calculator Estimates Income

The calculator uses these inputs to estimate the monthly income payments based on actuarial tables and assumptions about interest rates and mortality rates. The calculator takes into account your age and the expected duration of your lifetime to determine the appropriate payment amount.

Annuity joint ownership allows you to share the benefits of an annuity with another person. If you’re considering this option, it’s crucial to understand the implications. For more information on annuity joint ownership in 2024, visit Annuity Joint Ownership 2024.

Factors Affecting Immediate Annuity Income

Several factors can affect the amount of income an immediate annuity provides. These factors include:

Factors Affecting Annuity Income

| Factor | Impact on Income | Example |

|---|---|---|

| Interest Rates | Higher interest rates generally result in higher income payments. | If the interest rate is 4%, the monthly income payment may be $1,000. However, if the interest rate is 5%, the monthly income payment may be $1,200. |

| Mortality Rates | Annuity providers use mortality tables to estimate the average lifespan of individuals. Lower mortality rates (meaning people are living longer) generally result in lower income payments. | If the mortality rate is lower, the annuity provider will need to pay out income for a longer period. This means that the monthly income payments may be lower to compensate for the longer payout period. |

| Annuity Type | Different types of annuities offer different income payment options. For example, a single premium immediate annuity (SPIA) provides a fixed stream of income for life, while a variable annuity provides income payments that fluctuate with the performance of underlying investments. | A SPIA may provide a lower guaranteed income payment compared to a variable annuity, but it also offers more certainty and protection from market risk. |

Using an Immediate Annuity Income Calculator

Using an immediate annuity income calculator is a straightforward process. Here are the steps:

Steps to Use an Immediate Annuity Income Calculator

- Gather Your Information:Determine your age, the amount of money you plan to use to purchase the annuity, and the interest rate offered by the annuity provider.

- Input the Information:Enter the required information into the calculator fields.

- Calculate Your Income:Click on the “Calculate” button to generate your estimated monthly income payment.

Scenarios for Using the Calculator

Here are some scenarios where you might use an immediate annuity income calculator:

- Determining Retirement Income Needs:You can use the calculator to estimate how much income you can generate from your savings to meet your retirement income needs.

- Comparing Different Annuity Options:You can use the calculator to compare different annuity options and see which one offers the best income payment for your situation.

Annuity Scenarios and Income Estimates

| Scenario | Age | Principal Amount | Interest Rate | Estimated Monthly Income |

|---|---|---|---|---|

| Scenario 1 | 65 | $500,000 | 4% | $2,500 |

| Scenario 2 | 70 | $1,000,000 | 5% | $6,000 |

| Scenario 3 | 60 | $250,000 | 3% | $1,000 |

Considerations for Immediate Annuities

While immediate annuities offer several benefits, it’s important to consider the potential risks and drawbacks before purchasing one. Here are some factors to consider:

Potential Risks and Drawbacks

- Loss of Principal:When you purchase an immediate annuity, you are essentially exchanging your principal for a stream of income. If you die before you receive back the full amount of your principal, you will lose some of your investment.

- Interest Rate Risk:Interest rates can fluctuate over time, and if interest rates fall after you purchase an annuity, your income payments may be lower than you anticipated.

- Inflation Risk:Inflation can erode the purchasing power of your income payments over time. This means that your income may not be able to keep up with the rising cost of living.

- Limited Flexibility:Once you purchase an immediate annuity, you generally cannot access your principal or change the income payment amount. This can be a drawback if you need to access your money for an unexpected expense.

Factors to Consider When Deciding Whether an Immediate Annuity Is Right for You

- Financial Goals:Consider your retirement income needs and how an immediate annuity can help you achieve those goals.

- Risk Tolerance:Immediate annuities offer guaranteed income but also involve some risk. Consider your risk tolerance and whether you are comfortable with the potential for loss of principal.

- Investment Horizon:Immediate annuities are typically purchased with a long-term investment horizon. Consider your expected lifespan and whether an annuity will provide income for the duration of your retirement.

Tips for Maximizing Income from an Immediate Annuity

- Choose the Right Type of Annuity:There are several types of immediate annuities available, each with its own features and benefits. Consider your needs and goals when choosing the right type of annuity.

- Negotiate a Higher Interest Rate:Annuity providers may be willing to negotiate a higher interest rate, especially if you are purchasing a large annuity. Shop around and compare rates from different providers.

Epilogue

An immediate annuity income calculator is a valuable tool for anyone planning for retirement. By understanding how an immediate annuity works and using the calculator to estimate your potential income, you can make informed decisions about your retirement savings and income strategy.

Annuity calculations can be a bit complex, especially when dealing with variable annuities. If you’re looking to understand how annuities work in 2024, you can check out this helpful resource on Calculating An Annuity 2024. This guide will walk you through the process step-by-step, helping you make informed decisions about your financial future.

It’s important to remember that an annuity is a long-term investment, and you should consult with a financial advisor to determine if an immediate annuity is right for you.

Essential FAQs

What are the benefits of using an immediate annuity income calculator?

An immediate annuity income calculator helps you visualize your potential retirement income, compare different annuity options, and make informed decisions about your retirement savings.

Is it free to use an immediate annuity income calculator?

Immediate annuities provide a guaranteed stream of income starting right away. If you’re interested in learning more about the specifics of this type of annuity, check out Immediate Annuity Details. This resource will provide you with valuable information about the features and benefits of immediate annuities.

Many online immediate annuity income calculators are free to use. However, some financial institutions or insurance companies may charge a fee for using their calculators.

What factors affect the income estimate provided by an immediate annuity income calculator?

Factors like your age, principal amount, interest rate, annuity type, and mortality rates all influence the income estimate.

Should I use an immediate annuity income calculator before consulting a financial advisor?

While an immediate annuity income calculator can be a helpful tool, it’s always advisable to consult with a financial advisor to discuss your specific retirement goals and needs.

Annuity options can vary significantly. If you’re looking for information on a specific type of annuity, such as a 9 Annuity 2024 , it’s important to conduct thorough research to ensure it aligns with your financial goals.

Annuity calculations can be complex, especially when dealing with different currencies. If you’re looking to calculate an annuity in the UK in 2024, you can find helpful resources at Calculate Annuity Uk 2024. This resource will provide insights into the UK annuity market and how to calculate annuity payments.

Annuity payments can be structured in various ways. If you’re considering a lump sum annuity payment in 2024, you can find information on how to calculate these payments at Calculate Annuity Lump Sum 2024. This resource will provide insights into the different factors that influence lump sum annuity calculations.

Variable annuities can offer a joint life living benefit, providing income for multiple individuals. If you’re interested in this type of benefit in 2024, you can find detailed information at Variable Annuity Joint Life Living Benefit 2024. This resource will explain the features and benefits of joint life living benefits in variable annuities.

Retirement savings plans, such as 457(b) plans, may offer variable annuity options. If you’re considering a 457(b) variable annuity in 2024, you can find helpful information at 457 B Variable Annuity 2024. This resource will provide insights into the features and benefits of 457(b) variable annuities.

Annuity concepts can be understood in different languages. If you’re looking for a definition of variable annuities in Kannada, you can visit Variable Annuity Meaning In Kannada 2024. This resource will provide a clear explanation of variable annuities in the Kannada language.