Immediate Annuity Life Insurance offers a unique and compelling way to secure a steady income stream throughout retirement. It acts as a safety net, providing guaranteed payments that can help you navigate the uncertainties of later life, offering peace of mind and financial stability.

The word “annuity” has seven letters, but its meaning can be complex. Annuity 7 Letters 2024 might not provide a comprehensive definition, but it can be a starting point for understanding this financial product.

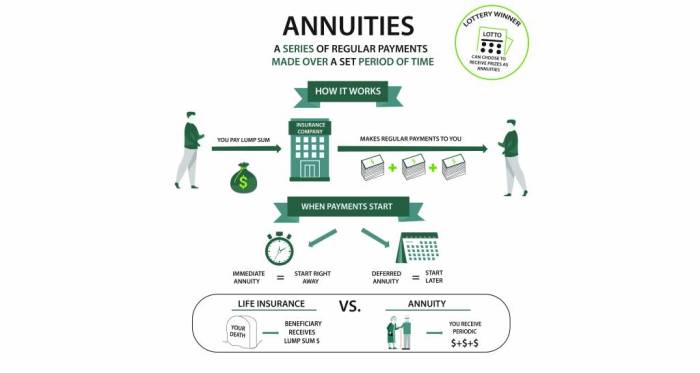

This type of insurance converts a lump sum of money into a series of regular payments, often for life. The amount of each payment is determined by factors like your age, the amount of your initial investment, and the type of annuity you choose.

While annuities provide income, they are not life insurance. Is Annuity Life Insurance 2024 clarifies this distinction and helps you understand the different benefits each product offers.

Unlike investments that can fluctuate with market changes, immediate annuities provide predictable income, ensuring you have a reliable source of funds to cover your living expenses.

Determining how much annuity you can get with $80,000 is a common question. How Much Annuity For 80000 2024 provides valuable insights and factors to consider when making this calculation.

Contents List

What is Immediate Annuity Life Insurance?

Immediate annuity life insurance, often simply called an “immediate annuity,” is a type of insurance product that provides a guaranteed stream of income payments for life. These payments begin immediately after the purchase of the annuity, making it a popular choice for retirees looking for a reliable source of income.

Excel can be a powerful tool for managing your finances, including calculating annuity payments. Calculating Annuity Payments In Excel 2024 provides guidance and formulas to make this process easier.

The purpose of an immediate annuity is to convert a lump sum of money into a steady stream of income, ensuring financial security during retirement.

The How To Calculate Annuity Pv Factor 2024 guide can be incredibly helpful. It walks you through the steps to determine the present value of an annuity, allowing you to make informed decisions about your financial future.

Key Features of Immediate Annuities

Immediate annuities offer several key features that make them attractive to retirees:

- Guaranteed Income Streams:Immediate annuities provide a guaranteed stream of income for life, regardless of market fluctuations or investment performance. This ensures a consistent source of income, even during periods of economic uncertainty.

- Tax Benefits:The income payments from an immediate annuity are typically taxed as ordinary income, but the principal amount invested is not taxed until it is withdrawn. This can provide significant tax advantages, especially for those in a lower tax bracket during retirement.

- Death Benefits:Some immediate annuities include a death benefit provision. This means that if the annuitant dies before receiving all of their payments, a designated beneficiary will receive a lump sum payment equal to the remaining value of the annuity.

Comparing Immediate Annuities with Other Annuities

Immediate annuities differ from other types of annuities, such as deferred annuities, in several key ways. While deferred annuities allow you to accumulate savings for retirement and receive payments at a later date, immediate annuities provide income immediately. Another key difference is that immediate annuities offer guaranteed income payments for life, whereas deferred annuities often have variable payout options.

Using an Annuity Calculator Nerdwallet 2024 can be a great way to estimate potential annuity payments. This tool allows you to input your desired information and receive a personalized projection.

- Deferred Annuities:These annuities allow you to accumulate savings for retirement and receive payments at a later date. They typically offer a variety of investment options, but the payout amount is not guaranteed and can fluctuate based on market performance.

- Variable Annuities:These annuities offer investment options that can grow or decline in value based on market performance. The payout amount is not guaranteed and can fluctuate with market conditions.

- Indexed Annuities:These annuities offer a guaranteed minimum return and the potential for higher returns based on the performance of a specific index, such as the S&P 500. However, the payout amount is not guaranteed and can fluctuate with the performance of the index.

While annuities and pension plans share similarities, they are not the same. Annuity Is Pension Plan 2024 explains the key differences between these retirement income options.

Immediate annuities offer a unique combination of guaranteed income payments, tax benefits, and death benefits, making them a valuable tool for retirement planning.

Wondering if you can still work while receiving an annuity? The answer is yes! Can You Receive Annuity And Still Work 2024 explores this question and provides valuable insights for those considering this option.

How Immediate Annuities Work

Purchasing an immediate annuity involves converting a lump sum of money into a stream of guaranteed income payments. The process is relatively straightforward and involves the following steps:

Purchasing an Immediate Annuity

- Determine Your Annuity Needs:First, you need to determine how much income you require in retirement and for how long. Consider your expenses, desired lifestyle, and longevity expectations.

- Choose an Annuity Type:There are different types of immediate annuities, each with its own features and payout options. You need to choose the type that best suits your needs and risk tolerance.

- Select an Insurer:It is essential to choose a reputable insurance company with a strong financial history and a good track record of paying out annuity claims.

- Fund the Annuity:Once you have selected an insurer and annuity type, you need to fund the annuity with a lump sum payment. The amount you invest will determine the size of your income payments.

- Receive Income Payments:After the annuity is funded, you will begin receiving regular income payments. These payments can be made monthly, quarterly, or annually, depending on your preference.

Types of Immediate Annuities

There are three main types of immediate annuities, each offering different features and payout options:

- Fixed Annuities:These annuities provide a fixed income stream for life, with the payment amount remaining constant regardless of market fluctuations. They offer guaranteed income and protection against investment risk, but the payments may not keep pace with inflation.

- Variable Annuities:These annuities offer a variable income stream that is tied to the performance of a specific investment portfolio. The payment amount can fluctuate based on market conditions, but they have the potential for higher returns than fixed annuities. However, they also carry greater investment risk.

- Indexed Annuities:These annuities offer a guaranteed minimum return and the potential for higher returns based on the performance of a specific index, such as the S&P 500. The payout amount is not guaranteed and can fluctuate with the performance of the index, but they offer a balance between guaranteed income and growth potential.

L Shares are a type of variable annuity, and understanding their workings is important. L Share Variable Annuity Finra 2024 offers valuable information on these annuities and their regulatory oversight.

Using Immediate Annuities in Retirement Planning

Immediate annuities can be a valuable tool for retirement planning, providing a reliable source of income and protecting against longevity risk. They can be used for various purposes, such as:

- Generating Income:Immediate annuities provide a guaranteed stream of income for life, ensuring a consistent source of income during retirement.

- Protecting Against Longevity Risk:Immediate annuities can help protect against longevity risk, the risk of outliving your savings. By providing a guaranteed income stream for life, they ensure that you will have a source of income even if you live longer than expected.

- Supplementing Social Security:Immediate annuities can supplement Social Security benefits, providing additional income to cover your expenses in retirement.

Benefits of Immediate Annuities: Immediate Annuity Life Insurance

Immediate annuities offer several benefits that can make them a valuable tool for retirement planning. These benefits include:

Advantages of Immediate Annuities

- Guaranteed Income Streams:Immediate annuities provide a guaranteed stream of income for life, regardless of market fluctuations or investment performance. This ensures a consistent source of income, even during periods of economic uncertainty.

- Tax Benefits:The income payments from an immediate annuity are typically taxed as ordinary income, but the principal amount invested is not taxed until it is withdrawn. This can provide significant tax advantages, especially for those in a lower tax bracket during retirement.

- Protection Against Market Fluctuations:Immediate annuities provide protection against market fluctuations. The income payments are guaranteed, regardless of how the stock market performs.

- Financial Security in Retirement:Immediate annuities can provide financial security in retirement, ensuring a consistent income stream regardless of market performance. This can help reduce financial stress and provide peace of mind.

Real-World Examples of Immediate Annuities

Immediate annuities have helped countless individuals achieve their financial goals in retirement. For example, a retired teacher who received a lump sum payment from a 401(k) plan may purchase an immediate annuity to provide a guaranteed stream of income for life.

Knowing how to Calculating Annuity Annual Payment 2024 is crucial for planning your financial future. This guide provides helpful formulas and steps to ensure you understand the potential income stream you could receive.

This would ensure that they have a reliable source of income to cover their expenses, even if they live longer than expected.

Annuity jokes can be funny, but it’s important to take your financial planning seriously. However, if you’re looking for a chuckle, check out Annuity Jokes 2024 for some lighthearted entertainment.

Risks and Considerations

While immediate annuities offer several benefits, it is important to be aware of the potential risks associated with them. These risks include:

Potential Risks of Immediate Annuities

- Interest Rate Risk:If interest rates rise after you purchase an immediate annuity, the value of your annuity may decrease. This is because the payments are based on the interest rate at the time of purchase. However, if interest rates fall, the value of your annuity may increase.

The Immediate Annuity Premium is the initial lump sum payment you make to secure your annuity. It’s important to understand this premium to make informed financial decisions.

- Inflation Risk:Inflation can erode the purchasing power of your annuity payments over time. If inflation rises faster than the rate of return on your annuity, your payments may not keep pace with the rising cost of living.

- Longevity Risk:There is always the risk that you may outlive your annuity payments. If you live longer than expected, your payments may run out before you die. This is a significant concern for those with a long life expectancy.

Considering Your Financial Situation

Before purchasing an immediate annuity, it is essential to carefully consider your financial situation, risk tolerance, and long-term goals. You should also compare the risks and benefits of immediate annuities with other retirement income strategies, such as traditional pensions, 401(k)s, and Roth IRAs.

Transparency is key when it comes to investments, and variable annuities are no exception. Variable Annuity Disclosure 2024 highlights the importance of understanding the risks and potential returns associated with these products.

Choosing the Right Immediate Annuity

Selecting the right immediate annuity is crucial to ensure that it meets your individual needs and financial goals. Consider the following factors when making your decision:

Factors to Consider When Choosing an Immediate Annuity

- Type of Annuity:Choose the type of annuity that best suits your needs and risk tolerance. Fixed annuities offer guaranteed income, while variable annuities offer the potential for higher returns but carry greater investment risk.

- Payout Options:Immediate annuities offer various payout options, such as a fixed monthly payment, a lifetime income guarantee, or a combination of both. Choose the payout option that best meets your needs and financial goals.

- Insurer’s Financial Stability:It is essential to choose an insurer with a strong financial history and a good track record of paying out annuity claims. Research the insurer’s financial stability and ratings before making a decision.

Step-by-Step Guide for Choosing an Immediate Annuity

- Determine Your Income Needs:Calculate how much income you require in retirement and for how long. Consider your expenses, desired lifestyle, and longevity expectations.

- Research Annuity Types:Learn about the different types of immediate annuities, including fixed, variable, and indexed annuities. Consider your risk tolerance and investment goals.

- Compare Insurers:Research and compare different insurers, considering their financial stability, ratings, and payout options.

- Seek Professional Advice:Consult with a financial advisor to get personalized advice on choosing the right immediate annuity for your situation.

Importance of Seeking Professional Financial Advice

Seeking professional financial advice is essential when making a decision about purchasing an immediate annuity. A financial advisor can help you understand the complexities of annuities, assess your financial situation, and recommend the best annuity for your individual needs and goals.

If you’re considering charitable giving, an Immediate Charitable Gift Annuity might be a great option. It allows you to support a cause you care about while receiving regular income payments.

Illustrative Examples

Table Comparing Immediate Annuity Options

| Annuity Type | Features | Advantages | Disadvantages |

|---|---|---|---|

| Fixed Annuity | Guaranteed income stream, fixed payment amount, no investment risk. | Guaranteed income, protection against market fluctuations. | Payments may not keep pace with inflation, limited growth potential. |

| Variable Annuity | Variable income stream, investment options, potential for higher returns. | Potential for higher returns, flexibility in investment choices. | Income payments are not guaranteed, greater investment risk. |

| Indexed Annuity | Guaranteed minimum return, potential for higher returns based on index performance. | Balance between guaranteed income and growth potential. | Income payments are not guaranteed, returns are tied to index performance. |

Hypothetical Scenario

Suppose a retired teacher named Mary receives a lump sum payment of $500,000 from her 401(k) plan. She decides to purchase a fixed immediate annuity to provide a guaranteed stream of income for life. The annuity pays her $30,000 per year, which is sufficient to cover her expenses and maintain her desired lifestyle.

Visual Representation of Income Stream, Immediate Annuity Life Insurance

[Illustrative diagram showing a steady income stream over time, representing the guaranteed income payments from an immediate annuity.]

Summary

Immediate Annuity Life Insurance offers a compelling solution for those seeking financial security in retirement. It provides a guaranteed income stream, offering peace of mind and protection against market fluctuations. By carefully considering your individual needs and financial goals, you can determine if an immediate annuity is the right choice for you.

Detailed FAQs

What is the minimum amount I need to invest in an immediate annuity?

The minimum investment amount varies depending on the insurer and the type of annuity you choose. It’s best to contact an insurance provider directly to get specific information.

Can I withdraw my money from an immediate annuity before the end of the payout period?

Generally, immediate annuities are designed to provide a consistent income stream for a specified period, often for life. Early withdrawals may be subject to penalties and may reduce the overall amount of your payments.

How are immediate annuities taxed?

The tax treatment of immediate annuities depends on the type of annuity and your individual tax situation. It’s essential to consult with a tax professional to understand the tax implications of your specific annuity.

Understanding the Annuity Formula Is 2024 is crucial for anyone considering an annuity. It helps determine the future stream of payments you can receive based on your initial investment and the interest rate.