Immediate Annuity Payout offers a unique approach to retirement income, providing a guaranteed stream of payments for life. Unlike deferred annuities, which accumulate value over time, immediate annuities begin paying out immediately after purchase. This makes them an attractive option for individuals seeking a reliable source of income during retirement, especially those who want to eliminate the risk of outliving their savings.

The Variable Annuity Market Share 2024 provides valuable insights into the current landscape of variable annuities, helping you understand the competitive landscape and identify potential investment opportunities.

The process of purchasing an immediate annuity involves exchanging a lump sum of money for a series of guaranteed payments. The amount of each payment is determined by factors such as the purchase price, the annuitant’s age, and the chosen payout option.

Understanding the concept of annuities is crucial, especially for those seeking financial security. The Annuity Ka Hindi Meaning 2024 article explains the concept in Hindi, making it accessible to a wider audience.

Immediate annuities come in various forms, including fixed, variable, and indexed annuities, each offering distinct features and potential benefits.

Dreaming of a secure retirement with a substantial income stream? The Annuity 2 Million 2024 article explores the potential of annuities to generate a substantial income, helping you visualize your financial future.

Contents List

- 1 What is an Immediate Annuity Payout?

- 2 How Immediate Annuity Payouts Work

- 3 Advantages and Disadvantages of Immediate Annuities: Immediate Annuity Payout

- 4 Who Should Consider an Immediate Annuity Payout?

- 5 Finding the Right Immediate Annuity

- 6 Immediate Annuity Payout in Retirement Planning

- 7 Last Point

- 8 FAQ Insights

What is an Immediate Annuity Payout?

An immediate annuity payout is a type of financial product that provides a stream of regular income payments starting immediately after you purchase it. This is a popular choice for individuals looking for a guaranteed income stream during retirement, especially those who want to eliminate the risk of outliving their savings.

When analyzing annuity options, a thorough understanding of present value is key. The Pv Annuity Sheet 2024 provides valuable insights into calculating present value, helping you determine the true worth of an annuity.

Defining an Immediate Annuity Payout

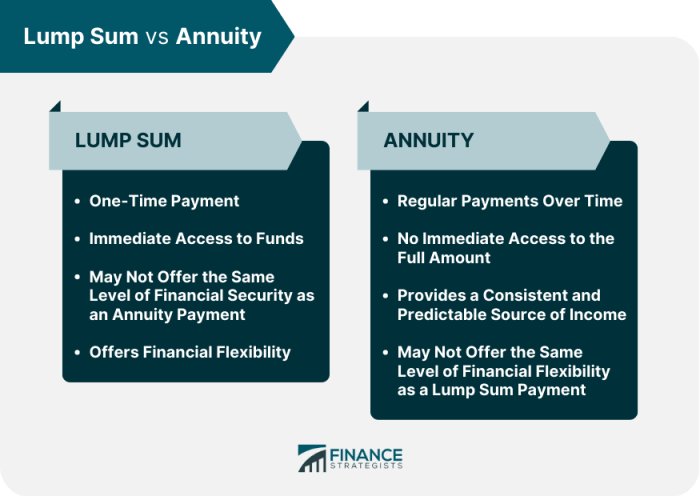

An immediate annuity is a contract between you and an insurance company. In exchange for a lump-sum payment, the insurance company agrees to make regular payments to you for a specified period or for the rest of your life. These payments can be monthly, quarterly, or annually, and they can be fixed or variable.

Immediate Annuities vs. Deferred Annuities

The key difference between an immediate annuity and a deferred annuity lies in the timing of the payments. An immediate annuity starts paying out immediately after you purchase it, while a deferred annuity has a delay period before payments begin.

When considering an annuity, it’s essential to factor in your life expectancy. The Annuity Calculator Based On Life Expectancy 2024 allows you to personalize your calculations, providing a more accurate projection of your future income stream.

This delay period can range from a few years to several decades.

Are you wondering if you can continue working while receiving annuity payments? The Can You Receive Annuity And Still Work 2024 article addresses this common question, providing valuable information for those seeking financial flexibility.

Benefits of Immediate Annuities

- Guaranteed Income:Immediate annuities provide a steady stream of income that is guaranteed for the duration of the contract, regardless of market fluctuations.

- Protection Against Outliving Savings:By providing a consistent income stream, immediate annuities can help you avoid the risk of outliving your savings in retirement.

- Tax Advantages:Some types of immediate annuities may offer tax advantages, such as tax-deferred growth or tax-free income.

- Simplicity:Immediate annuities are relatively straightforward to understand and manage, compared to other retirement income options.

Potential Risks of Immediate Annuities

- Lower Returns:Immediate annuities generally offer lower returns compared to other investment options, such as stocks or bonds.

- Limited Flexibility:Once you purchase an immediate annuity, you typically cannot withdraw the principal or change the payment schedule without incurring penalties.

- Inflation Risk:Fixed-income annuities do not adjust for inflation, which can erode the purchasing power of your payments over time.

- Longevity Risk:If you live longer than expected, your annuity payments may run out before you do.

How Immediate Annuity Payouts Work

Understanding how immediate annuity payouts work is essential before making a decision. This section explains the process, provides an example, and details the factors that influence payout amounts.

For those with a 401(k), exploring variable annuity options can be a smart move. The 401k Variable Annuity 2024 article provides insights into this strategy, offering potential for growth and income generation.

The Process of Purchasing an Immediate Annuity

- Contact an Annuity Provider:Start by contacting a reputable insurance company that offers immediate annuities.

- Provide Information:You will need to provide information about your age, health, and desired payment schedule.

- Choose an Annuity Type:You will need to select the type of annuity that best suits your needs and risk tolerance.

- Make a Lump-Sum Payment:You will make a lump-sum payment to the insurance company in exchange for the annuity contract.

- Receive Annuity Payments:The insurance company will begin making regular payments to you according to the terms of your contract.

An Example of an Immediate Annuity Payout

Imagine you are 65 years old and have a lump sum of $100,000 to invest. You decide to purchase an immediate annuity that will provide you with monthly payments for life. The insurance company calculates your payout based on your age, gender, and the interest rates prevailing at the time of purchase.

Understanding the certainty of annuity payments is essential for financial planning. The Is Annuity Certain 2024 article explores the various types of annuities and their respective guarantees, providing clarity on the level of security they offer.

Let’s say your monthly payment is $700. You will receive $700 every month for the rest of your life, regardless of how long you live.

Factors Determining the Payout Amount

- Age:The older you are, the higher your payout will be because you have a shorter life expectancy.

- Gender:Women generally live longer than men, so they tend to receive lower payouts for the same amount of principal.

- Interest Rates:When interest rates are higher, annuity payouts tend to be higher.

- Annuity Type:The type of annuity you choose, such as a fixed or variable annuity, will also affect the payout amount.

Types of Immediate Annuities

- Fixed Annuities:Provide a guaranteed fixed income stream for the duration of the contract.

- Variable Annuities:Offer a variable income stream that is linked to the performance of underlying investments. The payout amount can fluctuate based on market conditions.

- Indexed Annuities:Link the payout to the performance of a specific index, such as the S&P 500. They offer the potential for higher returns but also carry some risk.

Advantages and Disadvantages of Immediate Annuities: Immediate Annuity Payout

Before deciding whether an immediate annuity is right for you, it’s crucial to weigh the advantages and disadvantages. This section provides a detailed overview of the pros and cons, comparing them with other retirement income options.

Understanding the nuances of variable annuities can be complex, but the Variable Annuity Quarterly Statement 2024 provides a detailed breakdown of performance and investment options. This information is essential for making informed decisions about your retirement savings.

Advantages of Immediate Annuity Payouts

- Guaranteed Income:Immediate annuities provide a predictable and consistent income stream, eliminating the worry of market volatility.

- Protection Against Outliving Savings:This feature ensures that you will have a source of income for as long as you live, reducing the risk of running out of money in retirement.

- Tax Advantages:Depending on the type of annuity, you may enjoy tax-deferred growth or tax-free income.

- Simplicity:Immediate annuities are relatively easy to understand and manage compared to other retirement income options.

Disadvantages of Immediate Annuity Payouts

- Lower Returns:Immediate annuities typically offer lower returns than other investment options, such as stocks or bonds.

- Limited Flexibility:Once you purchase an immediate annuity, you generally cannot withdraw the principal or change the payment schedule without incurring penalties.

- Inflation Risk:Fixed-income annuities do not adjust for inflation, meaning the purchasing power of your payments can decline over time.

- Longevity Risk:If you live longer than expected, your annuity payments may run out before you do.

Comparison with Other Retirement Income Options

| Advantage | Disadvantage | Example | Explanation |

|---|---|---|---|

| Guaranteed income stream | Lower returns than other investments | A fixed immediate annuity pays a set amount each month, regardless of market performance. | This provides a predictable income source but may not keep pace with inflation. |

| Protection against outliving savings | Limited flexibility after purchase | You can’t withdraw the principal from a traditional immediate annuity without penalties. | This ensures a lifelong income stream but limits access to funds for other needs. |

| Tax advantages | Potential for lower returns | Some annuities offer tax-deferred growth or tax-free income. | This can reduce your tax burden but may not be as beneficial if returns are low. |

| Simplicity and ease of management | Inflation risk | Fixed annuities do not adjust for inflation, so your purchasing power can decline over time. | This provides a straightforward income source but may not keep pace with rising costs. |

Who Should Consider an Immediate Annuity Payout?

Immediate annuities can be a valuable tool for individuals with specific financial goals and circumstances. This section identifies the individuals who might benefit from this option and provides examples of suitable situations.

Individuals Who Might Benefit

- Individuals with a guaranteed income need:Those seeking a steady and predictable income stream, especially those who are risk-averse.

- Individuals concerned about outliving their savings:Those who want to ensure they have a lifelong source of income, protecting themselves from the risk of running out of money.

- Individuals seeking tax advantages:Those who can benefit from tax-deferred growth or tax-free income provided by certain types of annuities.

Situations Where an Immediate Annuity Might Be Suitable

- Retirement planning:Immediate annuities can provide a stable income stream for retirees, supplementing other sources of income.

- Long-term care planning:Annuities can help cover the costs of long-term care, ensuring that you have financial resources for future healthcare needs.

- Estate planning:Immediate annuities can be used to create a legacy for heirs by providing a guaranteed income stream after your death.

Decision-Making Process for Choosing an Immediate Annuity, Immediate Annuity Payout

Here is a flowchart illustrating the decision-making process for choosing an immediate annuity:

[Flowchart illustrating the decision-making process for choosing an immediate annuity]

Calculating the value of an annuity can be daunting, but with the right tools, it becomes easier. The How To Calculate Annuity On Calculator 2024 article provides step-by-step instructions, empowering you to make informed financial choices.

Finding the Right Immediate Annuity

With numerous annuity providers and options available, finding the right immediate annuity can be challenging. This section provides tips for finding a reputable provider and factors to consider when comparing annuity contracts.

The The Director 6 Variable Annuity Hartford 2024 is a specific product offering, and understanding its features and benefits is crucial for informed decision-making.

Finding a Reputable Annuity Provider

- Check Financial Strength Ratings:Look for providers with strong financial ratings from reputable agencies, such as AM Best or Moody’s.

- Read Reviews and Testimonials:Research online reviews and testimonials from other customers to gauge the provider’s reputation and customer service.

- Compare Fees and Charges:Compare the fees and charges associated with different annuity contracts to ensure you are getting a competitive deal.

- Seek Professional Advice:Consult with a financial advisor who specializes in annuities to get personalized recommendations and guidance.

Factors to Consider When Comparing Annuity Options

- Payout Amount:Compare the monthly or annual payouts offered by different providers for the same amount of principal.

- Annuity Type:Consider your risk tolerance and investment goals when choosing between fixed, variable, or indexed annuities.

- Fees and Charges:Pay attention to fees such as surrender charges, administrative fees, and mortality charges.

- Contract Terms:Review the contract terms carefully, including the payment schedule, duration, and any limitations on withdrawals.

Checklist for Evaluating Immediate Annuity Contracts

Here is a checklist to help you evaluate immediate annuity contracts:

- Provider’s Financial Strength:Check the provider’s financial ratings from reputable agencies.

- Annuity Type:Does the annuity type align with your risk tolerance and investment goals?

- Payout Amount:Compare the payout amount with other providers and options.

- Fees and Charges:Are the fees and charges reasonable and transparent?

- Contract Terms:Review the contract terms carefully, including the payment schedule, duration, and limitations on withdrawals.

- Customer Service:Research the provider’s customer service reputation.

Immediate Annuity Payout in Retirement Planning

Immediate annuities can play a significant role in retirement planning, providing a stable income stream and helping individuals achieve their financial goals. This section explores how immediate annuities can be used in different retirement scenarios.

For those seeking a comprehensive analysis of annuity payments, Excel offers powerful tools. The Calculating Annuity Payments In Excel 2024 article guides you through the process, enabling you to model and project your future income.

Role of Immediate Annuities in Retirement Planning

Immediate annuities can be a valuable tool for retirees seeking a guaranteed income stream. They can provide a predictable source of income to cover essential expenses, such as housing, healthcare, and utilities. This can help retirees feel more secure about their financial future and reduce the risk of outliving their savings.

As you plan for the future, it’s crucial to consider how your investments will grow over time. The Annuity Is Future Value 2024 article delves into the concept of annuities and their potential to generate a steady stream of income in retirement.

Achieving Retirement Goals

- Income Replacement:Immediate annuities can help replace lost income from employment, providing a steady source of funds to maintain a desired lifestyle.

- Expense Coverage:Annuities can help cover essential expenses in retirement, such as housing, healthcare, and travel.

- Financial Security:By providing a guaranteed income stream, immediate annuities can enhance financial security in retirement, reducing the worry of market volatility.

Examples of Immediate Annuity Use in Retirement Scenarios

- Early Retirement:For individuals retiring early, immediate annuities can provide a stable income stream before they are eligible for Social Security benefits.

- Bridge to Social Security:Annuities can act as a bridge to Social Security, providing income during the transition period before benefits begin.

- Supplementing Other Income Sources:Immediate annuities can supplement other income sources, such as pensions, savings, or investments, to meet retirement expenses.

Illustrative Scenario

John, a 67-year-old retiree, has a lump sum of $200,000 saved for retirement. He wants to ensure a steady income stream to cover his living expenses. He purchases an immediate annuity that provides him with $1,500 per month for life. This guaranteed income stream provides John with financial security and peace of mind, knowing he has a reliable source of income for the rest of his life.

Seeking an annuity with flexibility? The Variable Annuity No Surrender Charge 2024 explores options that eliminate surrender charges, offering greater control over your funds.

Last Point

Immediate annuities can be a valuable tool in retirement planning, offering peace of mind and financial security. However, it’s crucial to carefully consider the potential trade-offs, such as lower returns compared to other investments and limited flexibility. By understanding the advantages and disadvantages, individuals can make informed decisions about whether an immediate annuity aligns with their retirement goals and risk tolerance.

Tax implications are a significant factor when considering annuities. The Is Annuity Death Benefit Taxable 2024 article clarifies the taxability of annuity death benefits, helping you plan for your legacy.

FAQ Insights

What are the tax implications of immediate annuities?

The payments you receive from an immediate annuity are generally taxed as ordinary income. However, the portion of each payment that represents a return of your original investment is tax-free.

Can I withdraw my principal from an immediate annuity?

Once you purchase an immediate annuity, you generally cannot withdraw your principal. The annuity payments represent both principal and interest, and they are typically paid out over a fixed period or for the rest of your life.

How do I choose the right payout option for my immediate annuity?

The best payout option depends on your individual circumstances and needs. Consider factors such as your life expectancy, desired income level, and potential need for lump-sum payments.