Immediate Annuity Payout Options provide a structured way to convert a lump sum of money into a guaranteed stream of income for life. These annuities offer a unique opportunity to secure a predictable and reliable income stream for retirement, potentially reducing the need to rely heavily on investments or savings.

Each annuity contract typically has a unique identification number, often referred to as a “policy number.” Annuity Number Lic 2024 discusses the significance of this number and how it’s used to manage and track your annuity investment.

Immediate annuities are particularly attractive for individuals who are seeking financial security and peace of mind during their retirement years. They can offer a guaranteed income stream that is unaffected by market fluctuations, providing a safety net against the uncertainties of investing.

Variable annuities offer investment flexibility through sub-accounts that track various market indexes. Variable Annuity General Account 2024 delves into the general account component of a variable annuity and its role in providing stability and guaranteed minimum income.

Contents List

- 1 Immediate Annuity Payout Options

- 1.1 What is an Immediate Annuity Payout Option?

- 1.2 Advantages of Immediate Annuity Payout Options

- 1.3 Types of Immediate Annuity Payout Options

- 1.4 Factors to Consider When Choosing an Immediate Annuity Payout Option

- 1.5 Examples of Immediate Annuity Payout Options

- 1.6 Immediate Annuity Payout Options and Retirement Planning

- 1.7 Risks Associated with Immediate Annuity Payout Options

- 1.8 Choosing the Right Immediate Annuity Provider, Immediate Annuity Payout Options

- 1.9 Immediate Annuity Payout Options and Legacy Planning

- 1.10 Future Trends in Immediate Annuity Payout Options

- 2 Closing Notes

- 3 Commonly Asked Questions: Immediate Annuity Payout Options

Immediate Annuity Payout Options

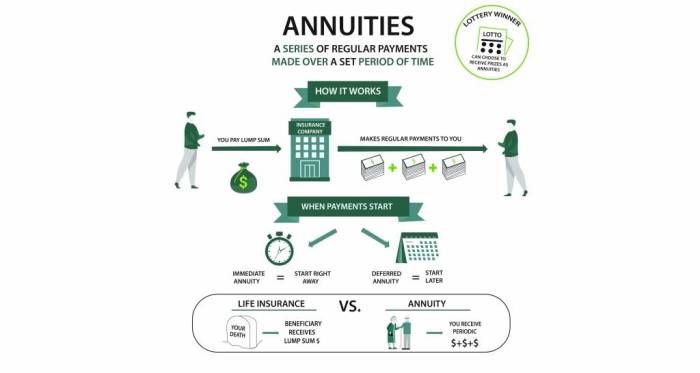

An immediate annuity payout option is a financial product that provides a guaranteed stream of income for life, starting immediately upon purchase. It’s a popular choice for retirees looking for a reliable and predictable income source. This article delves into the various aspects of immediate annuity payout options, exploring their advantages, types, and factors to consider when making a decision.

While annuities can be funded with regular payments, they can also be purchased with a single lump sum. Annuity Is Single Payment 2024 explores the advantages and considerations of single-payment annuities, providing insights into their potential benefits and drawbacks.

What is an Immediate Annuity Payout Option?

An immediate annuity payout option is a type of annuity contract where you make a lump-sum payment to an insurance company in exchange for a guaranteed stream of regular payments, typically for life. These payments can be made monthly, quarterly, annually, or even as a single lump sum.

One of the key benefits of an annuity is its tax-deferred growth potential. Is Annuity Tax Deferred 2024 explains how this feature works and its implications for your tax liability in retirement.

The amount of the payment depends on factors like the amount of the initial investment, the annuitant’s age, and the chosen payout option.

The Delaware Life Compass 3 Variable Annuity is a popular choice for investors seeking growth potential. Delaware Life Compass 3 Variable Annuity 2024 outlines the key features of this annuity, including its investment options, fees, and potential benefits.

Here are some key characteristics of immediate annuities:

- Guaranteed Income Stream:Immediate annuities provide a guaranteed income stream, regardless of market fluctuations or changes in interest rates. This makes them a valuable tool for retirement planning, as it ensures a predictable source of income for life.

- Lump-Sum Payment:To purchase an immediate annuity, you need to make a lump-sum payment to the insurance company. This payment is typically made from savings, retirement accounts, or other assets.

- Flexible Payout Options:Immediate annuities offer a variety of payout options, including fixed payments, variable payments, and joint-life options. These options can be tailored to meet your individual needs and financial goals.

- Tax Advantages:In many cases, the income received from an immediate annuity is taxed as ordinary income. However, some payout options may offer tax advantages, such as tax-deferred growth.

Here are some examples of different payout options available:

- Fixed Annuity:This option provides a fixed payment for life, regardless of market conditions. It’s a good choice for those seeking predictable income and protection against inflation.

- Variable Annuity:This option offers payments that fluctuate based on the performance of an underlying investment portfolio. It can potentially provide higher returns, but it also carries greater risk.

- Joint-Life Annuity:This option provides payments for as long as either the annuitant or their spouse is alive. It’s a good choice for couples who want to ensure a continuous income stream for their lifetime.

Advantages of Immediate Annuity Payout Options

Immediate annuities offer several advantages for retirement planning:

- Guaranteed Income:They provide a guaranteed stream of income for life, eliminating the risk of outliving your savings.

- Predictability:The payments are fixed and predictable, making it easier to budget for expenses.

- Income Diversification:Immediate annuities can help diversify your income sources, reducing your reliance on investments that are subject to market volatility.

- Inflation Protection:Some immediate annuity options offer inflation protection, ensuring that your payments keep pace with rising prices.

- Tax Advantages:The income received from an immediate annuity may be tax-advantaged, depending on the chosen payout option.

Types of Immediate Annuity Payout Options

Immediate annuities offer various payout options to suit different needs and preferences. Here are some common types:

- Straight Life Annuity:Payments continue for the rest of the annuitant’s life. This option provides the highest monthly payments but offers no death benefit.

- Period Certain Annuity:Payments are guaranteed for a specified period, even if the annuitant dies before the period ends. This option provides some death benefit, but the monthly payments are lower than a straight-life annuity.

- Cash Refund Annuity:Payments continue until the annuitant dies. If they die before receiving back the full purchase price, the remaining balance is paid to their beneficiary.

- Joint Life Annuity:Payments continue as long as either the annuitant or their spouse is alive. This option provides income for both spouses but typically has lower monthly payments than a single-life annuity.

Factors to Consider When Choosing an Immediate Annuity Payout Option

When choosing an immediate annuity payout option, consider these factors:

- Your Financial Goals:What are your income needs in retirement? Do you need a guaranteed income stream or are you comfortable with some risk?

- Risk Tolerance:How comfortable are you with the potential for your payments to fluctuate based on market conditions?

- Time Horizon:How long do you expect to live? This will affect the length of time you receive payments.

- Health Status:If you have a long life expectancy, a straight-life annuity might be a good option. If you have a shorter life expectancy, a period certain annuity might be more appropriate.

- Tax Considerations:How will the income from the annuity be taxed?

To help you choose the best payout option, consider these steps:

- Determine your income needs:Estimate your monthly expenses in retirement and factor in any other income sources.

- Assess your risk tolerance:Are you comfortable with the potential for your payments to fluctuate?

- Consider your life expectancy:This will help you determine the length of time you need income.

- Compare different payout options:Research the features and benefits of different payout options and choose the one that best aligns with your goals.

- Consult with a financial advisor:An advisor can help you understand the complexities of immediate annuities and make an informed decision.

Examples of Immediate Annuity Payout Options

| Payout Type | Benefits | Drawbacks | Suitability |

|---|---|---|---|

| Straight Life Annuity | Highest monthly payments, guaranteed income for life | No death benefit | Suitable for individuals with a long life expectancy and no need for a death benefit |

| Period Certain Annuity | Guaranteed payments for a specified period, some death benefit | Lower monthly payments than a straight-life annuity | Suitable for individuals who want some death benefit and a guaranteed income stream for a specific period |

| Cash Refund Annuity | Payments continue until death, death benefit if purchase price not fully received | Lower monthly payments than a straight-life annuity | Suitable for individuals who want a death benefit and a guaranteed return of their principal |

| Joint Life Annuity | Payments continue as long as either spouse is alive, provides income for both spouses | Lower monthly payments than a single-life annuity | Suitable for couples who want to ensure a continuous income stream for their lifetime |

Immediate Annuity Payout Options and Retirement Planning

Immediate annuities can play a crucial role in retirement planning, providing a predictable and reliable income stream. They can be incorporated into a comprehensive retirement plan by:

- Generating predictable income:Immediate annuities provide a fixed and predictable income stream, making it easier to budget for expenses in retirement.

- Supplementing other income sources:They can supplement other retirement income sources, such as Social Security and pensions, to ensure a comfortable lifestyle.

- Providing a safety net:They can serve as a safety net, protecting against the risk of outliving your savings.

- Reducing investment risk:By converting a portion of your savings into a guaranteed income stream, you can reduce your exposure to market volatility.

Risks Associated with Immediate Annuity Payout Options

While immediate annuities offer several advantages, it’s essential to understand the potential risks associated with them:

- Interest Rate Risk:Interest rate fluctuations can affect the value of an annuity, especially if you choose a fixed annuity. If interest rates rise, the value of your annuity may decline.

- Longevity Risk:If you live longer than expected, your annuity payments may not be sufficient to cover your expenses.

- Company Risk:There is a risk that the insurance company issuing your annuity could become insolvent, leaving you without your payments.

- Inflation Risk:Fixed annuities do not offer protection against inflation, so your payments may not keep pace with rising prices.

To mitigate these risks, it’s important to:

- Understand the terms and conditions of your annuity contract:Carefully review the contract to ensure you understand the risks and benefits.

- Choose a reputable insurance company:Research the financial stability of the insurance company issuing your annuity.

- Consider inflation protection:If you’re concerned about inflation, choose an annuity that offers inflation protection.

Choosing the Right Immediate Annuity Provider, Immediate Annuity Payout Options

Selecting the right annuity provider is crucial to ensure the security of your investment and the longevity of your income stream. Consider these factors when choosing a provider:

- Financial Strength:Research the provider’s financial stability and ratings from independent agencies.

- Product Variety:Choose a provider that offers a variety of annuity products to suit your needs.

- Customer Service:Look for a provider with a strong reputation for customer service and responsiveness.

- Fees and Charges:Compare the fees and charges associated with different annuity products and providers.

- Contract Terms:Carefully review the contract terms and conditions to understand the risks and benefits.

To find a reputable provider, consider these tips:

- Seek recommendations:Ask your financial advisor or other trusted professionals for recommendations.

- Read reviews:Check online reviews and ratings from independent sources.

- Compare quotes:Get quotes from multiple providers to compare rates and features.

Immediate Annuity Payout Options and Legacy Planning

Immediate annuities can also be incorporated into legacy planning to provide for beneficiaries after your death. Here are some ways to use immediate annuities for legacy planning:

- Provide income for beneficiaries:You can purchase an annuity that continues to pay income to your beneficiaries after your death.

- Create a guaranteed inheritance:An annuity can provide a guaranteed inheritance for your beneficiaries, ensuring they receive a regular income stream.

- Protect assets from taxes:In some cases, annuity payments may be tax-advantaged for beneficiaries.

Examples of how immediate annuities can be incorporated into estate plans include:

- Funding a trust:You can use an annuity to fund a trust that provides income for your beneficiaries.

- Creating a charitable gift:You can purchase an annuity that provides income to a charity after your death.

Future Trends in Immediate Annuity Payout Options

The immediate annuity market is constantly evolving, with new products and services emerging to meet changing needs. Some future trends in immediate annuities include:

- Increased Customization:Annuity providers are developing more customizable products to meet the specific needs of individuals.

- Integration with Technology:Technology is playing a growing role in the annuity market, with online platforms and mobile apps making it easier to purchase and manage annuities.

- Focus on Longevity:As people live longer, there is an increasing focus on annuities that provide income for a longer period.

- Growth of Variable Annuities:Variable annuities are becoming more popular as investors seek potential growth in their retirement income.

Closing Notes

In conclusion, immediate annuity payout options offer a valuable tool for retirement planning, providing a reliable and predictable income stream. By carefully considering the different types of payout options, factors such as risk tolerance, and financial goals, individuals can choose the option that best suits their individual needs and aspirations.

Income riders are optional features that can enhance the income stream from a variable annuity. Variable Annuity Income Rider 2024 explains how these riders work, including their potential to provide guaranteed lifetime income or increased payments.

Commonly Asked Questions: Immediate Annuity Payout Options

What are the potential downsides of immediate annuities?

Annuity products can be a valuable component of a retirement plan, providing guaranteed income for life. Is Annuity Retirement 2024 explores the advantages and disadvantages of annuities in retirement planning, helping you determine if they align with your financial goals.

While immediate annuities offer guaranteed income, they typically come with lower returns compared to other investments. Additionally, once you purchase an annuity, you generally cannot access the principal amount, and the payout amount is fixed, which may not keep pace with inflation.

How do immediate annuities work with Social Security?

Immediate annuities can complement Social Security income. You can receive both annuity payments and Social Security benefits simultaneously, creating a more robust income stream for retirement.

What are some examples of different annuity payout options?

If you’re considering surrendering your variable annuity in 2024, it’s crucial to understand the potential implications. Variable Annuity Out Of Surrender 2024 provides insights into surrender charges and potential tax consequences, helping you make informed decisions about your financial future.

Common payout options include:

- Fixed Annuity:Offers a guaranteed fixed payment for life.

- Variable Annuity:Provides a payment that fluctuates based on the performance of an underlying investment portfolio.

- Indexed Annuity:Links payments to the performance of a specific index, such as the S&P 500, providing potential for growth while offering some downside protection.

Understanding the concept of discount factors is essential when calculating the present value of annuity payments. Calculate Annuity Discount Factor 2024 provides a clear explanation of discount factors and their application in annuity calculations.

Annuity contracts are widely used for various financial purposes, including retirement planning, income generation, and estate planning. Annuity Is Used In 2024 highlights the diverse applications of annuities and their potential to address specific financial needs.

Variable annuities often involve 12b-1 fees, which are marketing and distribution expenses. 12b-1 Fees Variable Annuity 2024 provides a detailed explanation of these fees and their impact on your annuity investment returns.

Annuity contracts and perpetuities are both financial instruments that provide periodic payments, but they differ in key aspects. Annuity Vs Perpetuity 2024 outlines the distinctions between these instruments, helping you understand their unique characteristics and applications.

While often associated with retirement planning, annuities are actually a type of life insurance product. Annuity Is A Life Insurance Product That 2024 delves into the insurance aspect of annuities, explaining how they provide protection and guaranteed income.

Accounting professionals use various methods to calculate the present value of annuity payments. Calculating Annuity In Accounting 2024 provides an overview of these methods and their application in financial reporting.

To explore the potential benefits of an annuity, consider using an online calculator. Annuity Calculator Basic 2024 provides a simple and user-friendly tool to estimate annuity payments and potential returns based on your specific financial situation.