Immediate Annuity Plan Calculator, a powerful tool for retirement planning, allows individuals to understand how much income they can generate from their savings. This calculator takes into account factors like your current savings, age, life expectancy, and interest rates to project your potential annuity payments.

If you’re looking to understand the intricacies of annuities in 2024, you’ve come to the right place. Whether you’re curious about how annuities work in Excel ( Annuity Is Excel 2024 ), the specific dates related to annuities ( Annuity Date Is 2024 ), or the specifics of variable annuities ( Life Incl Variable Annuity (0214) 2024 ), we’ve got you covered.

An immediate annuity is a financial product that provides a stream of guaranteed income for life. It is a popular option for retirees who want to ensure a consistent income stream and reduce the risk of outliving their savings. Immediate annuity plan calculators can help you explore different annuity options, compare potential payouts, and make informed decisions about your retirement planning.

Contents List

- 1 Introduction to Immediate Annuities

- 2 How Immediate Annuity Plan Calculators Work

- 3 Benefits of Using an Immediate Annuity Plan Calculator

- 4 Types of Immediate Annuities

- 5 Considerations When Choosing an Immediate Annuity: Immediate Annuity Plan Calculator

- 6 Real-World Examples of Immediate Annuity Plans

- 7 Risks and Limitations of Immediate Annuities

- 8 Last Recap

- 9 FAQ Resource

Introduction to Immediate Annuities

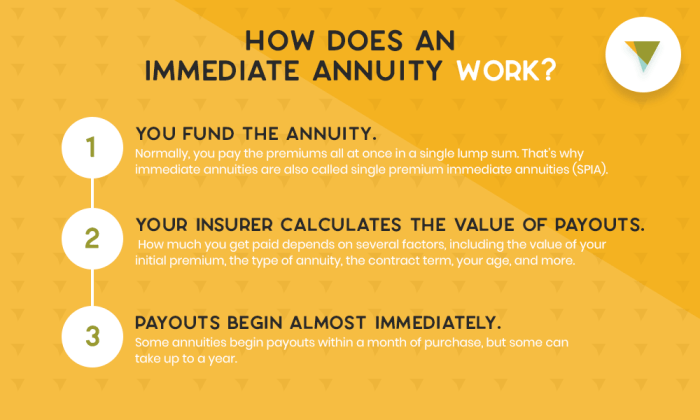

An immediate annuity is a financial product that provides a stream of regular payments to an individual, starting immediately upon purchase. These payments are guaranteed for a specific period or for the lifetime of the annuitant. Immediate annuities are often used in retirement planning to provide a steady income stream and protect against outliving one’s savings.

Key Features of Immediate Annuities

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for a specified period or for life.

- Regular Payments:Payments are typically made monthly, but can also be made quarterly, semi-annually, or annually.

- Lump Sum Investment:An immediate annuity is purchased with a lump sum payment, which is then used to fund the annuity payments.

- No Investment Risk:Once an immediate annuity is purchased, the principal investment is protected from market fluctuations.

Difference Between Immediate and Deferred Annuities

The key difference between immediate and deferred annuities lies in the timing of the payments. Immediate annuities begin payments immediately upon purchase, while deferred annuities start payments at a future date, often after a specified period or upon reaching a certain age.

Examples of Immediate Annuities in Retirement Planning, Immediate Annuity Plan Calculator

- Income Supplement:An immediate annuity can provide a steady income stream to supplement retirement savings and Social Security benefits.

- Guaranteed Income for Life:Immediate annuities can provide guaranteed income for life, reducing the risk of outliving one’s savings.

- Estate Planning:Immediate annuities can be used to provide income to beneficiaries after the annuitant’s death.

How Immediate Annuity Plan Calculators Work

Immediate annuity plan calculators are online tools that help individuals estimate potential annuity payments based on various factors. These calculators typically require specific inputs to perform their calculations.

Inputs Required for an Immediate Annuity Plan Calculator

- Investment Amount:The amount of money you plan to invest in the annuity.

- Age:Your current age at the time of purchase.

- Gender:Your gender, as life expectancies differ between men and women.

- Annuity Type:The type of annuity you are considering, such as fixed, variable, or indexed.

- Payment Frequency:The frequency of annuity payments, such as monthly, quarterly, or annually.

- Interest Rate:The interest rate offered by the annuity provider.

Calculations Performed by the Calculator

The calculator uses the inputs provided to determine the amount of each annuity payment. It typically performs calculations based on actuarial tables and financial models to project future income streams. The calculator considers factors such as interest rates, mortality rates, and the time value of money.

Factors Influencing Annuity Payment Amounts

- Interest Rates:Higher interest rates generally lead to larger annuity payments.

- Age:Younger individuals typically receive smaller annuity payments than older individuals, as they have a longer life expectancy.

- Life Expectancy:Individuals with longer life expectancies generally receive smaller annuity payments, as the payments need to be spread over a longer period.

Benefits of Using an Immediate Annuity Plan Calculator

Immediate annuity plan calculators offer several benefits for individuals considering annuity purchases.

Estimating Potential Annuity Income

Calculators provide a quick and easy way to estimate potential annuity payments based on your specific circumstances. This allows you to see how much income you could receive from an annuity and whether it meets your retirement income needs.

Comparing Different Annuity Options

Calculators can be used to compare different annuity options from various providers. By inputting the same information into different calculators, you can see how the payment amounts and terms vary between different annuity products.

Making Informed Decisions About Annuity Purchases

Annuity plan calculators provide valuable information to help you make informed decisions about annuity purchases. They allow you to explore different scenarios and understand the potential benefits and risks associated with different annuity options.

Types of Immediate Annuities

Immediate annuities are available in various types, each with its own features, benefits, and risks.

From understanding the specifics of Chapter 9 annuities ( Chapter 9 Annuities 2024 ) to exploring how annuities can be used for home loans ( Annuity Home Loan 2024 ), the world of annuities is vast.

Fixed Annuities

- Guaranteed Payments:Fixed annuities provide guaranteed, fixed payments for the life of the annuitant or for a specified period.

- No Investment Risk:The principal investment is protected from market fluctuations.

- Lower Potential Returns:Fixed annuities typically offer lower potential returns compared to variable or indexed annuities.

Variable Annuities

- Investment Options:Variable annuities allow you to invest your principal in a variety of sub-accounts, such as mutual funds or stocks.

- Potential for Higher Returns:Variable annuities have the potential for higher returns than fixed annuities, but also carry greater investment risk.

- No Guaranteed Payments:Payment amounts are not guaranteed and can fluctuate based on the performance of the underlying investments.

Indexed Annuities

- Linked to an Index:Indexed annuities link their returns to the performance of a specific market index, such as the S&P 500.

- Potential for Growth:Indexed annuities offer the potential for growth based on the performance of the underlying index.

- Limited Upside Potential:Indexed annuities typically have a cap on the maximum return they can earn.

Considerations When Choosing an Immediate Annuity: Immediate Annuity Plan Calculator

Choosing the right immediate annuity requires careful consideration of several factors.

Factors to Consider

- Your Financial Goals:Determine your retirement income needs and how an annuity can help you achieve your financial goals.

- Risk Tolerance:Assess your comfort level with investment risk and choose an annuity type that aligns with your risk tolerance.

- Life Expectancy:Consider your life expectancy and choose an annuity that provides income for the duration of your retirement.

- Interest Rates:Compare interest rates offered by different annuity providers to find the most favorable terms.

- Fees and Charges:Understand the fees and charges associated with different annuity products, including surrender charges and administrative fees.

Understanding Annuity Contract Terms

It is crucial to carefully review the terms and conditions of an annuity contract before purchasing. Pay close attention to the payment schedule, interest rate, surrender charges, and other provisions.

We cover a wide range of topics, including formula annuity bonds ( Formula Annuity Bond 2024 ), variable annuities with Fidelity ( Variable Annuity Fidelity 2024 ), and even provide real-life examples of variable annuities ( Variable Annuity Examples 2024 ).

Role of Financial Advisors

Financial advisors can play a valuable role in helping individuals choose the right immediate annuity. They can provide personalized advice based on your individual circumstances, financial goals, and risk tolerance.

And if you’re looking to get more hands-on, you can learn how to calculate annuity payments in Excel ( Calculating Annuity Payments In Excel 2024 ). Want to understand the guarantees of a variable annuity? ( A Variable Annuity Guarantees Which Of The Following 2024 )

Real-World Examples of Immediate Annuity Plans

| Annuity Type | Monthly Payment | Investment Amount | Interest Rate |

|---|---|---|---|

| Fixed Annuity | $2,500 | $250,000 | 3.5% |

| Variable Annuity | $2,000

|

$200,000 | 5% (average annual return) |

| Indexed Annuity | $2,200

|

$220,000 | 3% (minimum guaranteed return) + potential for growth |

These examples illustrate different scenarios and outcomes for immediate annuity plans, demonstrating the potential benefits and risks associated with each type.

Risks and Limitations of Immediate Annuities

While immediate annuities offer benefits, it is important to understand the potential risks and limitations associated with them.

Need to know more about variable annuity accounts? ( Variable Annuity Account 2024 ) We also cover how to calculate annuities for half-yearly periods ( Annuity Formula Half Yearly 2024 ). No matter what your annuity-related questions are, we’re here to help!

Interest Rate Risk

Fixed annuities are subject to interest rate risk. If interest rates rise after you purchase an annuity, the fixed payments you receive may be lower than what you could have earned with a new annuity at the higher rate.

Longevity Risk

There is a risk that you may outlive your annuity payments. If you live longer than expected, you may run out of income before you die.

Lack of Flexibility

Immediate annuities typically lack flexibility. Once you purchase an annuity, you cannot easily access the principal investment or change the payment terms.

Tax Implications

Annuity payments are generally taxed as ordinary income. You may need to consider the tax implications of annuity payments when making your purchase decision.

Mitigating Risks and Limitations

To mitigate the risks and limitations of immediate annuities, you can consider:

- Diversifying your retirement income sources:Don’t rely solely on an annuity for your retirement income. Supplement it with other sources, such as Social Security, savings, and investments.

- Choosing a longer payment period:Opt for an annuity with a longer payment period, such as a lifetime annuity, to reduce the risk of outliving your payments.

- Seeking professional financial advice:Consult with a financial advisor to understand the potential risks and limitations of annuities and to help you choose the right product for your needs.

Last Recap

Immediate annuity plan calculators are a valuable resource for anyone considering an immediate annuity. They provide a clear picture of potential income streams and help you compare different annuity options. However, it’s essential to consult with a financial advisor to ensure that an immediate annuity is the right choice for your individual circumstances.

FAQ Resource

What is the difference between a fixed and a variable annuity?

A fixed annuity offers a guaranteed interest rate and payment amount, while a variable annuity’s payments are linked to the performance of an underlying investment portfolio.

There’s a lot to consider when it comes to annuities, like whether to drawdown your annuity ( Is Annuity Drawdown 2024 ), the different riders available ( Variable Annuity Riders 2024 ), or even how Vanguard handles 1035 exchanges ( Vanguard Variable Annuity 1035 Exchange 2024 ).

How do I find a reputable annuity provider?

You can consult with a financial advisor, research online reviews, and check with the Better Business Bureau to find reputable annuity providers.

Are there any tax implications associated with immediate annuities?

Yes, annuity payments are generally taxed as ordinary income. Consult with a tax professional for specific guidance on your situation.