Immediate Annuity Plan Kotak offers a reliable way to secure a steady income stream for your retirement years. Kotak Mahindra Life Insurance, a trusted name in the Indian insurance market, provides these plans designed to provide financial stability during your golden years.

The rates for variable annuities can fluctuate based on market performance. If you’re looking for the latest variable annuity rates in 2024, you can find them on Variable Annuity Rates Today 2024. Keeping up with current rates is important for making informed investment decisions.

With Immediate Annuity Plans, you invest a lump sum amount, and in return, you receive regular payments for the rest of your life. This provides a predictable income source, shielding you from market fluctuations and inflation. The plans come with various payout options and frequencies, allowing you to customize them according to your individual needs and financial goals.

Immediate annuities offer guaranteed income for life, but they also come with certain limitations. To get a better understanding of whether immediate annuities are a good or bad choice for you, check out Immediate Annuity Good Or Bad.

This resource can help you weigh the pros and cons of immediate annuities.

Contents List

- 1 Introduction to Kotak Immediate Annuity Plans

- 1.1 What are Immediate Annuities?

- 1.2 Kotak Mahindra Life Insurance: A Leading Player in the Indian Insurance Market, Immediate Annuity Plan Kotak

- 1.3 Key Features of Kotak Immediate Annuity Plans

- 1.4 Benefits of Investing in Kotak Immediate Annuity Plans

- 1.5 Eligibility Criteria and Application Process

- 1.6 Comparison with Other Investment Options

- 1.7 Considerations and Risks Associated with Immediate Annuities

- 1.8 Case Studies and Examples

- 2 Epilogue: Immediate Annuity Plan Kotak

- 3 FAQ Resource

Introduction to Kotak Immediate Annuity Plans

Kotak Immediate Annuity Plans are a type of insurance product that provides a guaranteed stream of income for life. These plans are ideal for individuals looking for a secure and reliable source of income during retirement or other life stages.

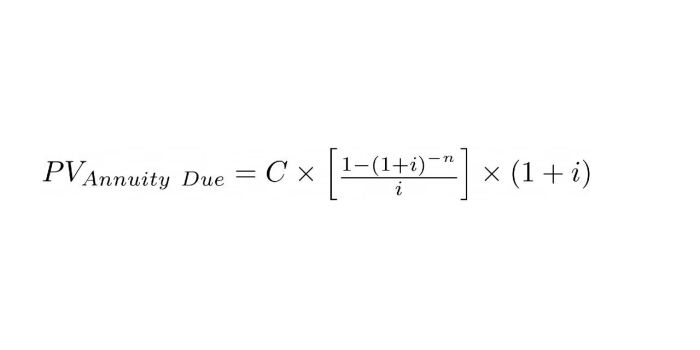

A PV calculator for annuities can be a helpful tool for estimating the present value of your future annuity payments. You can find a helpful PV calculator for annuities on Pv Calculator Annuity 2024. Using a calculator can make it easier to compare different annuity options.

Kotak Mahindra Life Insurance, a leading life insurance company in India, offers a range of immediate annuity plans designed to cater to diverse financial needs and risk appetites.

There are different types of annuities available, each with its own unique features and benefits. You can find information on six different types of annuities in 2024 at 6 Annuity 2024. This resource can help you compare and contrast different annuity options.

What are Immediate Annuities?

Immediate annuities are a type of insurance contract that provides a regular stream of income payments, starting immediately upon purchase. The amount of the annuity payment depends on factors such as the amount of the initial investment, the chosen payout option, and the age of the annuitant.

If you have a variable annuity and are considering rolling it over into an IRA, it’s important to understand the tax implications and other factors involved. You can find helpful information on rolling over variable annuities to an IRA in 2024 at Variable Annuity Rollover To Ira 2024.

These plans offer a guaranteed income stream for life, providing financial security and peace of mind.

An annuity is a financial product that provides a stream of regular payments over a set period. If you’re looking for a basic definition of an annuity in 2024, you can find it at Annuity Is Meaning 2024.

Understanding the basics of annuities can help you determine if they are right for your financial goals.

Kotak Mahindra Life Insurance: A Leading Player in the Indian Insurance Market, Immediate Annuity Plan Kotak

Kotak Mahindra Life Insurance is a renowned life insurance company in India, known for its innovative and customer-centric products and services. The company has a strong track record of providing reliable and comprehensive insurance solutions to individuals and families across the country.

Calculating the monthly payments for an annuity loan can be a bit tricky, but luckily, there are formulas to help you out. You can learn more about the annuity loan formula for 2024 and how to apply it to your specific financial situation by visiting Annuity Loan Formula 2024.

Kotak Mahindra Life Insurance is committed to delivering value to its customers and helping them achieve their financial goals.

An annuity with a starting principal of $50,000 can provide a steady stream of income over time. To learn more about annuities with a starting principal of $50,000 in 2024, visit Annuity 50k 2024. This resource can help you explore different annuity options and their potential returns.

Key Features of Kotak Immediate Annuity Plans

Kotak Immediate Annuity Plans offer a variety of features to suit different financial needs and preferences. Here are some key features of these plans:

- Types of Plans:Kotak offers various immediate annuity plans, including single premium, regular premium, and guaranteed period plans, each with its unique features and benefits.

- Payout Options:You can choose from different payout options, such as a fixed amount, a growing amount, or a combination of both. The payout frequency can be monthly, quarterly, semi-annually, or annually.

- Investment Amounts:The minimum and maximum investment amounts vary depending on the plan chosen. However, Kotak offers flexible investment options to suit different budgets.

- Tax Benefits:The premiums paid towards Kotak Immediate Annuity Plans are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. The annuity payments received are also tax-free under Section 10(10D) of the Act.

Benefits of Investing in Kotak Immediate Annuity Plans

Investing in Kotak Immediate Annuity Plans offers several advantages, including:

- Guaranteed Income Stream:These plans provide a guaranteed income stream for life, ensuring financial stability and security during retirement or other life stages.

- Protection Against Inflation and Market Volatility:Annuity payments are not affected by market fluctuations or inflation, providing a hedge against these uncertainties.

- Secure Retirement Income:Kotak Immediate Annuity Plans can help secure your retirement income, ensuring a comfortable and financially independent lifestyle.

- Specific Financial Goals:These plans can be used to achieve specific financial goals, such as funding education expenses, providing for family members, or supplementing existing income streams.

Eligibility Criteria and Application Process

To be eligible for Kotak Immediate Annuity Plans, you need to meet certain criteria. The application process is straightforward and can be completed through various channels.

Annuity due is a type of annuity where payments are made at the beginning of each period. If you’re looking to learn more about annuity due in 2024, including its features and benefits, then you can find more information at Annuity Due Is 2024.

Understanding the different types of annuities can help you make informed financial decisions.

- Eligibility Criteria:The eligibility criteria typically include age, health, and income requirements. You can find detailed information on the Kotak Mahindra Life Insurance website or contact their customer service team.

- Application Process:The application process involves completing an application form, providing necessary documentation, and undergoing a medical examination (if required). You can apply online, through an agent, or at a Kotak Mahindra Life Insurance branch.

- Required Documentation:The required documents typically include proof of identity, address, age, income, and medical records (if applicable). The specific documentation required may vary depending on the plan chosen.

- Application Channels:You can apply for Kotak Immediate Annuity Plans through the following channels:

- Online: Through the Kotak Mahindra Life Insurance website.

- Agent: Through an authorized Kotak Mahindra Life Insurance agent.

- Branch: By visiting a Kotak Mahindra Life Insurance branch.

Comparison with Other Investment Options

Kotak Immediate Annuity Plans offer a unique investment option compared to other retirement planning strategies. Here’s a comparison of Kotak Immediate Annuity Plans with other popular investment options:

| Investment Option | Key Features | Benefits | Risks |

|---|---|---|---|

| Kotak Immediate Annuity Plans | Guaranteed income stream, protection against inflation and market volatility, tax benefits | Financial security, peace of mind, guaranteed income for life | Limited flexibility, potential for lower returns compared to other investments |

| Fixed Deposits | Fixed interest rate, low risk, guaranteed returns | Predictable income, low risk | Returns may be lower than inflation, limited liquidity |

| Mutual Funds | Potential for higher returns, diversification, tax benefits | Growth potential, flexibility | Market volatility, risk of capital loss |

| Equity Investments | Potential for high returns, growth potential, liquidity | High growth potential, potential for capital appreciation | High risk, market volatility, risk of capital loss |

Considerations and Risks Associated with Immediate Annuities

Before investing in Kotak Immediate Annuity Plans, it’s essential to consider various factors and potential risks associated with these plans. Understanding these aspects will help you make an informed decision.

Immediate annuities are a popular choice for those seeking guaranteed income in retirement. To learn more about how immediate annuities work and their potential benefits, check out How Does An Immediate Annuity Work. This resource can provide valuable insights into this type of annuity.

- Factors to Consider:

- Your financial goals and objectives.

- Your risk tolerance and investment horizon.

- Your current income and expenses.

- Your health and life expectancy.

- Potential Risks:

- Lower Returns:Annuity payments may be lower than potential returns from other investments, especially in a bull market.

- Limited Flexibility:Once you purchase an annuity, you cannot withdraw the invested amount or change the payout options easily.

- Inflation Risk:While annuity payments are guaranteed, they may not keep pace with inflation, leading to a decline in purchasing power over time.

- Risk Mitigation:

- Choose the Right Plan:Select a plan that aligns with your financial goals, risk tolerance, and investment horizon.

- Consider Inflation Protection:Opt for plans that offer inflation protection to ensure your purchasing power is preserved.

- Diversify Investments:Don’t put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk.

Case Studies and Examples

Here are some real-life examples of how individuals have benefited from Kotak Immediate Annuity Plans:

- Case Study 1:Mr. Sharma, a retired school teacher, purchased a Kotak Immediate Annuity Plan to secure a regular income stream for his post-retirement life. The plan provided him with a guaranteed monthly income, allowing him to maintain his lifestyle and cover his expenses.

- Case Study 2:Ms. Patel, a working professional, wanted to ensure financial security for her family in case of an unexpected event. She purchased a Kotak Immediate Annuity Plan with a guaranteed period, providing her family with a regular income stream for a specified duration.

Epilogue: Immediate Annuity Plan Kotak

Choosing the right retirement plan is crucial for ensuring financial security in your later years. Kotak Immediate Annuity Plans offer a compelling solution with guaranteed income, inflation protection, and tax benefits. By carefully considering your individual circumstances and financial goals, you can make an informed decision about whether this plan is right for you.

Take the first step towards a secure retirement by exploring Kotak Immediate Annuity Plans today.

FAQ Resource

What is the minimum investment amount for Kotak Immediate Annuity Plans?

The minimum investment amount varies depending on the specific plan you choose. It’s best to contact Kotak Mahindra Life Insurance for detailed information.

Are there any age restrictions for applying for these plans?

Yes, there are age restrictions. You must be at least 18 years old to apply. However, the maximum age limit might vary depending on the plan.

Wondering if your annuity payments from life insurance are taxable? You can find the answer to that question and more about the tax implications of annuities in 2024 by visiting Is Annuity For Life Insurance Taxable 2024. Understanding the tax implications of annuities is crucial for financial planning, especially as you approach retirement.

What are the tax benefits associated with Kotak Immediate Annuity Plans?

The premiums paid towards these plans may qualify for tax deductions under specific sections of the Income Tax Act. Consult with a tax advisor for personalized advice.

How can I withdraw my investment before maturity?

These plans typically don’t offer the option to withdraw your investment before maturity. However, you can inquire about any potential exceptions or surrender options.

Understanding the formula for calculating immediate annuity payments can be helpful for making informed financial decisions. You can find the formula for calculating immediate annuities at Immediate Annuity Formula. This formula can help you estimate your potential annuity payments.

An annuity is a financial contract that provides a stream of payments over a specified period. If you’re looking for a detailed definition of an annuity in 2024, you can find it at Annuity Is Definition 2024. Understanding the definition of an annuity is crucial for making informed financial decisions.

Immediate annuities offer a variety of benefits, including guaranteed income for life, tax-deferred growth, and protection from market fluctuations. You can find more information on the benefits of immediate annuities at Immediate Annuity Benefits. Understanding the benefits of immediate annuities can help you determine if they are right for your financial goals.

The Polaris Platinum 3 Variable Annuity is a popular choice for those seeking a diversified investment with the potential for growth. To learn more about the Polaris Platinum 3 Variable Annuity in 2024, visit Polaris Platinum 3 Variable Annuity 2024.

This resource can provide insights into the features and benefits of this specific annuity.