Immediate Annuity Schemes In India are gaining popularity as a way to secure a steady income stream during retirement. These schemes offer a guaranteed payout for life, providing financial stability and peace of mind. By converting a lump sum into a regular income, immediate annuities can help individuals manage longevity risk and protect their savings from market fluctuations.

To help you plan for your future, Immediate Annuity Plan Calculator provides a useful tool for calculating your potential annuity payments. Immediate Annuity Payout explores the different payout options available with immediate annuities.

In India, a variety of immediate annuity schemes are available, each with its own unique features and benefits. These schemes can be tailored to meet individual needs and financial goals, whether it’s providing a steady income stream for daily expenses, supplementing existing retirement income, or leaving a legacy for loved ones.

If you’re considering an annuity in India, Immediate Annuity India provides information on immediate annuities available in India.

Contents List

Immediate Annuities in India: A Comprehensive Guide: Immediate Annuity Schemes In India

In India’s dynamic financial landscape, retirement planning has taken center stage, with individuals seeking secure and sustainable income streams to navigate their golden years. Immediate annuities, a unique financial instrument, have emerged as a viable option for those seeking guaranteed income and financial stability during retirement.

This comprehensive guide will delve into the intricacies of immediate annuities in India, exploring their purpose, features, benefits, and considerations for potential investors.

When considering an annuity, it’s important to understand the tax implications. Annuity Exclusion Ratio 2024 explains how annuity payments are taxed. If you’re looking for flexible payment options, Immediate Annuity With Quarterly Payments can help you explore the possibilities.

Introduction to Immediate Annuities in India

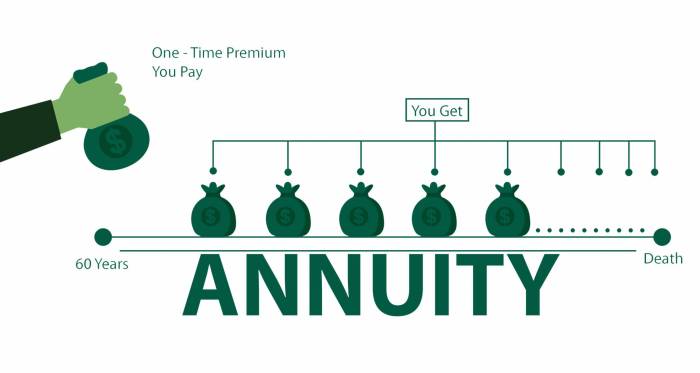

Immediate annuities, also known as single-premium immediate annuities (SPIAs), are financial contracts where an individual makes a lump-sum payment to an insurance company in exchange for regular, guaranteed income payments that begin immediately. These payments can continue for a fixed period, the lifetime of the annuitant, or the lifetime of the annuitant and their spouse.

Annuity is a series of equal payments, and understanding how they work is important for financial planning. Annuity Is A Series Of Equal Payments 2024 explains the basics of annuities, while Annuity Unit Is 2024 delves into the specific unit used in annuity calculations.

The purpose of immediate annuities in the Indian financial landscape is to provide a steady stream of income that is not subject to market fluctuations, making them an attractive option for individuals seeking financial security in retirement.

Winning the lottery can be life-changing, but understanding how annuity payments work is crucial. Calculating Lottery Annuity Payments 2024 explains the process of calculating lottery annuity payments. You can also learn about different types of annuities like Annuity Contingent Is 2024 , which is contingent on certain events.

Immediate annuities offer several key features that make them appealing to retirees:

- Guaranteed Income Streams:The most significant advantage of immediate annuities is the guarantee of regular income payments, regardless of market performance. This eliminates the risk of outliving one’s savings, a major concern for retirees.

- Tax Implications:In India, annuity payments are generally taxed as income, but the premiums paid are eligible for tax deductions under Section 80CCC of the Income Tax Act. This can significantly reduce the overall tax burden for annuitants.

It is important to distinguish between immediate annuities and deferred annuities. While both are annuity contracts, the key difference lies in the timing of income payments. Immediate annuities provide income payments immediately after the lump-sum premium is paid, while deferred annuities offer income payments at a future date, typically after a specified period or upon reaching a certain age.

Types of Immediate Annuities in India

The Indian annuity market offers a variety of immediate annuity products, each with its own unique features and risk profiles. Understanding these different types is crucial for choosing the annuity that best aligns with your financial goals and risk tolerance.

Here are the most common types of immediate annuities available in India:

| Type of Annuity | Features | Benefits | Risks |

|---|---|---|---|

| Fixed Annuity | Provides a fixed, guaranteed income stream for the life of the annuitant. The payment amount remains constant, regardless of market fluctuations. | Predictable and reliable income stream. Offers protection against inflation and market volatility. | Returns may not keep pace with inflation, potentially eroding the purchasing power of income payments. |

| Variable Annuity | Offers a variable income stream linked to the performance of a specific investment portfolio. The payment amount fluctuates based on the performance of the underlying investments. | Potential for higher returns compared to fixed annuities. Offers flexibility in choosing investment options. | Higher risk due to exposure to market fluctuations. Income payments may be lower than expected if investments underperform. |

| Indexed Annuity | Provides a guaranteed minimum income stream, with the potential for growth linked to a specific index, such as the Sensex or Nifty. The payment amount is adjusted based on the performance of the index, but there is a cap on the maximum growth. | Offers a balance between guaranteed income and potential for growth. Provides protection against inflation and market volatility. | Limited growth potential compared to variable annuities. The cap on growth may limit returns in a strong market. |

Benefits of Immediate Annuities in India, Immediate Annuity Schemes In India

Immediate annuities offer a range of benefits for individuals seeking financial security during retirement, particularly those seeking guaranteed income streams and protection against longevity risk and market fluctuations.

For those using financial calculators, Calculating Annuities On Ba Ii Plus 2024 offers guidance on how to calculate annuities using the BA II Plus calculator. If you prefer using spreadsheets, Pv Annuity Excel 2024 provides insights on using Excel to calculate annuities.

Here are some of the key advantages of immediate annuities in India:

- Guaranteed Income:Immediate annuities provide a guaranteed income stream that is not subject to market fluctuations, ensuring a steady flow of income throughout retirement. This eliminates the risk of outliving one’s savings, a major concern for retirees.

- Longevity Risk Management:Immediate annuities help manage longevity risk, the risk of living longer than expected and running out of savings. By providing a guaranteed income stream for life, they ensure that individuals have a reliable source of income even in their later years.

- Protection from Market Volatility:In a volatile market, immediate annuities offer a safe haven for retirement savings. The guaranteed income payments are not affected by market fluctuations, protecting individuals from potential losses in their investments.

Real-life scenarios illustrate the benefits of immediate annuities. Consider a retired individual who has a significant lump-sum amount saved for retirement. By purchasing an immediate annuity, they can convert this lump sum into a guaranteed income stream, ensuring a comfortable retirement even if they live longer than expected.

Variable annuities can offer potential growth, but they also come with risks. A Variable Annuity Does Not Provide 2024 sheds light on the potential drawbacks of variable annuities. To better understand the tax implications, How Annuity Is Taxed 2024 provides valuable information on how annuity payments are taxed.

Ending Remarks

Immediate annuities offer a valuable tool for individuals seeking financial security in retirement. By carefully considering their financial situation, risk tolerance, and long-term goals, individuals can choose an annuity scheme that aligns with their needs and provides a steady income stream for life.

As the Indian financial landscape evolves, immediate annuities are poised to play an increasingly important role in helping individuals secure a comfortable and fulfilling retirement.

Quick FAQs

What is the minimum age to purchase an immediate annuity in India?

There is no minimum age requirement to purchase an immediate annuity in India. However, the annuity payout will be lower if you purchase it at a younger age.

Are immediate annuities tax-deductible?

The premiums paid for immediate annuities are not tax-deductible in India. However, the annuity payments received are generally taxable as per your income tax slab.

What happens to the annuity payments if the annuitant dies?

The annuity payments may be discontinued upon the annuitant’s death, depending on the specific scheme. Some schemes offer a death benefit or a return of premium to the beneficiary.

Can I withdraw the premium paid for an immediate annuity?

Immediate annuities are typically non-refundable, meaning you cannot withdraw the premium paid. However, some schemes may offer a surrender value after a certain period.

If you’re looking to secure your retirement income, an immediate annuity could be a good option. Immediate Annuity For 80 Year-Old provides insights on how immediate annuities work for older individuals, while Fixed Variable Annuity 2024 explores the different types of annuities available.