Immediate Annuity Tables provide a roadmap for understanding how these financial instruments can help you secure a steady stream of income during retirement. Immediate annuities are contracts that provide guaranteed payments for life, starting immediately after purchase. They are a popular choice for retirees seeking predictable income and protection against outliving their savings.

This guide will explore the mechanics of immediate annuities, delving into their advantages, disadvantages, and key factors to consider when making a decision. We’ll also discuss the role of immediate annuity tables in retirement planning and provide a comprehensive overview of the factors that influence annuity payouts.

For those interested in a specific variable annuity product, the Delaware Life Compass 3 Variable Annuity 2024 article provides details about its features and potential benefits.

Contents List

- 1 Immediate Annuity Basics

- 2 How Immediate Annuities Work

- 3 Advantages of Immediate Annuities

- 4 Disadvantages of Immediate Annuities

- 5 Factors to Consider When Choosing an Immediate Annuity

- 6 Immediate Annuity Tables and Their Use

- 7 Immediate Annuities and Retirement Planning

- 8 Ultimate Conclusion: Immediate Annuity Tables

- 9 General Inquiries

Immediate Annuity Basics

An immediate annuity is a financial product that provides a guaranteed stream of income for life, starting immediately after the purchase. This type of annuity is a popular choice for retirees seeking to convert their savings into a reliable source of income.

If you’re considering a Nationwide Destination B Variable Annuity, the Nationwide Destination B Variable Annuity Prospectus 2024 article provides a detailed overview of its features and potential risks.

Key Characteristics of Immediate Annuities

Immediate annuities are characterized by several key features that differentiate them from other financial products. These characteristics include:

- Guaranteed Income:Immediate annuities offer a guaranteed stream of income for life, regardless of how long the annuitant lives. This provides peace of mind, knowing that income will continue even in the event of unforeseen circumstances.

- Fixed Payments:The payment amount is typically fixed for the life of the annuity. This ensures predictable income and helps with budgeting and financial planning.

- Lump-Sum Purchase:Immediate annuities are purchased with a lump sum payment, which is then used to generate the income stream. This allows for a one-time investment to secure future income.

Difference Between Immediate and Deferred Annuities

While both immediate and deferred annuities provide income, the main difference lies in the timing of the income payments. An immediate annuity starts paying out immediately after the purchase, whereas a deferred annuity has a waiting period before payments begin.

This waiting period can range from a few years to several decades, depending on the terms of the annuity contract.

Factors Influencing Immediate Annuity Payouts

Several factors influence the payout amount of an immediate annuity. These factors include:

- Age:The older the annuitant, the lower the payout amount, as the insurer expects to pay out for a shorter period. This is because older individuals have a shorter life expectancy.

- Interest Rates:Interest rates play a significant role in determining annuity payouts. When interest rates are high, insurers can offer higher payouts, as they can invest the lump-sum payment at a higher rate of return. Conversely, lower interest rates lead to lower payouts.

Sometimes, you might find yourself in a situation where your annuity is out of surrender. The My Annuity Is Out Of Surrender 2024 article explains what this means and your options for moving forward.

- Gender:Women generally receive lower payouts than men for the same amount of principal, as they tend to have a longer life expectancy.

- Annuity Type:Different types of immediate annuities offer varying payout options, which can impact the amount received. For example, a single-life annuity provides payments for the life of the annuitant, while a joint-life annuity provides payments for the lives of two individuals.

If you’re looking to secure a steady income stream for retirement, you might want to consider an annuity. But with so many different types and options available, it can be overwhelming to know where to start. Annuity 30k 2024 is a great starting point for understanding how much you can expect to receive, and the Annuity 30k 2024 article can help you navigate this complex world.

How Immediate Annuities Work

Purchasing an immediate annuity involves a straightforward process. Here’s a step-by-step guide:

Purchasing an Immediate Annuity

- Choose an Annuity Provider:Select a reputable and financially sound annuity provider. Consider factors such as financial stability, customer service, and product offerings.

- Determine the Annuity Type:Decide on the type of immediate annuity that best suits your needs and financial goals. This could include a single-life, joint-life, or variable annuity.

- Provide Personal Information:Provide the annuity provider with your personal information, including your age, gender, and health status. This information is used to determine the payout amount.

- Fund the Annuity:Make a lump-sum payment to the annuity provider. The amount of the payment determines the amount of income you will receive.

- Start Receiving Payments:Once the annuity is funded, you will begin receiving regular income payments, typically on a monthly basis.

Types of Immediate Annuities

Immediate annuities are available in several different forms, each with its own unique characteristics and payout options. Some common types of immediate annuities include:

- Single-Life Annuity:This type of annuity provides payments for the life of the annuitant. Payments cease upon the annuitant’s death.

- Joint-Life Annuity:This annuity provides payments for the lives of two individuals, typically a couple. Payments continue until the death of the last surviving annuitant.

- Variable Annuity:This type of annuity offers the potential for growth, but also carries the risk of loss. The payout amount is linked to the performance of a specific investment portfolio.

Examples of Using Immediate Annuities to Generate Income

Immediate annuities can be used in various ways to generate income. Some common examples include:

- Retirement Income:Immediate annuities can provide a reliable source of income during retirement, supplementing other retirement assets like pensions and Social Security.

- Estate Planning:Immediate annuities can be used to provide income for beneficiaries after the death of the annuitant. This can help to ensure financial security for loved ones.

- Long-Term Care:Immediate annuities can provide income to cover the costs of long-term care, such as nursing home expenses or assisted living.

Advantages of Immediate Annuities

Immediate annuities offer several advantages that make them a valuable tool for retirement planning and income generation. These advantages include:

Guaranteed Income for Life

One of the primary benefits of immediate annuities is the guarantee of income for life. This provides peace of mind, knowing that income will continue regardless of how long the annuitant lives. This is especially important for retirees who want to ensure a steady stream of income for the rest of their lives.

Ultimately, the question of whether an annuity is a good investment depends on your individual circumstances and financial goals. The Annuity Is It A Good Investment 2024 article offers valuable insights to help you determine if an annuity is the right choice for you.

Protection Against Longevity Risk

Immediate annuities can help to protect against longevity risk, the risk of outliving one’s savings. This is a growing concern for retirees, as people are living longer than ever before. By providing guaranteed income for life, immediate annuities help to ensure that retirees will have enough income to meet their needs throughout their retirement years.

If you’re trying to calculate the number of years your annuity will last, the Calculate Annuity Years 2024 article provides helpful tips and tools to make this calculation.

Example of Longevity Risk Protection, Immediate Annuity Tables

Imagine a retiree who has saved $1 million for retirement. They could choose to invest this money in stocks, bonds, or other investments, hoping to generate enough income to last their lifetime. However, there is no guarantee that these investments will perform well over the long term.

Many annuities have a 5-year rule, which impacts early withdrawals. The Annuity 5 Year Rule 2024 article provides a comprehensive overview of this rule and its implications.

If the retiree lives longer than expected, they could run out of money before they die. An immediate annuity, on the other hand, would provide a guaranteed stream of income for life, regardless of how long the retiree lives. This would eliminate the risk of outliving their savings.

One popular option is the Annuity 5, which offers a guaranteed income stream for five years. The Annuity 5 2024 article provides insights into the workings of this type of annuity, including its potential benefits and drawbacks.

Disadvantages of Immediate Annuities

While immediate annuities offer several advantages, they also have some potential drawbacks. These drawbacks include:

Potential Drawbacks of Investing in Immediate Annuities

- Lower Returns:Immediate annuities typically offer lower returns than other investment options, such as stocks or bonds. This is because the guaranteed income stream comes at a cost. The insurer must factor in the risk of having to pay out for a longer period than expected.

- Lack of Flexibility:Once an immediate annuity is purchased, the payout amount is fixed and cannot be changed. This can be a disadvantage if the annuitant’s financial needs change over time.

- Interest Rate Risk:The payout amount of an immediate annuity is influenced by interest rates. If interest rates fall after the annuity is purchased, the payout amount may not keep pace with inflation.

Impact of Interest Rate Changes on Annuity Payouts

Interest rates have a significant impact on annuity payouts. When interest rates are high, insurers can offer higher payouts, as they can invest the lump-sum payment at a higher rate of return. However, if interest rates fall after the annuity is purchased, the payout amount may not keep pace with inflation.

This means that the annuitant’s purchasing power could decline over time.

Finally, if you’re looking for information about annuity rates in the UK, the Annuity Rates Uk 2024 article provides a comprehensive overview of the current market and how to find the best rates.

Comparing Returns of Immediate Annuities with Other Investment Options

Immediate annuities typically offer lower returns than other investment options, such as stocks or bonds. This is because the guaranteed income stream comes at a cost. The insurer must factor in the risk of having to pay out for a longer period than expected.

However, it’s important to consider the risk and reward profile of each investment option. While stocks and bonds have the potential for higher returns, they also carry a greater risk of loss. Immediate annuities offer a guaranteed income stream, but at the cost of lower returns.

Factors to Consider When Choosing an Immediate Annuity

When choosing an immediate annuity, there are several factors to consider to ensure that you select the best option for your needs and financial goals. These factors include:

Key Considerations When Selecting an Immediate Annuity

- Annuity Provider:Choose a reputable and financially sound annuity provider. Consider factors such as financial stability, customer service, and product offerings. Look for providers with a strong track record and positive customer reviews.

- Annuity Type:Decide on the type of immediate annuity that best suits your needs and financial goals. Consider factors such as your life expectancy, the need for joint-life coverage, and your risk tolerance.

- Payout Options:Immediate annuities offer various payout options, such as monthly, quarterly, or annual payments. Choose the option that best aligns with your income needs and spending habits.

- Interest Rates:Interest rates play a significant role in determining annuity payouts. Compare rates from different providers to ensure that you are getting a competitive offer.

- Fees and Expenses:Be aware of any fees and expenses associated with the annuity, such as administrative fees, surrender charges, and mortality charges. These fees can impact the overall return on your investment.

Importance of Choosing a Reputable Annuity Provider

Choosing a reputable annuity provider is crucial to ensure the safety and security of your investment. A reputable provider will have a strong track record of financial stability and customer service. They should also be transparent about their fees and expenses.

If you’re considering a variable annuity, it’s essential to understand how to designate a beneficiary. The Variable Annuity Beneficiary 2024 article explains the process and the importance of choosing the right person to receive your annuity payments.

Look for providers with a high rating from independent financial rating agencies.

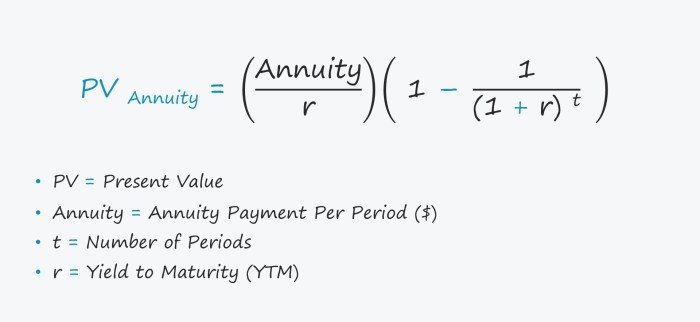

Understanding the present value of an annuity is crucial for making sound financial decisions. The Pv Annuity Of 1 Table 2024 article offers a helpful table and explanation of this important concept.

Factors Influencing the Payout Amount of an Immediate Annuity

Several factors influence the payout amount of an immediate annuity. These factors include:

- Age:The older the annuitant, the lower the payout amount, as the insurer expects to pay out for a shorter period.

- Gender:Women generally receive lower payouts than men for the same amount of principal, as they tend to have a longer life expectancy.

- Interest Rates:Higher interest rates lead to higher payouts, as insurers can invest the lump-sum payment at a higher rate of return.

- Annuity Type:Different types of immediate annuities offer varying payout options, which can impact the amount received.

Immediate Annuity Tables and Their Use

Immediate annuity tables are a valuable tool for understanding the payout options available for different ages and principal amounts. These tables are typically provided by annuity providers and can help individuals compare different annuity options and make informed decisions.

While annuities can provide financial security, they also involve a degree of uncertainty. The Annuity Uncertain 2024 article explores the factors that contribute to this uncertainty and how to manage it.

Purpose of Immediate Annuity Tables

Immediate annuity tables are designed to illustrate the relationship between age, principal amount, and payout amount. They provide a quick and easy way to estimate the income stream that can be generated from an immediate annuity. These tables are particularly helpful for individuals who are considering purchasing an immediate annuity and want to compare different payout options.

Table Demonstrating Different Annuity Payout Options

The following table shows the estimated monthly payouts for a $100,000 immediate annuity, based on different ages and annuity types:

| Age | Single-Life Annuity | Joint-Life Annuity (Couple) |

|---|---|---|

| 65 | $650 | $500 |

| 70 | $750 | $550 |

| 75 | $850 | $600 |

| 80 | $950 | $650 |

Note:These are just estimated payouts and actual payouts may vary depending on the specific annuity provider, interest rates, and other factors.

Limitations of Immediate Annuity Tables

Immediate annuity tables have some limitations that should be considered when using them. These limitations include:

- Generalizations:Annuity tables are based on general assumptions and may not accurately reflect the specific circumstances of an individual. Factors such as health status, investment performance, and fees can impact the actual payout amount.

- Outdated Information:Annuity tables are often based on current interest rates and other market conditions. These conditions can change over time, making the table’s information outdated.

- Limited Options:Annuity tables typically only show a limited number of payout options. They may not include all the available annuity types or payout structures.

Immediate Annuities and Retirement Planning

Immediate annuities can play a valuable role in retirement planning, providing a guaranteed income stream and helping to ensure financial security in retirement. They can be used in various ways to supplement other retirement assets and create a comprehensive retirement income plan.

For those looking for information about a specific mortality table used in annuities, the Annuity 2000 Mortality Table 2024 article offers insights into its workings and its impact on annuity payments.

Role of Immediate Annuities in Retirement Planning

Immediate annuities can be used to:

- Provide a guaranteed income stream:Immediate annuities offer a guaranteed stream of income for life, providing a reliable source of income during retirement.

- Supplement other retirement assets:Annuities can be used to supplement other retirement assets, such as pensions and Social Security, to create a more diversified income stream.

- Protect against longevity risk:Immediate annuities can help to protect against longevity risk, the risk of outliving one’s savings. This is a growing concern for retirees, as people are living longer than ever before.

Designing a Retirement Income Plan that Incorporates an Immediate Annuity

A retirement income plan that incorporates an immediate annuity should consider the following factors:

- Retirement income needs:Determine your estimated annual retirement income needs, taking into account expenses such as housing, healthcare, travel, and entertainment.

- Other retirement assets:Assess the value of your other retirement assets, such as pensions, Social Security, and savings accounts.

- Annuity amount:Decide on the amount of principal you want to allocate to an immediate annuity. This will depend on your risk tolerance, income needs, and financial goals.

- Annuity type:Choose the type of immediate annuity that best suits your needs and financial goals, such as a single-life, joint-life, or variable annuity.

- Payout options:Select the payout option that best aligns with your income needs and spending habits, such as monthly, quarterly, or annual payments.

Impact of Immediate Annuities on Other Retirement Assets

Immediate annuities can impact other retirement assets in several ways. For example, if you allocate a significant portion of your savings to an immediate annuity, you may have less money available for other investments. However, the guaranteed income stream from the annuity can provide peace of mind and allow you to reduce your reliance on other investments.

It’s important to carefully consider the impact of an immediate annuity on your overall retirement income plan.

It’s also important to understand whether an annuity is actually insurance. The Is Annuity Insurance 2024 article provides a clear explanation of the differences between annuities and insurance, helping you make an informed decision.

Ultimate Conclusion: Immediate Annuity Tables

Immediate annuities can be a valuable tool for retirement planning, offering guaranteed income for life and protection against longevity risk. However, it’s essential to weigh the potential drawbacks and carefully consider your individual circumstances before making a decision. By understanding the complexities of immediate annuities and utilizing the information provided in annuity tables, you can make informed choices that align with your retirement goals.

General Inquiries

What are the different types of immediate annuities?

However, before you commit to an annuity, it’s essential to understand the potential penalties associated with early withdrawals. The Variable Annuity Early Withdrawal Penalty 2024 article discusses the specifics of these penalties and how they can impact your financial plan.

Immediate annuities come in various forms, including fixed, variable, and indexed annuities. Each type offers distinct features and payout options, so it’s crucial to choose the one that best aligns with your risk tolerance and financial goals.

How do interest rates affect immediate annuity payouts?

Interest rate fluctuations can impact the payout amount of an immediate annuity. Higher interest rates generally lead to larger payouts, while lower interest rates may result in smaller payments. It’s essential to consider the current interest rate environment and its potential impact on your annuity payments.

What are the limitations of immediate annuity tables?

Annuity tables provide general estimates of payouts based on age and principal amount. However, they don’t account for individual factors like health, lifestyle, and specific annuity contract terms. Therefore, it’s crucial to consult with a financial advisor for personalized guidance.