The Immediate Annuity Tax Calculator takes center stage, providing a clear understanding of the tax implications associated with immediate annuities, a crucial element of retirement planning. This guide explores the intricacies of immediate annuities, including their payout structure, tax treatment, and ho

Annuities and 401(k)s are both popular retirement savings options. Annuity Vs 401k 2024 compares these two options, outlining their similarities and differences, and helping you make an informed decision about which best suits your retirement goals.

w they can be used to generate consistent retirement income.

Imme

An immediate annuity can provide a guaranteed stream of income for life. An Immediate Annuity Purchased With The Face Amount At Death explores the use of an immediate annuity purchased with the face amount of a life insurance policy at death, providing a unique approach to estate planning and retirement income.

diate annuities offer a unique way to convert a lump sum of money into a guaranteed stream of income for life. They can be an attractive option for individuals seeking a reliable source of income during retirement, but understanding the tax implications is essential for maximizing their benefits.

This guide delves into the tax treatment of immediate annuities, highlighting key factors that influence tax liability, and demonstrating how to use a tax calculator to make informed financial decisions.

Immediate annuities can be a valuable tool for individuals seeking to maximize their retirement income. Immediate Annuity Medicaid Compliant provides insights into the compatibility of immediate annuities with Medicaid eligibility, helping you understand how these financial products can impact your healthcare benefits.

Contents List

- 1 What is an Immediate Annuity?

- 2 Understanding Annuity Tax Implications: Immediate Annuity Tax Calculator

- 3 The Role of an Immediate Annuity Tax Calculator

- 4 Factors Influencing Immediate Annuity Tax Calculations

- 5 Using an Immediate Annuity Tax Calculator in Financial Planning

- 6 Alternative Retirement Income Strategies

- 7 Ultimate Conclusion

- 8 Q&A

What is an Immediate Annuity?

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments for life, starting immediately after the purchase. This type of annuity is a popular option for retirees looking for a reliable source of income and to protect against outliving their savings.

Choosing the right annuity can be challenging, especially with the variety of options available. Annuity Which Is Best 2024 can help you navigate the different types of annuities and determine which one aligns best with your financial goals and risk tolerance.

How Immediate Annuities Work

When you purchase an immediate annuity, you make a lump-sum payment to the insurance company, which then uses your investment to generate a series of regular payments. These payments can be made monthly, quarterly, annually, or even in a lump sum.

Variable annuities can be categorized into two main types. 2 Types Of Variable Annuity 2024 offers a detailed explanation of these two types, helping you understand the nuances and potential advantages of each.

The amount of your annuity payments will depend on factors such as your age, the size of your initial investment, and the type of annuity you choose.

American Legacy 3 is a popular variable annuity product. American Legacy 3 Variable Annuity 2024 provides information about this specific annuity, covering its features, benefits, and considerations for potential investors.

Key Features of Immediate Annuities

- Guaranteed Payments:Immediate annuities provide a guaranteed stream of income for life, regardless of how long you live. This eliminates the risk of outliving your savings.

- Payout Structure:You can choose from a variety of payout structures, including fixed payments, variable payments, and a combination of both. The payout structure will determine how much you receive each payment and how long the payments will last.

- Tax Implications:Payments from an immediate annuity are generally taxed as ordinary income. However, there are some tax advantages to immediate annuities, such as the ability to defer taxes on the growth of the annuity’s investment.

- Investment Options:Immediate annuities may offer different investment options, such as fixed-income investments, equity investments, or a combination of both. The investment options will affect the potential growth of your annuity and the amount of your payments.

Variable annuities come with their own unique terminology. Variable Annuity Terminology 2024 provides a glossary of common terms used in the context of variable annuities, making it easier for you to understand and navigate this type of investment.

Types of Immediate Annuities

There are several types of immediate annuities, each with its own set of features and benefits. Some common types include:

- Single Premium Immediate Annuity (SPIA):This type of annuity requires a single lump-sum payment and provides a guaranteed stream of income for life. It is a simple and straightforward option for retirees who want a guaranteed income stream.

- Fixed Annuity:This type of annuity provides a fixed payment amount for life. The payment amount is guaranteed, but it does not fluctuate with market conditions. This is a good option for retirees who want a predictable income stream.

- Variable Annuity:This type of annuity offers the potential for higher returns, but it also comes with a higher risk. The payment amount can fluctuate based on the performance of the underlying investments. This is a good option for retirees who are comfortable with some risk and want the potential for higher returns.

When you purchase an annuity, the life expectancy of the annuitant is a key factor. When Annuity Is Written Whose Life Expectancy 2024 explores how life expectancy impacts annuity payments, providing valuable insights for individuals considering this type of retirement income solution.

Understanding Annuity Tax Implications: Immediate Annuity Tax Calculator

The tax treatment of immediate annuities can be complex and depends on various factors, including the type of annuity, the payout structure, and your individual tax situation.

Immediate annuities can involve various expenses. Immediate Annuity Expenses provides insights into the different expenses associated with immediate annuities, helping you understand the true cost of this type of retirement income product.

Taxation of Annuity Payments

Payments from an immediate annuity are generally taxed as ordinary income. This means that the payments will be taxed at your marginal tax rate, which is the rate you pay on your highest dollar of income.

If you’re looking for information about immediate annuities in Marathi, you’ve come to the right place. Immediate Annuity Meaning In Marathi provides a comprehensive explanation of this type of annuity, which can be particularly useful for individuals who are nearing retirement and want to secure a steady stream of income.

Tax Advantages of Immediate Annuities

Despite being taxed as ordinary income, immediate annuities offer some tax advantages, such as:

- Tax Deferral:The growth of the annuity’s investment is generally not taxed until you start receiving payments. This allows you to defer taxes and potentially earn more money on your investment.

- Tax-Free Growth:Some immediate annuities offer tax-free growth, which means that the earnings on your investment are not taxed until you withdraw them. This can be a significant advantage for retirees who are in a high tax bracket.

- Income Tax Deductions:You may be able to deduct certain expenses related to your annuity, such as premiums or fees, on your tax return.

Variable annuities are a type of investment that can help you grow your retirement savings, but they can be complex. To understand how they work, check out this resource: Variable Annuity How Does It Work 2024. This guide will provide you with a clear explanation of variable annuities and their potential benefits.

Tax Implications vs. Other Retirement Income Sources

Immediate annuities have different tax implications compared to other retirement income sources, such as:

- 401(k) Distributions:Distributions from a 401(k) are taxed as ordinary income, but they may also be subject to early withdrawal penalties if you withdraw the funds before age 59 1/2.

- IRAs:Distributions from traditional IRAs are taxed as ordinary income, but you may be able to deduct contributions to a traditional IRA. Roth IRAs offer tax-free withdrawals in retirement, but contributions are not tax-deductible.

- Social Security Benefits:Social Security benefits are generally taxable, but the amount of taxes you pay depends on your income level.

The Role of an Immediate Annuity Tax Calculator

An immediate annuity tax calculator is a valuable tool for estimating your tax liability from an immediate annuity. It helps you understand the potential tax implications of different annuity options and make informed financial decisions.

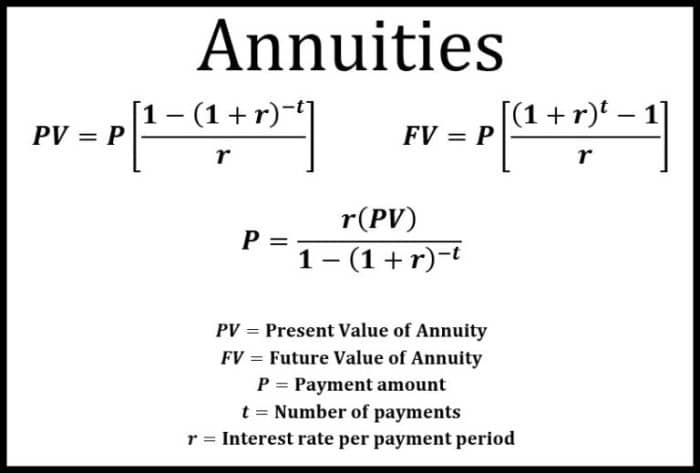

Understanding how annuities work involves some calculations. Calculating Annuities 2024 provides a detailed explanation of the calculations involved, helping you make informed decisions about your annuity investments.

How an Immediate Annuity Tax Calculator Works

An immediate annuity tax calculator typically requires you to input information such as:

- Annuity amount:The amount of your initial investment.

- Payout frequency:How often you want to receive payments (e.g., monthly, quarterly, annually).

- Investment options:The type of investment options available with the annuity.

- Age and health:Your age and health status can affect the payout amount and the length of the payments.

- Tax bracket:Your current tax bracket will determine how much tax you will pay on your annuity payments.

Based on this information, the calculator estimates your annual annuity payments and the amount of taxes you will owe.

Using an Immediate Annuity Tax Calculator

An immediate annuity tax calculator can help you:

- Compare different annuity options:You can use the calculator to compare the tax implications of different annuity options, such as fixed annuities, variable annuities, and SPIA. This can help you choose the option that best suits your financial goals and tax situation.

- Assess the tax implications of an annuity:The calculator can help you understand how an immediate annuity will affect your overall tax liability. This can help you plan for your taxes and make informed financial decisions.

- Estimate your retirement income:The calculator can help you estimate your annual retirement income from an immediate annuity. This can help you plan for your retirement expenses and make sure you have enough income to meet your needs.

Variable annuities can be a complex investment vehicle. Variable Annuity Overview 2024 offers a comprehensive overview of variable annuities, covering their features, benefits, and potential risks.

Factors Influencing Immediate Annuity Tax Calculations

Several factors can influence the tax calculations for immediate annuities, including:

Table of Key Factors

| Factor | Impact on Tax Liability |

|---|---|

| Annuity amount | A higher annuity amount generally results in higher payments and therefore higher tax liability. |

| Payout frequency | More frequent payments (e.g., monthly) can result in higher tax liability because you are taxed on the payments more often. |

| Investment options | The investment options available with the annuity can affect the growth of the investment and therefore the amount of your payments and your tax liability. |

| Age and health | Your age and health status can affect the payout amount and the length of the payments, which can impact your tax liability. |

| Tax bracket | Your tax bracket will determine the tax rate you pay on your annuity payments. A higher tax bracket will result in higher tax liability. |

Using an Immediate Annuity Tax Calculator in Financial Planning

An immediate annuity tax calculator can be a valuable tool for financial planning, helping you make informed decisions about your retirement income, estate planning, and long-term care.

Variable annuities and indexed annuities are both popular retirement income options. Variable Annuity Vs Indexed Annuity 2024 compares these two types of annuities, highlighting their key differences and helping you determine which one might be the better choice for your specific needs.

Retirement Income Planning

An immediate annuity tax calculator can help you estimate your retirement income from an immediate annuity, taking into account the tax implications. This can help you:

- Plan for your retirement expenses:You can use the calculator to estimate your annual retirement income and ensure you have enough to cover your expenses.

- Compare different retirement income strategies:The calculator can help you compare the tax implications of an immediate annuity with other retirement income strategies, such as 401(k) distributions, IRAs, and Social Security benefits.

- Make informed decisions about your retirement savings:The calculator can help you determine how much you need to save for retirement to achieve your desired income level, considering the tax implications of different retirement income sources.

Calculating annuities can be a bit confusing, but it doesn’t have to be. Annuity Calculation Questions And Answers 2024 provides a resource with common questions and answers about annuity calculations, helping you gain a better understanding of this important aspect of annuity planning.

Estate Planning

An immediate annuity tax calculator can help you understand the tax implications of leaving an annuity to your heirs. This can help you:

- Minimize estate taxes:You can use the calculator to estimate the tax liability on the annuity payments after your death and consider strategies to minimize estate taxes.

- Plan for the distribution of your assets:The calculator can help you determine how much your heirs will receive from the annuity after taxes and plan for the distribution of your assets accordingly.

Long-Term Care Planning

An immediate annuity tax calculator can help you understand the tax implications of using an annuity to fund long-term care. This can help you:

- Estimate your long-term care expenses:You can use the calculator to estimate the cost of long-term care and determine how much income you will need from the annuity to cover these expenses.

- Plan for long-term care expenses:The calculator can help you determine how much of your annuity payments you can use to cover long-term care expenses while still maintaining a comfortable income level.

Alternative Retirement Income Strategies

Immediate annuities are not the only retirement income strategy available. Other options include:

Comparison of Retirement Income Strategies

| Strategy | Tax Implications |

|---|---|

| 401(k) Distributions | Taxed as ordinary income, may be subject to early withdrawal penalties. |

| IRAs | Traditional IRAs: Taxed as ordinary income, but contributions may be deductible. Roth IRAs: Tax-free withdrawals in retirement, but contributions are not deductible. |

| Social Security Benefits | Generally taxable, but the amount of taxes you pay depends on your income level. |

Ultimate Conclusion

By leveraging an immediate annuity tax calculator, individuals can gain valuable insights into the tax implications of immediate annuities and make informed decisions about their retirement income planning. Understanding the tax implications of this income stream is crucial for maximizing its benefits and ensuring a secure financial future.

Q&A

What are the potential tax advantages of immediate annuities?

Immediate annuities can offer tax advantages over other retirement income sources. For example, a portion of your annuity payments may be tax-free, and the remaining portion is taxed as ordinary income, which can be beneficial compared to distributions from traditional IRAs or 401(k)s, which are taxed at your ordinary income tax rate.

How does an immediate annuity tax calculator work?

An immediate annuity tax calculator typically requires information about the annuity amount, payout frequency, investment options, your age and health, and your current tax bracket. It then uses these factors to estimate your annual tax liability and project your after-tax income stream.

Can I use an immediate annuity tax calculator to compare different annuity options?

Yes, you can use an immediate annuity tax calculator to compare different annuity options and assess their tax implications. This allows you to make informed decisions based on your individual circumstances and financial goals.