Immediate Annuity Valuation Rates are the key to unlocking a secure and predictable retirement income stream. These rates, determined by factors like interest rates, mortality, and inflation, represent the value of your annuity payments. Understanding how these rates are calculated and what influences them is crucial for making informed decisions about your retirement savings.

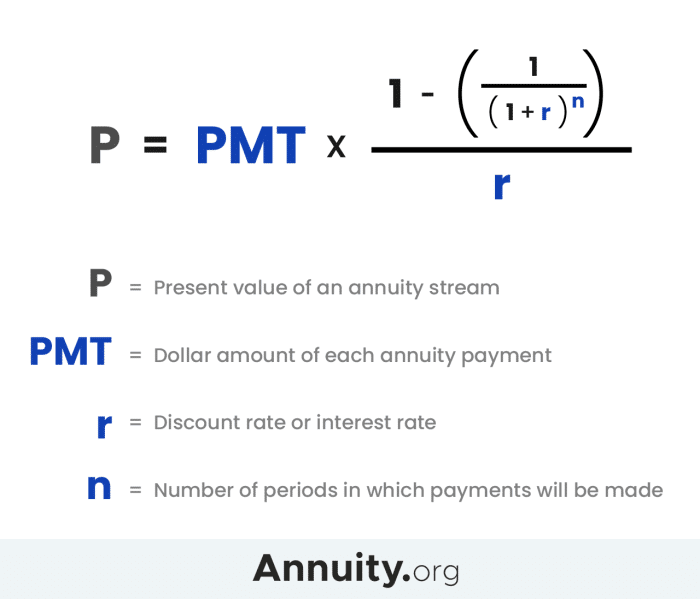

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Immediate annuities provide a guaranteed income stream for life, eliminating the worry of outliving your savings. They offer a range of options, from fixed payments to variable and indexed annuities, allowing you to tailor your income stream to your individual needs and risk tolerance.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

This article explores the intricacies of immediate annuity valuation rates, guiding you through the process of choosing the right annuity for your retirement goals.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Contents List

- 1 Introduction to Immediate Annuities

- 2 Factors Influencing Immediate Annuity Valuation Rates

- 3 Types of Immediate Annuities: Immediate Annuity Valuation Rates

- 4 How Immediate Annuities Work

- 5 Advantages and Disadvantages of Immediate Annuities

- 6 Evaluating Immediate Annuity Valuation Rates

- 7 Considerations for Purchasing an Immediate Annuity

- 8 Wrap-Up

- 9 Top FAQs

Introduction to Immediate Annuities

Immediate annuities are a popular retirement income solution that provides a guaranteed stream of payments for life. These annuities are designed to convert a lump sum of money into a regular income stream, starting immediately after purchase. The “immediate” aspect refers to the fact that payments begin within a short period, typically within a month or two of the purchase date.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Understanding Immediate Annuities

Immediate annuities are distinct from deferred annuities, which provide income payments at a future date. Unlike deferred annuities, immediate annuities do not have an accumulation phase where the principal grows over time. Instead, the purchase price is immediately converted into a stream of income payments.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

- Immediate Annuities:Payments begin within a short period after purchase, typically within a month or two.

- Deferred Annuities:Payments begin at a future date, often years after the purchase date.

For example, if you purchase an immediate annuity with $100,000, you might receive monthly payments of $5,000 for the rest of your life, starting immediately. In contrast, a deferred annuity might allow your $100,000 to grow for 10 years before you begin receiving monthly payments.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Factors Influencing Immediate Annuity Valuation Rates

The valuation rates for immediate annuities are influenced by several factors, including interest rates, mortality rates, inflation, and investment performance. These factors play a crucial role in determining the amount of income you receive from your annuity.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Interest Rates

Interest rates are a key factor in annuity valuations. When interest rates rise, annuity payouts tend to increase, as insurers can earn a higher return on their investments. Conversely, when interest rates fall, annuity payouts may decrease.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Mortality Rates

Annuity payouts are also affected by mortality rates, which reflect the average lifespan of individuals. Insurers use mortality tables to estimate how long annuitants will live. If individuals live longer than expected, the insurer’s payouts will be higher, potentially reducing the payout amount for each individual annuitant.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Inflation

Inflation can erode the purchasing power of annuity payments over time. Insurers often factor in inflation when setting annuity rates, but the rate of inflation can vary, making it difficult to predict the future value of annuity payments.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Investment Performance

The investment performance of insurers also impacts annuity rates. Insurers invest premiums from annuity contracts to generate returns, which in turn influence the payout amounts. Strong investment returns can lead to higher annuity rates, while poor performance may result in lower payouts.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Types of Immediate Annuities: Immediate Annuity Valuation Rates

Immediate annuities come in various forms, each with its own features and benefits. The most common types include fixed, variable, and indexed annuities.

Fixed Annuities

Fixed annuities offer a guaranteed, fixed rate of return. This means that the amount of your monthly payments will remain the same for the life of the annuity. Fixed annuities provide stability and predictability, but their returns are typically lower than other types of annuities.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Variable Annuities

Variable annuities provide a variable rate of return, which is tied to the performance of underlying investment funds. The value of your payments can fluctuate based on the performance of the investments. Variable annuities offer the potential for higher returns but also come with greater risk.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Indexed Annuities

Indexed annuities offer a return that is linked to the performance of a specific market index, such as the S&P 500. The growth of your annuity is tied to the index’s performance, but the payouts are capped at a certain percentage.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Indexed annuities provide some protection from market downturns while offering the potential for growth.

How Immediate Annuities Work

Purchasing an immediate annuity involves a straightforward process. You simply provide the insurer with a lump sum of money, and in return, they agree to make regular payments to you for the rest of your life.

Purchasing an Immediate Annuity

- Choose an Annuity Provider:Research and select a reputable annuity provider.

- Determine Your Annuity Type:Decide on the type of annuity that best suits your needs and risk tolerance.

- Select a Payout Option:Choose a payment frequency and duration that aligns with your financial goals.

- Fund the Annuity:Provide the insurer with the lump sum payment.

Annuity Payment Calculations, Immediate Annuity Valuation Rates

The amount of your annuity payments is determined by several factors, including the size of your initial investment, the annuity type, the interest rate, and your age and gender.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Payout Options

Immediate annuities offer various payout options to meet different needs. These options include:

- Lifetime Income:Payments continue for the rest of your life.

- Period Certain:Payments are guaranteed for a specific period, even if you die before the end of the term.

- Joint and Survivor:Payments continue to a surviving spouse after your death.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several advantages, but they also come with certain drawbacks. It’s essential to carefully consider both the benefits and risks before making a decision.

Advantages of Immediate Annuities

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, eliminating the risk of outliving your savings.

- Predictability:You know exactly how much income you will receive each month, making it easier to budget and plan for the future.

- Inflation Protection:Some annuities offer inflation protection, ensuring that your payments keep pace with rising costs.

- Tax Advantages:Annuity payments are generally taxed as ordinary income, but the principal is not taxed until it is withdrawn.

Disadvantages of Immediate Annuities

- Limited Liquidity:Once you purchase an immediate annuity, you typically cannot access the principal without incurring penalties.

- Potential for Low Returns:Fixed annuities offer lower returns than other investment options, especially during periods of high inflation.

- Loss of Principal:You cannot recover the principal if you die before receiving all of your annuity payments.

Evaluating Immediate Annuity Valuation Rates

Comparing annuity rates from different providers is crucial to ensure you’re getting the best possible deal. Evaluating valuation rates involves analyzing various factors and considering your individual needs.

Comparing Annuity Rates

When comparing annuity rates, it’s essential to consider factors such as:

- Annuity Type:Compare rates for similar types of annuities, such as fixed, variable, or indexed annuities.

- Payout Options:Consider the different payout options available and their impact on the valuation rate.

- Fees and Charges:Compare the fees and charges associated with different annuity contracts.

- Financial Strength of the Provider:Choose a reputable and financially stable annuity provider.

Analyzing Valuation Rates

You can use various methods to analyze and compare valuation rates, such as:

- Annuity Rate Tables:Many financial websites and publications provide annuity rate tables that compare rates from different providers.

- Annuity Calculators:Online annuity calculators can help you estimate the monthly payments you would receive based on your investment amount and other factors.

- Financial Advisor:Consult with a qualified financial advisor to discuss your options and get personalized recommendations.

Considerations for Purchasing an Immediate Annuity

Before purchasing an immediate annuity, it’s important to consider several factors, including your financial goals, risk tolerance, and overall retirement plan.

Annuity payments are a common financial tool for individuals seeking a steady stream of income during retirement. To calculate the annuity payment, you can use the formula for calculating the annuity payment , which considers factors such as the principal amount, interest rate, and payment period.

Understanding these calculations can help you make informed decisions about your retirement planning.

Factors to Consider

- Retirement Income Needs:Determine how much income you need to cover your essential expenses in retirement.

- Risk Tolerance:Assess your willingness to accept fluctuations in the value of your annuity payments.

- Health and Lifespan:Consider your health and expected lifespan when choosing a payout option.

- Other Retirement Income Sources:Evaluate your other retirement income sources, such as Social Security, pensions, and savings.

Impact on Retirement Planning

An immediate annuity can significantly impact your retirement planning by providing a guaranteed income stream and reducing the risk of outliving your savings. However, it’s crucial to consider the trade-offs, such as the loss of principal and potential for lower returns.

Maximizing Benefits

To maximize the benefits of an immediate annuity, you can consider strategies such as:

- Shop Around:Compare rates from multiple providers to find the best deal.

- Choose the Right Payout Option:Select a payout option that aligns with your needs and goals.

- Consider Inflation Protection:Look for annuities that offer inflation protection to preserve the purchasing power of your payments.

Wrap-Up

In conclusion, understanding Immediate Annuity Valuation Rates is essential for maximizing your retirement income potential. By carefully considering factors like interest rates, mortality, and inflation, and comparing rates from different providers, you can make informed decisions about your annuity purchase.

Remember, immediate annuities are a valuable tool for ensuring a secure and predictable retirement income stream, allowing you to enjoy your golden years with peace of mind.

Top FAQs

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed income stream for life, while a variable annuity offers a potentially higher return but with greater risk. The value of payments from a variable annuity can fluctuate based on the performance of underlying investments.

How do I find the best immediate annuity rates?

Compare rates from multiple providers and consider factors like interest rates, mortality, and inflation. It’s also important to assess the financial stability and reputation of the annuity provider.

What are the tax implications of immediate annuities?

Annuity payments are generally taxed as ordinary income. However, there may be tax-advantaged options available depending on the type of annuity and your individual circumstances.

Can I withdraw my principal from an immediate annuity?

Immediate annuities typically do not allow for withdrawals of principal. You are only entitled to receive regular income payments for life.