Immediate Annuity Vs Annual Allowance: Navigating the complex world of retirement planning can be daunting, especially when faced with choices like immediate annuities and annual allowances. These two options offer distinct approaches to securing a steady stream of income during your golden years, each with its own advantages and disadvantages.

If you’re considering an immediate annuity, you may have questions about its workings. Annuity Immediate Questions And Answers addresses common questions and concerns related to immediate annuities, providing clear and concise answers to help you make informed decisions.

Understanding the nuances of each option is crucial for making informed decisions that align with your individual financial goals and risk tolerance. This article delves into the intricacies of immediate annuities and annual allowances, comparing their features, benefits, and drawbacks to help you make the best choice for your retirement journey.

Contents List

- 1 Understanding Immediate Annuities: Immediate Annuity Vs Annual Allowance

- 2 Exploring Annual Allowances

- 3 Comparing Immediate Annuities and Annual Allowances

- 4 Factors to Consider When Choosing Between Immediate Annuities and Annual Allowances

- 5 Examples of Immediate Annuities and Annual Allowances in Action

- 6 Closing Summary

- 7 FAQ Corner

Understanding Immediate Annuities: Immediate Annuity Vs Annual Allowance

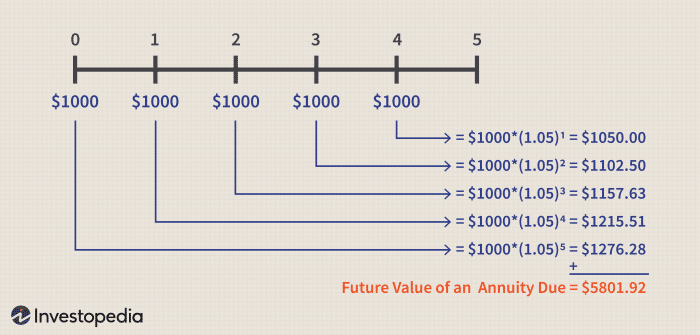

An immediate annuity is a financial product that provides a guaranteed stream of income payments for life, starting immediately after the purchase. It’s a popular option for retirees seeking a steady and predictable income source.

Many people wonder about the certainty of annuities. Is Annuity Certain 2024 explores the different types of annuities and their guarantees, helping you understand the level of certainty associated with each option.

Key Features of Immediate Annuities

Immediate annuities are characterized by several key features:

- Guaranteed Income:Payments are guaranteed for life, regardless of how long the annuitant lives.

- Immediate Payments:Payments begin immediately after the annuity is purchased.

- Fixed or Variable Payments:Annuities can offer fixed payments, providing a predictable income stream, or variable payments, where the amount fluctuates based on the performance of an underlying investment portfolio.

- Lump-Sum Purchase:Immediate annuities are typically purchased with a lump sum of money.

Real-World Examples of Immediate Annuity Applications, Immediate Annuity Vs Annual Allowance

Immediate annuities find practical applications in various retirement scenarios:

- Income Supplement:Retirees can use immediate annuities to supplement their existing retirement savings, ensuring a steady income stream even if their savings are depleted.

- Guaranteed Income for Life:Immediate annuities can provide peace of mind by guaranteeing a lifetime income stream, eliminating the risk of outliving one’s savings.

- Estate Planning:Immediate annuities can be used as part of estate planning strategies, providing a guaranteed income stream to beneficiaries after the annuitant’s death.

Advantages of Immediate Annuities for Retirement Planning

Immediate annuities offer several advantages for retirees:

- Guaranteed Income:The most significant advantage is the guarantee of lifetime income payments, regardless of market fluctuations or longevity.

- Predictability:Fixed annuities provide predictable income, making it easier to budget and plan for future expenses.

- Longevity Protection:Immediate annuities protect against the risk of outliving one’s savings, ensuring a steady income stream throughout retirement.

- Simplicity:Immediate annuities are relatively simple to understand and manage, eliminating the need for ongoing investment decisions.

Potential Disadvantages of Immediate Annuities

While immediate annuities offer several advantages, there are also some potential drawbacks to consider:

- Irreversible Decision:Once an immediate annuity is purchased, the decision is generally irreversible, making it crucial to carefully consider the terms and conditions.

- Lower Returns:Immediate annuities typically offer lower returns compared to other investment options, especially in a rising market.

- Lack of Flexibility:Immediate annuities offer limited flexibility in terms of withdrawing or accessing funds, unlike other retirement savings options.

- Inflation Risk:Fixed annuities may not keep pace with inflation, potentially eroding the purchasing power of future income payments.

Exploring Annual Allowances

An annual allowance, also known as a retirement income drawdown, is a flexible retirement planning strategy that allows retirees to withdraw a specific amount of money from their retirement savings each year.

If you’re looking to convert your pension pot into an annuity, knowing how to calculate the appropriate amount is vital. Calculate Annuity From Pension Pot 2024 offers guidance on determining the ideal annuity payment based on your pension pot, ensuring you maximize your retirement income.

Purpose of Annual Allowances in Retirement Planning

Annual allowances provide retirees with greater control over their retirement income, offering flexibility and the potential for higher returns compared to immediate annuities.

Understanding the basic definition of an annuity is crucial for making informed financial decisions. Annuity Is Definition 2024 provides a clear and concise explanation of what an annuity is, including its key characteristics and benefits.

How Annual Allowances Work

Annual allowances work by allowing retirees to withdraw a portion of their retirement savings each year. The amount withdrawn can be adjusted annually based on individual needs and market conditions.

- Flexible Withdrawals:Retirees can adjust their annual withdrawals to meet changing needs and expenses.

- Investment Growth Potential:The remaining portion of retirement savings can continue to grow and potentially generate higher returns.

- Tax-Efficient Withdrawals:Withdrawals from retirement accounts are often taxed as ordinary income, but the tax implications can vary depending on the specific account and withdrawal strategy.

Examples of Using Annual Allowances to Manage Retirement Income

Annual allowances can be used in various ways to manage retirement income:

- Income Generation:Retirees can use annual allowances to generate a steady income stream while maintaining a portion of their savings for future growth.

- Living Expenses:Annual allowances can be used to cover essential living expenses, such as housing, utilities, and healthcare.

- Lifestyle Spending:Retirees can use annual allowances to fund travel, hobbies, and other discretionary spending.

Benefits and Limitations of Using Annual Allowances for Retirement Planning

Annual allowances offer several benefits, but they also come with certain limitations:

- Flexibility:Annual allowances provide greater flexibility in managing retirement income compared to immediate annuities.

- Investment Growth Potential:The remaining portion of retirement savings can continue to grow and potentially generate higher returns.

- Risk:Annual allowances involve a greater level of risk, as the value of retirement savings can fluctuate with market conditions.

- Longevity Risk:If withdrawals are too high, retirees may risk outliving their savings.

Comparing Immediate Annuities and Annual Allowances

Immediate annuities and annual allowances offer distinct approaches to retirement income planning. Understanding the key differences can help retirees choose the option that best aligns with their individual needs and circumstances.

The question of whether an annuity is better than a 401(k) is a common one. Is Annuity Better Than 401k 2024 examines the pros and cons of each retirement savings option, helping you determine which is the right choice for your circumstances.

Key Differences in Retirement Income Provision

- Immediate Annuities:Provide a guaranteed stream of income for life, starting immediately after purchase.

- Annual Allowances:Allow retirees to withdraw a specific amount of money from their retirement savings each year, providing flexibility but also exposing them to market risks.

Benefits and Drawbacks of Each Option

Both immediate annuities and annual allowances have their own set of benefits and drawbacks:

- Immediate Annuities:

- Benefits:Guaranteed income, predictability, longevity protection, simplicity.

- Drawbacks:Irreversible decision, lower returns, lack of flexibility, inflation risk.

- Annual Allowances:

- Benefits:Flexibility, investment growth potential, potential for higher returns.

- Drawbacks:Risk, longevity risk, tax implications, potential for market volatility.

Table Comparing Key Features

| Feature | Immediate Annuity | Annual Allowance |

|---|---|---|

| Income Stream | Guaranteed for life | Flexible withdrawals based on individual needs |

| Payment Timing | Immediate after purchase | Annual withdrawals |

| Investment Growth Potential | Limited | Potential for higher returns |

| Risk | Low | High |

| Flexibility | Limited | High |

| Inflation Protection | Limited | Depends on investment strategy |

Factors to Consider When Choosing Between Immediate Annuities and Annual Allowances

The decision of whether to choose an immediate annuity or an annual allowance depends on various factors, including individual circumstances, risk tolerance, and financial goals.

Age, Health, and Life Expectancy

Age, health, and life expectancy play a crucial role in choosing between immediate annuities and annual allowances. For those with a shorter life expectancy, immediate annuities may be less appealing, as they may not fully benefit from the guaranteed income stream.

The BA II Plus calculator is a popular tool for calculating annuity payments. Calculate Annuity Payments Ba Ii Plus 2024 provides step-by-step instructions on how to use the calculator to determine annuity payments, making the process easier and more efficient.

Risk Tolerance and Investment Goals

Risk tolerance and investment goals are essential considerations. Retirees with a low risk tolerance may prefer the guaranteed income of immediate annuities, while those with a higher risk tolerance may be more comfortable with the potential for higher returns offered by annual allowances.

Financial Circumstances and Future Income Streams

Financial circumstances and future income streams also influence the decision. Retirees with substantial savings and limited future income streams may find immediate annuities attractive, while those with smaller savings and potential for additional income may prefer the flexibility of annual allowances.

Decision-Making Flow Chart

The following flow chart illustrates the decision-making process for choosing between immediate annuities and annual allowances:

1. Assess your age, health, and life expectancy.

2. Determine your risk tolerance and investment goals.

3. Evaluate your financial circumstances and future income streams.

4. If you prioritize guaranteed income and have a shorter life expectancy, an immediate annuity may be a suitable option.

5. If you seek flexibility, potential for higher returns, and have a longer life expectancy, an annual allowance may be a better choice.

Choosing between a variable annuity and an IRA can be challenging. Variable Annuity Vs Ira 2024 provides a comprehensive comparison of these retirement savings options, highlighting their key differences and helping you make the best choice for your individual needs.

6. Consult with a financial advisor to discuss your individual circumstances and make an informed decision.

Examples of Immediate Annuities and Annual Allowances in Action

Real-world examples illustrate how immediate annuities and annual allowances can be applied in retirement planning.

Compound annuities utilize the power of compounding to generate returns over time. Compound Annuity Uses The Principles Of 2024 explores the principles behind compound annuities, highlighting how this powerful concept can significantly enhance your retirement savings.

Real-World Examples of Immediate Annuities

Consider a retiree, John, who is 65 years old and has a substantial retirement savings account. He is seeking a guaranteed income stream to cover his essential expenses and wants to eliminate the risk of outliving his savings. John decides to purchase an immediate annuity with a portion of his savings, providing him with a fixed monthly income for life.

Case Studies of Annual Allowances

Mary, a 62-year-old retiree, has a diversified investment portfolio and a moderate risk tolerance. She wants to maintain flexibility in her retirement income and potentially benefit from investment growth. Mary chooses to use an annual allowance strategy, withdrawing a specific amount from her retirement savings each year, allowing the remaining portion to continue growing.

Vanguard offers a variety of financial tools, including an annuity calculator. Annuity Calculator Vanguard 2024 provides access to this calculator, allowing you to explore different annuity scenarios and determine the best option for your individual needs.

Potential Outcomes in Specific Scenarios

The outcomes of choosing one option over the other can vary depending on individual circumstances and market conditions. In a rising market, annual allowances may generate higher returns, while in a declining market, immediate annuities may provide greater stability.

Variable annuities often have different share classes, including B shares. Variable Annuity B Shares 2024 provides an explanation of B shares, including their features, fees, and potential advantages or disadvantages compared to other share classes.

Table Showcasing Retirement Scenarios and Suitable Options

| Retirement Scenario | Suitable Option |

|---|---|

| Retiree with a shorter life expectancy and a desire for guaranteed income | Immediate Annuity |

| Retiree with a longer life expectancy and a higher risk tolerance seeking potential for higher returns | Annual Allowance |

| Retiree with substantial savings and a desire for simplicity and predictability | Immediate Annuity |

| Retiree with a moderate risk tolerance and a need for flexibility in managing retirement income | Annual Allowance |

Closing Summary

Ultimately, the choice between an immediate annuity and an annual allowance hinges on your individual circumstances, financial goals, and risk tolerance. Carefully considering factors like age, health, life expectancy, and investment goals is essential for making a well-informed decision. Consulting with a financial advisor can provide valuable guidance and help you navigate the complexities of retirement planning, ensuring you choose the option that best aligns with your unique needs and aspirations.

Understanding the math behind annuities is essential for making informed financial decisions. Annuity Calculator Math 2024 breaks down the key formulas and concepts, helping you navigate the complexities of annuity calculations.

FAQ Corner

What is the difference between an immediate annuity and an annual allowance?

The Director 5 is another popular variable annuity offering. The Director 5 Variable Annuity 2024 provides an in-depth look at this specific product, including its features, investment options, and potential advantages.

An immediate annuity provides a guaranteed stream of income starting immediately, while an annual allowance offers flexibility in how you access your retirement funds, allowing for withdrawals over time.

Variable annuities offer a way to grow your retirement savings, but understanding the tax implications is crucial. Variable Annuity Non Qualified Stretch 2024 explores the tax implications of non-qualified stretch distributions, helping you make informed decisions about your retirement planning.

How do I choose between an immediate annuity and an annual allowance?

The best option depends on your individual circumstances, risk tolerance, and financial goals. Consider factors like age, health, life expectancy, and desired income level.

Are there any tax implications associated with immediate annuities and annual allowances?

If you’re looking to understand how to calculate an annuity using a financial calculator, this guide can help. How To Calculate Annuity Using Financial Calculator 2024 provides a step-by-step process for calculating annuity payments and present values, ensuring you have a clear understanding of your financial options.

Yes, both options have tax implications. Consult with a tax advisor to understand the specific tax treatment for your situation.

When considering variable annuities, the Putnam Capital Manager 5 is a popular choice. Putnam Capital Manager 5 Variable Annuity 2024 provides an overview of this specific product, including its features, investment options, and potential benefits.

What are the risks associated with immediate annuities and annual allowances?

Immediate annuities carry the risk of outliving your savings, while annual allowances expose you to market volatility and potential investment losses.

Can I change my mind after purchasing an immediate annuity?

It is typically difficult to change your mind after purchasing an immediate annuity. Consult with the provider to understand their specific policies.