Immediate Annuity With Cola Calculator offers a powerful tool for individuals seeking to secure a reliable stream of income during retirement. This calculator helps you understand the potential benefits of immediate annuities with a Cost of Living Adjustment (COLA), a feature that protects your income against inflation.

Different methods are used to calculate annuity payments. Understanding the Calculating Annuity Method 2024 used for your chosen annuity is crucial for ensuring you receive the expected payments. Consulting with a financial advisor can help you understand the complexities of annuity calculations.

Immediate annuities provide a guaranteed stream of income for life, often with the option to include a COLA that increases your payments over time. This can help you maintain your purchasing power and avoid the risk of outliving your savings.

The John Hancock Venture 3 Variable Annuity 2024 offers a way to potentially grow your retirement savings with the potential for higher returns. However, it’s important to understand the risks involved with variable annuities, such as market volatility and potential loss of principal.

By using an immediate annuity with COLA calculator, you can estimate your potential monthly payments, explore different scenarios, and gain valuable insights into the long-term financial implications of this retirement income strategy.

Contents List

- 1 Understanding Immediate Annuities with COLA

- 2 How COLA Works in Immediate Annuities

- 3 Using an Immediate Annuity with COLA Calculator

- 4 Factors to Consider When Choosing an Immediate Annuity with COLA

- 5 Real-World Examples and Case Studies

- 6 Last Recap: Immediate Annuity With Cola Calculator

- 7 General Inquiries

Understanding Immediate Annuities with COLA

Immediate annuities are a popular retirement income option that provides a guaranteed stream of payments for life. They are often attractive to retirees who want to convert their savings into a predictable income stream. However, one important feature that can significantly enhance the value of an immediate annuity is the inclusion of a Cost of Living Adjustment (COLA).

This article will delve into the intricacies of immediate annuities with COLA, exploring how they work, their benefits and drawbacks, and factors to consider when making a decision.

Defining Immediate Annuities and COLA

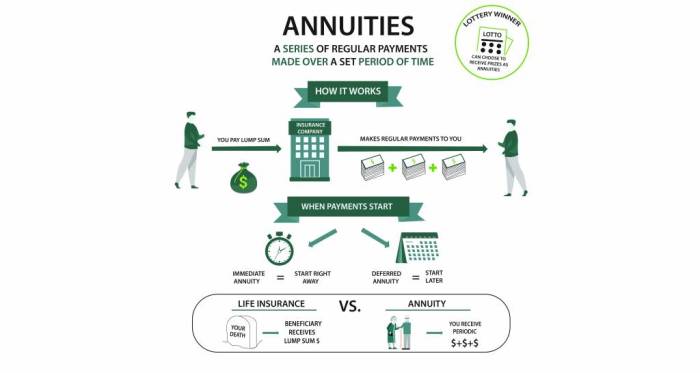

An immediate annuity is a type of annuity contract that begins making payments immediately after the purchase. It is a lump-sum investment that is exchanged for a series of regular payments. The amount of each payment is determined by factors such as the principal amount invested, the annuitant’s age, and the interest rate offered by the annuity provider.

The Immediate Annuity Plan Of Lic provides a guaranteed stream of income for life, offering financial security during retirement. It’s important to weigh the pros and cons of this plan, considering factors like your age, health, and financial goals.

Immediate annuities typically offer a guaranteed income stream for life, providing financial security and peace of mind.

A Cost of Living Adjustment (COLA) is a feature that adjusts the annuity payments to keep pace with inflation. COLA ensures that the purchasing power of the annuity payments remains relatively stable over time. This is particularly important in a period of rising inflation, as it helps to protect retirees from a decline in their standard of living.

Comparing Immediate Annuities with Other Retirement Income Options

Immediate annuities with COLA offer a distinct advantage over traditional pensions and 401(k) rollovers. While pensions provide a guaranteed income stream, they are often subject to changes in funding and benefit structures. 401(k) rollovers, on the other hand, require individuals to manage their own investments, which can be risky and uncertain.

For those planning for retirement, it’s a common question: Can You Receive Annuity And Still Work 2024 ? The answer depends on the specific annuity you choose and your employment situation. It’s best to consult with a financial advisor to determine how receiving annuity payments might impact your income and tax obligations.

Immediate annuities with COLA offer a guaranteed income stream, protection against inflation, and a fixed payment schedule, making them a more predictable and reliable retirement income option.

Advantages and Disadvantages of Immediate Annuities with COLA

- Advantages:

- Guaranteed income for life

- Protection against inflation through COLA

- Fixed payment schedule, providing financial predictability

- No investment risk, as the principal is converted into a stream of payments

- Disadvantages:

- Lower initial returns compared to other investment options

- Limited flexibility, as the payments are fixed and cannot be withdrawn early

- Potential for lower COLA rates than the actual inflation rate, reducing the effectiveness of inflation protection

How COLA Works in Immediate Annuities

COLA in immediate annuities is typically calculated as a percentage of the original annuity payment. The COLA rate is determined by the annuity provider and is often based on a specific inflation index, such as the Consumer Price Index (CPI).

Variable annuities offer a potential for growth but come with risks. Understanding the Variable Annuity Meaning 2024 and how it works is crucial for making informed investment decisions. It’s essential to weigh the potential for higher returns against the risks involved.

The COLA is applied to the annuity payment annually or periodically, increasing the payment amount to keep pace with inflation.

Typical COLA Percentages and Influencing Factors

The COLA percentage offered by annuity providers varies depending on factors such as the annuity contract, the interest rate environment, and the provider’s financial performance. Typically, COLA rates range from 2% to 4% per year. However, it is important to note that COLA rates are not guaranteed and can be subject to change over time.

When considering an annuity, understanding the 3 Year Annuity Factor 2024 can be helpful. This factor helps determine the amount of your monthly payments based on your chosen annuity type and investment options. It’s crucial to research and compare different factors to make informed decisions.

Factors that can influence COLA rates include:

- Inflation rate

- Interest rate environment

- Annuity provider’s financial performance

- Contractual terms of the annuity

Examples of COLA Impact on Annuity Payouts

Let’s consider an example to illustrate how COLA affects annuity payouts over time. Assume an individual purchases an immediate annuity with a principal amount of $100,000 and receives an initial annual payment of $6,000. If the annuity includes a COLA rate of 3%, the annual payment will increase by $180 (3% of $6,000) in the first year.

In the second year, the payment will be $6,180, and so on. Over time, the COLA will ensure that the purchasing power of the annuity payments remains relatively stable, even in the face of inflation.

Using an Immediate Annuity with COLA Calculator

An immediate annuity with COLA calculator is a useful tool that can help individuals estimate their potential annuity payments and assess the impact of COLA over time. These calculators are typically available online and are designed to simplify the process of calculating annuity payments.

When choosing a retirement savings strategy, it’s essential to consider your options. Deciding whether Is Annuity Better Than Drawdown 2024 for your specific situation requires careful analysis of your financial goals, risk tolerance, and desired income stream.

Functionality and Step-by-Step Guide

Immediate annuity calculators typically require users to input key variables, such as the principal amount, the annuitant’s age, and the COLA rate. Once these variables are entered, the calculator will generate an estimated annual payment and a projection of how the payment will grow over time, taking into account the COLA rate.

Calculating your potential annuity payments can be complex. The Formula For Calculating The Annuity 2024 takes into account various factors, including your initial investment, interest rates, and chosen payment period. It’s helpful to consult with a financial advisor to determine the best annuity option for your needs.

The calculator can also provide information on the total amount of payments received over the annuitant’s lifetime.

Here is a step-by-step guide on how to use an immediate annuity with COLA calculator:

- Enter the principal amount you intend to invest in the annuity.

- Input your age at the time of annuity purchase.

- Select the COLA rate offered by the annuity provider.

- The calculator will then generate an estimated annual payment and a projection of how the payment will grow over time.

- Review the results and compare different annuity options to find the best fit for your financial goals.

Inputting Variables and Assessing Potential Growth

When using an immediate annuity with COLA calculator, it is important to understand the impact of different variables on the estimated payments. For instance, a higher principal amount will generally result in higher annuity payments. Similarly, a higher COLA rate will lead to faster growth in annuity payments over time.

An annuity can provide a steady stream of income during retirement. If you’re considering an annuity, it’s helpful to research different options and their potential returns. Understanding Annuity 200k 2024 options can help you determine if this is the right choice for your retirement planning.

The calculator can help individuals assess the potential growth of their annuity payments over time, taking into account the impact of COLA and other factors.

Factors to Consider When Choosing an Immediate Annuity with COLA

Choosing an immediate annuity with COLA requires careful consideration of various factors to ensure that it aligns with your individual financial goals and risk tolerance. It is crucial to understand the intricacies of annuity contracts, COLA options, and the potential impact of inflation on annuity payments.

Excel can be a powerful tool for managing your finances. Learning how to Calculating Annuity Payments In Excel 2024 can help you project your future income, analyze different annuity options, and make informed decisions about your retirement planning.

Understanding Financial Goals and Risk Tolerance

Before making a decision, it is essential to define your financial goals and assess your risk tolerance. Consider factors such as your retirement income needs, your desired level of financial security, and your willingness to accept potential fluctuations in annuity payments.

Understanding your financial goals and risk tolerance will help you choose an annuity that aligns with your overall financial strategy.

Choosing an Annuity Provider

The choice of annuity provider is critical. Consider factors such as the provider’s financial stability, reputation, and track record. It is advisable to choose a reputable and financially sound provider with a proven history of delivering on its promises. Research the provider’s financial strength, customer reviews, and any regulatory actions taken against them.

Additionally, consider the provider’s COLA options and their approach to managing inflation risk.

Types of COLA Options

Annuity providers offer different types of COLA options, including fixed and variable COLA rates. Fixed COLA rates are guaranteed for a specific period, while variable COLA rates fluctuate based on market performance. Fixed COLA rates offer greater predictability, while variable COLA rates may provide higher returns in a strong market but also carry more risk.

Consider your risk tolerance and desired level of predictability when choosing a COLA option.

Impact of Inflation

It is essential to consider the potential impact of inflation on annuity payments. While COLA helps to protect against inflation, it is not always guaranteed to keep pace with the actual inflation rate. If inflation exceeds the COLA rate, the purchasing power of your annuity payments may decline over time.

To mitigate this risk, consider choosing an annuity with a higher COLA rate or diversifying your retirement income sources.

Real-World Examples and Case Studies

Immediate annuities with COLA have been used successfully by many retirees to secure a predictable income stream and protect against inflation. Here are some real-world examples and case studies that illustrate the benefits and challenges of using these annuities.

For couples planning for retirement, the Annuity Joint Life Option 2024 provides a stream of income for as long as either spouse is alive. This option can offer peace of mind and financial security for couples during their later years.

Real-World Examples

For example, a retired teacher with a $200,000 savings account may choose to purchase an immediate annuity with COLA to generate a steady income stream. The annuity could provide a guaranteed monthly payment of $1,500, with a 3% annual COLA.

If you have a variable annuity in a traditional IRA or 401(k), you may be considering a Variable Annuity Rollover To 401k 2024. This can offer potential tax advantages and flexibility, but it’s crucial to understand the rules and implications of such a move before making a decision.

This would ensure that the teacher’s income keeps pace with inflation, allowing them to maintain their standard of living in retirement. In another example, a couple nearing retirement with a $500,000 retirement portfolio may decide to allocate a portion of their savings to an immediate annuity with COLA.

The annuity could provide them with a guaranteed income stream of $3,000 per month, ensuring a stable source of income for their retirement years.

Case Studies

Case studies have shown that immediate annuities with COLA can be effective in protecting retirees from inflation and providing a reliable income stream. For instance, a study by the Society of Actuaries found that retirees who purchased immediate annuities with COLA experienced a significantly lower risk of outliving their savings compared to those who did not.

This is because the COLA ensured that their income kept pace with inflation, allowing them to maintain their standard of living over time.

Variable annuities offer a potential for growth, but it’s crucial to consider the risks involved. Understanding Variable Annuity Usa 2024 options and their potential for both gains and losses is vital for making informed decisions about your retirement savings.

Impact of Market Fluctuations, Immediate Annuity With Cola Calculator

While immediate annuities with COLA offer protection against inflation, they are not immune to market fluctuations. The interest rate environment and the financial performance of the annuity provider can impact the COLA rate and the overall value of the annuity.

An annuity is a financial product that provides a stream of income payments. Understanding the Annuity Is Meaning 2024 is essential for making informed decisions about your retirement savings. It’s crucial to consider the different types of annuities available and choose one that aligns with your financial goals.

For example, if interest rates decline, the COLA rate may be reduced, potentially reducing the growth of annuity payments. It is important to consider the potential impact of market fluctuations when choosing an immediate annuity with COLA.

Long-Term Financial Implications

Immediate annuities with COLA can have significant long-term financial implications for retirees. By providing a guaranteed income stream and protection against inflation, they can help ensure financial security and peace of mind in retirement. However, it is crucial to carefully consider the terms of the annuity contract, the COLA options, and the potential impact of market fluctuations to make an informed decision that aligns with your individual financial goals and risk tolerance.

Last Recap: Immediate Annuity With Cola Calculator

Choosing the right retirement income strategy is a crucial decision. An immediate annuity with COLA can provide a valuable solution, offering a guaranteed income stream with protection against inflation. By carefully considering your financial goals, risk tolerance, and the factors discussed above, you can make an informed decision about whether an immediate annuity with COLA is the right choice for you.

General Inquiries

What is the difference between a fixed and variable COLA?

If you’ve decided to purchase an annuity, understanding the process of An Immediate Annuity Has Been Purchased is essential. This typically involves a lump sum payment in exchange for regular income payments, which can be tailored to your specific needs and preferences.

A fixed COLA offers a predetermined annual increase, while a variable COLA adjusts based on a specific index, such as inflation.

How often is COLA typically adjusted?

COLA adjustments are usually made annually, but the frequency can vary depending on the annuity provider.

Are there any tax implications associated with immediate annuities with COLA?

Yes, annuity payments are generally taxed as ordinary income. However, there may be tax advantages depending on the specific type of annuity and your individual tax situation.