Immediate Income Annuity Rates offer a way to turn your savings into a guaranteed stream of income for life. These annuities are a popular choice for retirees looking for a reliable source of income, especially those concerned about outliving their savings.

Need help calculating your annuity payments? Learn how to calculate your annuity using an HP10bii calculator in 2024. This can make the process much easier and more efficient.

By purchasing an immediate income annuity, you essentially exchange a lump sum of money for a series of regular payments, typically starting immediately.

Looking for a variable annuity with a guaranteed return? Explore the variable annuity guaranteed return in 2024. This feature can offer you peace of mind knowing that your investment will provide a minimum level of income.

The rates you receive on an immediate income annuity depend on various factors, including your age, gender, health status, and the current interest rate environment. Understanding how these factors influence your annuity rates is crucial for making an informed decision.

Looking for a variable annuity that can adapt to your changing needs? Explore the variable annuity AIR in 2024. This option allows you to adjust your payments based on your individual circumstances.

Contents List

- 1 Immediate Income Annuities: Understanding the Basics

- 1.1 What is an Immediate Income Annuity?

- 1.2 Factors Influencing Immediate Income Annuity Rates

- 1.3 Benefits of Immediate Income Annuities

- 1.4 Risks Associated with Immediate Income Annuities

- 1.5 Choosing the Right Immediate Income Annuity

- 1.6 Illustrative Examples of Immediate Income Annuity Rates

- 1.7 Immediate Income Annuities in Retirement Planning, Immediate Income Annuity Rates

- 2 Concluding Remarks

- 3 FAQ Insights: Immediate Income Annuity Rates

Immediate Income Annuities: Understanding the Basics

Immediate income annuities, also known as fixed immediate annuities, are financial products that provide a guaranteed stream of income for life. They are popular among retirees seeking a reliable source of income during their golden years. In this article, we’ll delve into the world of immediate income annuities, exploring their workings, benefits, risks, and how they can fit into your retirement planning.

Wondering if your annuity income is taxable? Find out whether your annuity is taxable or not in 2024. This will help you plan for your taxes and make sure you’re maximizing your retirement income.

What is an Immediate Income Annuity?

An immediate income annuity is a type of insurance contract that provides a steady income stream in exchange for a lump-sum payment. This payment, known as the “premium,” is used to purchase the annuity. Once the annuity is purchased, you receive regular payments for the rest of your life, regardless of how long you live.

Ready to start planning for your retirement? Learn how to calculate your retirement annuity in 2024. This will help you determine the amount you need to save and how much income you can expect in retirement.

Imagine you have a substantial sum of money saved for retirement. With an immediate income annuity, you can exchange this lump sum for a guaranteed income stream, ensuring financial security in your later years. The payments you receive can be used for everyday expenses, travel, hobbies, or anything else you desire.

Interested in the history of variable annuities? Discover the variable annuity history in 2024. Understanding the evolution of this financial product can provide valuable insights into its potential and risks.

Immediate income annuities offer several key features:

- Guaranteed income for life:You receive regular payments for the rest of your life, regardless of how long you live. This provides peace of mind and financial security in retirement.

- Fixed payments:The amount of each payment is typically fixed, ensuring predictability and stability in your income.

- Tax-deferred growth:The interest earned on the annuity premiums is generally tax-deferred until you begin receiving payments.

- Protection against longevity risk:Annuities protect you from the risk of outliving your savings. Even if you live longer than expected, your income stream will continue.

There are different types of immediate income annuities, each with its own features and payout options. Some common types include:

- Single premium immediate annuity (SPIA):This is the most common type of immediate annuity. You make a single lump-sum payment to purchase the annuity.

- Flexible premium immediate annuity (FPIA):You can make multiple payments over time to purchase the annuity. This can be beneficial if you want to gradually build up your income stream.

- Joint and survivor annuity:This type of annuity provides income to two individuals, usually a couple. The payments continue until both individuals pass away.

- Period certain annuity:This annuity guarantees payments for a specific period of time, regardless of whether you live that long. If you pass away before the period ends, the payments may be paid to a beneficiary.

Factors Influencing Immediate Income Annuity Rates

The rate at which you receive payments from an immediate income annuity is known as the “annuity rate.” This rate is determined by several factors, including:

- Age:Younger individuals generally receive lower annuity rates than older individuals. This is because they are expected to live longer and receive payments for a longer period.

- Gender:Women typically receive lower annuity rates than men, as they have a longer life expectancy.

- Health status:Individuals with good health typically receive higher annuity rates. This is because they are expected to live longer and receive more payments.

- Interest rates:When interest rates rise, annuity rates generally increase. This is because insurers can earn more on their investments, allowing them to offer higher payouts.

- Market conditions:Factors such as inflation and economic growth can also influence annuity rates.

Benefits of Immediate Income Annuities

Immediate income annuities offer several benefits for retirement planning, including:

- Guaranteed income for life:This provides peace of mind and financial security in retirement, knowing you’ll have a reliable source of income regardless of how long you live.

- Protection against longevity risk:Annuities protect you from the risk of outliving your savings. Even if you live longer than expected, your income stream will continue.

- Flexibility in payment options:You can choose from various payment options, such as monthly, quarterly, or annual payments, to fit your needs.

- Tax-deferred growth:The interest earned on the annuity premiums is generally tax-deferred until you begin receiving payments.

Risks Associated with Immediate Income Annuities

While immediate income annuities offer many benefits, it’s essential to be aware of the potential risks:

- Outliving your annuity payments:If you live longer than expected, your annuity payments may run out before you pass away. This risk is mitigated by choosing an annuity with a longer payout period or a joint and survivor option.

- Inflation:Inflation can erode the purchasing power of your annuity payments over time. This risk is mitigated by choosing an annuity with a cost-of-living adjustment (COLA), which increases payments annually to keep pace with inflation.

- Loss of principal:When you purchase an annuity, you surrender your principal for a guaranteed income stream. You cannot access the principal after purchasing the annuity, so you lose access to this lump sum.

Choosing the Right Immediate Income Annuity

Selecting the right immediate income annuity is crucial to ensure it meets your specific needs and financial goals. Consider the following factors when making your decision:

- Payment options:Choose a payment option that aligns with your spending habits and income needs. Consider monthly, quarterly, or annual payments.

- Payout period:Decide on the length of time you want to receive payments. Longer payout periods generally result in lower annuity rates but offer greater protection against longevity risk.

- Annuity provider:Compare different annuity providers and their offerings, considering factors such as financial stability, customer service, and product features.

- Fees and expenses:Be aware of any fees associated with the annuity, such as administrative fees or surrender charges.

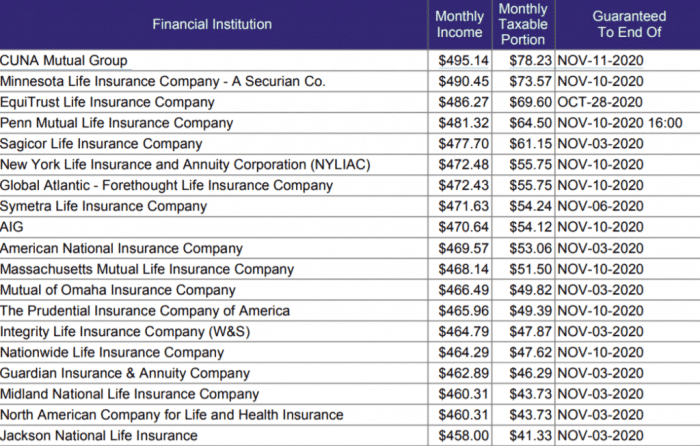

Illustrative Examples of Immediate Income Annuity Rates

The following table provides illustrative examples of immediate income annuity rates based on various factors. These rates are for informational purposes only and may vary depending on the specific annuity provider and current market conditions.

Want to learn more about variable annuities? Check out the variable annuity guaranteed minimum income benefit in 2024. This feature can offer you a safety net, ensuring a minimum income even if your investments don’t perform as well as expected.

| Age | Gender | Health Status | Annuity Rate |

|---|---|---|---|

| 65 | Male | Good | 5.5% |

| 65 | Female | Good | 5.0% |

| 70 | Male | Good | 6.0% |

| 70 | Female | Good | 5.5% |

| 65 | Male | Excellent | 5.8% |

| 65 | Female | Excellent | 5.3% |

Immediate Income Annuities in Retirement Planning, Immediate Income Annuity Rates

Immediate income annuities can play a valuable role in retirement planning, providing a stable and reliable source of income. They can be integrated into various retirement strategies, such as:

- Supplementing other retirement income sources:Annuities can provide a steady stream of income to complement Social Security, pensions, and other retirement savings.

- Protecting against longevity risk:Annuities can help ensure you have enough income to cover your expenses throughout your retirement years, even if you live longer than expected.

- Creating a guaranteed income stream:Annuities provide peace of mind knowing you have a guaranteed income stream for life, regardless of market fluctuations or investment performance.

Concluding Remarks

Immediate income annuities can be a valuable tool for retirement planning, providing a secure stream of income and protection against longevity risk. However, it’s important to carefully consider the potential risks associated with annuities, such as the possibility of outliving your payments or the impact of inflation.

Wondering when your annuity payments will start? The annuity date is 2024 , so you can start planning for your future now. This gives you ample time to understand how annuities work and choose the best option for your needs.

Consulting with a financial advisor can help you determine if an immediate income annuity is right for you and how it can fit into your overall retirement plan.

FAQ Insights: Immediate Income Annuity Rates

What are the tax implications of immediate income annuities?

Need a quick guide to understand the key terms associated with variable annuities? Check out the variable annuity terminology in 2024. This will help you make informed decisions about your retirement planning.

The payments you receive from an immediate income annuity are generally taxed as ordinary income. The amount of tax you pay will depend on your individual tax bracket.

Looking for a way to secure a steady income stream in 2024? Consider an annuity of 50k ! This financial product can provide you with regular payments for a set period, giving you peace of mind and financial stability.

Can I withdraw my principal from an immediate income annuity?

Once you purchase an immediate income annuity, you generally cannot withdraw your principal. The annuity payments represent both principal and interest.

How do I choose the right annuity provider?

It’s essential to compare annuity providers and their offerings carefully. Consider factors such as financial stability, reputation, and the specific terms of the annuity contract.

Want to know how annuities are treated under the Income Tax Act? Explore the annuity under the Income Tax Act in 2024. This will help you understand the tax implications of annuities and make sure you’re compliant with the law.

Need a clear definition of variable annuities? Check out the variable annuity definition in 2024. This will help you understand the basic principles of this financial product.

Want to learn how to calculate your annuity payments using a financial calculator? Discover how to calculate your annuity using a financial calculator in 2024. This will help you make informed decisions about your retirement savings.

Thinking about an immediate annuity? Consider whether an immediate annuity is good or bad for you. This type of annuity provides payments right away, but it’s important to weigh the pros and cons before making a decision.

Looking for the latest information on immediate annuity rates? Check out the immediate annuity rates in 2024. This will help you compare different annuity options and choose the best one for your needs.